Ahead of Storage Report, April Natural Gas Futures Find Modest Momentum

Natural gas futures avoided falling further into the red on Wednesday despite expectations for a modest storage withdrawal and forecasts that called for continued mild weather and light heating demand.

The April Nymex contract settled at $2.692/MMBtu, up 3.0 cents day/day. The prompt month had declined the five previous trading sessions. May advanced 3.2 cents on Wednesday to $2.728.

NGI’s Spot Gas National Avg. eked out a 1.5-cent gain to $2.485, snapping a four-day losing streak amid comfortable spring temperatures.

Thomas Saal, senior vice president of energy at StoneX Financial Inc., told NGI that the advances in futures likely reflected a technical bounce – as opposed to a response to a new catalyst – with speculators shifting from sellers to buyers in anticipation of prices bottoming out after the multi-day slump.

But he noted that futures have traded in a wide range most of this year – exacerbated by the Arctic freeze that forced production declines last month – and that it was difficult to pinpoint a fundamental reason for speculators to shift into buying mode.

“The market is sort of fumbling around, not quite sure what it wants to do,” Saal said.

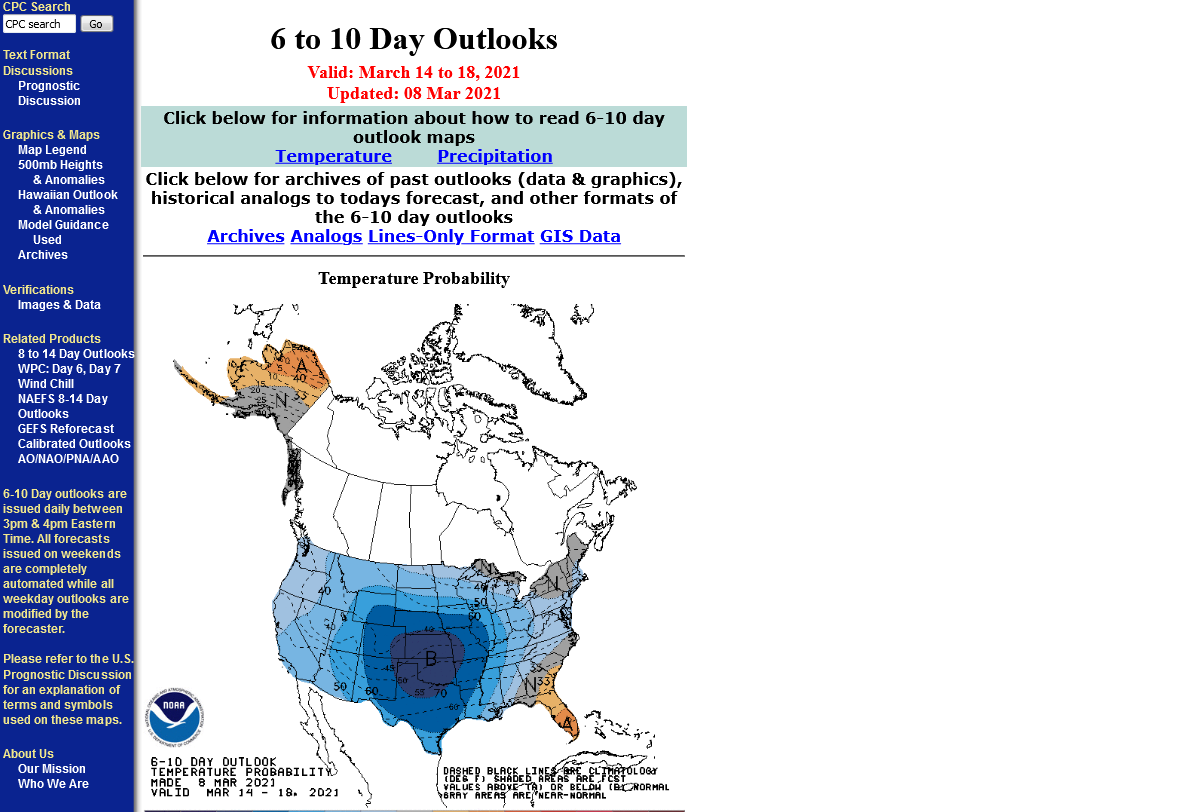

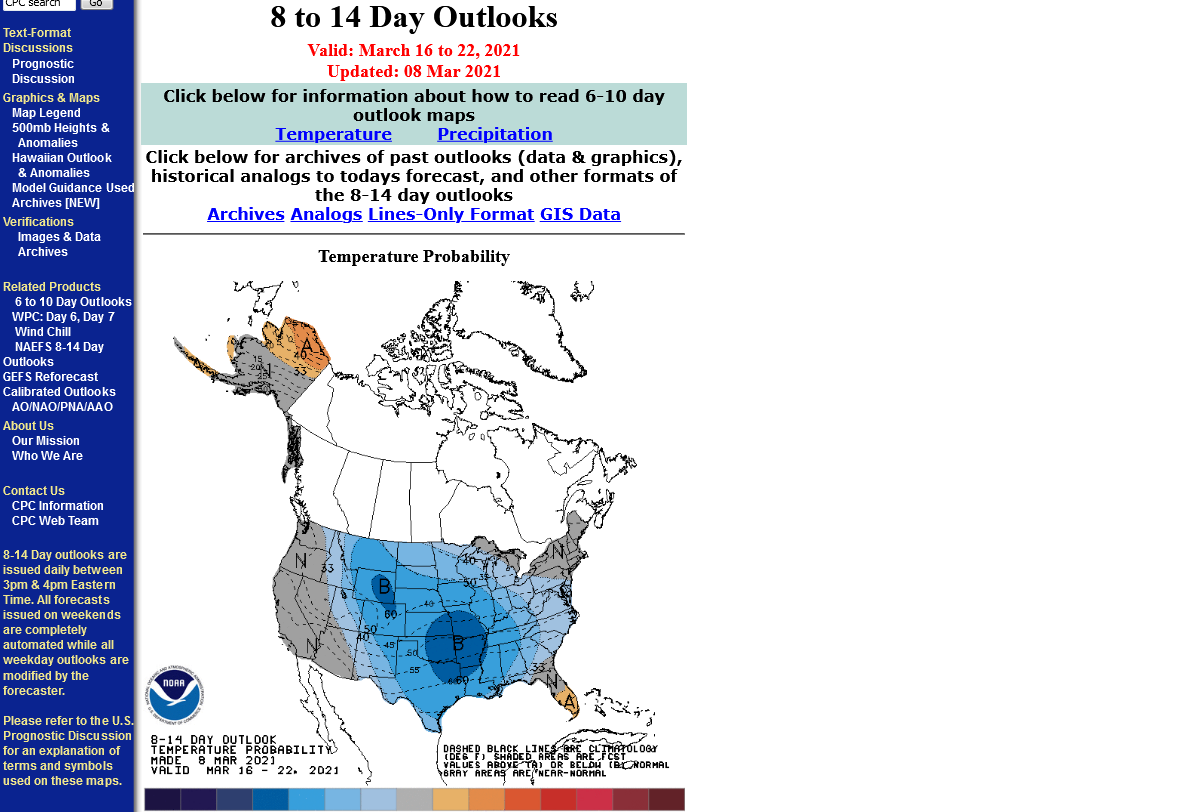

Overnight weather data shifted cooler and shed expected demand from the prior day, forecasters noted, with power burns weak to date in March amid the onset of spring weather across much of the Lower 48.

“The pattern still does not deviate too far from normal, though we have moved the 11- to 15-day time frame a little on the warm side of normal” with Wednesday’s changes, Bespoke Weather Services said. Both the domestic and European weather models moved about seven gas-weighted degree days from a day earlier.

“Longer range expectations remain for a warm lean late month into April, which is still bearish,” the firm added. “As such, we are not expecting weather to assist natural gas bulls much anytime soon, at least until entering the true warm season.”

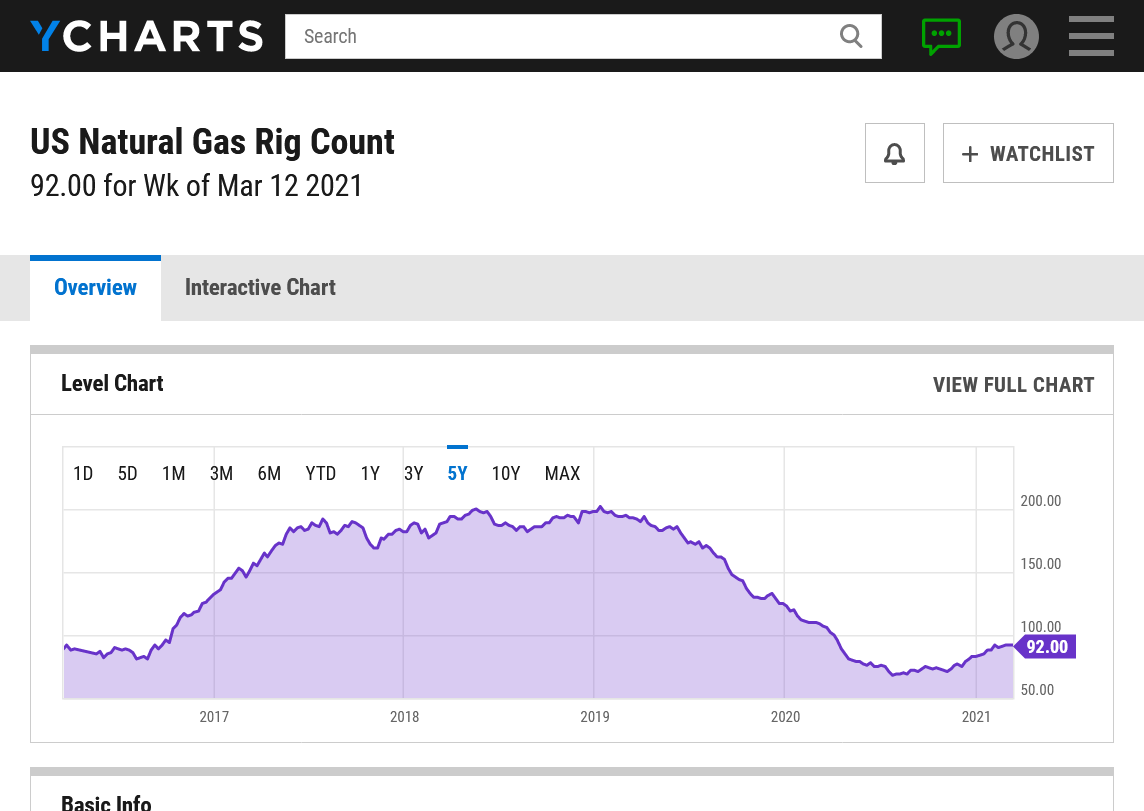

Production, meanwhile, has recovered from the losses in Texas last month. At the same time, liquefied natural gas (LNG) levels have tapered off this week. After topping 11 Bcf last Friday – a high since the Texas freeze and near the levels seen prior to mid-February — LNG feed gas volumes have hovered near 10 Bcf for five straight days, NGI data show.

“We have yet to see LNG volumes move back to their highs…while production did return to its pre-freeze-off levels,” Bespoke said. “A bigger hindrance is a massive weakness in power burns, even on a weather-adjusted basis. This is at least partially due to huge wind generation, especially in Texas. In short, there is simply no catalyst to send prices back higher as of right now.”

All eyes now turn to the Energy Information Administration’s (EIA) storage report Thursday.

NGI’s model predicted a 104 Bcf pull for the week ending March 5. Last year, EIA recorded a 72 Bcf withdrawal for the period, and the five-year average is a pull of 89 Bcf.

A Bloomberg survey showed respondents predicting a median 78 Bcf withdrawal for this week’s EIA report, with estimates ranging from draws of 58 Bcf to 104 Bcf.

A Reuters poll showed estimates ranging from withdrawals of 39 Bcf to 104 Bcf, with a median decline in stocks of 76 Bcf.

Saal said the wide ranges in the polls reflected the uncertainty that emerged after EIA’s inventory report last week.

Utilities pulled 98 Bcf of gas from storage in the week ended Feb. 26, a far lighter pull than market expectations for a withdrawal in the 130s Bcf or more, depending on the poll.

“I missed by a mile,” Saal said. He estimated an 85 Bcf withdrawal for this week’s report.