Continue here from prior thread;

I assume Mike would agree that NG is up due to non-weather change factors as the weather changes have been neutral and overall pretty mild.

Last thursday, it almoist made it back down to the lows in December. Not sure if the market is going to bounce back up, or is just taking a breath. But definitely not weather driven today.

Agree that Monday was NOT weather driven....more later today.

Thanks Larry for the new thread.

Previous ng thread here:

From Natural Gas Intelligence the past 2 days:

Monday

Natural gas futures on Monday advanced for a second consecutive session, boosted by continued robust liquefied natural gas (LNG) levels. The April Nymex contract settled at $2.582/MMBtu, up 4.7 cents day/day. May gained 5.3 cents to $2.619. NGI’s Spot Gas National Avg. rose 4.0 cents to $2.310, with prices up across the Rocky Mountains region…

March 22, 2021

Tuesday

AM

Continued expectations for mild temperatures later this month into early April saw natural gas futures reverse some of their gains from the previous session in early trading Tuesday. The April Nymex contract was down 2.6 cents to $2.556/MMBtu at around 8:50 a.m. ET. Overnight changes in the weather data included a loss of 13 heating…

PM/CLOSE

Just as a rally started to mount, natural gas futures stumbled on Tuesday and dashed hopes for a three-day winning streak. Strong liquefied natural gas (LNG) levels had propelled the prompt month over the two prior trading sessions, but continued forecasts for weak domestic weather demand curbed the momentum. The April Nymex contract shed 7.4…

U.S. Natural Gas Storage

Latest Release Mar 18, 2021 Actual-11B Forecast-17B Previous-52B https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Mar 18, 2021 | 10:30 | -11B | -17B | -52B | |

| Mar 11, 2021 | 11:30 | -52B | -73B | -98B | |

| Mar 04, 2021 | 11:30 | -98B | -136B | -338B | |

| Feb 25, 2021 | 11:30 | -338B | -333B | -237B | |

| Feb 18, 2021 | 11:30 | -237B | -252B | -171B | |

| Feb 11, 2021 | 11:30 | -171B | -181B | -192B |

for week ending March 12, 2021 | Released: March 18, 2021 at 10:30 a.m. | Next Release: March 25, 2021

-11 BCF Bearish but the market can't make new lows on it

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (03/12/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 03/12/21 | 03/05/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 328 | 350 | -22 | -22 | 414 | -20.8 | 353 | -7.1 | |||||||||||||||||

| Midwest | 426 | 440 | -14 | -14 | 514 | -17.1 | 449 | -5.1 | |||||||||||||||||

| Mountain | 114 | 113 | 1 | 1 | 96 | 18.8 | 107 | 6.5 | |||||||||||||||||

| Pacific | 199 | 205 | -6 | -6 | 199 | 0.0 | 186 | 7.0 | |||||||||||||||||

| South Central | 715 | 685 | 30 | 30 | 811 | -11.8 | 779 | -8.2 | |||||||||||||||||

| Salt | 197 | 176 | 21 | 21 | 245 | -19.6 | 237 | -16.9 | |||||||||||||||||

| Nonsalt | 519 | 509 | 10 | 10 | 566 | -8.3 | 543 | -4.4 | |||||||||||||||||

| Total | 1,782 | 1,793 | -11 | -11 | 2,035 | -12.4 | 1,875 | -5.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Notice:Automated retrieval policy

Working gas in storage was 1,782 Bcf as of Friday, March 12, 2021, according to EIA estimates. This represents a net decrease of 11 Bcf from the previous week. Stocks were 253 Bcf less than last year at this time and 93 Bcf below the five-year average of 1,875 Bcf. At 1,782 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly pe

These were the temps from last weeks EIA report.

Very mild in the Center. After the 2 biggest bearish surprises (combined) in history, one would have thought that the guesses would have been adjusted to be much more bearish. The number was still a bit more bearish than expected.

There were the temperatures, ending last Friday that will be used for the next EIA report on Thursday.

Still pretty mild!

Just a reminder of how bearish the previous 2 weeks(before last week) were for EIA withdrawals vs expectations:

https://www.marketforum.com/forum/topic/66348/#66351

By WxFollower - March 7, 2021, 5:50 p.m.

The EIA report issued last week was shockingly bearish as Mike noted. How bearish vs the WSJ survey mean that I've followed for 18 years? 46 bcf! The mean guess was -144 vs the actual of +98.

Since I happen to have a record of the WSJ survey mean guess going back to 2003, I was able to go back to see if this was THE most bearish. It turns out it was the SECOND most bearish and the most bearish in over 15 years. But I also should note that this one was by far the most bearish for a nonholiday week (by 14 bcf) as the holiday weeks often have had bigger misses due to more difficulty in guessing holiday related demand loss:

Here are the most bearish and bullish EIAs in relation to the WSJ mean with the dates listed being the end of the EIA week with an asterisk meaning holiday week: (+ means bearish and - means bullish)

Bearish:

12/30/05 +51*

02/26/21 +46

12/27/13 +37*

01/16/04 +32

01/02/09 +31*

02/13/09 +30

Bullish (none of the 4 most bullish were holiday weeks):

12/11/09 -31

01/25/08 -31

07/21/06 -30

02/06/04 -30

By WxFollower - March 11, 2021, 5:56 p.m.

https://www.marketforum.com/forum/topic/66348/#66556

Last week's report's EIA miss vs the WSJ survey was +46. Today's was +26. They add to +72. Was this the most bearish two week period vs the WSJ survey on record back to 2003? Yes, but only barely: 12/30/05 was +57 and 1/6/06 was +14 making that two week period +71 vs the +72 that has just occurred!

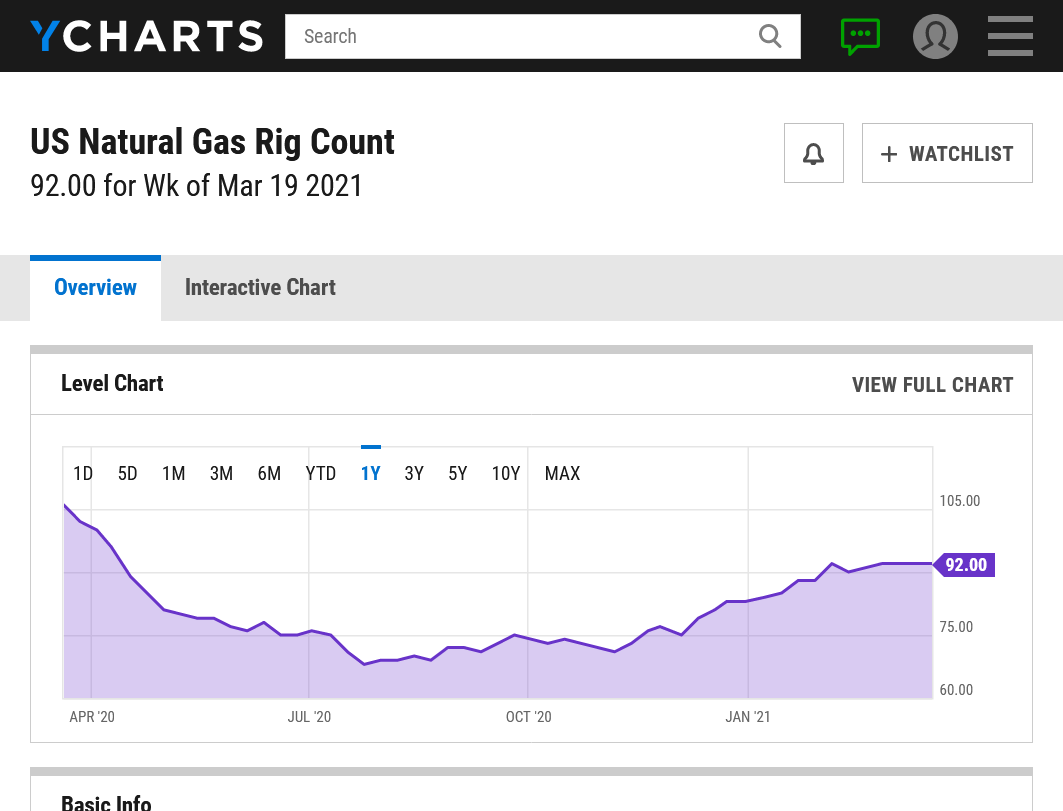

https://ycharts.com/indicators/us_gas_rotary_rigs

Natural Gas rig count steady at 92 for the past month+.

One year ago, the rig count was at 106 and crashing to the lowest number in history on July 24, 2020 at 68.

The seasonal, in many years is very supportive in March/April.

March and April are often very strong months, with it tapering off in May. Some years, it lasts into early June.

It failed badly last year because of COVID lost demand.

This year, we are fighting the most bearish EIA reports vs expectations in history as well as bearish weather.........but Winter is over and weather is not as important anymore.

However, April still remains $2,000/contract above the lows in December and is extremely unlikely to get back down there.

Storage has dropped below the 5 year average and prices are expected to average higher than this for the rest of the year, so the current prices represent value for buyers.

Also, COVID is being crushed, down 75% since the peak in early January and this is bullish the economy and ng demand.

Europe and China had a cold Winter and are rebuilding ng stocks. They have much higher ng prices than we do so our export market is looking strong for the rest of the year.

Russia is in the process of building a second oil and gas pipeline into Europe. Don't have a clue if there is any deal with the Chinese. There could be, but it would be kept secret from us.

Good point!

Russia has massive reserves of natural gas and there is no way in heck that they will be cutting back on production because of the fake climate crisis.

Putin may be an evil character, doing some bad things but he has a brain that thinks independently(and rationally/intelligently) of the Climate Accord and Green New Deal scam narratives.

There are those that will attach this behavior as being part of his evil character and him destroying the planet for his personal gain.

They would be correct that he's doing it for his country's gain. He is the president of Russia, this is the right thing to do for Russia.

They would be exactly wrong about it having 1 iota of an affect on the planet.............other than causing it to green up more.

March 24, 2021

NG likely bounced some this morning due largely to cooler models/forecasts vs yesterday with the 0Z Euro and GFS ens being ~10 HDD colder vs runs from 24 hours earlier.

Thanks.........The only thing about that Larry is that we made the lows of the day at 7am, well AFTER that guidance came out.

2.542 at 7:06am for the May ng.

I agree though, that those models were colder with a cold front coming up in less than a week.

Mike,

It bounced from 2.510 to 2.538 between when the 0Z GFS ens was in its early maps and the end of the 0Z Euro ens. Today looked to me like a battle between the cooler 0Z and 6Z models and the overall bearish situation otherwise. So, the range ended up fairly small.

I agree that ng had a small bounce for a couple of hours, just after midnight, after that colder guidance came out, before making new lows.

for week ending March 19, 2021 | Released: March 25, 2021 at 10:30 a.m. | Next Release: April 1, 2021

-36 BCF BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (03/19/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 03/19/21 | 03/12/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 307 | 328 | -21 | -21 | 400 | -23.3 | 329 | -6.7 | |||||||||||||||||

| Midwest | 405 | 426 | -21 | -21 | 495 | -18.2 | 424 | -4.5 | |||||||||||||||||

| Mountain | 112 | 114 | -2 | -2 | 93 | 20.4 | 106 | 5.7 | |||||||||||||||||

| Pacific | 193 | 199 | -6 | -6 | 195 | -1.0 | 186 | 3.8 | |||||||||||||||||

| South Central | 730 | 715 | 15 | 15 | 827 | -11.7 | 778 | -6.2 | |||||||||||||||||

| Salt | 215 | 197 | 18 | 18 | 256 | -16.0 | 236 | -8.9 | |||||||||||||||||

| Nonsalt | 515 | 519 | -4 | -4 | 571 | -9.8 | 542 | -5.0 | |||||||||||||||||

| Total | 1,746 | 1,782 | -36 | -36 | 2,009 | -13.1 | 1,824 | -4.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,746 Bcf as of Friday, March 19, 2021, according to EIA estimates. This represents a net decrease of 36 Bcf from the previous week. Stocks were 263 Bcf less than last year at this time and 78 Bcf below the five-year average of 1,824 Bcf. At 1,746 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Mar 25, 2021 Actual-36B Forecast-25B Previous-11B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Mar 25, 2021 | 10:30 | -36B | -25B | -11B | |

| Mar 18, 2021 | 10:30 | -11B | -17B | -52B | |

| Mar 11, 2021 | 11:30 | -52B | -73B | -98B | |

| Mar 04, 2021 | 11:30 | -98B | -136B | -338B | |

| Feb 25, 2021 | 11:30 | -338B | -333B | -237B | |

| Feb 18, 2021 | 11:30 | -237B | -252B | -171B |

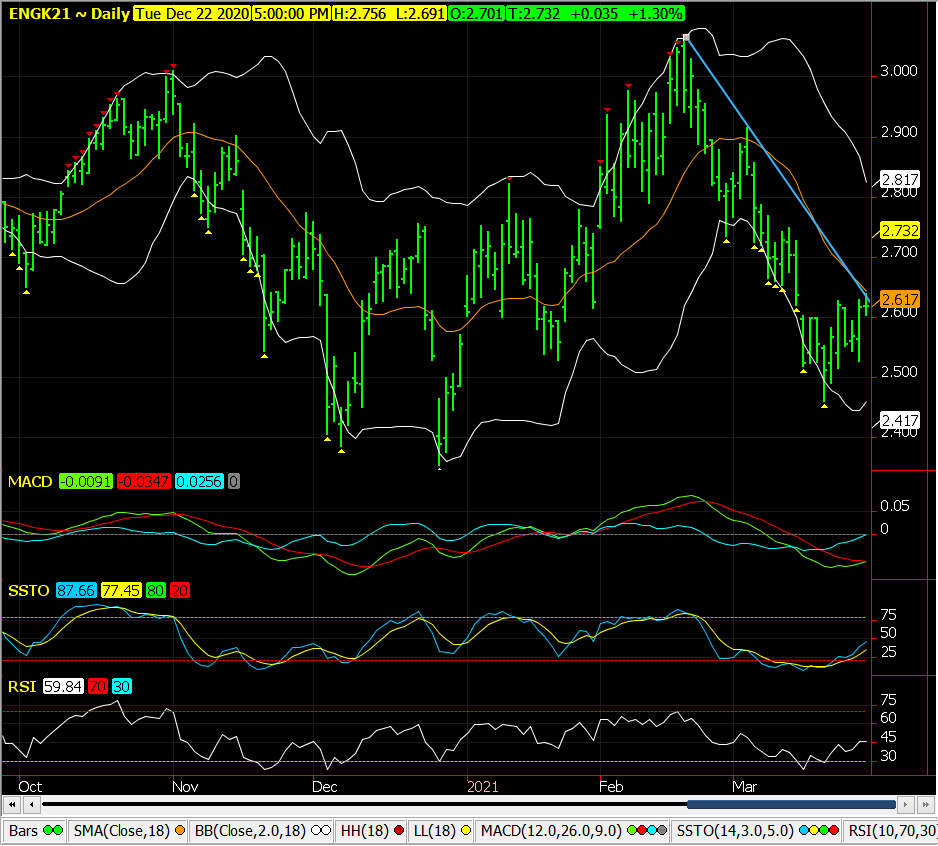

From Thursdays close

Friday Morning:

This is the May contract. It has made it back up to touch the trendline. Seems to be quite indecisive today.

Edit: Pay no attention to the date and numbers. The chart itself is correct. Just tried a copy and paste again, and it came up with numbers from Nov 18th.

Wonderful chart Mark, thanks!

It looks like we will break that downtrend line, if I had to guess, based on the time of year and the bullish EIA report and increasing export demand.

Pretty decent cold snap this week(but we are ending March-it's Spring) followed by much milder weather.

April NG expires tomorrow/Monday. Price spikes are not usual ahead of expiration.

We opened the week and are trading up a tad from the close on Friday.

Natural gas futures crept higher in early trading Monday as markets continued to monitor the obstruction in the Suez Canal. While projections continued to point to weak near-term demand for gas, the expiring April contract picked up 2.5 cents to trade at $2.582/MMBtu at around 8:50 a.m. ET. The May contract was up 2.2

metmike: April/front month expires today. Anything goes with the price.

NG has tested the top of the trendline and held. Don't really know of any other bullish fundies that would drive it up. Maybe exports.

Thanks Mark,

Seasonals are extremely strong here https://www.marketforum.com/forum/topic/66971/#67035

and we eroded the storage surplus to less than the 5 year average https://www.marketforum.com/forum/topic/66971/#67107

and prices are pretty low vs expectations for the rest of the year, so this represents value.

Export picture is good and so is demand from COVID recovery.

But the weather is pretty bearish...................but we are talking April. Its pretty tough to generate many HDD's in April and even then, the market knows the sun is rapidly getting higher in the sky and will overwelm any temporary weather patterns that are blowing diminishing cold air from higher latitudes(that are losing all their cold).

Tuesday earlier:

With little change to the temperature outlook in the latest round of forecast data, natural gas futures hovered close to even in early trading Tuesday. The May Nymex contract was up 0.1 cents to $2.654/MMBtu at around 8:45 a.m. ET. There were no major changes in the overnight weather data, according to NatGasWeather. Both the…

March 30, 2021

Already strong U.S. exports climbed higher Tuesday, but a weakening weather outlook and anticipation of a storage injection kept natural gas futures in check. The May Nymex contract debuted as the prompt month by falling 3.0 cents day/day to $2.623/MMBtu. June shed 2.7 cents to $2.681. Cash prices, in contrast, climbed on Tuesday amid a

Wednesday close:

Thursday early:

+14 BCF..........Bullish vs expectations.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Apr 01, 2021 Actual14B Forecast21B Previous-32B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Apr 01, 2021 | 10:30 | 14B | 21B | -32B | |

| Mar 25, 2021 | 10:30 | -36B | -25B | -11B | |

| Mar 18, 2021 | 10:30 | -11B | -17B | -52B | |

| Mar 11, 2021 | 11:30 | -52B | -73B | -98B | |

| Mar 04, 2021 | 11:30 | -98B | -136B | -338B | |

| Feb 25, 2021 | 11:30 | -338B | -333B | -237B |

for week ending March 26, 2021 | Released: April 1, 2021 at 10:30 a.m. | Next Release: April 8, 2021

https://ir.eia.gov/ngs/ngs.html

+14 BCF BULLISH

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (03/26/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 03/26/21 | 03/19/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 307 | 307 | 0 | 0 | 384 | -20.1 | 310 | -1.0 | |||||||||||||||||

| Midwest | 401 | 405 | -4 | -4 | 478 | -16.1 | 407 | -1.5 | |||||||||||||||||

| Mountain | 112 | 112 | 0 | 0 | 92 | 21.7 | 106 | 5.7 | |||||||||||||||||

| Pacific | 194 | 193 | 1 | 1 | 197 | -1.5 | 189 | 2.6 | |||||||||||||||||

| South Central | 749 | 734 | R | 15 | 15 | 838 | -10.6 | 787 | -4.8 | ||||||||||||||||

| Salt | 226 | 215 | 11 | 11 | 256 | -11.7 | 239 | -5.4 | |||||||||||||||||

| Nonsalt | 523 | 519 | R | 4 | 4 | 583 | -10.3 | 548 | -4.6 | ||||||||||||||||

| Total | 1,764 | 1,750 | R | 14 | 14 | 1,989 | -11.3 | 1,800 | -2.0 | ||||||||||||||||

| R=Revised. The reported revision caused the stocks for March 19, 2021 to change from 1,746 Bcf to 1,750 Bcf. As a result, the implied net change between the weeks ending March 12 and March 19 changed from -36 Bcf to -32 Bcf. Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,764 Bcf as of Friday, March 26, 2021, according to EIA estimates. This represents a net increase of 14 Bcf from the previous week. Stocks were 225 Bcf less than last year at this time and 36 Bcf below the five-year average of 1,800 Bcf. At 1,764 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

This was the 7 day period, ending last Friday for this last EIA report.

Extremely mild in the high population centers of the Upper Midwest to Northeast.

Spring is here and HDD's are not as important...........like they were a couple of months ago but the GSF ensemble got quite a bit colder overnight.

+++++++++++++++++++++

After the close on Thursday:

metmike: I thought the EIA was bullish. Also, the milder Thur. PM European model ensemble, caused a bit of pressure on the afternoon price.

Milder temps since Friday have ng hitting on a bearish note to start the week.

Over the holiday weekend both the European and American weather models showed large losses in degree days, according to EBW Analytics Group analysts. They estimated a decline of 18 Bcf in total projected natural gas demand resulting from the forecast changes.

“This large loss has sent natural gas prices down sharply in early-morning trading,” the EBW analysts noted. “The May contract is already testing support near the next major support level at $2.55/MMBtu. While it is possible support will hold this morning, further losses may occur later this week if the forecast continues to trend milder.”

The latest forecast from Bespoke Weather Services showed the current week sitting at a “near-record” low for national gas-weighted degree days.

“There is support for a cooler trough to move into the eastern U.S. as we get toward the middle of the month, though this is only expected to bring demand back up toward near-normal levels at this time, keeping April on pace to be yet another warmer-than-normal month rather easily,” Bespoke said.

“While there can be some variability at times, our view is that the general warmer-than-normal regime will continue to roll along, which is bearish for a few more weeks” before cooling degree days “begin to take over more as we get toward the middle part of May.”

Alongside weather, other fundamental factors including production gains and weak power burns were creating a “perfect storm of bearishness” for natural gas early Monday, according to Bespoke.

“The bigger story remains the weakness in power burns,” the firm said. “It was a holiday weekend, of course, but these burns, even when adjusting for weather, are still very weak, with lower prices the last few weeks doing very little to bring in more demand, at least so far.”

Meanwhile, going back to last week’s U.S. Energy Information Administration (EIA) storage report, the 14 Bcf injection reported by the agency came in around 0.4 Bcf/d looser than the five-year average when compared to degree days and normal seasonality, according to Wood Mackenzie analyst Eric Fell.

“Last week is almost back to neutral after four very loose stats in a row,” Fell said in a note to clients.

Looking ahead to this week’s EIA report, NGI issued a preliminary estimate for a 23 Bcf build for the week ended April 2. Last year, EIA recorded a 30 Bcf injection for the similar week, and the five-year average is an injection of 8 Bcf.

NG has broken thru the pennant/flag formation that could have been a bull flag or a bear flag.............now obviously a bear flag as we've crashed thru recent support/lows.

Very weak weather demand is the reason but at a time of year when weather demand is the lowest, I thought that even lower than average demand might not be THIS negative on prices.

We are at 2.500, down over $1,300 for the day. The next level of support is 2.459-March 18, 2021 low. Then 2.352-December 28, 2021 low.

OK, we just spiked to a new low of 2.489.

All 0z models were quite a bit colder but the trend started back on Monday with the 12z model runs

Colder trend stalled or ended with 12z models and its mainly just for a 5-7 day very chilly period..........IN MID APRIL!

It ends after that. Just too late in the heating season for HDD changes to have lasting power unless its something really extreme.

In just over a month, May 10th, The climate average for Cooling Degree Days will go higher than the climatological average for HDD's.

NG has crashed to new lows for the move, a few ticks below the March 18th low of 2.459.

The next level of MEGA support would be 2.357 from the December 28, 2020 lows.

Below that would be way down at 2.057 from the COVID panic and historic spike lows to the lowest prices in 3 decades(in the front month) back on March 9, 2020.

At that time, the May 2021 contract was over a year out and holding a ton of premium, staying above $2.

I didn't think we would drop this much in the Spring, usually a seasonally strong time for prices, even with bearish weather.

Prices are getting cheap down here though and represent value. There may also be bearish fundamentals that I'm not aware of, which are bringing more supplies to the market, to refill storage, depleted to just below the 5 year average.

Shortly after my early pm post yesterday, the European model came out a bit colder and we bounced a bit and held the huge support level mentioned previously thru the evening, with another small bounce early overnight that has been fading because there just is not enough cold left at this time of year, even with below average temps coming up.

Shortly after my early pm post yesterday, the European model came out a bit colder and we bounced a bit and held the huge support level mentioned previously thru the evening, with another small bounce early overnight that has been fading because there just is not enough cold left at this time of year, even with below average temps coming up.

However, prices are low enough with enough cold that we could hold the huge support that barely held yesterday.

After a lot of hesitation yesterday afternoon through earlier this morning to maintain the price rise based on clearly colder models (~8-16 HDD increases)(obviously based on non wx factor(s), probably stronger production along with Mike’s reasoning that even strong cold for mid April is not going to have as much impact as during winter), the fact that models retained these colder trends along with a further slight rise overall has likely been the reason for NG’s strong late morning. I mean for mid April, it is looking pretty impressively cold as I don’t think it could get a whole lot colder than what models have been showing. And it isn’t like there isn’t some bullish effect on projected demand as HDDs still are the dominant wx force through all of April. So, with relatively cheap prices, today’s rise back makes perfect sense. Now if only we could know this in advance rather than just giving hindsighted based commentary....

The projected cold looks to be driven largely by projected -NAO along with a little help from a projected slight -AO and +PNA. Going to be fun to follow this.

The projected -NAO would be the strongest of the entire gearing season with near -1.5 fo midmonth!

Thanks for your expert assessment. I agree with the --NAO being especially impressive Larry.

It is a very short lived cold spell in the big picture and also Mid-April but at the very least, it gave us enough buying (lack of selling) at the huge support levels.

This is what NGI says caused todays rally:

Natural gas futures recovered a few cents in early trading Wednesday as the latest forecasts showed colder temperatures arriving into the Midwest and East later this month. After sliding 5.5 cents in the previous session, the May Nymex contract was up 2.9 cents to $2.485/MMBtu at around 8:45 a.m. ET. The updated forecast from Bespoke…

Thanks, Mike. IF the NAO were to fall to -1.8, which is quite possible looking at the GEFS prog, it would be the strongest -NAO since the -1.81 from all of the way back on 5/10/17!

Wow. This is also a factor in the MINN wheat rallying today. That --NAO pattern means dry weather in the N.Plains/upper Midwest which will worsen the drought there.

Story of the day Natural Gas Intelligence

metmike: European model came out less cold and took away some pm gains. Evening GFS was colder but has been no help. We just can't count on mid April weather to be the most important driver all the time because the main heating season has long past and cooling season has a bit to go.

Weekly Natural Gas Storage Report

for week ending April 2, 2021 | Released: April 8, 2021 at 10:30 a.m. | Next Release: April 15, 2021

+20 BCF.......Neutral

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (04/02/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 04/02/21 | 03/26/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 305 | 307 | -2 | -2 | 382 | -20.2 | 303 | 0.7 | |||||||||||||||||

| Midwest | 398 | 401 | -3 | -3 | 475 | -16.2 | 400 | -0.5 | |||||||||||||||||

| Mountain | 115 | 112 | 3 | 3 | 92 | 25.0 | 106 | 8.5 | |||||||||||||||||

| Pacific | 198 | 194 | 4 | 4 | 202 | -2.0 | 194 | 2.1 | |||||||||||||||||

| South Central | 768 | 749 | 19 | 19 | 867 | -11.4 | 806 | -4.7 | |||||||||||||||||

| Salt | 235 | 226 | 9 | 9 | 264 | -11.0 | 248 | -5.2 | |||||||||||||||||

| Nonsalt | 533 | 523 | 10 | 10 | 604 | -11.8 | 558 | -4.5 | |||||||||||||||||

| Total | 1,784 | 1,764 | 20 | 20 | 2,019 | -11.6 | 1,808 | -1.3 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,784 Bcf as of Friday, April 2, 2021, according to EIA estimates. This represents a net increase of 20 Bcf from the previous week. Stocks were 235 Bcf less than last year at this time and 24 Bcf below the five-year average of 1,808 Bcf. At 1,784 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Latest Release Apr 08, 2021 Actual20B Forecast21B Previous14B

https://www.investing.com/economic-calendar/natural-gas-storage-386

Release DateTimeActualForecastPrevious

Apr 08, 2021 10:3020B21B14B

Apr 01, 2021 10:3014B21B-32B

Mar 25, 2021 10:30-36B-25B-11B

Mar 18, 2021 10:30-11B-17B-52B

Mar 11, 2021 11:30-52B-73B-98B

Mar 04, 2021 11:30-98B-136B-338B

7 day temperatures for that period, ending last Friday were close to average overall vs recent weeks that have yoyo'd up and down.

It seems quite the conundrum we have fundamentally. Rig count is only down by 1, ever so slightly bullish. Exports are up, bullish. Despite the nuetrality of the storage number, gas in storage is maintaining, and looks to possibly increase, bearish. And as you have pointed out, short of a few cold snaps, winter is over. HDDs going down, bearish.

No wonder we aren't getting too much action, especially on seaasonals.

Thanks Mark!

Speaking of the rig count. Up from the lowest of the last 10 years of 68 in July 2020 because of COVID last year but still well below the previous loftier levels:

Please go to new NG thread for continued discussions as this has gotten long.

Weather is colder, with more HDD's on all the models vs last Friday. They keep the chilly weather going well into week 2 today, numerous days longer than late last week.

We're talking late April now and CDD's , seasonally go higher than HDD's around May 10th.

This means that in a few weeks, cool weather will become bearish instead of bullish.