Here's a new NG thread. On Friday, NG sold off 4 cents 1:15-2:30 PM CDT. I'm pretty confident that that was due to a cooler Euro suite, especially cooler week 2 on the EE.

With the 12Z Sun EE and GE both having lost a handful or so of CDDs vs the 12Z Fri runs and with forecasts a little cooler as a result, it is no surprise that NG opened down a few cents.

Thanks much Larry!

This is the previous thread. I'll add more here when I get the chance.

| Directors Cut | 7/20/2021 | ||||||||

| NDIC | |||||||||

| Oil | M over M | M over M | Gas | M over M | M over M | ||||

| Mth | Mthly cum | Bbls/ D | Mthly cum | Mcf/ D | |||||

| 2021 | May | 34,953,034 | 4% | 1,127,517 | 1% | 92,411,537 | 4% | 2,981,017 | 1% |

| April | 33,646,529 | -2% | 1,121,551 | 1% | 88,898,778 | 0% | 2,963,293 | 3% | |

| March | 34,361,668 | 13% | 1,108,441 | 2% | 89,236,535 | 18% | 2,878,598 | 6% | |

| Feb | 30,324,555 | -15% | 1,083,020 | -6% | 75,710,555 | -14% | 2,703,943 | -5% | |

| Jan | 35,568,679 | -4% | 1,147,377 | -4% | 88,327,784 | -2% | 2,849,283 | -2% | |

| 2020 | Dec | 36,956,504 | 1% | 1,192,145 | -3% | 89,680,150 | 4% | 2,892,908 | 0% |

| Nov | 36,736,201 | -3% | 1,224,240 | 0% | 86,323,059 | -3% | 2,887,402 | 0% | |

| Oct | 37,909,008 | 3% | 1,223,107 | 0% | 89,083,281 | 5% | 2,873,654 | 2% | |

| Sept | 36,649,997 | 1% | 1,221,667 | 5% | 84,453,374 | 3% | 2,815,112 | 7% | |

| Aug | 36,126,492 | 12% | 1,165,371 | 12% | 81,692,742 | 14% | 2,635,250 | 14% | |

| July | 32,304,503 | 21% | 1,042,081 | 17% | 71,375,125 | 21% | 2,302,356 | 17% | |

| June | 26,703,268 | 0% | 890,109 | 4% | 59,198,681 | -1% | 1,973,289 | 2% | |

| May | 26,640,218 | -27% | 859,362 | -30% | 59,771,779 | -27% | 1,928,122 | -29% | |

| April | 36,572,571 | -17% | 1,219,086 | -15% | 81,365,042 | -16% | 2,712,168 | -13% | |

| March | 44,276,463 | 1,428,273 | 96,902,755 | 3,125,895 | |||||

| All time highs | |||||||||

| Oil | 1,519,037 | Bbls/D | 11/30/19 | ||||||

| Gas | 3,145,172 | Mcf/D | 11/30/19 | ||||||

| Rig count | 218 | 5/29/2012 | |||||||

NG has now been certified as the “wackiest, wildest, most incredible” market in history…. in futures. Yes, that’s a play on Jon Sterling’s call during the 7/4-5/1985 Atlanta Braves-NY Mets game when Atlanta’s horrible hitting relief pitcher Rick Camp with 2 outs and on an 0-2 pitch hit his first and only home run ever to tie the game in the bottom of the 18th to send it to 19.

NG having risen to 4.165 made less than zero sense from a wx standpoint at least. And then it plunged 15 cents to within 2 cents of the session low just 1.75 hours later!

Yes, I've been tied up and not watching every tick like I often do but that was really wild like you said.

Expiration of the front month, August early this week probably played a role.

The overnight Euro had MORE CDD's/was bullish then the next 6z GFS had LESS CDD's, so that also could have been a huge factor and the market is ULTRA sensitive.

Like has been the case for many days of the last few weeks, it isn't just wx that has been propping up NG today. Actually, wx is net bearish vs Fri on a change basis and that includes the 0Z EE vs Fri.

Update after 12Z EE: went back cooler and lost as much as the 0Z run gained in CDD. That did lead to a 3 cent selloff after an unexplained (in terms of wx changes I mean) rise of 3-4 cents. So, here we are in the 4.060's for Sep, which is still some 6-7 cents higher than it was when it opened last night following yesterday's 12Z EE, which is similar to today's 12Z EE. Again, more evidence that NG had nonwx bullish factors leading to buying.

Edit: And now back up to 4.085. Has to be more too it than wx that isn't already dialed in because the 12Z GE and EE were both notably cooler.

Finally, NG goes down due to cooler forecasts. Finally! Took it long enough.

Thanks Larry,

While I don't disagree with you, when a market has not responded to weather changes on several occasions in a row, how do you know that THIS time it was responding to them, after not doing so a bunch of times previously, especially with the expiration of the front month August?

What tells you that this time was different..........other than assuming that when it happened, it would be from the cooler changes.

The European model overnight WAS cooler for sure.

Again, I agree with the idea but am wondering why the same idea wouldn't work so many times recently for natural gas?

Hey Mike,

Good point! I don't know for sure but I'm assuming that it finally went down due to cooler forecasts/models. I have both the EE and GE a whopping 12 CDDs cooler vs 24 hours ago. I'm assuming that was too much for the underlying bullish factors to "bear". <G>

Wow Larry, I didn't realize it was THAT much. This is pretty compelling. I've been busy with so many other things and with NGQ expiring, was not tracking the exact CDD numbers.

Thanks!

It was more than “modestly” milder wx. It was quite a bit milder wx.

WxFollower vs Natural Gas Intelligence

I'll take WxFollower every single time!!

metmike: The afternoon trading felt like anything but strong. ...............but who would have guessed at the start of the year that prices would be this high??

Re: From the Bakken. 23 Rigs running and I have 1

By joelund - July 26, 2021, 8:57 a.m

Thanks much Joe!

Well, that was entertaining. Watched the anticipation build up for a bullish run from the report, but it was very shortlived. Not that the report itself was very bullish.

for week ending July 23, 2021 | Released: July 29, 2021 at 10:30 a.m. | Next Release: August 5, 2021

+36 BCF BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/23/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 07/23/21 | 07/16/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 583 | 562 | 21 | 21 | 704 | -17.2 | 636 | -8.3 | |||||||||||||||||

| Midwest | 702 | 683 | 19 | 19 | 813 | -13.7 | 715 | -1.8 | |||||||||||||||||

| Mountain | 184 | 183 | 1 | 1 | 195 | -5.6 | 181 | 1.7 | |||||||||||||||||

| Pacific | 246 | 247 | -1 | -1 | 313 | -21.4 | 289 | -14.9 | |||||||||||||||||

| South Central | 999 | 1,002 | -3 | -3 | 1,212 | -17.6 | 1,060 | -5.8 | |||||||||||||||||

| Salt | 269 | 279 | -10 | -10 | 340 | -20.9 | 283 | -4.9 | |||||||||||||||||

| Nonsalt | 729 | 723 | 6 | 6 | 872 | -16.4 | 776 | -6.1 | |||||||||||||||||

| Total | 2,714 | 2,678 | 36 | 36 | 3,237 | -16.2 | 2,882 | -5.8 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,714 Bcf as of Friday, July 23, 2021, according to EIA estimates. This represents a net increase of 36 Bcf from the previous week. Stocks were 523 Bcf less than last year at this time and 168 Bcf below the five-year average of 2,882 Bcf. At 2,714 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jul 29, 2021 Actual 36B Forecast 43B Previous 49B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B | |

| Jul 15, 2021 | 10:30 | 55B | 47B | 16B | |

| Jul 08, 2021 | 10:30 | 16B | 34B | 76B | |

| Jul 01, 2021 | 10:30 | 76B | 68B | 55B | |

| Jun 24, 2021 | 10:30 | 55B | 66B | 16B |

7 Days ending last Friday for this latest EIA report. This is climatologically the hottest week of the year.

Hot N.Plains.

NOT as hot as usual S.Plains to Northeast.

metmike: Cooler European model is letting out some of the steam in the bullish reaction.

metmike: Increasing COVID?

Major widespread heat coming up!

Natural gas continues to trade with insanity.

After dropping sharply during the very early morning hours, down below $3.92 just after 7am, it went back on a rampage...........with only very minor assistance for the weather. The 12z GFS added a couple of CDD's but was still lower than Monday's 18z run.

The 12z Euro was around +1 CDD vs the previous run but progression of days is causing total CDD's to be higher compared to previous runs because we are eliminating the cool CDD from the current regime and replacing it with much warmer temps for new days at the very end of the new periods.

Temperatures ending last Friday for this Thursdays EIA report. Except for the Northeast(lots of people) and parts of the Southwest(not many people) much of the country was pretty hot. So the number should be smaller than average for that week, the last week in July.........which usually is one of the smallest numbers of the year because its barely after the climatological peak in temperatures and in fact, captures some of that period.

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

This is clearly a BULL market!!!!

After two solid days in the black, natural gas futures prices reached new heights on Wednesday as production continued to decline, and hot weather remained firmly in next week’s forecast. The September Nymex gas futures contract hit a $4.205 intraday high before settling at $4.158, up 13.1 cents from Tuesday’s close. At A Glance: Next…

++++++++++++++++++++++++++

Thursday early:

After a steep 13-cent rally during the prior trading session, natural gas futures pedaled back a bit early Thursday as major weather models showed slightly less heat in mid-August. The September Nymex gas futures contract was trading two-tenths of a cent lower at $4.156 at 8:45 a.m. ET. Despite the loss of 2-3 cooling degree…

metmike: Tiny EIA number on the way from last weeks heat.

Bullish!!

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Aug 05, 2021 Actual13B Forecast21B Previous36B| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 05, 2021 | 10:30 | 13B | 21B | 36B | |

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B | |

| Jul 15, 2021 | 10:30 | 55B | 47B | 16B | |

| Jul 08, 2021 | 10:30 | 16B | 34B | 76B | |

| Jul 01, 2021 | 10:30 | 76B | 68B | 55B |

https://ir.eia.gov/ngs/ngs.html

for week ending July 30, 2021 | Released: August 5, 2021 at 10:30 a.m. | Next Release: August 12, 2021

+13 BCF BULLISH!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (07/30/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 07/30/21 | 07/23/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 604 | 583 | 21 | 21 | 716 | -15.6 | 655 | -7.8 | |||||||||||||||||

| Midwest | 719 | 702 | 17 | 17 | 828 | -13.2 | 734 | -2.0 | |||||||||||||||||

| Mountain | 184 | 184 | 0 | 0 | 201 | -8.5 | 184 | 0.0 | |||||||||||||||||

| Pacific | 244 | 246 | -2 | -2 | 311 | -21.5 | 287 | -15.0 | |||||||||||||||||

| South Central | 976 | 999 | -23 | -23 | 1,214 | -19.6 | 1,053 | -7.3 | |||||||||||||||||

| Salt | 250 | 269 | -19 | -19 | 336 | -25.6 | 276 | -9.4 | |||||||||||||||||

| Nonsalt | 726 | 729 | -3 | -3 | 877 | -17.2 | 777 | -6.6 | |||||||||||||||||

| Total | 2,727 | 2,714 | 13 | 13 | 3,269 | -16.6 | 2,912 | -6.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,727 Bcf as of Friday, July 30, 2021, according to EIA estimates. This represents a net increase of 13 Bcf from the previous week. Stocks were 542 Bcf less than last year at this time and 185 Bcf below the five-year average of 2,912 Bcf. At 2,727 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2016 through 2020. The dashed vertical lines indicate current and year-ago weekly perio

Bullish after the market futzes around making you second guess yourself....

Not sure what that point was Jim. Can you translate that please?

The market was obviously expecting this based on the muted reaction and the incredibly high prices compared to the last several years.

Your response indicated you know what I was talking about. But your point is taken. The average estimations were at 22BCF injection. I was expecting us to move comfortably above $4.2 though. Never happens fast enough.

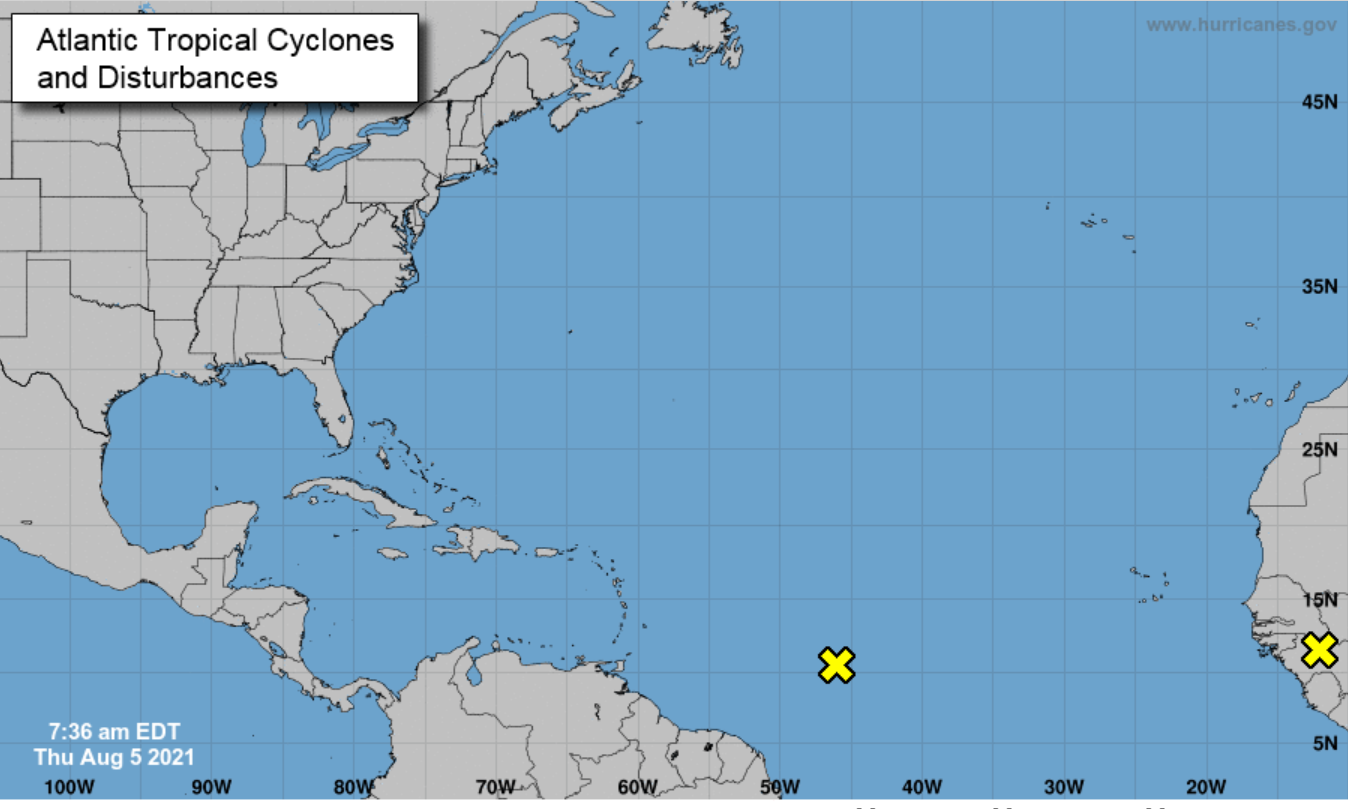

Of course we do have some weather building in the Atlantic. Maybe a hurricane will give it lift.

Thanks Jim,

I wasn't questioning you, just wanting to be clear........ we need to actually try to understand what other people are saying because in today's world, we need more of that.

I get your point now.

It's too early to decide where ng will end up but it's holding together for the moment.

Thanks for bringing up the tropics.

I totally forget about them.

Atlantic weather activity has been relatively quiet so far this year.

Jim,

It is relatively quiet vs last season but last season was a beast. It otherwise really has been relatively quite active vs long term averages/climo with already 5 named storms through just July! And the SE US has had well above average impacts for June-July.

Larry,

What's your valued opinion on this storage number and how does it stack up with different comparison metrics?

Mike asked:

Larry,

What's your valued opinion on this storage number and how does it stack up with different comparison metrics?

----------------------------------

Hey Mike,

Sorry, I just saw this. I'll try to get back to this as soon as I have time.

Looking forward to it Larry.

metmike: The 0z European model was a bearish -5 CDD's but then the 6z GFS came in + +5 CDD's vs the previous run! NG is going to have some wild trading for the next several months with these extremely bullish storage reports drawing down the storage vs previous years. This market MUST have a minimal amount in storage by that start of Winter/the main heating season to be amply supplied in case for a cold Winter. The best way to insure that is with higher prices that encourage additional production.

Mike asked:

Larry,

What's your valued opinion on this storage number and how does it stack up with different comparison metrics?

-------------------------------------------------------

Mike and others,

I finally got a chance to do some comparisons with not just earlier this season but also in past summers. My assessment:

- The +13 on 85 CDDs is barely behind the +16 bcf on 82 CDDs of 4 weeks ago for easily the two most bullish weeks of the summer.

- The bullishness of these two weeks this season appears to be about as strong as all other summer weeks going back to 1994 on a CDD adjusted basis!

Most bullish summer weeks (on CDD adjusted basis) of each summer (EIA/CDD)

2021: +16/82

2020: +35/84

2019: +36/91

2018: +24/89

2017: +30/73

2016: +17/87 (also had +11 on 94 CDDs and -6 on 105 CDDs, but these weren't as bullish)

2015: +32/88

2014: +75/64

2013: +41/87

2012: +20/92

2011: +25/100

2010: +27/88

2009: +57/75

2008: +57/74

2007: +21/92

2006: -12/103 (also had a -7 on 102 but that's not quite as bullish)

2005: +37/89

2004: +70/75

2003: +53/83

So, of these summers, the only ones comparable are 2017's +30/73 and 2006's -12/103 with 2016's +17/87 pretty close behind by ~8-9 bcf. All of the other summers were 15-20++ bcf more bearish than the most bullish 2021 week. The most bearish were 2004's +70/75, 2003's +53/83, 2011's +25/100, and 2019's +36/91, which were 44/38/36/34 bcf more bearish than 2021's most bullish week.

Thanks a 13,000,000,000!

This one is well worth copying and printing out!

Mike

Thats some great information. Is it me or was Saturday’s NWS 6-10 and 8-14 maps a lot cooler than today’s (Sundays) maps?

Astute observation Jim!

The automated NWS weekend maps were MUCH less hot yesterday than today.

I don't think the market trades on them so much as what the latest models show. The models that went into them were from data that was obtained the previous evening.

In my honest observation, we in the SE have had a more moderate season temperature wise. It's August, and we should have already posted several 100+degree days. But the closest we have got, is a handfull of upper 90's at best. Even the lows are cooler than average for this time of year. Weather, both experienced and projected, doesn't really seem to have been the driving factor for NG. At least not over this summer. Seems that most of the driving force has been storage and export demand.

JMHO

Good observation Mark!

This is the last 90 days below, which is the main cooling season so far.

Temps in the South/Southeast have been around 1 deg. F below average. That's not huge but for 90 days that adds up to less CDD's. It's been -2 deg. F in TX.

Amazing heat out West, with anomolies of +5 deg. F in parts of the Northwest. That's amazing. The heat has been spilling out into the N.Plains and U.Midwest........exactly where the drought is and by no coincidence.......same pattern causing both, related to the cool temps in the tropical Pacific and La Nina type signature as well as the -PDO.

Here's the temps over the last 30 days. Very close to the temps from the last 90 days.

While we're on temp maps, here's the 7 days for the next EIA report. Same temp configuration as the 90 and 30 day temps but even cooler where the most people live in the Midwest, East and South.......so the EIA report this Thursday will show a bigger injection.