Rather large heat build in later 2nd week, GFS. Slight affect on Atlantic coast and northeast. Mostly in the Mississippi valley region. Gonna be interesing to see how Europe responds to it tonight.

Also going to be interesting to see how the expiry of a contract on report day goes. Should be an interesting morning.

Thanks for starting a new ng page Mark.

Previous thread here:

https://www.marketforum.com/forum/topic/73381/

"Rather large heat build in later 2nd week, GFS. Slight affect on Atlantic coast and northeast. Mostly in the Mississippi valley region. Gonna be interesing to see how Europe responds to it tonight."

Not sure what you are talking about? The 0z GFS ensemble was actually 6 CDDs COOLER, all from week 2.

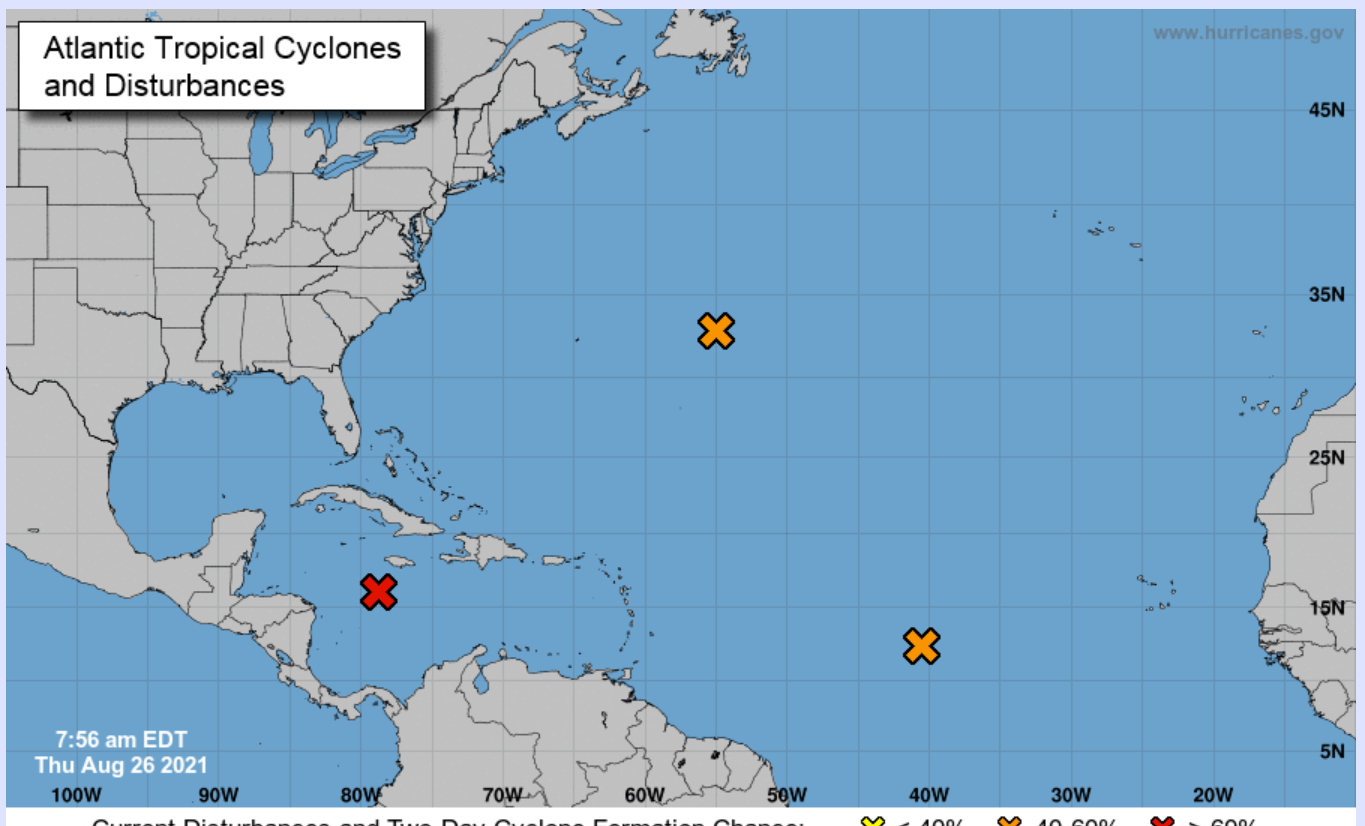

Agree that expiration of the front month, September on an EIA report day could mean volatility...........along with a potential hurricane threat!

Temperatures for this weeks EIA report released on Thursday at 9:30 am CDT.

VERY warm to hot Midwest and East Coast. Also West Coast.

Chart action looks like they are preparing for a short move. I'm on the sideline.

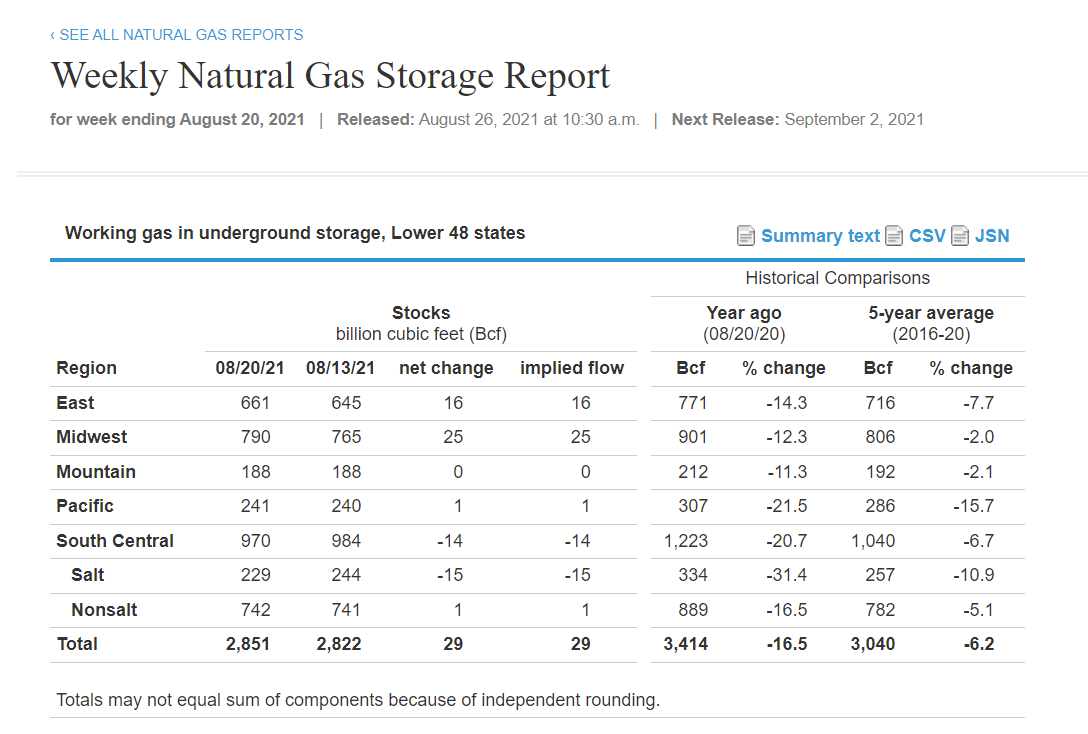

I'm guessing the way the market shot up, that it was a bullish report. I don't know that I saw what the guesses were.

Throw a little weekend potential weekend hurricane and it makes for a volatile day/s!

Selling the exhaustion @4.121

Thanks Jim!

VERY BULLISH!

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Aug 26, 2021 Actual 29B Forecast 40B Previous 46B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B | |

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B | |

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B | |

| Aug 05, 2021 | 10:30 | 13B | 21B | 36B | |

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B |

Pulled the plug @4.112. They aren"t done yet.

Elevated hurricane (Ida) threat, although not as much production in the GOM as 15 years ago, when this would have been HUGE:

Kinda crazy that this only got is to where we were at the beginning of the month. Friday could be quite a day. Bullish report and now a hurricane heading right up the chute and storage running kind of weak. Buckle up!

September natural gas futures rocketed higher Thursday, buoyed by a shockingly tight government storage print and a rebound in liquefied natural gas (LNG) demand. The prompt month hit a $4.193/MMBtu intraday higher and went on to settle at $4.184, up 28.7 cents from Wednesday’s close. The October contract jumped 28.6 cents to $4.211. Spot gas…

metmike: I'm thinking these are the highest prices at this time of year in well over a decade?

Latest on soon to be Hurricane Ida:

GFS was a couple CDD's warmer but European model was more than -4 CDD cooler.

metmike: September ng expires today. I was thinking yesterday, earlier this week. It's all IDA and the bullish storage and not temps.

Following through on the previous session’s prodigious rally and then some, natural gas futures soared early Friday as traders contemplated tight balances and a potential major Gulf Coast hurricane. The expiring September Nymex contract was up 18.0 cents to $4.364/MMBtu at around 8:45 a.m. ET. October was up 17.2 cents to $4.383. At 8 a.m.…

Looks like a gap up opening coming. Probably crap out later.

Great call Mark!

I'm guessing you're right on the crap part too.

As soon as they know that no rigs or production plants are damaged (which I doubt they are), it will fall like manna from the sky. ;-)

edit: As an added thought, would the power outages for a few days have any affect? There are about 6 gas companies right in the middle of the track, and they will experience some delay of production.

That's a great point Mark!

Power outages are bearish!

Maybe not REAL bearish but it means less demand.

It crapped and got crushed just like you speculated it would Mark!

From earlier this morning:

Nearly all of the natural gas and oil produced in the Gulf of Mexico (GOM) was shut-in, as the unrelenting terror of Hurricane Ida stormed ashore Louisiana, knocking out power to more than one million people and killing at least one person. The Category 4 hurricane on Monday had weakened to a tropical storm with…

metmike: Natural gas did a gap higher at the end of a strong move up that was filled and proven to be a buying exhaustion(at least a short term one). The shrinking storage situation, with Winter coming up, however is not resolved and remains extremely bullish right now.

Here's a good discussion/explanation for gap and craps.

Gap and Crap buying exhaustion formation

1 response |

Started by metmike - Aug. 30, 2019, 6:12 p.m.

Though still early for a full assessment of former Hurricane Ida, natural gas futures traders on Monday focused squarely on the destruction of natural gas demand brought about by the catastrophic Category 4 storm. The October Nymex gas futures contract, on its first day in the prompt position, settled at $4.305, off 8.3 cents from…

metmike: Demand destruction. https://www.marketforum.com/forum/topic/74223/#74383

Tuesday after the close:

Wednesday Morning:

September 1, 2021

Tomorrow's forecast is 25.

With the shutins this week, that will create an even smaller injection for next week's report. The bull market remains.

Also saw an EIA article predicting a lower than usual storage for this coming winter months. Hhhhmmm.

Thanks Mark,

Temperatures were hot last week for much of the country except the Northwest.........so yes, the EIA report should be pretty bullish!

Couple of minutes before shift change.

Nat Gas Industry can't fill storage. 20 BCF build week ending 08/27.

Rigs available but labor a problem especially for frac crews.

This guy really needs an editor but does extensive research on all sources of energy.

https://twitter.com/CelsiusEnergyFM

joelund, thanks!!! Gonna have to keep up with this guy.