"Since your charts continue to use Fibonacci and E-waves analysis/levels"

First wanted to mention that E-waves are not really a part of my strategies but when a wave 3 develops as now is the case in the financials it is easy to recognize, these waves are fast, furious and relentless.

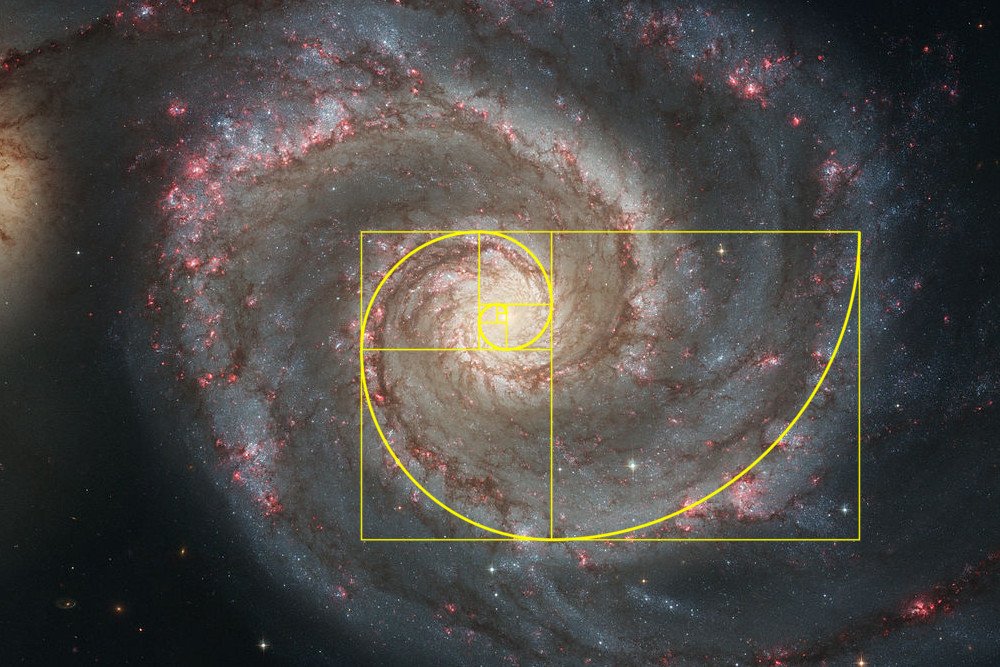

About Fibonacci numbers and ratios: they are all around us and have been since the beginning of time:

"can you please explain it and why you think that it works"

That these numbers appear in the markets is just another way of shall we say "creating order" ? As to why they appear, well: not my "problem", I just enjoy them showing up !

"why you think that it works so that readers will understand what you are doing"

When it comes to trading, first order in my book is reducing losses to an absolute minimum.

Through the use of what are called "inflection points" or "confluences" one can pre- determine the possible and at times inevitable losses. A losing trade in the S&P for example should cost no more than two points.

Looking for these inflection points I will use a combination of several retracements and/or extensions in price, ideally combined with an extension in time. Numbers I look for are .786, 423.6, .707, .50, 1.618, .618, 200, 127.2, 141.4 being the main ones. Price is the ultimate indicator, nothing else really matters. When two or more of these fibo numbers fall within 1 to 2 points max of one another it can turn into a possible profitable trade.

Finding these points is not all that difficult with a little practice. It does require adjusting charts as price keeps moving and patterns develop, i.e.; where was the previous high and low of this move, how many ABC's (or 1-2-3's) are in this move/wave, where can I best start putting my levels and when do I adjust? Do I discern a 5 wave pattern, a 3 wave, a cypher pattern? Plenty of stuff to consider and yes: it does take some practice.

When I find such a point of inflection or confluence it is easy enough to place a stop limit order at exactly that level (or a market order as a last resort).

Depending on the fill, a stop is put in place again within 1or 2 points max from the point of entry.

"and the projections?"

Projecting is always the most difficult proposition, for me I just try to observe what phase the overall trend is in (bull/bear), how fast the market is moving, how much volume the move produces, how volatile the action is etcetera.

Also: what is the traders' objective; get out every day trying to average 10/15 points, go for a swing trade that produces 60 to 100 points, long term investment as opposed to a trade?

The possibilities in the markets are endless so to speak, both in a good and a bad way. One should not have any biases as in: "this is what the market should be doing here", try instead to just follow what the market is actually doing.

Don't ever fret about missing a trade, exercise patience, there is another trade around the corner: start adjusting your charts, apply your strategy and wait until the next opportunity presents itself.

Finally, and I know many people have preached this for the longest of time but I still refer back to this statement about being humble:

The irony is that with humility, a trader can actually get a better feel for the "subjective approach" to trading. He then can follow his "hunches" and anticipate some pretty good opportunities. His humility will save him in the end, because he will be the first to recognize his error, and adjust accordingly.

-------------------------------------------------------------------------------------------------------------------------------

I believe that some of the affect from this and other technical trading is a self fulfilling prophesy in the minds of many thousands of traders at the same time.

When enough people using the same system believe a level is good support/resistance or a key buying/selling level that results in enough of them acting on it at the same time and it causes that level to act exactly like they expected.

Traders using similar systems/indicators can drive technical reactions.

Do you agree with that?

That is an age old question Mike and personally it is not something that I deem important. Considering that most traders never "make" it I doubt the validity of the preposition but who knows for sure? I just try to worry about my stuff and do what I can so as to not eff things up ;-)

-------------------------------------------------------------------------------------------------------------------

Anyone: feel free to ask me to clarify or expand on some of this stuff.

Delightfully inspiring post, thank you~!~