"in 2008-9, when the Fed started quantitative easing, I thought that inflation would take off. I was wrong. Instead, velocity - the rate at which money turns over per year - declined, taking away its inflationary sting. Velocity is still falling."

- Cathie Wood, CEO of Ark Invest

link for chart of M2 velocity:

https://fred.stlouisfed.org/series/M2V

Just another angle to consider...

Thanks joj, good points.

It's going to be hard to avoid inflation if energy prices don't start behaving and hopefully, we are putting in a typical pre Winter high here.

If energy prices go up............transportation of everything goes up. If they go up alot, those costs go up alot and that gets passed along.

The cost for heating/cooling and electricity will be soaring.

Nat Gas is double the price of a year ago.

Unlike every other time that I've been observing in 30 years, the ng rig count has gone up when the ng prices jumps much higher...

This is the first time its NOT going higher.

The big companies that normally jump to take advantage of the wonderful profit margins know what the game is here...........to obliterate fossil fuels.

All the funding and subsidy money is for the solar and wind that will NEVER be reliable.

This is the recipe for sustained higher to much higher energy prices.....which were inevitable in this environment.

Just took a relatively short RV trip. About 280 miles round trip. Paying about 1.25 more per gallon of diesel than a year ago. At 7.8 miles per gallon, that adds up fast. And I get better mileage than those trucks that transport just about everything we consume at some point. They have to pay for that somehow.

Exactly Tim. Great real world example.

People in the middle are not just going to all make much less money when their cost to transport goes way up.

When the cost of doing business goes up.......it gets passed along. In this case, eventually to the consumer at the end of chain.

The utility companies will be paying double for natural gas and electricity compared to a year ago. They MUST pass most of that on to the consumer or they lose money.

And we are only pointing to direct energy price costs.

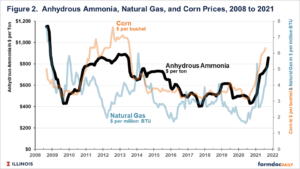

Half of the worlds fertilizers are made with/from natural gas.

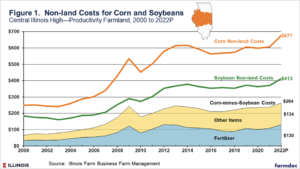

Fertilizers prices are are approaching record highs and you can't even get it in some places.

This will have a powerful impact on crop production and food supplies. Not just from lower yields but when input costs for crop growing go way up, it ends up getting dialed into the price of the crop and the consumer is at the end of the food chain.

Even when its animal food. We eat the animals and if it costs more to feed them.......it ends up being passed on eventually.

There are alot of unusual/unprecedented forces at play here.

The biggest one is the agenda to obliterate fossil fuels. This is one of the most powerful inflationary policies in history(cheap, reliable and efficient fossil fuels ARE THE LIFEBLOOD of every developed country) . We'll see how it plays out.

Another secret about fossil fuels: Haber Bosch process-fertilizers feeding the planet using natural gas-doubling food production/crop yields. September 2019

anhydrous up 300/t in 2 days....540 in 2021 to 1300 so far. what a great deal we got

Thanks mcfarm!

This is one of the overlooked, unintended consequences of the war on fossil fuels that some of us have insisted was coming for years if we took this path.........well, here it is.

It's sad that a yahoo/nobody atmospheric scientist can see it clearly for years and the ones making all the decisions are completely blind.

metmike: This graph below was BEFORE the latest price spikes for nitrogen fertilizer got dialed in .

Note the price of corn and cost of anhydrous correlate closely. Take away cheap nitrogen fertilizer and producers will be tempted to plant something other than corn........which causes less production/supply and higher corn prices.

That article hits the nail on the head with these extremely profound points:

"More broadly with respect to fertilizer prices, Bloomberg writers Randy Thanthong-Knight and Jasmine Ng reported on Friday that, “Rice, the staple food for half of humanity, is set to become more expensive because of a blistering rally in fertilizer prices.”

The Bloomberg article explained that, “Global fertilizers costs have rocketed to records on a perfect storm of events — from extreme weather and plant shutdowns to government sanctions. The energy crises in Europe and China are exacerbating the impact as coal and natural gas are important feedstocks. The cost increase comes at a worrying time, with international food prices at a decade high.

“China is also stepping up scrutiny on its fertilizer industry, including imposing new hurdles for exporters in a bid to protect domestic supplies.”

Other costs are also on the rise, including diesel fuel (see below) and propane."

metmike: This is competely unprecedented in history. The extreme weather they mentioned above is what we call COLD. COLD increases demand for heating from fossil fuels. When everybody is dwelling on a fake climate crisis from global WARMING............we weren't prepared for COLD.

Last Winter was unusually COLD in Europe and China and the fake green energy was not able to keep up with the increased demand....so it caused a drawn down in natural gas in storage.

So predictable.

Just like this disaster in Texas last winter.

Global warming causes everything/TEXAS

https://www.marketforum.com/forum/topic/65704/

Texas energy messed up again

https://www.marketforum.com/forum/topic/71143/

the fact that 5 yr interest rates are going up faster suggests that inflation will jump for a few years, but then drop after that.

interest rates for the 30 year is not surging like the 5 year.

of course markets have been wrong before.

the low rates on 30 yr bonds of the 40's did not look so good when you get to the late 60's early 70's.

and buying a tech stock in 1999 with no earnings did not look so good by 2003...

maybe the yield curve is trying to flatten, or maybe even invert.

How much will farmers reduce fertizer$ application? and how much will that reduce yields?

Hunger% = $ income/food cost

Gravity = complexity/entropy

Maybe near term rates going up the fastest is like all bullish markets.........the front months go up the fastest.

Bullish spreads always work..........long front month/short back months.

It doesn't mean the market assumes that back months at the later times frame WON'T go even higher, just that the near term forces will cause the near term rates to accelerate fastest.

Instead of doing a play of just having the outright position, which might be more riskly.......a spread can be put on that lowers the risk.

The spread would be based on having the highest confidence that rates will be going up more now than rates will be going up in 30 years, which makes total sense if it were a physical commodity and we were using prices in a bull market.

Not sure about interest rates though because I've never traded them.

I'm long ZN (10y) future contracts. Also I hanging some otm weekly short calls for prem. This position will explode any hour now. The fuse is lit but lets go brandon and his posse of twilight-zoners. Powell, the cross-eyed owl and the dirty yellow bellyd rat, yellen, they must be reading the new edition of the Marquis De Sade's 'Crimes of Love'.

mMike; you know I lurk here alot. Your atmosphere readings are bar none.

Thanks much Becker!