$6 Jan has been my line in the sand lately for trading. Above it, long. Below it, short. I've been trading mini's because with the volatility, if you take profits, You can sometimes get back in at your initial point 2-3 times a day.

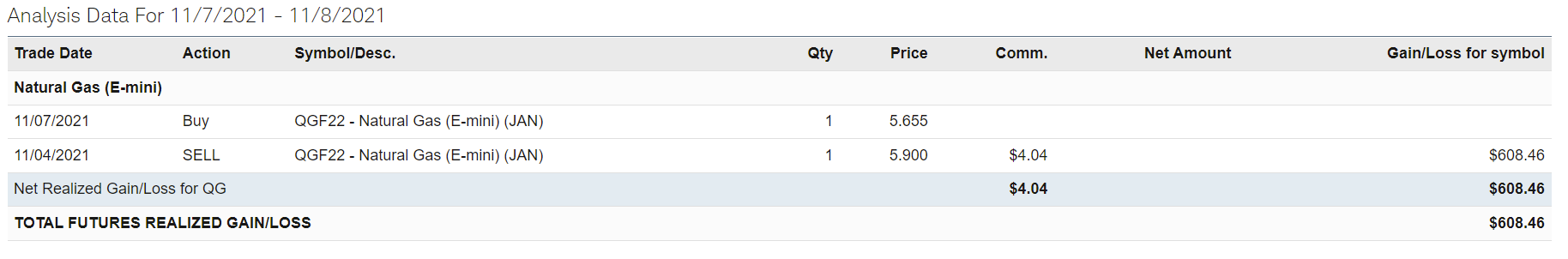

So anyway, I had a sell stop Jan $5.900. I had closed out all of my positions Friday and never even looked at my order because the market was so far away. I logged into my account this morning and somehow my order got filled and I was up $300! I must have lucked out on one of those spikes and it hit my order.

2 morals to the story.

1. sometimes it pays to be lucky

2. use stops cautiously. That could have stopped you out of a good position and lost you some money.

Thanks Jim but I'm confused.

So you had an order to sell stop at 5.9 right.

My program only allows me to sell on a SELL stop if the price is higher than the sell stop........or else it would have to be a market order.

So for me, this ng order would have had to be put in when NGF was trading ABOVE 5.9, which was for an extremely brief time on Thursday.

EDIT: (I looked back and it was above 5.9 for while on a couple of times on Thurs and much of the time on Wed) so maybe then you put it in? Never mind some of this except for how you sell stopped into the position unless it was higher when you placed the order.........any way good for you!

But this was obviously some sort of resting , good until cancelled order.

So you are still short right? and the account shows you up $300...........but that is based on the 1:30 pm day session close. We bounced after that and the NGF closed at +160 for you at 4pm.........if I have this right.

So you are ahead on paper by $300, correct?

Which means you will either make of lose money on Sunday Night based on the open but are feeling happy because you account statement is telling you that you are ahead $300(from the close 2.5 hours before the real close).

I'm happy for you and not trying to disagree but just wanted to understand it.

The models have a monumental spread right now and have been going back and forth. The Canadian model is the first 12z model to come out and it just came out. There are very mild and also very cold members.

In a case like this. I have no bias. To many conflicting signals and it could go either way. I'll be on the fence while thats the case.

If the cold members dominate Sunday PM, there will be a gap higher open and possible gap lower if they are mostly mild.

But it's nice to have a bit of a cushion for the direction that you favor.

Whether you are really lucky or not will decided Sunday at 5pm right?

This is the solution:

384h GZ 500 forecast valid on Nov 22, 2021 12 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members (global model not available)

I've never traded the mini's are they 10% of the big ones, which was my assumption from you being up $300?

OK, I see that you had closed out your positions too and so assume that meant this particular position was closed then.

Does your trading platform not show what your current position is and what the value of it is, updated to the exact tick of the last price?

Anyway, congrats on the luck and also the skill to pick a wonderful entry point to short at.

Sorry for the confusion Mike. It was a limit order. Here is what I do Mike. Say I sold a contract at $5.90 and then bought it back at $5.70. I go ahead and place another sell order @ $5.90. In the course of day and particularly NG lately, it has these huge swings and churns. NG minis are 25% of a full contract. If your in the money, don't be afraid to take it.

So Friday I had 2 active minis and this standing limit Order to sell a mini @ $5.90. When the market dived before 2:30 I bought back my minis. I had forgotten about my open order. At roughly 30 cents above where the market was at 2:30 getting that order filled was the last thing on my mind. So you can imagine my surprise when I looked Saturday morning and it got filled. So somehow the market went from the low $5.60s, spiked to hit my order and now I am up $300 as of where the market closed.

where I will be Sunday night is anyone’s guess, but like I said, my line in the sand is $6 so I’m not worried. As I’ve mentioned before, I think NG is wildly over priced and we are priced where we are more over Europe’s problems than where our storage is. Until I see a polar vortex I will be shorting any rally’s. That’s the beauty of minis. The entry price is lower and you’re not as exposed. A couple hundred dollars here and there adds up quickly. Watch your charts and patience can be rewarded.

Thanks much for the elaborating Jim!

OK, so you are currently short on a position that you didn’t know that you had on and WOULD Pay 300 if the 1-30pm price on Friday was trading right now.

Maybe the 12z models will warm up and help you but I’m thinking that after the open you may not be thinking you are as lucky as you thought you were.

I’m also puzzled how the ng mini spiked that high in the afternoon session on Friday if I read you right.

It must be tied closely to the main ng contract, right?

I could see the position filling on Thursday but how did we get there on Friday? Maybe I’m missing something and sorry if that’s the case.

You read it right. I have no idea how it got filled and it happened after 2:30. I'll take it anyway I can get it.

I think I will be okay at the open. If I only make $10, it was a gift.

I just checked the price charts for the QG.F22 and the last time it traded at or above 5.9 was very early on Thursday afternoon.

It makes no sense that it got filled on Friday after you closed all your positions.

Better be careful.

If I were you, I would be calling the trade desk ASAP before the open tonight because if they made a mistake in assigning you that position and you buy a contract to cover it, then........they fix the mistake(and they will if its a mistake) and take back the trade........you could end up being long 1 contract of the QG.F22!

Better to get it settled before the open if possible.

You need to establish WHEN that trade was put on.

I get a fill report with all my trades that shows the time to the second. Do you have that?

If not, the trade desk has it.

Could be that you had the trade on from Thursday and it never got cancelled even though you claim you closed out everything.

You need to find out for sure.

When you closed out your positions Friday afternoon did you just close out the ones that you thought you had on and didn't realize this one was on for over a day(which is the only time it could possibly have been filled) and it slipped thru the cracks because you didn't notice?

Do you have a broker?

Maybe they put it in by mistake and it was supposed to go into another clients account.

I'm just telling you with certainty that this is what had to have happened.

1. You were short the ng mini from Wed or Thu and didnt know it and didnt close it.

2. If you closed everything at 2:30pm on Fri and were completely flat, that position had to come from somewhere other than getting filled trading the rest of the day. Where did it come from?

3. If not from you, then it was a mistake from your firm or broker and and when they fix it and take it away, you may still be held accountable for any decisions you made based on an assumption that the mistake would count as your trade. You may have a case to battle over it but they will ask you to explain why you thought you were short from 5.9 late Friday when we never even traded close to that price. If your answer is........"I thought it was a mistake but was hoping I got to keep it because it was in my account" probably won't go well with the CFTC, if you want them to go to bat for you."

Regardless, I think you want to be out of that position right now and most importantly , know with certainty how to do it so that it gives you the least amount of risk or damage.

Or maybe not.

You said you want to be short and risk to $6 but if you put a buy stop in at $6 and this is a mistake.......you will be long from $6 after they fix it..........and if its a mistake.....they will find it and fix it.

I hope this makes sense.

In your favor is that at least the 12z models were not as cold late morning/early afternoon.

The oz models/overnight were pretty cold.

Please let us/me know what's going on with this position Jim but this is not a weather shorting position..........for me at least unless the extended models turn milder and that could happen overnight.

This is the first time ever that I will be tracking an mini contract to watch how it trades compared to the main one and what the volume is, so I appreciate the opportunity to learn something new.

Maybe just modestly higher than the day close and around the the 4pm close on the open but still ok for you to dump the position for +200 if you wanted.

Or stay in and risk X amount with a buy stop...........you know what you want to do.

If the models shift even milder(less cold) than the 12z runs, I will be wanting to join you but won't get anything close to the price that you got.

The 18z GFS is coming out an hour earlier than last week because of the time change and is milder thru week 1 to day 10- than all previous runs for the last couple of days.

I just closed the order. I made $600. I'll put in another limit order at $5.800 and call it an evening.

Thanks Jim!

Congrats.

OK that actually explains it.

Your account does show that you shorted on THURSDAY 11-4-21, so that when you thought that you closed all of your positions on Friday, you had actually been short 1 Jan NG mini that didn't get closed.

If your account showed you flat at the end of the day 11-4-21 and this position suddenly popped up after the close Friday 11-5-21(that had been put on Thursday but did not show up in your account Thursday) then I would make sure its valid because the high on Friday was 5.742 so it was impossible to sell at 5.9 as your account shows.

You must have had this order in on Thursday correct?

If you did not have it in on Thursday and only did on Friday then this would have to be a mistake, so you must have just forgotten.

Regardless, if you shorted on Thursday at 5.9 that was skill at picking a great price.

This 18z GFS run looks like it could come in something like -20 HDD warmer than the very chilly 0z run and -10 HDD warmer than the warmer 12z run.

This would rank up pretty high for a change that great so quick.

I saw that, Mike and agree. The 18Z is by a good margin warmer than the prior 3 runs all the way through 11/20. Then it suddenly catches up on 11/21 before getting colder than the others on 11/22 (and likely also 11/23-4 if the run had continued). By then, of course, the credibility/accuracy is way down vs earlier in the run, especially since it got so much warmer earlier and there's no telling how long that cold would have continued beyond the end of the run.

But NG came down pretty hard largely on that run it appears. Perhaps it will now hold here and maybe bounce, especially with crude being up nicely right now.

Well Sweet Honey Mustard. That has to be it. I would tell you that I thought I was 99.9% closed out of all positions on Friday. I spent 2:20 to 2:30 watching the last of the trading and would swear that I had no position, but clearly at this point that is the only explanation. I'm getting Biden...I'm mean old....hahaha.

Thanks Jim!