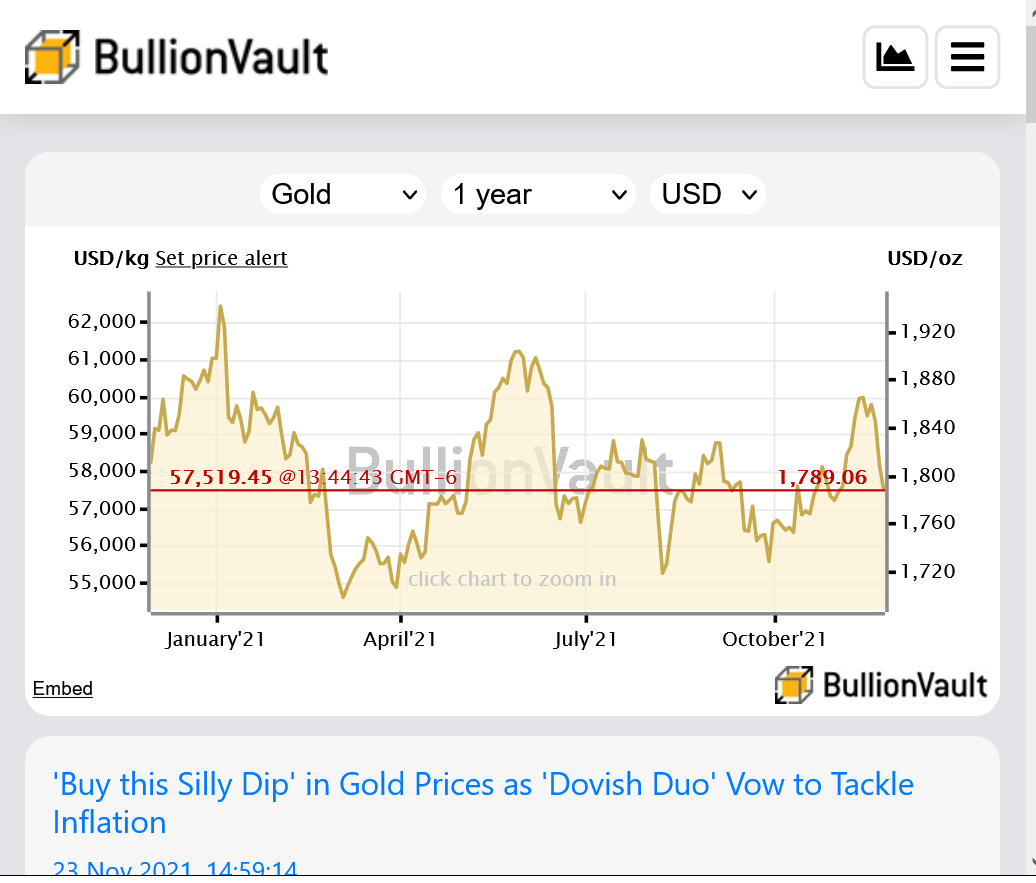

Previously I commented that gold was going sideways even though inflation numbers had been bubbling up. I considered that bad action. Today, the inflation number gave gold a reason to pop and it did indeed pop. It might have also had a technical element to it in that above the 1840 area were some big long term buy stops. If it can hold these gains for the remainder of the week I'm inclined to be bullish.

IMHO, gold and other traditional inflation hedges have been disappointing due to the huge money flows into cryptocurrencies. I haven't seen this talked about, but the cryptos have been like giant sponge soaking up massive amounts of money. If something would happen to those markets, which is always a possibility, metals could explode higher.

Always a new twist - right? Roosevelt made gold ownership illegal in 1933 - and then he promptly nearly doubled the price. If government comes out with its own crypto and makes alternate currencies illegal, who knows? Some say that this is impossible - but does anyone know? And, would gold ownership even still be legal then??

The only certain thing is that government will act to benefit government and not the people.

Interesting points cfdr.

I have seen some mentions of the crypto effect on gold. Crypto is MUCH more volatile than gold. I read somewhere that from its inception at pennies per bitcoin to the present "valuation" north of $60,000, bitcoin has lost 80-90% of its value on 7 occasions. The most recent drawdown of 50% this past year before making new highs recently. Clearly it is already the greatest bull market in the history of man.

As for the government making crypto illegal, I don't think that is possible. That is one of the allures of crypto. It is out of the reach of governments. It belongs to no country. That is why criminals use it.

The other attraction of bitcoin to "investors" is that the bitcoin will eventually reach its maximum supply available at approximately 21 million. But I wonder if the endless possibility of other crypto currencies would dilute bitcoin. A friend and devotee of bitcoin says that cannot happen. He explained it to me but it is above my pay grade.

I considered allocating some money to it a while back but the requirement of tech savviness made me balk. Of course, young folks have that tech savvy nature so its probably here to stay.

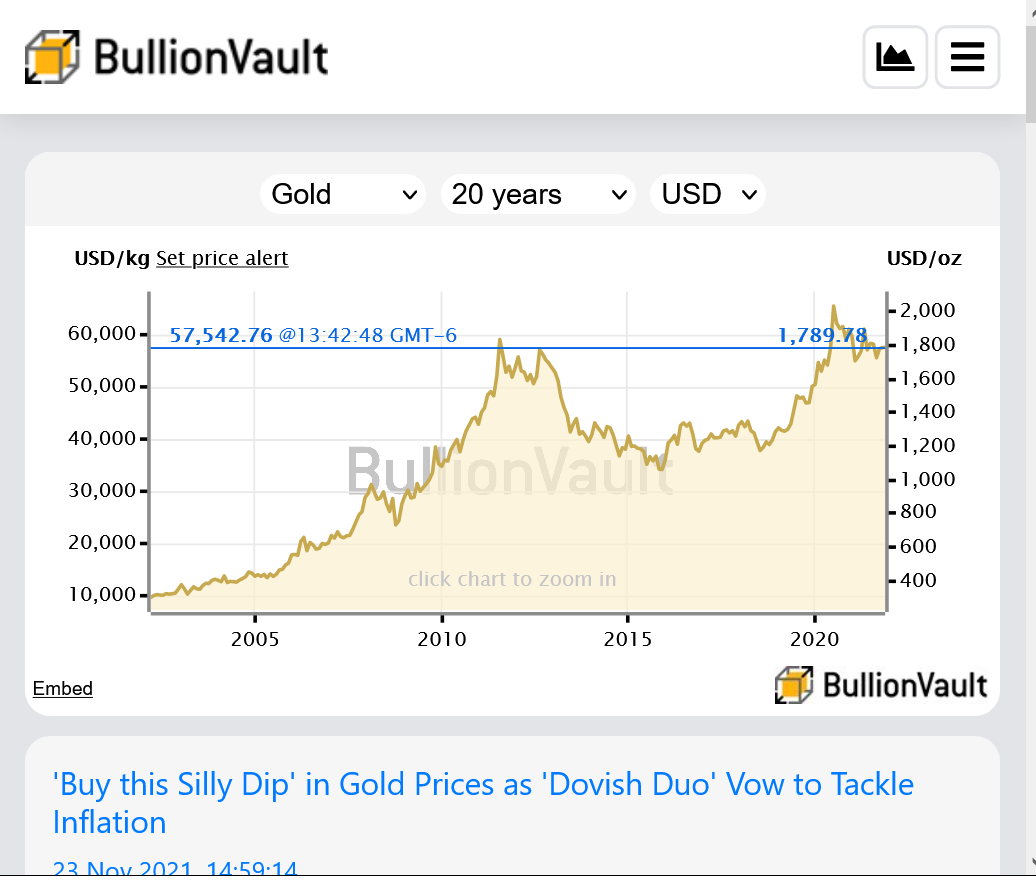

People like Jamie Dimon and Warren Buffet have poo-poo'd it but I heard another analyst say that "If bitcoin is in a bubble then gold has been in a bubble for 5,000 years".

Of the 21m btc max limit possible, 4m btc have already been lost forever. This has been offered as a reason not to own it; one day it will all be 'lost'. Another con I read; when quantum computing gets real then encrytion will be no more.

There are 2b people in the orient wanting even a crumb of gold under a mattress.

Becker,

Regarding the lost bitcoins; Most of the 3.5 million bitcoins lost were attributed to the early days when they were worth pennies. If you were discarding your computer for the next upgrade and you had 20-30 bitcoins in the hard drive that were worth 12 cents each you wouldn't have been concerned with saving them. I'm not sure how that means it's therefore going to result in the other millions being lost when they are worth $60,000 a piece.

You bring up a good point about the affinity toward gold of the Asian cultural. As 100s of millions have moved from poverty to the middle class that may give a bid to the shiny yellow metal.

One thing that is very obvious

Countries have bought gold as a store of wealth I am not aware of any country buying crypto although i think a south americian country did make crypto legal tender

China and russia, india come to mind as buyers of large amounts of gold but not crypto

Gov't can make crypto illegal with a stroke of a pen, especially those who bought gold and want their gold to have value

At least that is what I would do, if I was Putin or Xi or???

Perhaps we should change the title of the thread to cryptocurrencies?

Governments can make cryptocurrency illegal but they can't stop it from happening. I'm pretty sure they cannot tax it either. I don't own a single crypto of any kind.

Back to the drawing board. The breakout in gold, after holding for more than a week completely caved in these past 2 days. Either inflation isn't going to be a problem or gold is the worst inflation hedge out there. I like it long, long term as financial disaster insurance, but the chart looks dead in the water now.

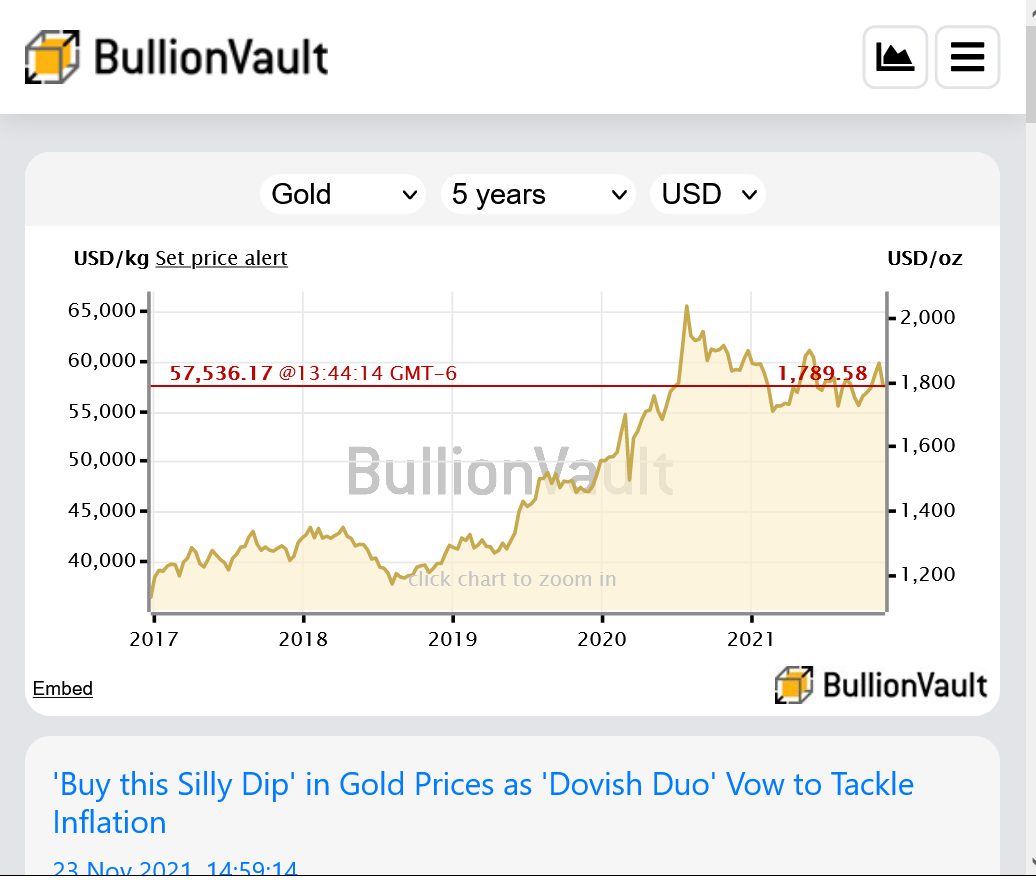

I dunno joj, this chart sure looks bullish LONG TERM to me still and a bull flag in a volatile market that got ahead of itself.

But the short term indicators do look like a potential top and very weak.

I never traded or bought gold in my life.........so don't mind me.

https://www.bullionvault.com/gold-price-chart.do

Thanks MM,

Bear, I read somewhere that seasonal lows in gold come in mid December. Is that what you have?

Thanks in advance.

a big reason gold suddenly went down. if you look at the total number of contracts being traded, open interest, etc. that number normally is high when gold is at a top. and it was higher in early nov, than at any time over the last couple years. (sorry i don't have the chart/number in front of me at the moment).

open interest goes up and down with the price of gold.