I know it rose very nicely Fri on upcoming cold, but I’d be quite surprised if this didn’t gap up nicely tomorrow evening/Monday based on the upcoming much colder pattern for the first half of Jan vs the very warm December. Withdrawals are going to rise sharply starting with the one to be reported the week after next. With NG still relatively cheap vs most of the last couple of months, I see this as an excellent buying opportunity assuming it isn’t going to revert to being dumb.

Thanks much Larry for starting the overdue new thread!

I agree and was going to mention yesterday that NG is set up for a gap higher open on Sunday Evening.

Previous thread:

NG 12/13/21

72 responses |

Started by Jim_M - Dec. 13, 2021, 9:35 a.m.

https://www.marketforum.com/forum/topic/78991/

More to come in a minute!

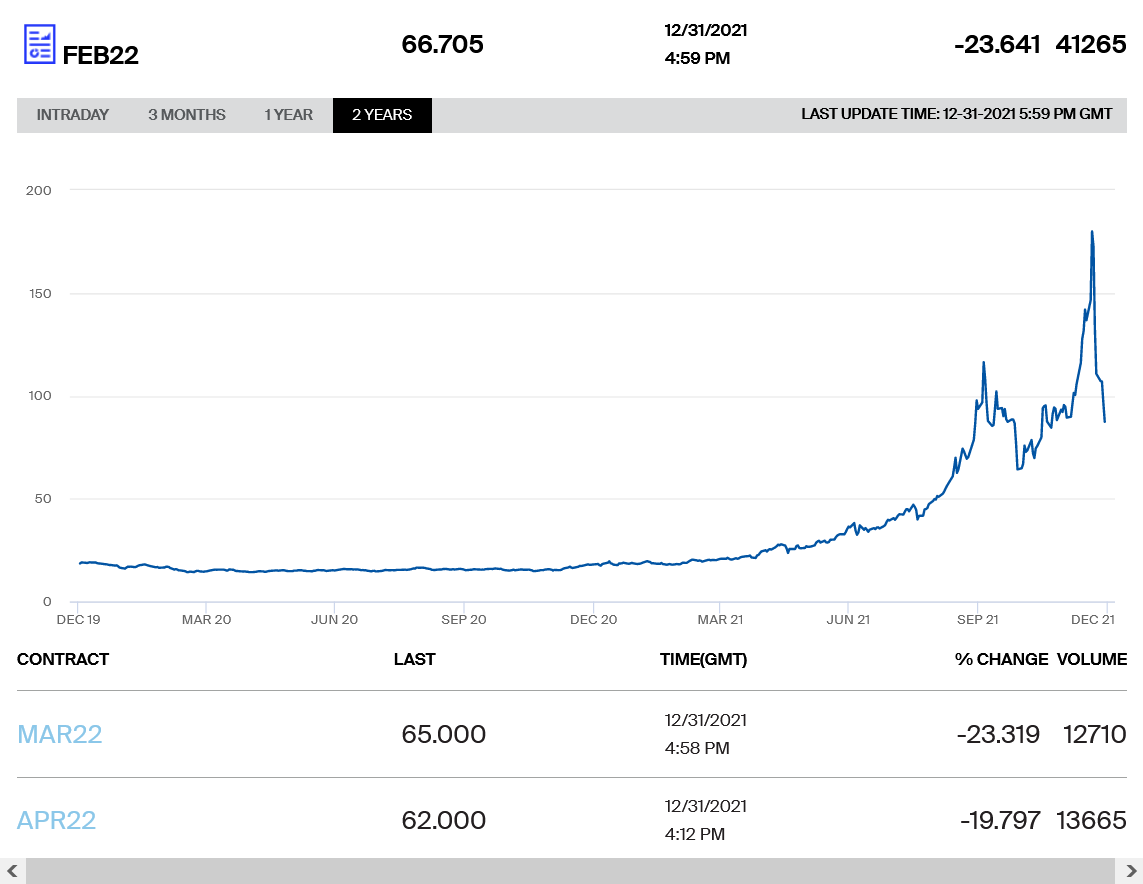

I still think that part of the reason for NG to act so dumb last week was related to this below.

Europe NG prices dropped 50% in just a week(with record wamth).

You remember back in September/early October when the NG price in the US was above $6 and it made no sense..........except it was tracking Europe.

Why wouldn't an even greater crash lower have a negative impact?

https://www.marketforum.com/forum/topic/78991/#79714

By metmike - Dec. 31, 2021, 12:58 p.m.

"Am wondering if near record warm temps in Europe right now are a negative for US NG prices.

NG prices in Europe have been collapsing the past week!"

https://www.theice.com/products/27996665/Dutch-TTF-Gas-Futures/data?marketId=5336900&span=1

By MarkB - Jan. 1, 2022, 2:04 a.m.

The thing about models, is that the parameters that are set, are not always accurate to reality. And can change in 6 hours. The market reponds to them, even though they might be inaccurate. The reality of today, is not what directs our course in trading. Except on report day. But, rather, the imagined future prospect. And that is what we focus on.

++++++++++++++++++++++++++++++++++

By metmike - Jan. 1, 2022, 3:59 p.m.

Thanks Mark,

Models are just ten of thousands of mathematical equations(mostly calculus) that represent the physical laws of the atmosphere.

These equations are "solved" after feeding in initial conditions in the form of measurements/observations of temperature, pressure, wind, moisture and so on from the bottom to the top of the atmosphere at various key levels and time frames.

Like you said, the GFS GLOBAL model is run every 6 hours with data that is 6 hours fresher each time and out to 384 hours-16 days. Other GLOBAL models are run every 12 hours.

Regional models can be run every hour with new hourly observations. They don't go out that far in time.

The market will put more weighting on the European Ensembles, that come out every 12 hours, then the GFS ensembles.

The ensembles are dozens of different solutions of the same model, with slight variations in a parameter/equation to get a solution thats like a 2nd, 3rd, 4th....etc opinion..........because the main operational model does NOT have the omnipotent equations that are always right under every condition.

Each individual ensemble member might do better under certain situations and bad under other situations.

Turns out, when you average them together(the mean) you filter/balance out the extremes/outliers and are extremely consistent from run to run and in the long run, have the best product.

1 individual run might go from one extreme to the opposite extreme 6 hours later but that only happens with a few at the most. The rest, stay on the previous path because, really, not much has changed in 6 or 12 hours that will justify an extreme change going forward.

The biggest problem by far is that errors magnify with time.

None of the models will be too different from each other 5 days from now, for instance.

However, a slight variation at 5 days can grow into an entirely different pattern in 15 days. The disparity grows with time. The more models/solutions that you average in, the more you can average out these extreme outliers.

However, sometimes, the outliers are picking up on something new. In that case, you will often have several other members that see the same thing, against the other ones that haven't seen it yet. If there is only 1 outlier against dozens of others against it........then you should throw it out.

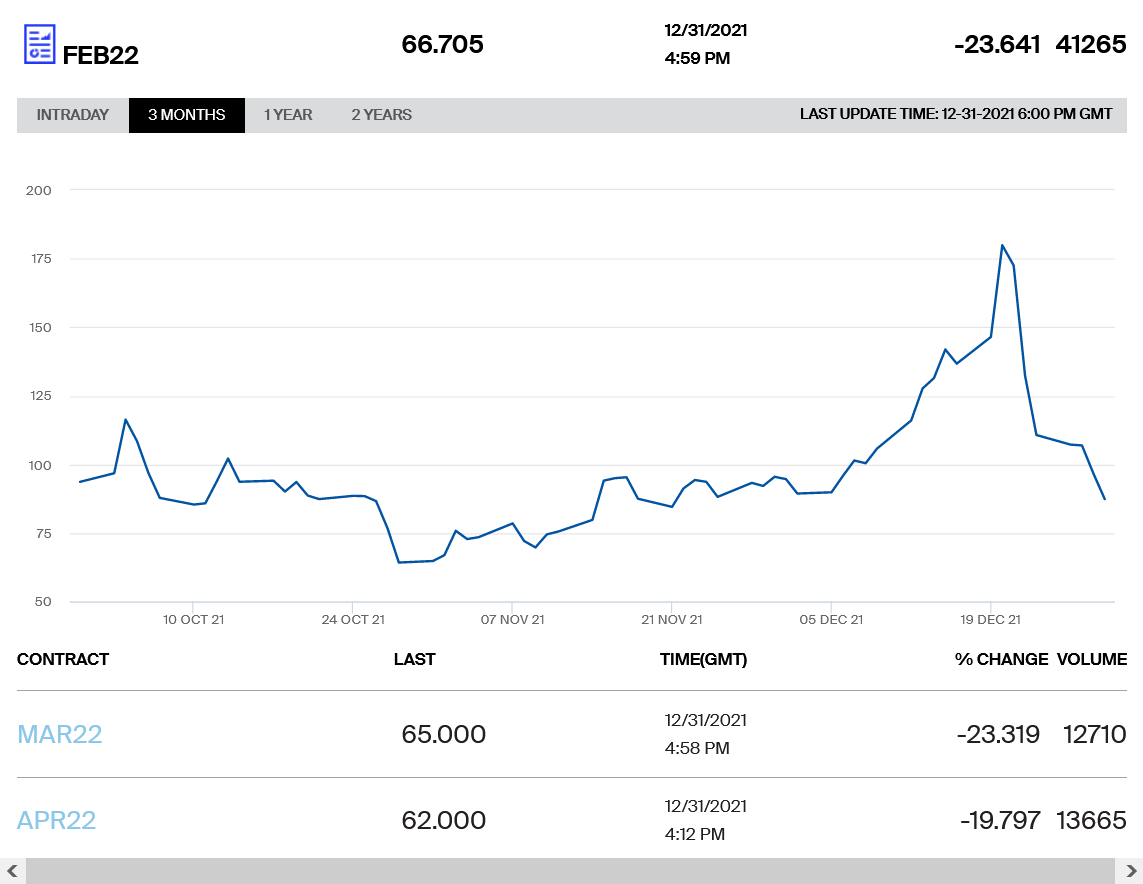

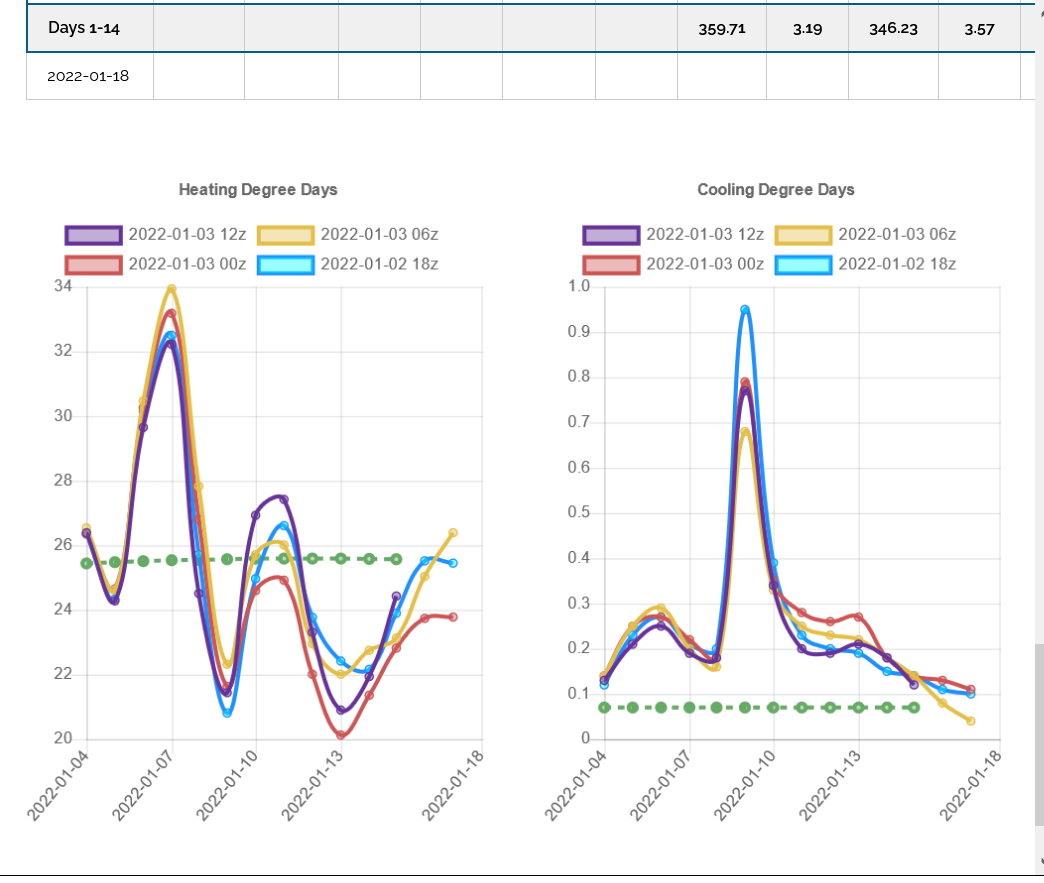

This is the latest GFS ensemble solutions. Looking pretty cold in the Midwest and East the next 2 weeks.

Previous EIA storage change from last Thursday. Slightly bullish. The drawdown was 11 BCF greater than expected.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Dec 30, 2021 Actual-136B Forecast-125B Previous-55B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Dec 30, 2021 | 10:30 | -136B | -125B | -55B | |

| Dec 23, 2021 | 10:30 | -55B | -56B | -88B | |

| Dec 16, 2021 | 10:30 | -88B | -86B | -59B | |

| Dec 09, 2021 | 10:30 | -59B | -54B | -59B | |

| Dec 02, 2021 | 10:30 | -59B | -57B | -21B | |

| Nov 24, 2021 | 12:00 | -21B | -22B | 26B |

-136 BCF

for week ending December 24, 2021 | Released: December 30, 2021 at 10:30 a.m. | Next Release: January 6, 2022

| ge, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (12/24/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 12/24/21 | 12/17/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 777 | 809 | -32 | -32 | 815 | -4.7 | 758 | 2.5 | |||||||||||||||||

| Midwest | 918 | 963 | -45 | -45 | 979 | -6.2 | 913 | 0.5 | |||||||||||||||||

| Mountain | 180 | 188 | -8 | -8 | 205 | -12.2 | 187 | -3.7 | |||||||||||||||||

| Pacific | 235 | 247 | -12 | -12 | 290 | -19.0 | 265 | -11.3 | |||||||||||||||||

| South Central | 1,116 | 1,155 | -39 | -39 | 1,186 | -5.9 | 1,084 | 3.0 | |||||||||||||||||

| Salt | 326 | 334 | -8 | -8 | 334 | -2.4 | 315 | 3.5 | |||||||||||||||||

| Nonsalt | 790 | 820 | -30 | -30 | 852 | -7.3 | 769 | 2.7 | |||||||||||||||||

| Total | 3,226 | 3,362 | -136 | -136 | 3,476 | -7.2 | 3,207 | 0.6 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

These were the temperatures for that previous EIA report. Mild in much of the country but cold along the Canadian border and West Coast.

++++++++++++++++++++++++++++++++++++++++

These were the temperatures for the next EIA report:

Record warmth in the Southeast 1/3rd of the country! From TX to the Ohio River to the Mid-Atlantic. Mild for Chrismas-time surrounding that area. Dense population centers.

Frigid weather from the far Upper Midwest/N.Plains(low population) to the West Coast.

So the draw down will be dinky for the last week of December!

The model disparities and changes are enormous right now and have resulted in massive HDD changes.

It appears that much of this is based on what stream gets the most influence. The Canadian ensemble model has been steadfast with a strong northern stream and deep/far south upper level trough that sends cold air to the Gulf Coast...based on the upper level ridge axis staying along the West Coast.

The GFS ensemble has the upper level ridging shifting farther east and the northern stream trough deflected much farther northeast and more shallow.

I'm not so sure about the gap higher tonight Larry based on some of the milder recent solutions.

What do you think?

Mike,

Gap up unless more dumb dumbness. Way different pattern vs December. Much larger draws on the way.

Thanks,

I still agree with that but when solutions like the last GFS ensembles come out with -22 HDD's less than the one 12 hours earlier, it makes me concerned........if the European model would follow.

However, the ending maps of the GFS ensembles still go back to the amplified ridge/west, trough/east couplet which is always going to be cold in the Midwest/East.

And it's the PATTERN that matters most and over rides model to model changes like the less bullish parts of the last couple of GFS solutions that took away so many HDD's...........and delayed the amplification of the ridge/west and trough/east.

When I'm long(or short) over a weekend, it also causes me to get more nervous than usual.

On that last GFS solution, if the market was open, I might have covered.........to avoid the spike down.........and then watch the market come all the way back based on the overall MUCH colder pattern ahead.

Which is what you're focused on.

If the EE looks pretty cold, then it could be a decent gap higher and NG is known for over reacting on gaps higher or lower. I will remain concerned if it looks milder.

The 12z CMC model looks more like the very cold Canadian model, with the trough much farther west like the Canadian.

The 12Z EE 360 is nice and cold in the high demand areas of the E 1/3 of the US from a line drawn Chicago to Houston eastward.

The 0 Deg. C isotherm at 850 mb is almost down to Atlanta at that time.

We actually opened lower.

The last 2 EE's were -19 HDD's.

Not totally shocked as the last several runs of the GFS and last 2 runs of the EE were much milder.

The AO is only around 0 and the NAO is actually a bit positive which is not ideal for major cold in the East.

+PNA is favorable for cold in the East if the ridging stays far enough west and amplifies to high latitudes.

Mike, but:

1. Even with the drop in the cumulative DDs on the latest runs, the ends of the runs still look cold in the E US with no sign of a warmup.

2. Even with the DD drop, we’re still looking at much, much colder wx overall vs late December. No more ridiculous warmth in the high demand areas.

3. Based on what you said, I’ll assume it opened lower due to the DD drop as opposed to dumbness. But I expect the market will later in this session come to its senses and rise back up based on the idea that prices are near multimonth lows despite a much colder pattern.

GFS was yet another -7 HDD's milder, which spiked us to new low by 5 ticks at 3.677 and we bounced back towards the highs this evening right after that as the Euro operational was slightly colder as was the EE at +3 HDD's that just finished.

Natural gas futures eased lower in early trading Monday after warmer weather trends showed up in modeling over the weekend. The February Nymex contract was down 4.3 cents to $3.687/MMBtu at around 8:55 a.m. ET. Over the weekend weather models had appeared poised to move in a “bullish direction” by raising gas-weighted degree day (GWDD)…

metmike: Starting with the 0z Sunday European model run, around 34 hours ago, the models have been taking out massive amounts of HDD's the next 2 weeks(on many runs) .......then, bringing in the colder pattern change but the change has less gusto each time.

This is likely because of the AO and NAO are UNfavorable for major cold deeply penetrating in the US. Both a slightly positive and ideally we need them to be solidly negative. The PNA does finally shift from extremely negative to around 0, which is why the West will go from to extreme cold to very mild:

1. Even with the drop in the cumulative DDs on the latest runs, the ends of the runs still look cold in the E US with no sign of a warmup.

2. Even with the DD drop, we’re still looking at much, much colder wx overall vs late December. No more ridiculous warmth in the high demand areas.

3. Based on what you said, I’ll assume it opened lower due to the DD drop as opposed to dumbness. But I expect the market will later in this session come to its senses and rise back up based on the idea that prices are near multimonth lows despite a much colder pattern.

Thanks Larry!

This is the latest GFS Ensemble HDD graph, including the just out 12z model run.

Doesn't really look that bullish after the spike higher from this current cold.

The pattern change to colder at the end of 2 weeks looked very impressive, as recently as Saturday.......and there is uncertainty still but things have consistently morphed more bearish/milder since then.

It's colder than the December weather though but it always has to be MUCH colder in January to inspire aggressive buying than in Nov/Dec as we have plenty of gas to make it thru the Winter.

NG prices dropped 50% in Europe in just the last 10 days of trading. That had to take a bearish toll too.

I think we can still go much higher if the models go back to INCREASING the cold again instead of decreasing it much of the last 2 days.

Not too many traders are wanting to buy ng when the HDD and pattern analysis is taking cold OUT of the forecasts.

The GFS and Canadian ensembles still have some frigid members/solutions and it looks like the surface conditions, will allow the low level cold in Canada to undercut the less than optimal (for deep penetration/cold air delivery) upper levels quite a bit and cause the surface temperatures to be colder than the ensemble mean/average pattern might suggest............especially if the cold members are right.

As I expected since last evening, we’re near session highs now. This isn’t December any more. The market is slowly getting a clue. The pattern keeps showing E US cold at the ends of about all of the model runs.

This last 12z GFS Ensemble was COLDER at the end of the period compared to the 0z run, 12 hours earlier.

Here's the 850 temp maps.

Note on the first one below from 12 hours ago, the 384 hour temp in Chicago was -8 Deg. C.

On the last update, the 384 hour temp in Chicago is -12 Deg. C!

Also, the 6-10 day period of the European ensemble was a whopping +11 HDD's more bullish for just that period.

The models are going to waver from run to run HDDwise. But the important theme of cold favoring the E US and the ends of all model runs keep suggesting that it continues. Thus, NG is at new session highs. As stupid as it has been, it is (maybe?) finally waking up.

I sure wouldn't call this a weather map that's bullish nat gas!

That was the biggest problem before the 12z guidance finally added some cold. This map was based on the guidance BEFORE the 12z models came out. If we take out the added cold overnight, NG is likely to come back down. Add to the cold and we can keep going higher.

metmike: The 12z models turned COLDER. Actually, the 6z GFS started it.

NG reverting to dumbness again? Mike, opinion about it being down at the moment? Was making sense earlier. 6Z GEFS was even colder than 0Z. 0Z EE wasn’t as cold as 12Z but is still significantly colder than 0Z of Monday. And it still looks cold in the E US at the end.

Larry,

It's not all one sided bullish as you think.

This was the last European ensemble map 1st one below. The flow is almost zonal. The deep trough in the East, not only doesn't amplify but it fills in and the ridge out west breaks down too.

There is tremendous uncertainty here and I'm not committing to either side but the last EE just took a bearish turn. I put the run from 2 days ago below it so that you can see that its turning LESS bullish.

As you said, the last EE was -7 HDD's bearish. The market gives the EE the most weighting.

I've been long and short this week and my last trade was short.

I think the market trading close to unch makes complete sense to me based on the cold risk that you see on the GFS......which, was LESS amplified at the end on the 6z run too.

This is causing me to lean slightly towards less amplification at the end of 2 weeks but I've been going back and forth on that........adjusting to model output. There is no way that you and me can really know(or the models either) what WILL happen at 2 weeks and beyond when we have a very uncertain pattern and battling forces between 2 streams like this.....unless we were weather prophets (-:

metmike: Made my comments above.

I'm not trying to make a case against you, just showing you the objective pattern which includes some bearish weather changes on the EE. I'm neutral here.

The HDD's below from last EE shows lower peaks and in a downtrend........NOT going higher at the end. It's just one model but it tells you exactly why we are lower right now. It could be wrong but you can't convince the thousands of other ng traders that it is wrong currently because what reason would they have to NOT believe it?

We'll continue to react the rest of the day to the latest models.

If the EE changes course and looks colder at the end and not milder yet(like it did Monday on the 12z run which got the rally really going), I predict that the price of ng will be higher.

If not, ng may have its goose cooked.

The 12z Canadian model(not traded much by the market) was still pretty cold at the end. The upper levels were similar to the 0z run. However, the surface features did not show as much cold coming in. The previous run had surface cold gushing in pretty far south in the lowest level. Note the tremendous disparity in individual members/solutions.

384h GZ 500 forecast valid on Jan 20, 2022 12 UTC

Forecasts for the control (GEM 0) and the 20 ensemble members (global model not available)

I almost forgot to include the update from the AO, NAO and PNA.

From that perspective(which is tainted by the 0z GFS ensemble) the cold potential went up.

Great uncertainty here:

just so you'll appreciate my neutrality, I bought ng at 3748 when part of the week 2 GFS forecast was coming in slightly colder but it didn't end that way.

When we had a spike above the entry level, I put in a tight stop at 3752 and got taken out quickly.

The total HDD's are not that different but the end of the run doesn't have the amplification of the ridge west/trough east pattern I want to be long for.

ADD ON: My initial stop, which I put in when seeing the warmer end was actually 3725 and I was thinking........might as well hope that the support will hold here and hope for a spike above the entry level to raise the stop but honestly, I was thinking........ok, how much do I want to minimize the loss to.

So I got lucky.

Next up, the European model.

European operation not as cold and early ensemble slightly less cold, so NG is making new lows.

Mike,

Thanks for your thoughts as always. Just in case you're curious, I'm flat and have been flat (my favorite position) for many days. So, I feel I've been looking at this objectively. I think you're doing the same but different people will have different objective feelings.

Larry,

Your opinions/credibility on weather and markets are a 10 out of 10 for me.........only because the scale doesn't have a higher number (-:

So the EE did come out modestly milder with -7 HDD's lower but apparently we don't have traders interested in pressing us below the lows today.........at least for the moment.

Probably still way to much cold coming up the next 2 weeks compared to December as Larry has stated.

So we are trading milder models compared to previous models but with a backdrop of a colder pattern in January compared to December.

However, the market is not going to be rescued by a colder EE like we saw yesterday that caused to big early afternoon move up.

18z GFS was no help to natural gas.

Similar to the last few except slightly milder. -6 HDD's. Despite that, the pattern is stil much colder than December and staying colder.

The end maps of the GFS and European look colder to me.

metmike: AO and NAO turn negative and increase cold risks late in week 2. This happened overnight.

Strength in cash prices and expectations for ongoing blasts of frigid air over swaths of the Lower 48 sent natural gas futures higher on Wednesday. The February Nymex contract settled at $3.882/MMBtu, up 16.5 cents day/day. March gained 12.8 cents to $3.710. At A Glance: Cash prices cruise higher in the Midwest, Northeast Forecasters call…

-33 BCF vs -54 BCF.............bearish!

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Jan 06, 2022 | 10:30 | -31B | -54B | -136B | |

| Dec 30, 2021 | 10:30 | -136B | -125B | -55B | |

| Dec 23, 2021 | 10:30 | -55B | -56B | -88B | |

| Dec 16, 2021 | 10:30 | -88B | -86B | -59B | |

| Dec 09, 2021 | 10:30 | -59B | -54B | -59B | |

| Dec 02, 2021 | 10:30 | -59B | -57B | -21B |

for week ending December 31, 2021 | Released: January 6, 2022 at 10:30 a.m. | Next Release: January 13, 2022

https://ir.eia.gov/ngs/ngs.html

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (12/31/20) | 5-year average (2016-20) | |||||||||||||||||||||||

| Region | 12/31/21 | 12/24/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 767 | 777 | -10 | -10 | 771 | -0.5 | 728 | 5.4 | |||||||||||||||||

| Midwest | 893 | 918 | -25 | -25 | 930 | -4.0 | 873 | 2.3 | |||||||||||||||||

| Mountain | 172 | 180 | -8 | -8 | 197 | -12.7 | 178 | -3.4 | |||||||||||||||||

| Pacific | 219 | 235 | -16 | -16 | 283 | -22.6 | 256 | -14.5 | |||||||||||||||||

| South Central | 1,143 | 1,116 | 27 | 27 | 1,166 | -2.0 | 1,063 | 7.5 | |||||||||||||||||

| Salt | 347 | 326 | 21 | 21 | 333 | 4.2 | 315 | 10.2 | |||||||||||||||||

| Nonsalt | 796 | 790 | 6 | 6 | 833 | -4.4 | 749 | 6.3 | |||||||||||||||||

| Total | 3,195 | 3,226 | -31 | -31 | 3,349 | -4.6 | 3,099 | 3.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Latest weather including long range and MJO:

metmike: The guidance has been looking COLDER for the end of week 2, especially the 12z guidance just out. However the mega bearish EIA is likely pressuring the market.

The U.S. Energy Information Administration (EIA) on Thursday reported a withdrawal of 31 Bcf natural gas from storage for the final week of 2021. The result fell far short of the midpoint of analysts’ estimates and punctuated market concerns about weather-driven demand. The result was “super-duper bearish,” as one participant on The Desk’s online energy…

metmike: Weather models have been looking a bit colder late in week 2!

Some very strong indications of extreme cold coming at the end of 2 weeks into week 3.... with even higher confidence today....having to battle the negative mentality of the mega bearish EIA number yesterday.

The GFS is by far the most amplified with the pattern and very bullish. If its too amplified, then it won't be as cold.

The EIA yesterday was one of the most bearish vs WSJ survey on record. However, it wasn’t as bearish as one from early 2021. More on that hopefully when I get time.

We look forward to that very much Larry!

Nowhere else on the internet or with private, pay for services do we get historic EIA storage reports like yours.

I used to keep track of this closely until 2011, when Jon Corine raided my 6 figure account, on Halloween that year...... then the rest of my money was stolen in July 2012 at PFG Best.

tjc,

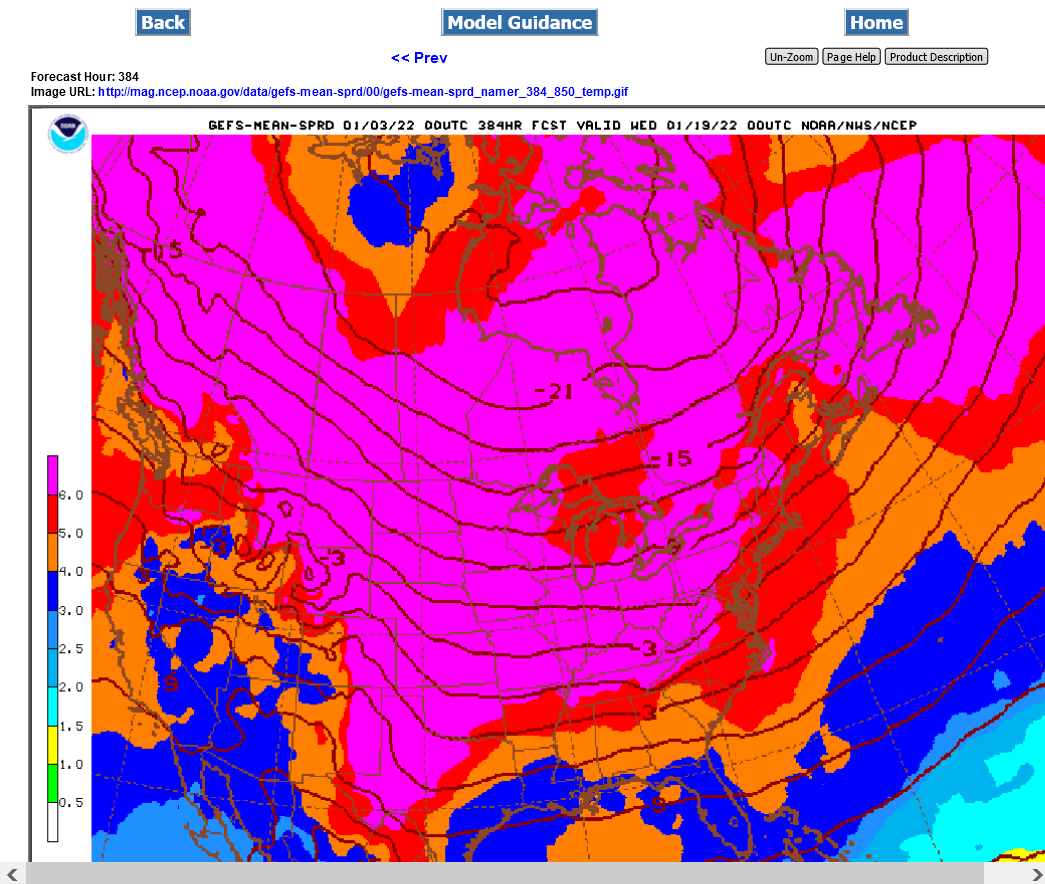

You asked for updates on the weather thread earlier, so I'm giving this one to you. The GFS has been the coldest model by far and the European with just modest cold late in week 2. The 18z GFS ensemble just delayed the cold slightly, and with -14 HDD's vs the previous runs.

The cold upper level trough isn't quite as deep at the end but the previous, 12z run, if it would be like that on Sunday, would cause a huge gap higher with very high confidence!

The purple is the last, 18z run. This means exactly ZERO for trading on Sunday.

All the models are looking very cold in week 2 and getting colder.

Gap higher on Sunday night with these solutions!

The NAO and AO actually are neutral though, so they aren't helping much. This is probably coming from the current phase of the MJO/tropics as Larry has been discussing since late November. The current phase connects strongly with major cold over much of the US.

I 'hit' you with a LIKE!

Gap higher!

Wonderful!

Huge gap higher-- 4.185 to 4.125 in first half hour.

Gas now has a 5 week island!

4.5 is 32 fib retace; 5.0 is 50% and 5.50 is 68 fib. Very near 25% retrace at tonight high

Wont hold after Thurs/Fri

I would be pretty surprised if we went to $5(maybe if it stays cold for over a month) and shocked if we got to $5.5 since we aren't going to run low in storage this Winter but maybe natural gas is trading in a new, higher price range?

European model is -6 HDD's.........less cold. GFS was -3 HDD's.

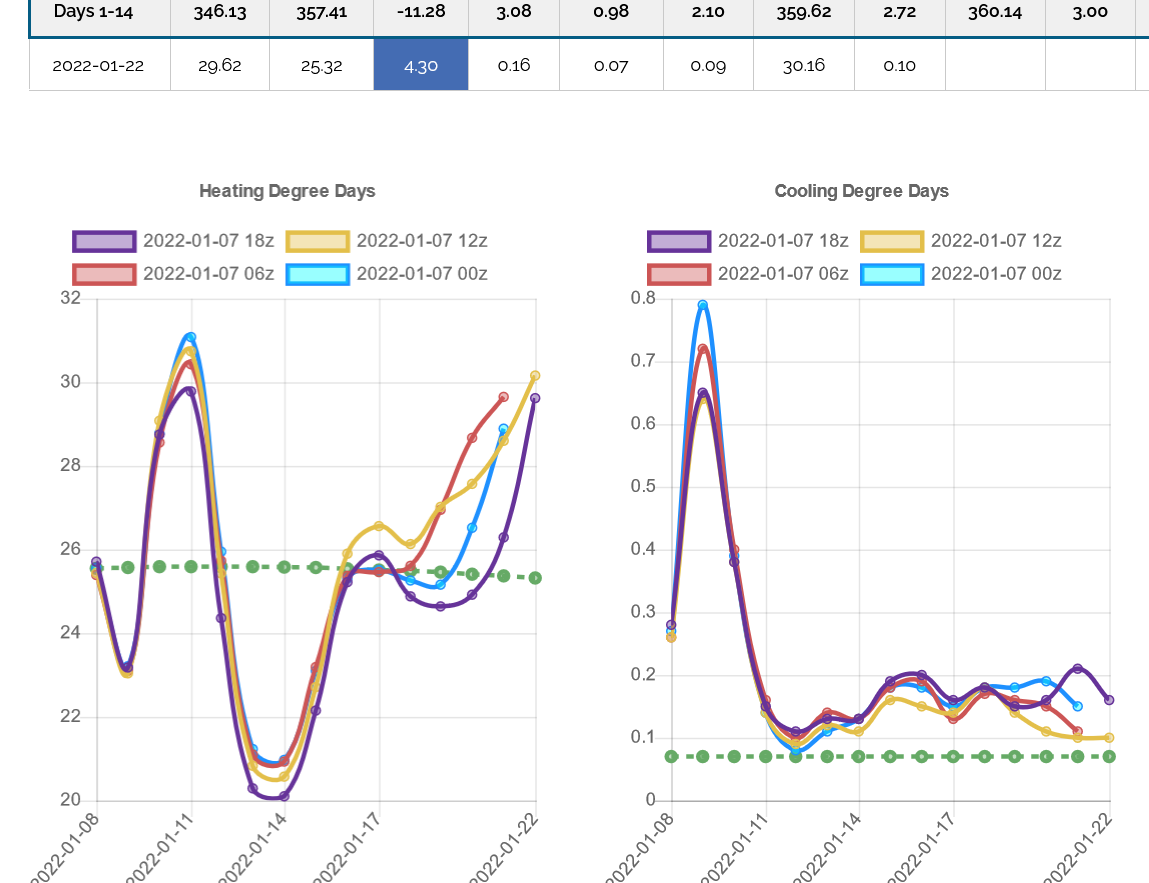

This weeks EIA report will be based on the 7 day period below, ending January 7, 2022.

Compare that to the previous 7 days below that which had an extremely bearish -33 BCF drawdown!

https://www.marketforum.com/forum/topic/79754/#79980

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

As updated weather models raised the prospect of intense winter chills reaching key markets later this month, natural gas futures were trading sharply higher early Monday. The February Nymex contract was up 24.0 cents to $4.156/MMBtu at around 8:45 a.m. ET. March was trading 18.5 cents higher to $3.911. In the most recent models heading…

metmike: Extremely wild session, that featured a massive gap higher........then early this morning, a huge sell off that dipped below $4 and closed the massive gap higher........but then turned around and went back up to last nights open. The 12z models were COLDER, which has helped alot. +11 HDD's from the previous 6z GFS and +3 HDD's from the previous 0z European model.

We will close the late session BELOW the open last night.

I would not be long this market if the pattern changes to milder(outside of model run variations)