Natural Gas.....bearish....

If our own production is still down, and imports from Canada are still strong, that is bullish. Given the mild weather last week, I dont expect a large draw on the report thursday. But the next one after that, is going to be large!

Previous Natural Gas thread:

NG 1/1/22+

61 responses |

Started by WxFollower - Jan. 1, 2022, 4:52 p.m.

https://www.marketforum.com/forum/topic/79754/

metmike: As I mentioned at the end of the previous thread...........don't be long if we have signs of the cold pattern letting up(other than models flip flopping with solutions) The 0z GFS was just -2 HDD's less cold than the 12z run(though +5 HDD's from the 18z run) but -11 HDD's less cold on the European model caused us to drop $1,000/contract as it came out.

The pattern looks mighty cold still but even small hints of it being less cold cause NG to get hit pretty hard. When the forecast goes back to average temps, it seems likely that NG is going to drop hard.

12z models were colder again.

Market started rallying midmorning. I was about to ask you for update.

How much colder? Or is it expected to last longer?

I must trade in and out more. Holding after the immediate jump Sunday night was agonizing, but now new highs!

tjc,

I still see no end in sight for the mainly chilly wx in much of the eastern half of the US. Models will vary and have from run to run but the chilly theme remains. These ups and downs make options more attractive though they lose time value pretty fast. So, pretty quick and/or strong trends are needed to make profits on buying options. But at least the loss is limited to the price for the option.

Thank everyone for the support.

Rang the bell !!

Bot 375 feb call ,226 sold .85 BAM! Equivalent of 4.60! Huray!

Congrats tic,

Agree with Larry again.

European ensemble was especially colder overnight. Interesting that ng picks times to shoot up that are unpredictable like this.

Options paid off big in this case.

metmike: That was it! WOW!

I see new highs.. Some may say I was wrong. I say great profit

I've never had a bad profit. Congrats!!

I had tons of bad profits from getting out way too early!

And tons of wonderful losses..........tiny ones that avoided huge losses!

Really nice to see you whallop a haymaker on that Natty. Keep picking those spots and pretty soon you'll be collecting BitCoins! Again, congrats on a job well done, great New Year start to you.

TY Hayman

Have my eye on coffee. Bought Monday and looking pretty good

Should grind higher. Adding on a dip tomorrow

European model another +9 HDD's.

Private guys had that from a little before noon? Rally almost nonstop from that time, making new highs!

Congrats, tjc!

No, they didn’t have that EE info til 2PM EST and after. The rally is on the general idea that the rest of the month still looks cold and to add to that with still no end in sight. This is so much colder than the very mild December that caused NG to plunge. The EE later helped it to rally more.

Big TY to everyone.

Perhaps a dip to the 4.15 (Sunday night open) to 4.40 support area will allow re-entry. Almost got back to the 50% retrace today. SWINGS ARE NOW HUGE

Natural gas futures surged on Wednesday, extending the first lengthy rally of 2022 to four straight days as forecasts for bitter cold temperatures and lofty heating demand intensified. The February Nymex gas futures contract soared 60.8 cents day/day and settled at $4.857. March jumped 35.9 cents to $4.327. At A Glance: ‘Strongest demand’ of winter…

metmike: Amazing that the market decided to dial in so much of the upcoming cold in 1 day. I would never have expected it to happen like this, considering how poorly the market had been acting at times early in the week(filling the huge gap higher from Sunday night on Monday, then struggling to go higher on Tuesday).

Volatility could be extremely high for awhile! Margins may increase because of this.

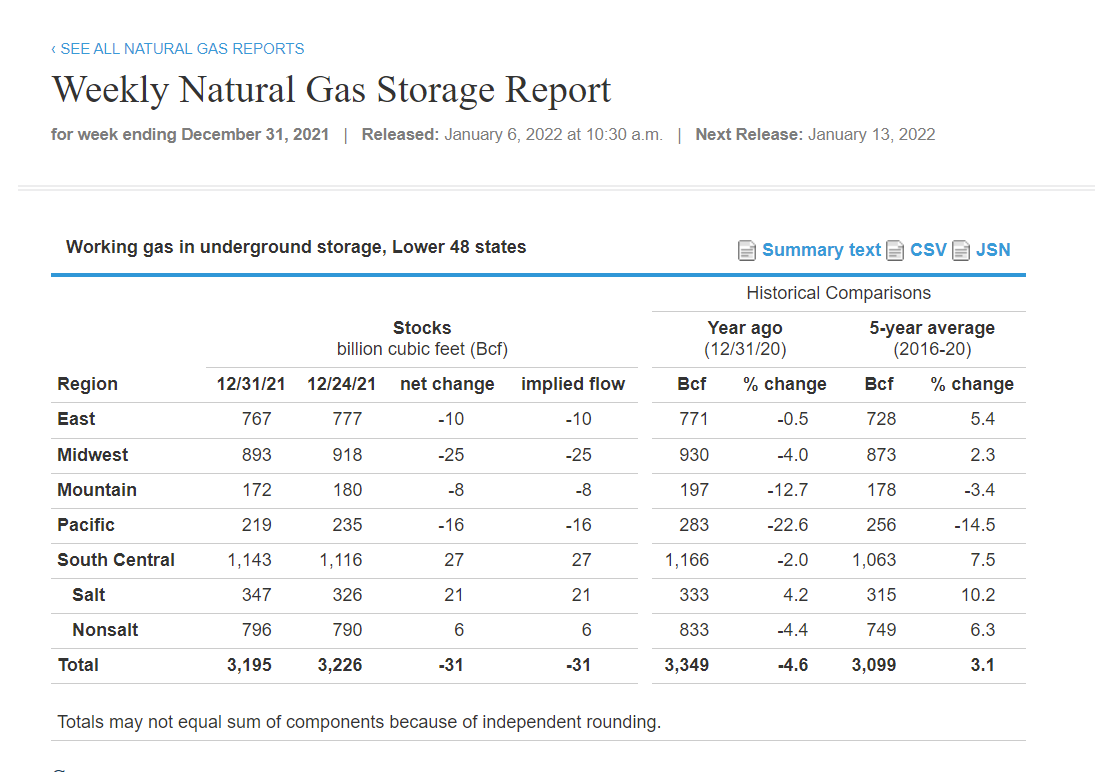

Tomorrow's EIA report will be based on the 7 day period below, ending January 7, 2022.

Compare that to the previous 7 days below that which had an extremely bearish -33 BCF drawdown!

https://www.marketforum.com/forum/topic/79754/#79980

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jan 13, 2022 Actual-179B Forecast-173B Previous-31B| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 13, 2022 | 10:30 | -179B | -173B | -31B | |

| Jan 06, 2022 | 10:30 | -31B | -54B | -136B | |

| Dec 30, 2021 | 10:30 | -136B | -125B | -55B | |

| Dec 23, 2021 | 10:30 | -55B | -56B | -88B | |

| Dec 16, 2021 | 10:30 | -88B | -86B | -59B | |

| Dec 09, 2021 | 10:30 | -59B | -54B | -59B |

The U.S. Energy Information Administration (EIA) reported a pull of 179 Bcf natural gas from storage for the week ended Jan. 7, the largest so far this winter and in line with expectations. Nymex natural gas futures, already down in morning trading following a four-day rally, held deep in the red after the print. Ahead…

metmike: The forecast did not change that much from Tue to Wed for us to go up 6,000+/contract(the 0z European model was colder..........but thats happened lots of times) and has not changed that much for us today, to be down 5,000/contract(overall the models are just as cold). Extreme volatility and unpredictability.

I will say that Wednesday was just a 1 off deal with the huge funds having a massive short and the short covering fed on itself all day with positive feedback on the chart signature and technical indicators and extreme ammo from vulnerable shorts having huge drawdowns.

https://ir.eia.gov/ngs/ngs.html

for week ending January 7, 2022 | Released: January 13, 2022 at 10:30 a.m. | Next Release: January 20, 2022

-179 Neutral vs expectations.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/07/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 01/07/22 | 12/31/21 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 730 | 767 | -37 | -37 | 732 | -0.3 | 688 | 6.1 | |||||||||||||||||

| Midwest | 835 | 893 | -58 | -58 | 885 | -5.6 | 823 | 1.5 | |||||||||||||||||

| Mountain | 159 | 172 | -13 | -13 | 189 | -15.9 | 168 | -5.4 | |||||||||||||||||

| Pacific | 204 | 219 | -15 | -15 | 279 | -26.9 | 246 | -17.1 | |||||||||||||||||

| South Central | 1,088 | 1,143 | -55 | -55 | 1,131 | -3.8 | 1,019 | 6.8 | |||||||||||||||||

| Salt | 330 | 347 | -17 | -17 | 328 | 0.6 | 302 | 9.3 | |||||||||||||||||

| Nonsalt | 759 | 796 | -37 | -37 | 803 | -5.5 | 717 | 5.9 | |||||||||||||||||

| Total | 3,016 | 3,195 | -179 | -179 | 3,215 | -6.2 | 2,944 | 2.4 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 3,016 Bcf as of Friday, January 7, 2022, according to EIA estimates. This represents a net decrease of 179 Bcf from the previous week. Stocks were 199 Bcf less than last year at this time and 72 Bcf above the five-year average of 2,944 Bcf. At 3,016 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

MetMike

Wednesday was shake out massive shorts. Weather has not gotten warmer. Do funds now buy??

Not sure about that tjc. If the weather stayed this cold for over a month..........then yes. If the pattern changes to mild again.........we will go lower!

The price of natural gas for delivery next month nosedived on Thursday as traders took profits after a massive four-day rally. The February Nymex gas futures contract settled at $4.270/MMBtu, down 58.7 cents day/day. March dropped 32.2 cents to $4.005. NGI’s Spot Gas National Avg., in contrast, continued to climb, gaining 89.0 cents to $6.450…

metmike: It would have been almost impossible to know how natural gas would act this week. I usually strongly recommend NOT using options, as tjc knows from the past because you will pay out the wazoo for the right to limit your risk and most options expire worthless but this was one of the examples of them paying off handsomely.............if you knew when to get out. If you were long futures and got out yesterday, you had massive profits too but with the futures, there have been some huge spikes down that are almost impossible to stay long thru in this environment.

For instance, if I'm long, no way will I sit thru a $2,000/contract correction. Whether its a drawdown or whether it just wiped out that much in profits.........NO WAY for me.

I'd be interested in WxFollower/Larry's take on the last 2 days. Even for natural gas, they were incredible and we ended up almost back to Tuesday's price.

I've been tied up with several things going on the last few days and not had time to look at the actual weather maps, only looking at the HDD data much of the time.

After looking at the actual maps from model solutions going back to Wednesday, it actually does make some sense why the market acted this way.

Definately an OVER reaction but the models peaked in cold intensity overnight Tuesday.......so the spike higher on Wednesday.

However, the weather maps have been looking more and more zonal and milder towards the end of the period since then. Previous to Tuesday Night, the maps were looking colder and colder, with an exception for a run or two but then colder again.

The NWS extended outlook may have looked colder today but the models were clearly less cold late in the period and that has continued so far tonight. The AO and NAO were NOT very bullish/cold overnight Wednesday/Thursday early ......just nuetral/near zero, though the 500 mb anomaly map was still pretty cold(not as cold as early Wed).

metmike: Agree that potential for cold to fade in late January was what clobbered the market on Thursday. Updated extended large scale anomalies/indices.

https://www.marketforum.com/forum/topic/78385/#78399

Quoting a wise man here.....we are another day closer to spring. :)

Mike asked me what do I think about this week’s NG action. My answer? Considering yesterdays huge drop, the current significant drop off daily highs along with being back down for the day,and colder 12Z models, I’d consider a conservative long for the weekend by maybe buying an OOTM call at these levels. There’s still a lot of intense cold on the way along with several 200+ EIA draws likely no matter what may happen near the end of the month. Also, crude is back close to its recent highs, which may indirectly help LNG demand, which is already at record highs. Options don’t expire til January 26th I believe.

Looking at the neverending widespread and intense US cold of the rest of this month at least (as per about all models the last few days) and definitely including today, I couldn’t imagine wanting to short NG at these prices. I’ve been saying things are bullish for NG all month but especially now. But that’s if the market cares enough about US wx, which logic would say it should. This is turning into an epic January.

Still looks extremely cold the next week!

The question is..........as we moderate after than, do we stay pretty cold into early February or are we close to average by the end of the month, with half the GFS ensembles, the European/Canadian and CMC models think with a more zonal pattern with time?

Cold side of average but moderating the last week of the month.

Updated extended discussion/maps:

Still looks pretty cold, even while moderating in week 2.

Out of town at my grandighters cheer competition today.

Looks as though it might stay cold fo a while from the midwest to the northeast. Winter has arrived.

One also has to wonder if NG and CL are trading sympathetic with each other. Especially since crude is on a serious uptrend right now. And their daily charts seem to be quite reflective of each other for long term basis.

They sometimes have factors in common that affect prices Mark.

I wouldn't want to be long ng if all models turn milder overnight.

I agree. But I would also be looking at "trading with the trend". Given, that if the models hold true, there's going to be a lot of drawdown in supply in the next 2 weeks. Maybe more. Is that factored in yet?

The other consideration is now in a global market situation. Not just in NG. And not just in the US.

The market knew about these upcoming huge drawdowns last week.

That's old news. NEW news comes when those huge drawdowns are updated to be even bigger or not as big and then, what is early February going to be like.

Looks like moderation is actually the trend.

Mike and Mark both have some good points. I’ve already stated my points and have no reason to change them when taking into account wx updates to the present. The country looks quite cold as a whole through the rest of the month at least with still no indication of a return to anything even remotely resembling the mildness of December. There is going to be a string of at least 4 big draws to be reported, all either near or above 200 bcf after the next 4 reports. Some may be well above due partially to freeze-offs halting production. This will likely bring storage vs the 5 year average from the current +72 surplus to a deficit at least near 100 bcf and possibly close to 200. Since just 2 weeks ago, end of March projections have dropped ~200 bcf just based on January/first few days of February cold, alone. If that weren’t enough, if after a short closer to normal period in early Feb there’s renewed cold domination, then we’d be looking at even that much more bullish comparisons vs the 5 year average.

Edit/update: models I’ve seen suggest US HDD likely remain higher than normal through at least February 12th. Yes it is just speculation, especially after week 2. But if even the speculation has cold for almost another 4 weeks, well, hopefully y’all see my point. What would bears hang their hat on now?

Thanks Larry!

My opinion on price direction(and always trading positions) often takes into account the relative aspect of the temperature forecast compared to previous forecasts.

Is it getting colder/warmer than before and how much of that is dialed in?

Obviously the week 3 part of the forecast is the most speculative/least known, so whatever that is, as it slowly becomes known, 1 day at a time, can have more absolute significance because there isn't a great deal to compare it to.

Going from much below temps to below temps, to me is not all that bullish if the market expected that or if the market was expecting a continuation of much below temps and now its just below.

But each day is different and we have prices changes that can dial in a weeks worth of colder/warmer weather in 1 day. Like we did last week with a 6,000+ spike higher...........and the maps were not that much colder on that day.

So you can be long for several days and give up, then suddenly the market responds right after you get out.

If we do continue this cold for a month, it seems likely that ng will go higher but in the 2nd half of Winter, there is not nearly as much speculative interest based on weather.

In November, a sustained pattern has twice as long to affect storage. In last January, not only is that cut in half but if the first half was mild, you've eliminated the possibility of storage levels to get precariously low.

That's just an example.

Also, it's not like prices are still near the lows. The market has rebounded quite a bit on the pattern change to cold.

The easy money comes very early in the pattern change. The market has not reacted yet and you have a bunch of traders following the old trend caused by the old weather pattern. You jerk them out of the market which is additional fuel to add to the NEW direction.

We've established the new direction now. The spike to almost $5 last week probably maximized the jerking out of the most shorts in a brief period.

No more easy money trading natural gas now.

However, I do agree that the forecast looks bullish/cold for the rest of the month and into early February.....though moderating.

Greetings MarketForum

Larry/Wx, MetMike, and Mark I believe you are all correct! Unlike Dec when big shorts pounded the market down on perceived (and fullfilled) mild temps, as Larry says, it is now cold and appears to extend for many weeks; the huge, one day spike happened (TY) so easy money is over; USA and Europe has witnessed a change to cold with a need for NG. ALL THESE FACTORS NOW SPELL--DEMAND.

In any event, I went long before your three Monday afternoon posts. I opine NG ups/downs Tu/Wed, but dont be short Th/FRi. Another round of blowing out re-established shorts will occur. Truly believe NGF expires next week at/near 5.5 or possibly 6 (market exaggeration). I may buy a call or two Wed night/Thurs a.m.

USE a stop

Thanks tjc!

The days 6-10 part of the European model were +10 HDD's.

The GFS was also colder during that period but we made new lows after that came out.

The rest of the forecast is about the same.

The AO and NAO are not the best for sustained cold but the teleconnections and anomalies are really good for cold.

Temperatures for this Thursday's EIA:

European model coming out quite a bit LESS cold. The first 10 days were -7 HDD's, then its slightly colder.

6Z GFS was a whopping -11 HDD's, which caused us to spike down to $4.2, then an hour later got back above $4.3.

Aftere 8:30am, there's been serious pressure.

Natural gas futures hovered close to even early Wednesday as traders appeared to be keeping their powder dry ahead of potentially the coldest stretch of the winter season so far. The February Nymex contract was up 1.4 cents to $4.297/MMBtu at around 9 a.m. ET. The February contract went as high as $4.385 in after-hours…

metmike: Latest extended analysis........taking out lots of cold risk.

https://www.marketforum.com/forum/topic/78385/#80600

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jan 20, 2022 Actual-206B Forecast-194B Previous-179B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 20, 2022 | 10:30 | -206B | -194B | -179B | |

| Jan 13, 2022 | 10:30 | -179B | -173B | -31B | |

| Jan 06, 2022 | 10:30 | -31B | -54B | -136B | |

| Dec 30, 2021 | 10:30 | -136B | -125B | -55B | |

| Dec 23, 2021 | 10:30 | -55B | -56B | -88B | |

| Dec 16, 2021 | 10:30 | -88B | -86B | -59B |

https://ir.eia.gov/ngs/ngs.html

for week ending January 14, 2022 | Released: January 20, 2022 at 10:30 a.m. | Next Release: January 27, 2022

Bullish but the market is focused on the big pattern change to milder late in the period........as it should.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/14/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 01/14/22 | 01/07/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 669 | 730 | -61 | -61 | 686 | -2.5 | 643 | 4.0 | |||||||||||||||||

| Midwest | 770 | 835 | -65 | -65 | 835 | -7.8 | 771 | -0.1 | |||||||||||||||||

| Mountain | 151 | 159 | -8 | -8 | 178 | -15.2 | 159 | -5.0 | |||||||||||||||||

| Pacific | 201 | 204 | -3 | -3 | 275 | -26.9 | 236 | -14.8 | |||||||||||||||||

| South Central | 1,019 | 1,088 | -69 | -69 | 1,062 | -4.0 | 968 | 5.3 | |||||||||||||||||

| Salt | 308 | 330 | -22 | -22 | 300 | 2.7 | 286 | 7.7 | |||||||||||||||||

| Nonsalt | 711 | 759 | -48 | -48 | 761 | -6.6 | 683 | 4.1 | |||||||||||||||||

| Total | 2,810 | 3,016 | -206 | -206 | 3,036 | -7.4 | 2,777 | 1.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,810 Bcf as of Friday, January 14, 2022, according to EIA estimates. This represents a net decrease of 206 Bcf from the previous week. Stocks were 226 Bcf less than last year at this time and 33 Bcf above the five-year average of 2,777 Bcf. At 2,810 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

The Energy Information Administration (EIA) reported a monstrous 206 Bcf withdrawal from storage for the week ending Jan. 14, a steeper pull than the market was expecting. Nymex natural gas futures had a modest reaction to the triple-digit draw, though, which was the first 200-plus Bcf withdrawal of the winter season. The February Nymex contract…

metmike: https://www.marketforum.com/forum/topic/79978/#80491

Latest extended. Back to December's pattern? Cold West, Mild East.

From yesterday eve:

Natural gas futures floundered a second consecutive day as weather patterns tilted warmer, overshadowing record export volumes, threats to production and the steepest storage withdrawal of the season. A day after dropping 25.2 cents, the February Nymex gas futures contract on Thursday shed 22.9 cents day/day and settled at $3.802/MMBtu. March fell 19.6 cents to…

From Fri AM

Natural gas futures recovered some of their recent losses in early trading Friday as weather models trended colder overnight. The February Nymex contract was up 9.0 cents to $3.892/MMBtu at around 8:55 a.m. ET. The American Global Forecast System (GFS) model trended colder by 15 heating degree days overnight, according to NatGasWeather. Most of the…

metmike: When we have a potential pattern change like the one coming up, there will be huge model to model/run to run fluctuations. Risk on again overnight/Friday for February cold!

MUST BE COLDER??

The pattern change the last several days had been to much milder, back to Decembers pattern..........which is why we crashed lower.

But the last couple runs are uncertain about how that shapes up exactly and looks potentially colder.

When there is an extreme temp gradient from northwest(cold) to southeast(mild) a slight change to the position of the main features can mean a 20 HDD difference.

The 0z GFS last night was +20 HDD vs the previous run!

Here's the latest:

metmike: As mentioned:

1. Models have a pattern change back to the December pattern(with the MJO weakening and no longer a bullish influence on forcing a cold pattern downstream which is likely what caused us to shift colder at the end of December). Models are least reliable when we have pattern change predictions. Sometimes, they make the changes too soon as patterns that have been entrenched for awhile are hard to dislodge.

2. This particular pattern has an very stout temperature gradient from the very cold northwest to very mild southeast. Slight shifts in the location of features in a changing pattern more than a week from now can be huge in terms of HDD's when the gradient is this tight.

The 0Z GFS overnight was +20 HDD's vs the previous run, for instance. This last, 18Z run was +13 HDD's vs the last, 12Z run. There's some solutions with a strongly negative, --AO(others are positive) late in the period. This means a huge difference in how much cold will be in Canada as a source region for cold fronts in the US. Canada looks frigid again, like in December. Where those cold fronts will hit makes a huge difference too.

Lower open but not crazy lower.

Eyeing a February warm-up, traders shrugged off signs of tight balances in the interim to send prompt month natural gas futures lower early Monday. The February Nymex contract was off 4.5 cents to $3.954/MMBtu at around 8:45 a.m. ET. March, meanwhile, was trading close to even at $3.780. Trends from the major weather models were…

metmike: We reversed to sharply higher this morning!

Cold looks aimed more towards the middle of the country instead of the West, in week 2 with a similar pattern in December that was extremely mild in the East.

GFS was the much colder model but turned much milder -16 HDD's with the 12z run.......but then the milder European model shifted to much colder!

+11 HDD's during the 6-10 day period!

Then, slightly milder and +8 HDD's for the entire period.

Regardless of model to model/run to run changes like this, the cold has peaked and the new pattern will be less cold(milder) with temps, maybe closer to average for the country as a whole(averaged) with more cold northwest half and more warmth southeastern 1/3 to 1/2.

Feb NG expires on Thursday with a lot of big shorts probably still in the market covering.

Volume today, for Feb/G, the front month was down to 50% of the next month/Mar/H.

40,000-G vs 75,000-H.

Volume for Feb will continue to plunge the next 3 days.

metmike: Weather models do have a warm up with the cold having peaked.

Uncertainty over the extent winter chills into the month of February put downward pressure on natural gas futures in early trading Tuesday. The February Nymex contract was off 5.6 cents to $3.971/MMBtu at around 8:50 a.m. ET. March was off 3.8 cents to $3.837. The European weather model shed heating demand from the outlook overnight

metmike: Front month expires on Thursday. Usually means unpredictable price movements...especially at this time of year with a potential pattern change that features uncertainty.

Volume for Feb was down to 20K and for Mar was 83K at just after 1:30p CST.

7 day temps for this Thursdays EIA report. It should be the biggest drawdown of this Winter. That and the front month, Feb expires the same day.......and a pattern change coming up to less cold.

Latest weather:

metmike: Too much cold for us to go lower, too much moderation for us to really get going higher.

0z models were colder!

Quick update. Long two calls and futures. Options expire today.

I guess knowing when to blink is the next difficult decision!

JUST HOW COLD AND HOW LONG? Any upward surprizes tomorrow??

Wish I could help you tjc.

The day before expiration in January is anybody's guess.

The overnight models were MUCH colder +18 HDD's on the European model and the massive spike higher gave you renewed hope on your options but as I mentioned yesterday, the amount of uncertainty right now is as high as it ever is.

The temp gradient between extreme cold along the Canadian border and warmth in the Southeast is incredible............so small changes in the position of features can make a 30 degree temperature difference in the forecast for some high population areas for several days(which is what happened on the European model last night in week 2).

If the European model take that back, we'll go back down.

HOWEVER, MY PERSONAL OPINION(which is not much more than a GUESS is that the colder trend is the RIGHT one and forecasts could still get even colder later this week(with extremely low confidence)

TY MetMike

I have orders in to sell my calls near the high of the day with no premium.. Thin vol with wide b/a. Perhaps a short will be more worried than I and let me out. If not, I will sell 2 futures and ride my current position into tomorrow expiration.

metmike: The 8-14 day NWS forecast dropped several categories colder in the SouthCentral US based on the huge 0z models colder change. I have a bit more confidence that it WILL be colder in February than what they showed earlier this week because models are mostly agreeing on that but how cold in uncertain.

Well, the saga is over. Sold out my out calls converted to longs and my exiting long for 2600 profit. HAD I AWAKEN at 4 am, could have doubled profit!

Made the most on the call bought at nearby strike when ng made the 'flush' described by MetMike. Slow recovery until last few days.

Observation--NG seems to do little until 10pm cst and on these bullish days peaks around 4am. Any significance?

Also, I think NG will peak when it closes near its daily high---in other words, these 4am spikes have not yet signalled the top UNTIL NG closes near one of these spikes.

Larry, MetMike, Others any thoughts?

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jan 27, 2022 Actual-219B Forecast-216B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jan 27, 2022 | 10:30 | -219B | -216B | -206B | |

| Jan 20, 2022 | 10:30 | -206B | -194B | -179B | |

| Jan 13, 2022 | 10:30 | -179B | -173B | -31B | |

| Jan 06, 2022 | 10:30 | -31B | -54B | -136B | |

| Dec 30, 2021 | 10:30 | -136B | -125B | -55B | |

| Dec 23, 2021 | 10:30 | -55B | -56B | -88B |

https://ir.eia.gov/ngs/ngs.html

for week ending January 21, 2022 | Released: January 27, 2022 at 10:30 a.m. | Next Release: February 3, 2022

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/21/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 01/21/22 | 01/14/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 609 | 669 | -60 | -60 | 646 | -5.7 | 599 | 1.7 | |||||||||||||||||

| Midwest | 701 | 770 | -69 | -69 | 787 | -10.9 | 718 | -2.4 | |||||||||||||||||

| Mountain | 143 | 151 | -8 | -8 | 171 | -16.4 | 150 | -4.7 | |||||||||||||||||

| Pacific | 201 | 201 | 0 | 0 | 275 | -26.9 | 227 | -11.5 | |||||||||||||||||

| South Central | 938 | 1,019 | -81 | -81 | 1,019 | -7.9 | 921 | 1.8 | |||||||||||||||||

| Salt | 279 | 308 | -29 | -29 | 289 | -3.5 | 274 | 1.8 | |||||||||||||||||

| Nonsalt | 658 | 711 | -53 | -53 | 730 | -9.9 | 647 | 1.7 | |||||||||||||||||

| Total | 2,591 | 2,810 | -219 | -219 | 2,899 | -10.6 | 2,616 | -1.0 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,591 Bcf as of Friday, January 21, 2022, according to EIA estimates. This represents a net decrease of 219 Bcf from the previous week. Stocks were 308 Bcf less than last year at this time and 25 Bcf below the five-year average of 2,616 Bcf. At 2,591 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

From earlier:

Natural gas futures sat near even early Thursday as traders braced for potential market-moving impacts from the latest government inventory data and from the looming prompt-month expiration. Heading into its final day of trading, the February Nymex contract was up 2.3 cents to $4.300/MMBtu at around 8:45 a.m. ET. March was up 1.0 cent to…

Feb NG jumped over $2? Ouch....some people got hurt today.

Covered my last long at $7.

Just kidding (-:

How do you spell SICK At least 15000 left on the table Who would have thought this kind of explosion

Sold out my out calls converted to longs and my exiting long for 2600 profit. HAD I AWAKEN at 4 am, could have doubled profit!

And you would have known exactly then to cover your longs?

I would just be grateful the weather pattern changed to much colder the last several days, along with excessive shorts from funds, bailed you out from a draw down to a profit.

Congrats on the profit tjc!

On the 4 am thing. There isn't anything special happening then that I know of. The last of the 0z models has been out for 2+ hours and almost none of the 6z model output is out.

Reminds me of the time I was on the wrong side of oil futures

Oil was dropping like a rock during the nite, I was on vacation with just my lap top

So dang sleepy did not realize the danger to my account

Finally woke up enough to completely reverse the entire position. I was a bit nervous but long story short by morning had recovered most of my loses. I never did find a reason for the drop in oil except markets do that

I closed out all positions and resolved to never have an open commodity position while on vacation

I have a stk portfolio which is buy and hold thing

But commodities is out while on vacation

Great story Wayne.

With stocks, most people are used to making or losing $1 for every $1 they have invested.

The leverage on commodities is 20 to 1 with your money and some firms allow day trading that makes that 80 to 1.

If you maximize that day trading leverage on big move days, you can more than double your money.........or lose even more than what's in the account!

From yesterday:

Natural gas prices hovered in a narrow range early Thursday but spiked after a bullish government inventory report and customary buying into prompt-month expiration. The February Nymex gas futures contract settled at $6.265/MMBtu, up $1.988 day/day. It rolled off the books at the close. March, which takes over as the front month, climbed 24.7 cents…

A more frigid outlook overnight from one of the major weather models saw natural gas futures extend their recent gains in early trading Friday. After posting a 24.7-cent rally in the previous session, the March Nymex contract was up another 26.7 cents to $4.550/MMBtu at around 8:45 a.m. ET. The European weather model underwent “another…

metmike: European model was +12 HDD's overnight!!

Sharply higher open!!

Maybe around Fri's highs or even a gap higher?