Do you think the Biden administration will come up with a monetary assistance program to help those facing difficulty with high energy bills and income that is insufficient

As utility Co.'s lock in winter needs for customers, many houses will likely have heating bills 3x larger than last yr

Plus pump gas and you have a lot of unhappy voters

Will Dems do some thing to help with energy cost before election

If they do, will that buy enough votes

Good thinking Wayne!

Lots of things can happen between now and then.

Folks might remember 2008, when crude and natural gas prices got even higher than this(though not this high at the pump) and the market suddenly collapsed.

I'm not saying anything like this is coming. For one thing, the war on fossil fuels has had over a decade to get a good start on obliterating our reliable energy supplies/sources, at least in the US and Western Countries(China, Russia and India are paying no attention to that economy crushing silliness and the fake climate crisis).

Key Takeaways

energy assistance after creating the mess. Boy if that does sound just like Obama-biden. Fire millions and then hire them back after the covid scare and young healthy people had no business getting fired. Just like big gov, create a fraud and try to use it politically. Here ya go peons, here is 259 bucks and these peons in Indiana are paying what, 59 cents on each gal of fuel for taxes?????? Yes this makes perfect sense to a lib

Wayne said:

"As utility Co.'s lock in winter needs for customers, many houses will likely have heating bills 3x larger than last yr"

------------------

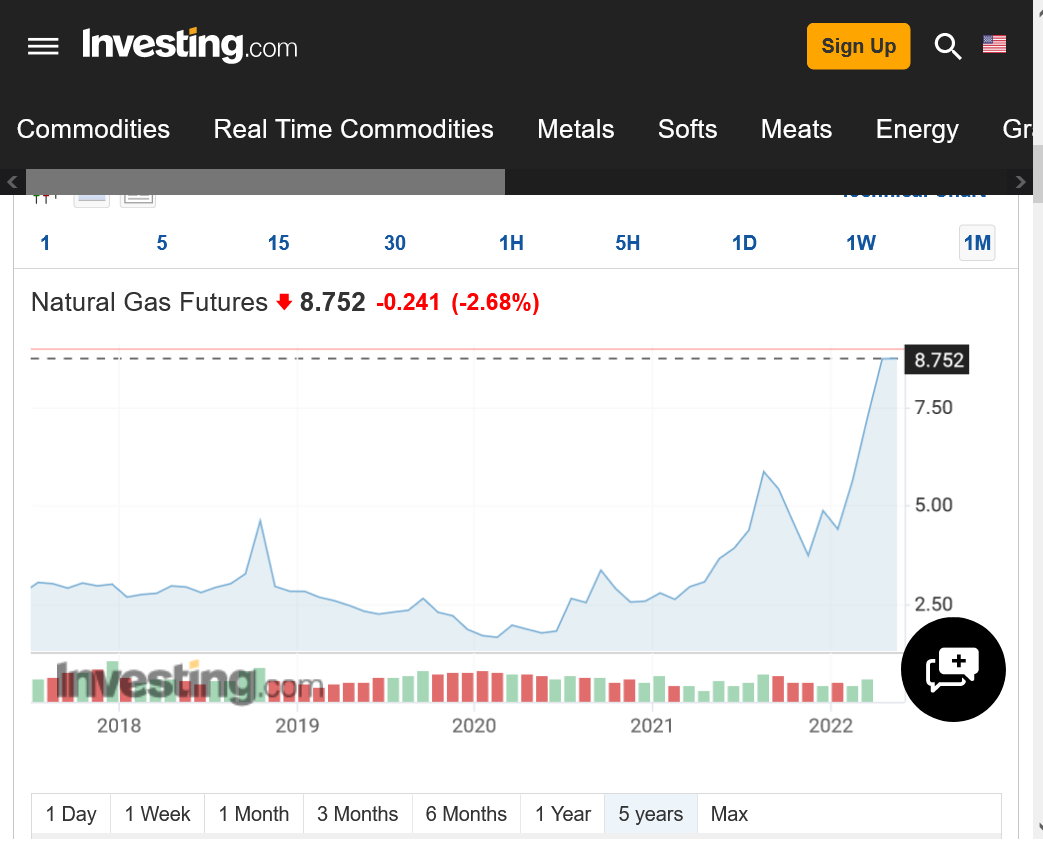

Natural gas is the #1 heating fuel in the US and it is, indeed, way up vs a year ago. This imo has (virtually) nothing to do with Biden. Much of it is due to a large increase in demand caused by LNG demand, especially in Europe and extra especially with Europe wanting the US to do its best to replace the demand for Russian NG ASAP. Remember that futures look ahead and they're anticipating even greater exports down the road. It used to be that US NG prices were almost exclusively determined by US supply and demand. Now international/European gas prices have much greater impact than they used to have. As a matter of fact, that's one of the main reasons I've stopped trading it as upcoming US weather is not nearly as exclusive a factor as it used to be. Sometimes it is the main factor but sometimes it isn't (more than in the past) and thus it makes for too much unpredictability for comfort for me.

I strongly disagree with that assessment NOT affecting ng prices here Larry!

Not only has this resulted in a tremendous negative affect in the US NG industry, which, in the past would have already been gushing in new supplies to make up our current deficit but a double whammy has occurred.

Europe REALLY shot themselves in the foot by curtailing their reliance on fossil fuels and, this past Summer, when there wasn't the expected amount wind energy to make electricity they went into the Fall with extremely low ng in storage and this increased US demand and US prices because NG is no longer just traded in the US, like its on an island. Its much more globally priced because we have a huge export market.

Funny thing is that you can't find honest articles telling you the truth about it, so I understand why it's not so crystal clear as the facts point to.

They've killed off most coal in the EE and much of the US. That provided tremendous amounts of FOR SURE reliable energy, available 24hours/day, all year.

https://electrek.co/2020/07/23/europe-green-energy-exceeded-fossil-fuels/

Oct 14, 2021 — Europe is in the midst of an unprecedented energy crisis, exacerbated by overly ambitious green policies

CNN, puts an absurd spin on it............the fix for the problem, is to increase reliance on what caused the problem:

https://www.cnn.com/2021/09/22/business/europe-energy-gas-renewables-climate-cmd-intl/index.html

And John Kerry is absolutely delusional and needs to go ASAP! We are in the early stages of an energy disaster......and he's doubling down trying to sell exactly what's causing the disaster. This would be a snake oil salesman, selling a health elixir to consumers with arsentic in it, getting people sick.........pushing to increase sales!

Apr 20, 2022 — Many observers now agree that Europe's lack of energy security and ... Where natural gas is concerned, Europe now faces the prospect of ...

Killing Coal

14 responses |

Started by metmike - Nov. 21, 2021, 10:57 p.m.

Natural gas is the #1 heating fuel in the US and it is, indeed, way up vs a year ago. This imo has (virtually) nothing to do with Biden.

Larry, it has EVERYTHING to do with Biden:

The Biden administration is allowing for additional natural gas exports after Russia shut off gas to two of the U.S.’s NATO allies.

The Energy Department announced on Wednesday that it would issue two orders allowing for the export of a total of 500 million additional cubic feet per day of liquified natural gas from projects in Texas and Louisiana.

That represents enough energy to heat about 2.5 million homes for a day.

metmike: So US consumers are paying for it with higher prices. But that's a tiny part of it. The US natural gas industry has not responded robustly to the lower supplies as in the past because most of the new investment money and benefits are all going to crappy fake green energy as Biden and company, do their best to kill fossil fuels, including ng, with Biden leading the way.

++++++++++++++++++++++++

https://www.cnn.com/2021/01/26/politics/biden-halt-new-oil-gas-leases/index.html

The move is expected to be the most prominent in a series of climate actions the President will take on Wednesday, including elevating the climate crisis as a national security issue.

+++++++++++++++++++++++++++++++

The Biden administration says it is canceling three oil and gas lease sales scheduled in the Gulf of Mexico and off the coast of Alaska.

|

May 12, 2022

WASHINGTON (AP) — The Biden administration says it is canceling three oil and gas lease sales scheduled in the Gulf of Mexico and off the coast of Alaska, removing millions of acres from possible drilling as U.S. gas prices reach record highs.

“Unfortunately, this is becoming a pattern — the administration talks about the need for more supply and acts to restrict it,'' said Frank Macchiarola, senior vice president of the American Petroleum Institute, the top lobbying group for the oil and gas industry."

++++++++++++++++++++++++++++++++++

$555billion to fight the fake climate crisis

Started by metmike - Nov. 2, 2021, 12:19 p.m.

https://www.marketforum.com/forum/topic/76969/

People that keep repeating that this is not Biden's fault are just repeating rhetoric they read from MSM sources that control the FALSE narratives on this topic...and not doing any of their own research/homework.

And if you want to take that position, then he is even MORE responsible for it because he was the VP in the administration that really got the ball rolling and now it's had plenty of time to inflict the inevitable damage:

https://www.marketforum.com/forum/topic/84689/#84695

Just earlier this week, he not only owned the problem but he doubled down and embraced the current pain as being part of THE PLAN that he is full steam ahead in imposing on the American people.

Really, he just did that!

This president is not only the worst one in history with regards to energy policies, but if we had another country that was our enemy and wanted to hurt the USA, they would want his energy policies for us.

And we have a very serious problem with inflation, especially food inflation, so what is one of the things that Biden does?

E15 gas this Summer

Started by metmike - April 12, 2022, 4:04 p.m.

https://www.marketforum.com/forum/topic/83265/

It's a bad move anytime but I can't think of a worse time to do this counterproductive measure.

Mike,

1. When I said higher prices had (virtually) nothing to do with Biden, I was thinking of domestic NG production still heading to record highs during Biden's term. I wasn't thinking of Biden approving an increase in how much the US could export. Actually, I admittedly didn't know what power he had on controlling the export levels. So, incorporating that, I can see where Biden can be considered a significant factor on prices.

So, the free market isn't the main determiner of how much NG US companies can and will export?

2. Regarding prices and Biden, I meant I felt he had very little to do with it as POTUS, not VP. I was addressing the reason for tripling of prices over the last year....the increased exports causing much of it imo.

This is what I said:

"Natural gas is the #1 heating fuel in the US and it is, indeed, way up vs a year ago. This imo has (virtually) nothing to do with Biden. Much of it is due to a large increase in demand caused by LNG demand, especially in Europe and extra especially with Europe wanting the US to do its best to replace the demand for Russian NG ASAP. Remember that futures look ahead and they're anticipating even greater exports down the road."

But as you said, his having to actually approve of more exports admittedly appears to be a major factor.

Thanks Larry!

Larry,

Here's another piece of solid evidence related to Biden's war on natural gas that has greatly discouraged new investment money in natural gas, at least as of last October when I did this report.

Being somebody with great knowledge/experience in following the natural gas business, you will be able to appreciate it more than most.

https://www.marketforum.com/forum/topic/76792/#76918

Mike said:

"Larry,

Here's another piece of solid evidence related to Biden's war on natural gas that has greatly discouraged new investment money in natural gas, at least as of last October when I did this report."

-------------------------------

Mike,

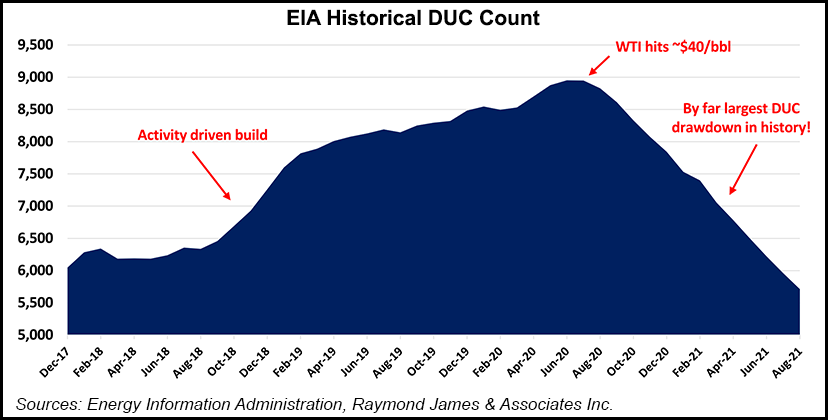

So, DUC wells as of Oct of 2021 were still falling although they had been since July of 2020. What I read was that the drop actually started due to COVID as opposed to the war against fossil fuels:

But regardless, perhaps now the main reason as you said is the war against fossil fuels that Biden is helping to fuel (no pun intended) because as you said it discourages investment in new drilling. I didn't think about this before and is worth considering despite the back to near record high production and projections for even higher production in 2023. Interesting and quite possibly a valid point.

Aside: I reread some of my posts in this thread and they reminded me of the frustration and difficulty I had in trading NG then due to moves that made little sense with regard to wx. Reading these makes me feel even better that I'm no longer dealing with the nonsense from my perspective that has been occuring for quite awhile in this market.

Thanks Larry, you seem to be missing the main point.

They didn't recover when COVID was over, as much as in the past with increasing demand and prices because of the war on fossil fuels being led by Biden. This is NOT me speculating!

They've made tremendous progress in killing coal and Biden has been on a mission to kill natural gas too.

I'm actually involved in a business with my wife and can't divulge proprietary information related to this but trust me, Biden's objectives have assisted in totally killing all new coal projects(The government in Canada has already made that totally final.........coal is dead in Canada and no new investment money wants to touch it).

Almost every energy company in the US is now planning to shut down all coal burning power plants. This was well on the way before Biden and he didn't have to lift a finger to alter that course. There are some extreme things that could happen to save coal in the US but it would require a tremendous fight upstream against Biden and the ones who actually control the killing of fossil fuel agenda. Big money is putting ALL their money on things that are NOT coal.

However, what's new is that they also know that ng is next on the list and though there will be an extended bridge for natural gas.........longer term investments are all drying up because it's extremely well understood in the industry that Biden's action are all designed to kill ng too. And I already showed this earlier.

You keep looking at the actual supplies in storage right now and not looking at what the market has been focusing on for over a year.

$555 billion to fight the fake climate crisis

Started by metmike - Nov. 2, 2021, 12:19 p.m.

https://www.marketforum.com/forum/topic/76969/

https://www.marketforum.com/forum/topic/84844/#84857

Killing Coal

14 responses |

Started by metmike - Nov. 21, 2021, 10:57 p.m.

Mike,

I had said: "But regardless, perhaps now the main reason as you said is the war against fossil fuels that Biden is helping to fuel (no pun intended) because as you said it discourages investment in new drilling."

So, I'm actually warming up to your thinking that Biden is going to later cause a big drop in NG production as new/DUC wells are no longer there in high enough numbers to replace aging wells and the idea that DUC drops are now due to Biden's energy policy reducing incentives to invest in new NG wells. So, I don't think I'm missing your point at all. I'm following what you're saying. I'm saying I hadn't realized this before due to my ignorance.

Larry I sincerely apologize for misreading and mischaracterizing you.......my bad!

I actually learned some things in this discussion too. In doing research to be accurate here, I discovered that Biden had authorized a significant increase in our exports of ng to Europe.

That one didn't make much news. I'm all for helping Europe because of Russia cutting them off from their robust ng but not when the US has low supplies, and with the highest ng prices in over a decade and the certainty that consumers will pay higher utility/energy bills because of it.

For those not familiar with this report/graph, the blue line below shows that US ng in storage is pretty close to the lows of the past 5 years and this market desperately needs an increase in supplies IN THE US. Shipping more out to Europe is about the WORST thing we can do for the US consumer and energy security in the US right now.

The last EIA was a bullish surprise too with a much smaller injection than expected. Part of that is because of the big exports of our natural gas. We need to increase FASTER than the 5 year average not fall farther behind by increasing our production and SENDING IT TO EUROPE.

https://www.marketforum.com/forum/topic/83540/#84897

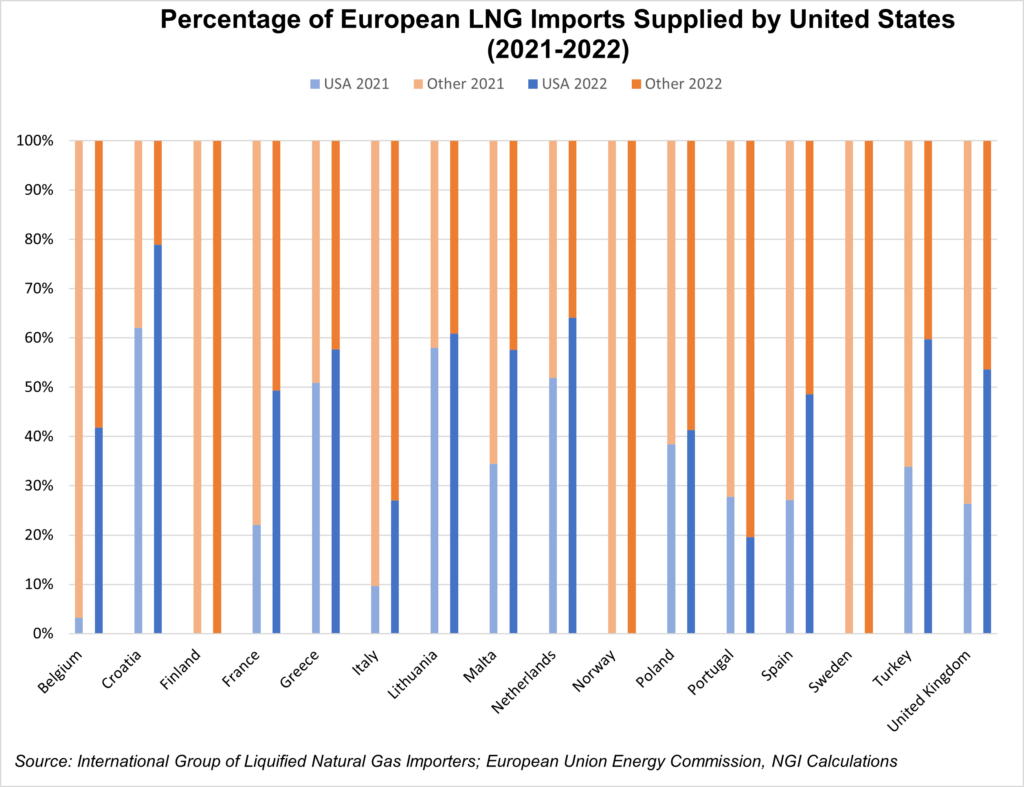

Exports below. Rapidly increasing the last few years, with an extremely short lived drop from COVID.

_yAkKG39.png)

Prices below, we actually hit $9.4 earlier today, right off the top of the graph. Highest prices since 2008. More than 3 times higher than what they were in early 2021.

So on one hand, the Biden administration is using aggressive legislation to curtail, long term/future ng production in the US and the other hand, he's doing short term SIGNALLYING to ship that production out of the US.

That's why I keep saying that the Biden energy policies are the worst in history by an extremely wide margin.

We are drawing down the SPR oil needed for emergencies which isn't doing much(but maybe this is an emergency?) except to make us less energy secure, when we can buy other countries oil on the global market for not much more.

In the long run, the war on fossil fuels ensures prices will stay this high, so why draw down SPR stocks now?

Forcing an extra 5% ethanol on the gasoline market this Summer, in a time of extremely high food inflation and corn prices near record highs already.

E15gas this Summer

Started by metmike - April 12, 2022, 4:04 p.m.

https://www.marketforum.com/forum/topic/83265/

“The secrecy around this critical task force is reminiscent of some of the worst actions of the Trump administration in handing public policy over to private interests, while appearing to violate the law,” said Global Witness senior adviser Zorka Milin.

The task force was formed in late March by the Biden administration and EC President Ursula von der Leyen. Its formation came at the same time the White House pledged to send another 15 billion cubic meters (Bcm) of LNG to Europe this year and 50 Bcm annually through at least 2030. The European Union (EU) is working to stop imports of Russian energy supplies by 2030.

metmike: That would be an additional 525 bcf this year and 1,750 bcf more, starting next year, thru 2030.

This is extremely outrageous and will be almost impossible, considering the current demand/supply dynamics, especially since Biden has been pushing policies to kill ng in the US.

The cost to US consumers could amount to trillions of dollars during that period and it would obliterate energy security for heating/cooling/electricity. The only way this makes a lick of sense is that they must want to drain our ng supplies, derangely hoping that it will help inspire more investing in fake green energy(crappy wind and solar). They have almost killed coal, now it's time make future plans to kill ng. ........Trying to force increased sales to Europe when we have very low supplies in the USA already for Pete's sake. Most retarded energy policy in the history of our country!!!!! This is what a mortal enemy of the US would want to happen!!!!

We need to get this party out of control ASAP before they intentionally obliterate our energy reserves and leave us with a dire supply/storage emergency.

Global Witness asked President Biden to open all the task force’s meetings to the public, require attendees to file declarations of interest and keep records of each meeting.

FACA stipulates that a federal advisory committee consists of private sector representatives who consult with the president or government agencies on a regular basis. Such committees must also comply with open meeting mandates and work with the public.

“So, because the joint EU-U.S. energy security task force is just federal and EU officials, it isn’t an advisory committee,” said LNG Allies CEO Fred Hutchison. The U.S. trade group represents the sector.

“Moreover,” he told NGI, “the private sector representatives who have attended the task force meetings did so to provide individual advice.” Hutchison noted another FACA exemption that allows individuals to offer guidance to federal officials on their own and not as part of a group.

The task force is led by the U.S. State Department’s Amos Hochstein, senior adviser for global energy security. The former Tellurian Inc. executive directs the task force with Björn Seibert, head of cabinet of the EC president. The commission is the EU’s executive arm.

[LNG Projects: Tune into NGI’s Hub & Flow podcast to learn about Canada’s efforts to export LNG and join the global natural gas market. Listen now.]

The task force is meeting with industry across the world to help displace Russian energy supplies. Companies including Cheniere Energy Inc. and Freeport LNG Development LP have said they’ve participated in a task force meeting.

Hutchison said the task force has a vital role to play, partly because politicians in Washington and Brussels “may well need to signal support” for the additional infrastructure needed to ship and receive more gas and help industry gain financing.

In a joint statement shortly after the letter was sent and Russia cut off gas supplies to Finland, the White House and EC said they “reaffirm our commitment to strengthening Europe’s energy security.”

Europe imported 45% of its natural gas from Russia last year. Since late February, when Russia invaded Ukraine, the continent has moved to distance itself from the pariah state.

“The European Commission and the United States understand the urgency of taking decisive action to reduce energy imports from Russia,” said the joint statement. “Through the task force we will continue working to diversify Europe’s supply of natural gas while we accelerate the deployment of energy efficiency and smart technologies in European homes and businesses, electrify heating, and ramp-up clean energy output to reduce demand for fossil fuels altogether.”

The Global Witness letter sent May 23 came days after a group of U.S. Democratic lawmakers and some members of the European Parliament sent a letter to President Biden urging the task force to stop new oil and gas projects, including LNG infrastructure, in the interest of the climate.

Biden and all those that support these US destroying energy schemes must go........ASAP!!!

Cheap energy is driving life, growth, and prosperity

https://fee.org/articles/fossil-fuels-are-the-lifeblood-of-civilization/

Life without petroleum-based products

Started by metmike - May 21, 2022, 10:46 p.m.

https://www.marketforum.com/forum/topic/84689/

More brain dead climate crisis stupidity in Europe that has got them in a serious ENERGY crisis here is the REAL world, as they make decisions based on a science fiction, manufactured reality:

Dutch farmers and nitrogen

Started by metmike - July 7, 2022, 8:49 p.m.

https://www.marketforum.com/forum/topic/86882/

It sounds like I'm being pretty harsh on these people that are just trying to save the planet, right?

That's what they want people to think..........so they don't have to be held accountable for incompetence, dishonesty and taking actions that really, REALLY hurt other people for their self serving interests and accomplish..........very little of what they claim they are trying to do.

Thought I would add a bit of some thing to this discussion

Some body must think Ontario will change it's policy re: wind power

Sales people are ringing door bells all over our part of the world

They want to lease land for future wind towers

They think there will be a change in alternative energy policy and are willing to invest money now to get land leased for future wind tower projects

They have an ambitious schedule of land they want to lease as I have seen the map of what they hope to lease

The lease is for 5 yrs and re-negotiated at the end of 5 yrs, with a huge land mass they hope to lease

Most land owners we talk to, are not leasing their rights away

As one land owner said my answer is always "no" and another bigger "no"

So some money thinks wind power is alive and well in our part of the world, in Ontario, Canada

It costs big money to lease as much land as they hope to lease

Plus they hired laid back sales people that aren't pushy using high pressure sales tactics

I think the industry found out farmers re act differently to high pressure sales

Not sure what's happening in Canada, Wayne but they are clearly on board with the capital cronyism that defines the extremely anti environmental, fake green wind energy scams.

These articles/posts sum it up in the United States:

Capital Cronyism in leading wind producer Texas.

https://www.marketforum.com/forum/topic/88534/#88536

Big failure during peak energy loads in California

https://www.marketforum.com/forum/topic/88534/

Fake inflation reduction act. Wind, the energy source from environmental hell.

https://www.marketforum.com/forum/topic/88185/

https://www.masterresource.org/droz-john-awed/25-industrial-wind-energy-deceptions/

metmike: With regards to energy assistance, yes that's very possible. Good point, Wayne. Biden suddenly announced the forgiveness of hundreds of billions of dollars worth of student loans, so anything is possible:

https://nypost.com/2022/08/25/student-loan-forgiveness-is-bidens-hail-mary-pass-to-buy-votes/

Mike,

Earlier in this thread I said this about NG production:

"So, I'm actually warming up to your thinking that Biden is going to later cause a big drop in NG production as new/DUC wells are no longer there in high enough numbers to replace aging wells and the idea that DUC drops are now due to Biden's energy policy reducing incentives to invest in new NG wells."

---------------

Mike,

Do you have an update regarding the number of DUC (new) wells for NG? Even though NG production has recently been at new record highs, which has helped bring down NG prices considerably vs where they were a few months ago and has allowed recent very high weekly EIA injections, I learned about reduced DUC counts from you and how that is expected to lead to later drops in production. When do you see domestic NG production dropping significantly?

Thanks in advance.

Great question Larry!

The answer is........I have no idea but will try to find out.

Like you said, production is gushing out here and it would be enlightening to understand the current dynamics at play that led to this.

I'm guessing that there's more to it than just DUC's and the producers, unlike years ago, that required many months to slowly ramp up production, can do it in a much shorter period. Obviously, just based on the last several EIA reports!

That didn't take very long!

Seek and ye shall find (-:

I'll try to look for more info later. Thanks for the question.

October 7, 2022

https://www.eia.gov/todayinenergy/detail.php?id=54179

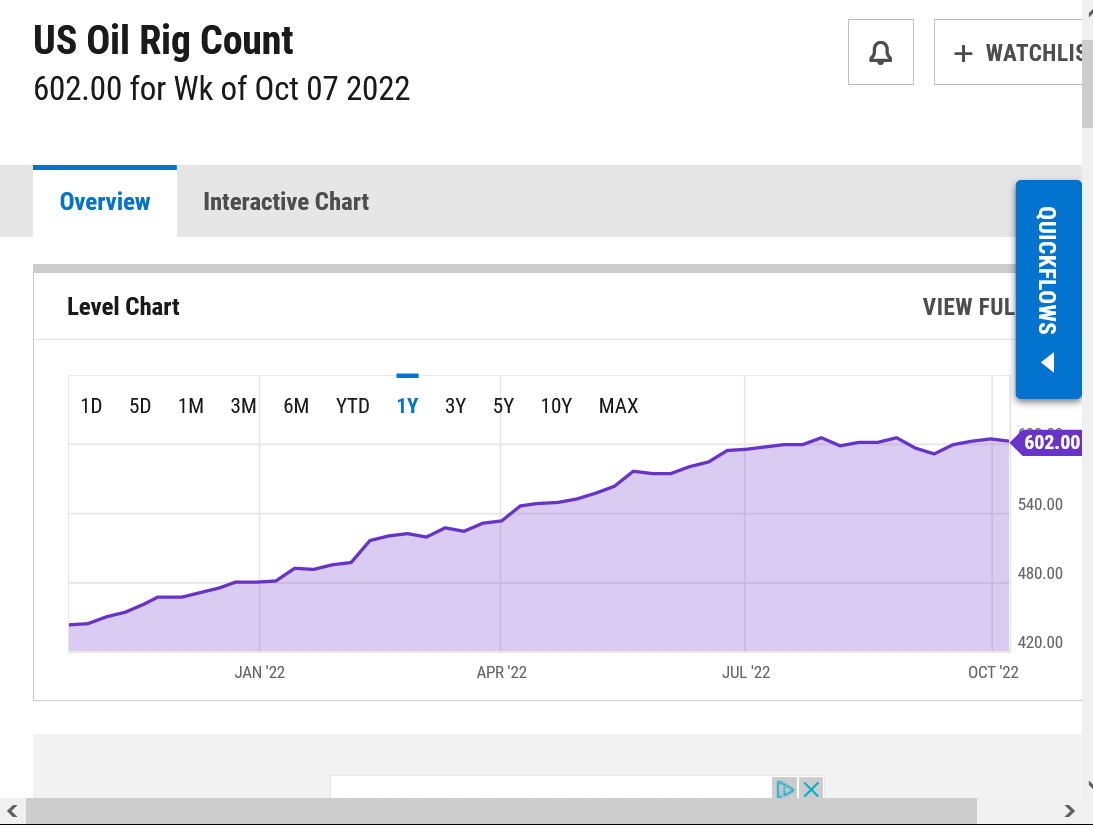

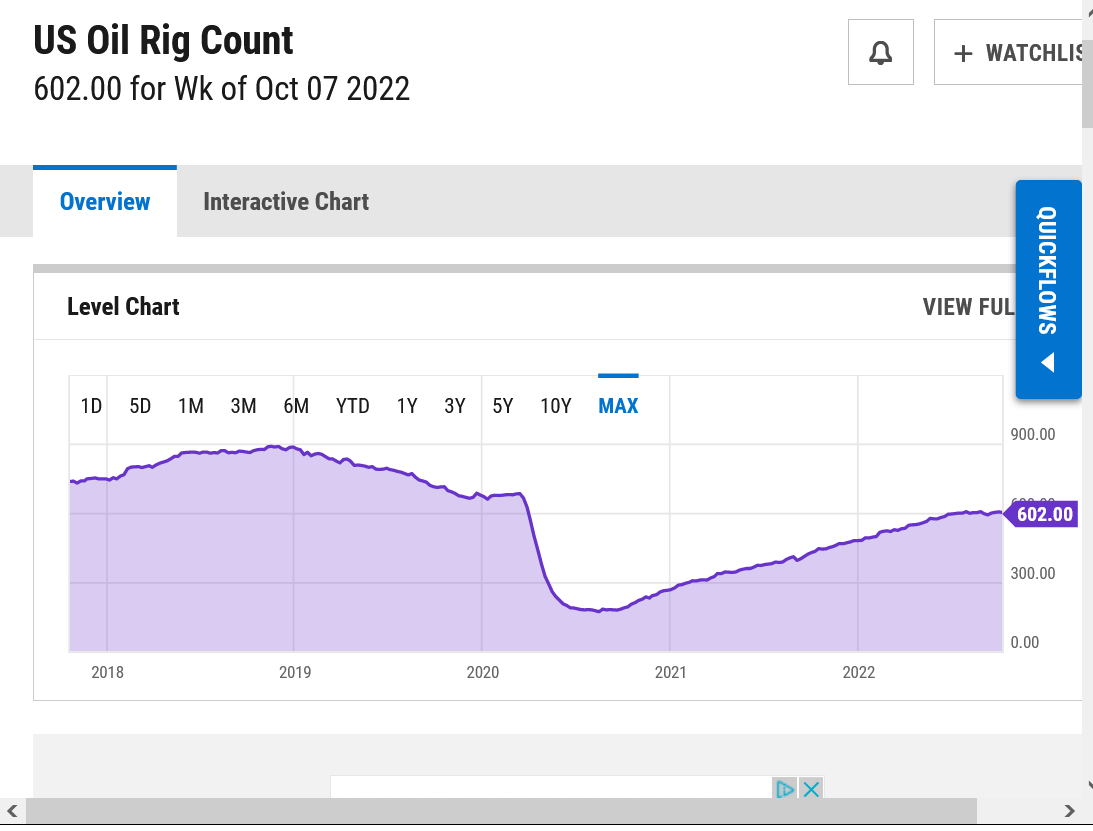

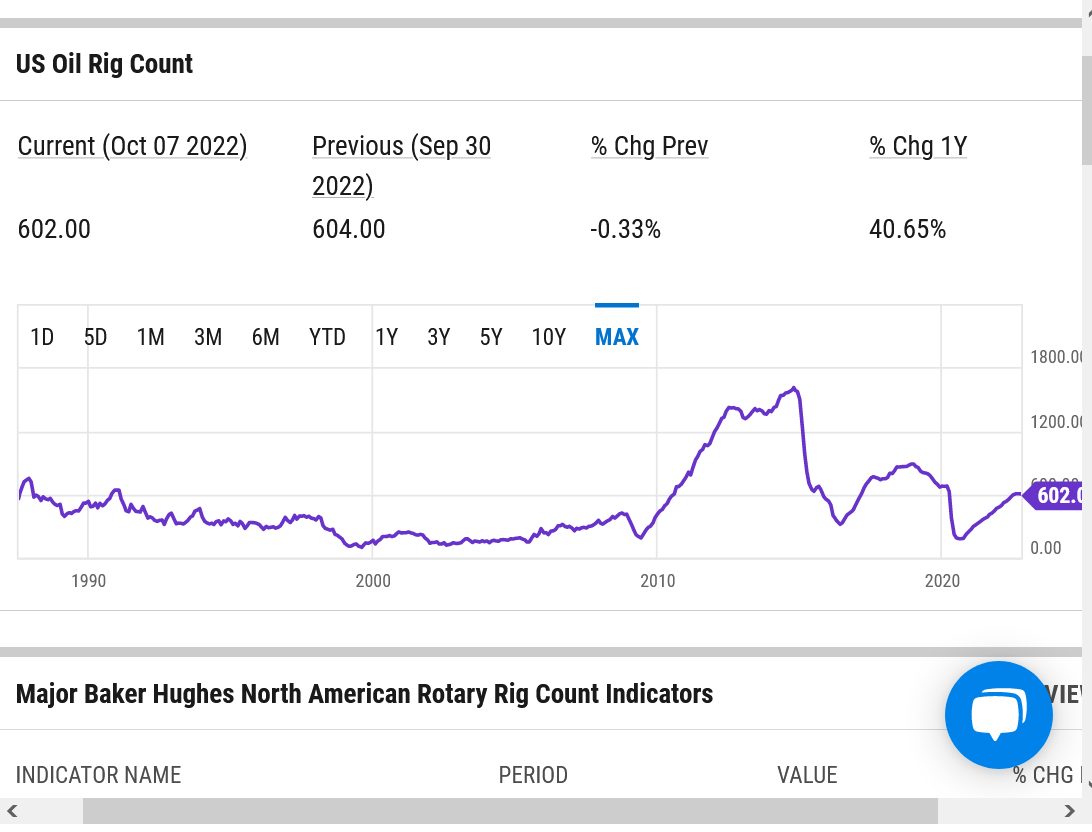

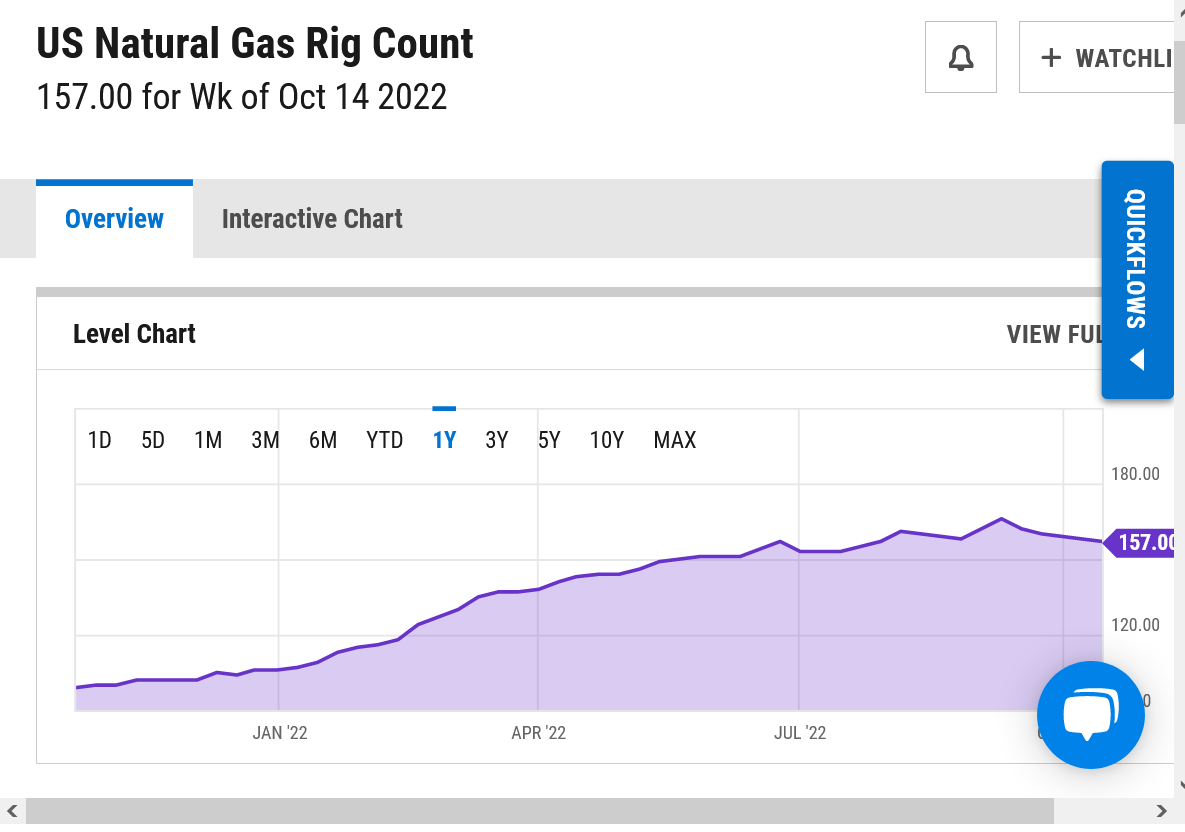

In 2022, drilling for both oil- and natural gas-directed wells has increased in the United States, according to weekly data collected by Baker Hughes. Natural gas-directed rigs total 160 as of September 30, an increase of 53 so far this year. Oil-directed rigs total 602, an increase of 481 so far this year. Although the total number of U.S. DUC wells has declined overall throughout 2022, this increase in drilling activity has slowed the monthly decline. In August, the number of DUC wells grew by 16, the smallest monthly addition since July 2020.

602.00 for Wk of Oct 07 2022

https://ycharts.com/indicators/us_oil_rotary_rigs

++++++++

Found this. The peak was 1,582 in late Oct, 2014

https://ycharts.com/indicators/reports/baker_hughes_rotary_rig_count

I went back farther and found this(combination of oil and natural gas rigs. The peak was 4,521 in December 1981.........but those were almost all Gulf of Mexico rigs! Big difference with horizontal LAND fracking, that took over, starting 15 years ago and can extract much more gas-oil for each drilled and developed well.

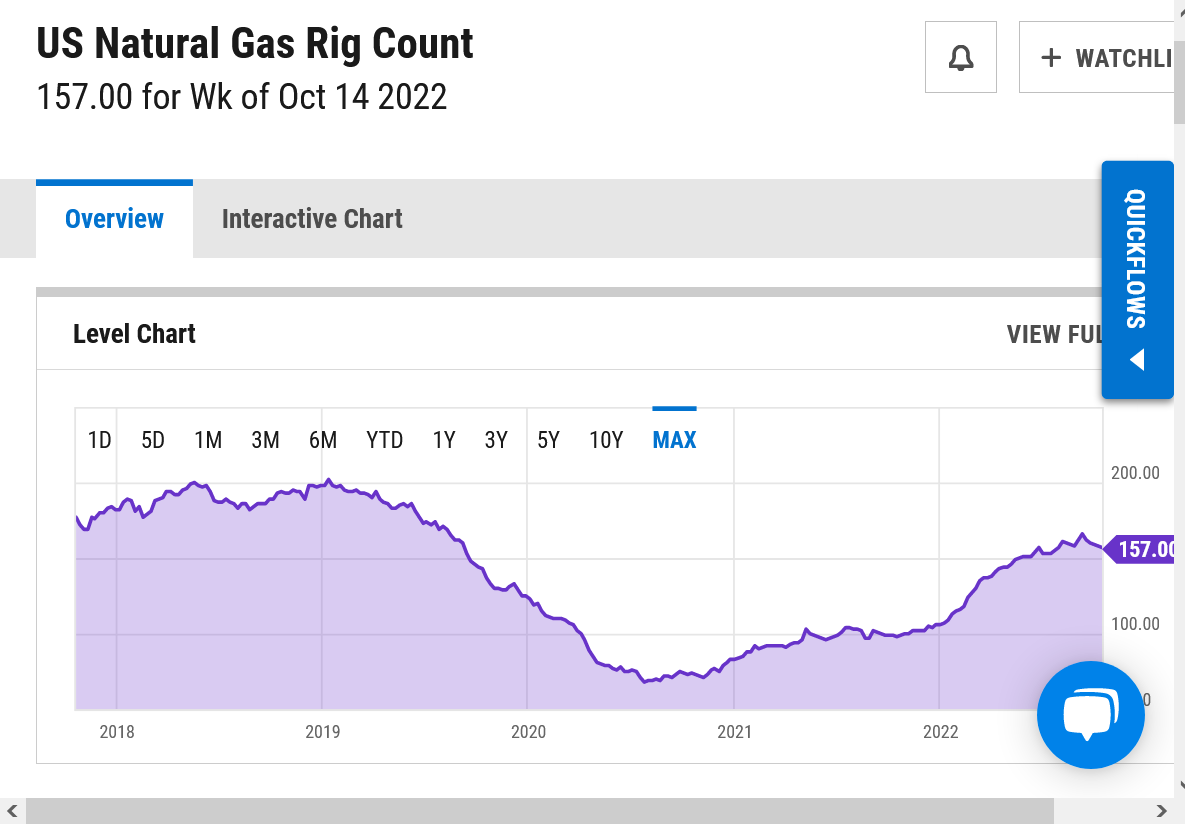

How about natural gas? Same sort of thing, except we're slightly above when COVID started but still way down from previous years.

157.00 for Wk of Oct 14 2022

https://ycharts.com/indicators/us_gas_rotary_rigs

Here's a really good site with data going back 35 years! September 2008 at 1,585 rigs was the peak for natural gas rigs, when the price was in the double digits BEFORE horizontal wells had replaced most of the GOM wells.

https://www.eia.gov/dnav/ng/ng_enr_drill_s1_m.htm

https://www.eia.gov/dnav/ng/hist/e_ertrrg_xr0_nus_cm.htm

.png)

I'm "upgrading" this thread to the trading forum because it's loaded with wonderful market information thanks to Larry's wonderful question.