Memorial Day week EIA vs CDDs 2003-2021:

CDD EIA Year

60 +92 2018

57 +77 2006

55 +62 2012

55 +80 2011

52 +65 2016

51 +99 2010

45 +119 2019

44 ? 2022

42 +102 2020

38 +110 2007

37 +119 2014

36 +102 2004

32 +132 2015

31 +111 2013

30 +106 2017

30 +124 2009

30 +105 2008

26 +105 2005

26 +98 2021

25 +114 2003

Avg CDD 2003-2021 = 40

Avg EIA 2003-2021 = +101

Any guesses for this week's Memorial Day week based report? CDDs were 44. Memorial Day week has been the week averaged out with the largest injection of the year though not every year is that way of course.

Thanks Larry!

Old thread here:

Natural Gas April 21, 2022

86 responses |

Started by metmike - April 21, 2022, 11:48 a.m.

https://www.marketforum.com/forum/topic/83540/

++++++++++++++++++++++++++++++

Temperatures from last week for the next EIA report this Thursday, including Memorial Day.

Very warm in the East and South that have some high population centers.

Cool Northwest to Rockies to N.Plains, where not many people live.

Injection might be a bit less than average.

OK, I just looked at your EIA injection data for the first time and it confirms that with the CDD's in the top half of the years which you have listed.

Wow, Larry. You sure have tons of great data!

Dome of death, La Nina heat ridge developing in week 2!

https://www.marketforum.com/forum/topic/83844/#83852

https://www.marketforum.com/forum/topic/83844/#83854

| |||||||||

Here's some good data from the last year, so that you can see how the injections/withdrawals compared to the forecast.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jun 02, 2022 Actual 90B Forecast 86B Previous 80B| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 09, 2022 | 10:30 | 96B | 90B | ||

| Jun 02, 2022 | 10:30 | 90B | 86B | 80B | |

| May 26, 2022 | 10:30 | 80B | 89B | 89B | |

| May 19, 2022 | 10:30 | 89B | 87B | 76B | |

| May 12, 2022 | 10:30 | 76B | 79B | 77B | |

| May 05, 2022 | 10:30 | 77B | 68B | 40B | |

| Apr 28, 2022 | 10:30 | 40B | 38B | 53B | |

| Apr 21, 2022 | 10:30 | 53B | 37B | 15B | |

| Apr 14, 2022 | 10:30 | 15B | 15B | -33B | |

| Apr 07, 2022 | 10:30 | -33B | -26B | 26B | |

| Mar 31, 2022 | 10:30 | 26B | 21B | -51B | |

| Mar 24, 2022 | 10:30 | -51B | -56B | -79B | |

| Mar 17, 2022 | 10:30 | -79B | -73B | -124B | |

| Mar 10, 2022 | 11:30 | -124B | -117B | -139B | |

| Mar 03, 2022 | 11:30 | -139B | -138B | -129B | |

| Feb 24, 2022 | 11:30 | -129B | -134B | -190B | |

| Feb 17, 2022 | 11:30 | -190B | -193B | -222B | |

| Feb 10, 2022 | 11:30 | -222B | -222B | -268B | |

| Feb 03, 2022 | 11:30 | -268B | -216B | -219B | |

| Jan 27, 2022 | 11:30 | -219B | -216B | -206B | |

| Jan 20, 2022 | 11:30 | -206B | -194B | -179B | |

| Jan 13, 2022 | 11:30 | -179B | -173B | -31B | |

| Jan 06, 2022 | 11:30 | -31B | -54B | -136B | |

| Dec 30, 2021 | 11:30 | -136B | -125B | -55B | |

| Dec 23, 2021 | 11:30 | -55B | -56B | -88B | |

| Dec 16, 2021 | 11:30 | -88B | -86B | -59B | |

| Dec 09, 2021 | 11:30 | -59B | -54B | -59B | |

| Dec 02, 2021 | 11:30 | -59B | -57B | -21B | |

| Nov 24, 2021 | 13:00 | -21B | -22B | 26B | |

| Nov 18, 2021 | 11:30 | 26B | 25B | 7B | |

| Nov 10, 2021 | 13:00 | 7B | 10B | 63B | |

| Nov 04, 2021 | 10:30 | 63B | 63B | 87B | |

| Oct 28, 2021 | 10:30 | 87B | 86B | 92B | |

| Oct 21, 2021 | 10:30 | 92B | 90B | 81B | |

| Oct 14, 2021 | 10:30 | 81B | 94B | 118B | |

| Oct 07, 2021 | 10:30 | 118B | 105B | 88B | |

| Sep 30, 2021 | 10:30 | 88B | 87B | 76B | |

| Sep 23, 2021 | 10:30 | 76B | 75B | 83B | |

| Sep 16, 2021 | 10:30 | 83B | 76B | 52B | |

| Sep 09, 2021 | 10:30 | 52B | 40B | 20B | |

| Sep 02, 2021 | 10:30 | 20B | 25B | 29B | |

| Aug 26, 2021 | 10:30 | 29B | 40B | 46B | |

| Aug 19, 2021 | 10:30 | 46B | 31B | 49B | |

| Aug 12, 2021 | 10:30 | 49B | 49B | 13B | |

| Aug 05, 2021 | 10:30 | 13B | 21B | 36B | |

| Jul 29, 2021 | 10:30 | 36B | 43B | 49B | |

| Jul 22, 2021 | 10:30 | 49B | 44B | 55B | |

| Jul 15, 2021 | 10:30 | 55B | 47B | 16B | |

| Jul 08, 2021 | 10:30 | 16B | 34B | 76B | |

| Jul 01, 2021 | 10:30 | 76B | 68B | 55B | |

| Jun 24, 2021 | 10:30 | 55B | 66B | 16B | |

| Jun 17, 2021 | 10:30 | 16B | 72B | 98B | |

| Jun 10, 2021 | 10:30 | 98B | 98B | 98B | |

| Jun 03, 2021 | 10:30 | 98B | 95B | 115B |

1. Note that the blue line in the graph below is well below the 5 year average and near the bottom of the 5 year range. This is one of the biggest reasons that prices are the highest in over a decade.

2. Record exports and high prices in Europe are another factor.

3. Seasonals (based on historical prices) are often peaking in June is another factor.

4. Long term investment by the big players in natural gas, have been lagging too because of the war on fossil fuels, so production has been slow to respond to such high prices compared to other times in the past.

https://ir.eia.gov/ngs/ngs.html

for week ending May 27, 2022 | Released: June 2, 2022 at 10:30 a.m. | Next Release: June 9, 2022

+90 BCF Bearish

| Working gas in underground storage, Lower 48 states Summary textCSVJSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (05/27/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 05/27/22 | 05/20/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 357 | 325 | 32 | 32 | 409 | -12.7 | 418 | -14.6 | |||||||||||||||||

| Midwest | 420 | 391 | 29 | 29 | 519 | -19.1 | 494 | -15.0 | |||||||||||||||||

| Mountain | 113 | 109 | 4 | 4 | 150 | -24.7 | 133 | -15.0 | |||||||||||||||||

| Pacific | 195 | 190 | 5 | 5 | 266 | -26.7 | 245 | -20.4 | |||||||||||||||||

| South Central | 817 | 797 | 20 | 20 | 955 | -14.5 | 948 | -13.8 | |||||||||||||||||

| Salt | 248 | 251 | -3 | -3 | 299 | -17.1 | 297 | -16.5 | |||||||||||||||||

| Nonsalt | 569 | 546 | 23 | 23 | 656 | -13.3 | 651 | -12.6 | |||||||||||||||||

| Total | 1,902 | 1,812 | 90 | 90 | 2,299 | -17.3 | 2,239 | -15.1 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,902 Bcf as of Friday, May 27, 2022, according to EIA estimates. This represents a net increase of 90 Bcf from the previous week. Stocks were 397 Bcf less than last year at this time and 337 Bcf below the five-year average of 2,239 Bcf. At 1,902 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

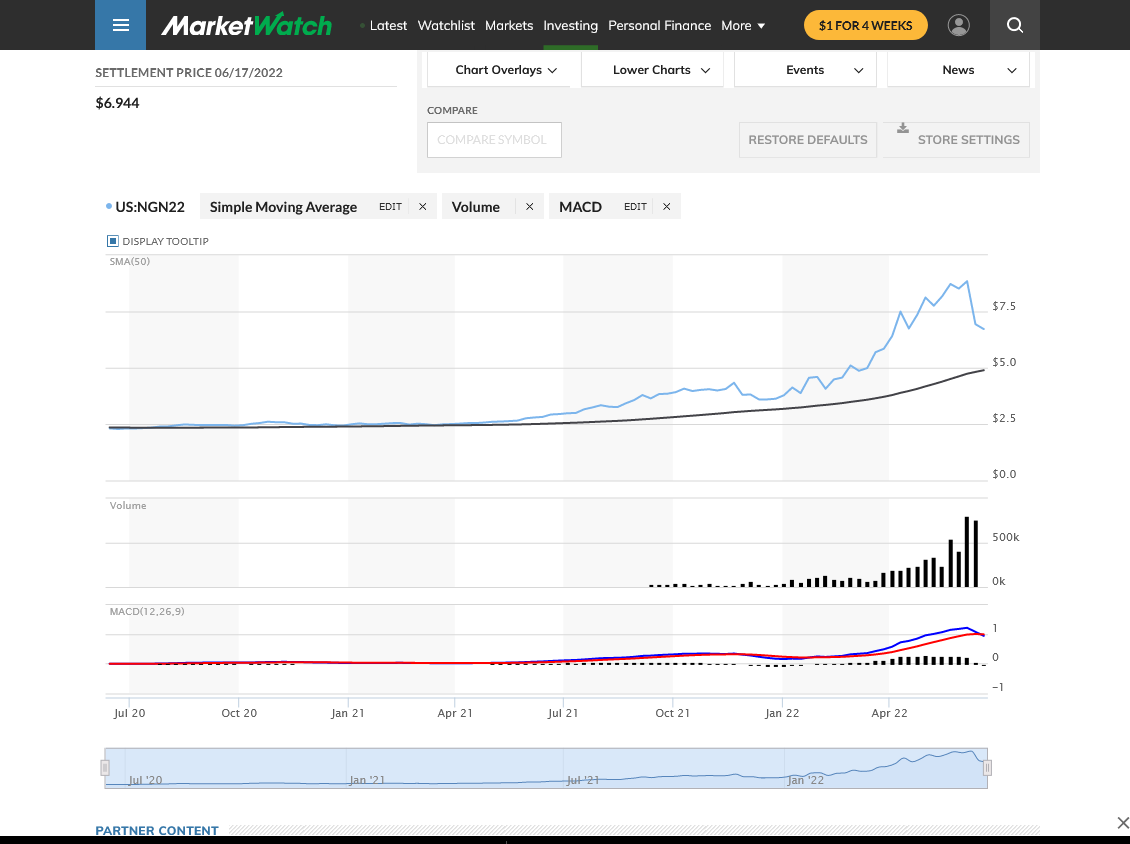

Declining production estimates and indications of stronger heat toward the middle of the month in the latest forecasts helped send natural gas futures sharply higher in early trading Monday. The July Nymex contract was up 46.0 cents to $8.983/MMBtu at around 8:45 a.m. ET. The July contract was testing the psychologically significant $9 mark in…

metmike: The upside breakaway gap on last night's open obviously held and we're up $7,000 vs the close Friday from the heat ridge.

https://www.marketforum.com/forum/topic/83540/#85252

https://www.marketforum.com/forum/topic/83844/#85338

NG just dropped $7,000/contract in 1 hour!!!

-$9,000 now from the highs!

Around a 10,000 drop from the high today to the low a few minutes ago.

Barely filled the huge bullish break away gap higher on Sunday Night's open.

Now back up 4,000+ from the extreme spike lows just 5 minutes ago. This is the most extreme trading in ng in history and I've been trading it for 3 decades.

Back down to -12,000 from the highs(to the lows). Yep, have NEVER witnessed this extreme of a price move so quickly in ng trading history before today. NEVER!

Larry,

Are you sure you don't want to start trading natural gas again (-:

Mike, yes, I'm sure. What do the GEFS CDDs look like today at 12Z vs the 6Z/0Z?

NG dropped from ~9.54 just after noon CDT to ~8.46 near 12:50 PM CDT.

Here's the cited main reason for the plunge, a SMALL explosion at Freeport LNG export facility:

Any guesses for tomorrow's EIA? Will it be the highest injection so far this season?

Thanks much Larry. I'll guess in a minute.

Although the long-term implications were still unknown, news of an explosion at the Freeport liquefied natural gas (LNG) terminal on the Texas coast took a hatchet to natural gas futures midweek. The July Nymex gas futures contract – up about 30 cents at midday and not far off the $9.664/MMBtu intraday high – plummeted as…

metmike: The huge heat ridge was supporting ng, with it being sharply higher..... until the explosion damaged one of our export facilities and ng had the wildest trading day in history. Closing the huge bullish gap higher on Sunday Night and at one point traded over $12,000/contract off the highs of the day and most of the drop came in just over an hour.

Sharply lower still this evening.

Larry, I'll guess 99 BCF

NG down another 5,000+ since the close and down 15,000+ from the highs late this morning.

I would bet that this is the biggest drop in less than 8 hours in history.

for week ending June 3, 2022 | Released: June 9, 2022 at 10:30 a.m. | Next Release: June 16, 2022

+97 BCF A bit bullish??..........I guessed +99 BCF

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (06/03/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 06/03/22 | 05/27/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 387 | 357 | 30 | 30 | 440 | -12.0 | 448 | -13.6 | |||||||||||||||||

| Midwest | 445 | 420 | 25 | 25 | 543 | -18.0 | 523 | -14.9 | |||||||||||||||||

| Mountain | 118 | 113 | 5 | 5 | 159 | -25.8 | 141 | -16.3 | |||||||||||||||||

| Pacific | 206 | 195 | 11 | 11 | 275 | -25.1 | 255 | -19.2 | |||||||||||||||||

| South Central | 843 | 817 | 26 | 26 | 980 | -14.0 | 972 | -13.3 | |||||||||||||||||

| Salt | 251 | 248 | 3 | 3 | 302 | -16.9 | 301 | -16.6 | |||||||||||||||||

| Nonsalt | 593 | 569 | 24 | 24 | 678 | -12.5 | 670 | -11.5 | |||||||||||||||||

| Total | 1,999 | 1,902 | 97 | 97 | 2,397 | -16.6 | 2,339 | -14.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 1,999 Bcf as of Friday, June 3, 2022, according to EIA estimates. This represents a net increase of 97 Bcf from the previous week. Stocks were 398 Bcf less than last year at this time and 340 Bcf below the five-year average of 2,339 Bcf. At 1,999 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jun 09, 2022 Actual97B Forecast96B Previous90B

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 09, 2022 | 10:30 | 97B | 96B | 90B | |

| Jun 02, 2022 | 10:30 | 90B | 86B | 80B | |

| May 26, 2022 | 10:30 | 80B | 89B | 89B | |

| May 19, 2022 | 10:30 | 89B | 87B | 76B | |

| May 12, 2022 | 10:30 | 76B | 79B | 77B | |

| May 05, 2022 | 10:30 | 77B | 68B | 40B |

metmike: Intense heat which will increase AC use and ng demand still on the way but after yesterday/last nights plunge of more than $16,000/contract in less than 24 hours..........one would think that the bulls may be more cautious......but this is ng. Maybe we'll be up $20,000/contract next week? Seriously!

Mike, excellent guess of the EIA. With it being +97, it is the largest injection of the season to date. It remains to be seen whether or not it ends up the largest of the entire year. Going back 20 years, Memorial Day week's average injection is higher by a good margin than any other week of the year though that doesn't mean any one year's Memorial Day week's injection will necessarily be the largest of that year. The hottest ones are less likely to be.

It looks like average survey guesses properly took into account the Memorial Day holiday related demand reduction because they were near this level (upper 90s to low 100s). For example, the WSJ poll mean was perfect with its +97.

Thanks very much Larry!

I remember the good old days when you brought a contest like this to us weekly and had several people making guesses.

As you noted a several weeks ago, trading ng with skill/profits based mostly on weather has become more like driving thru a field loaded with land minds!

The historical drop of $16,000/contract in less than 24 hours, 2 days ago with NO CHANGE in the HOT weather forecast is a perfect example.

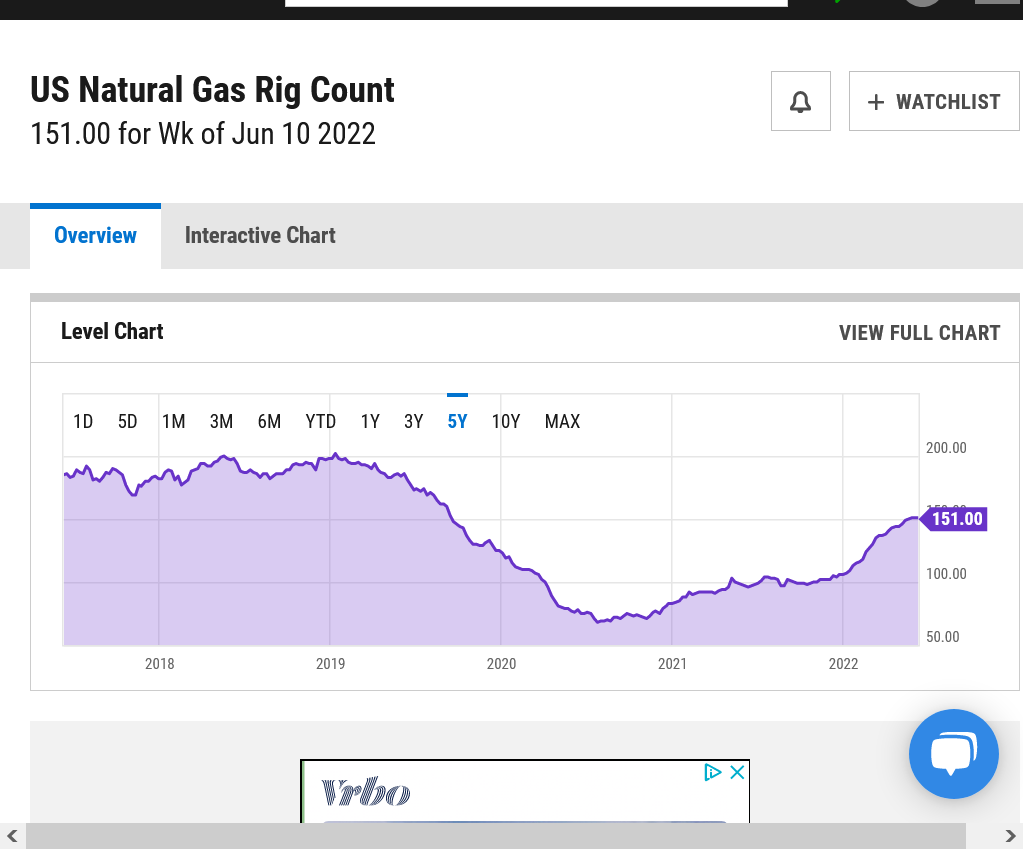

Highest price for natural gas in 14 years. Every time prices increased, even half this much the rig count soared higher so that supplies would gush out as the big investers saw incentive to make more money.

The cure for high prices is...............high prices.

Not any more with fossil fuels. The government is suppressing new supplies by disadvantaging new money investments in fossil fuels to stifle future profits with its war on fossil fuels.

https://ycharts.com/indicators/us_gas_rotary_rigs

Investment moneys in this business have seen the writing on the wall, long before Biden took over(Obama made it crystal clear). There are other factors at play with regards to production/well too.

https://www.eia.gov/dnav/ng/hist/e_ertrrg_xr0_nus_cm.htm .png)

https://www.politico.com/story/2012/04/uttered-in-2008-still-haunting-obama-in-2012-074892

“If somebody wants to build a coal-fired power plant, they can. It’s just that it will bankrupt them,” Obama said, responding to a question about his cap-and-trade plan. He later added, “Under my plan … electricity rates would necessarily skyrocket.”

Forecast is close to expected. Troughing in the East/Northeast means cooler temps there where alot of people live........a bit bearish ng.

Heat ridge shifts west to the Plains, where less people live.

Natural gas futures hovered in a narrow range of modest gains and losses early Monday before cruising downward and ultimately finishing deep in negative territory, as traders assessed robust summer demand expectations against a shock last week to U.S. export capacity. The July Nymex gas futures contract settled at $8.609/MMBtu, down 24.1 cents day/day. The…

metmike: The heat has become a bit more bullish the model run, with less cooling in week 2 in the Northeast. This is battling some strong bearish headwinds.

Temps for this Thursday's EIA:

Hot in the SW/W to Texas.

Pleasant, N.Plains to Midwest to Northeast to Mid Atlantic to Upper South..where alot of people live. Injection should be close to average, maybe a few BCF more than average.

Do you have anything Larry? Others?

NG just fell off another cliff!

Up sharply after midnight when, especially the Euro was much hotter......+6 CDD's but just spiked down $9,000 from those highs real fast.

Down $16,000/contract from the highs!

17,000.....18,000

Mike,

So glad to not be trading this these days. If you are, hopefully you're doing well or at least ok.

Thanks Larry!

I was going to buy 5 contracts after midnight, especially after the Euro came out hotter and of course use a trailing stop and staying up all night and could have done well as we rallied to the highs after 6:30am.

Just couldn't pull the trigger and chose sleep instead of stress. A drop of 19,000, most of it in less than 2 hours. I think that breaks last weeks record drop.

In the past, there were some YEARS that didn't feature a range that wide!

Just confirmed, we blew away last weeks 12,000 drop easily!

https://www.marketforum.com/forum/topic/85343/#85434

$15,000 of it came in around 20 minutes!! Any idea what the news was?

Mike said: "$15,000 of it came in around 20 minutes!! Any idea what the news was?"

-------------------------------------------------------------------------

Mike,

06/14 08:43a CST *DJ Natural Gas Falls 13% to $7.460 After Freeport LNG Says Full Restart Not Likely Until Late 2022 (MORE TO FOLLOW) Dow Jones Newswires

06/14 09:00a CST DJ Natural Gas Falls 16% On Freeport Restart Delays -- Market

Talk

0959 ET - Natural gas prices drop 16% to $7.211/mmBtu after Freeport LNG,

the nation's second-largest LNG exporter, says in an email it's not likely to

see operations fully back to normal until late 2022 following last week's fire

and explosion that shut down the plant completely. It says, however, that the

plant could see a resumption of "partial operations" in about 90 days. The

company previously said it would be shut down for at least three months, and so

this news of even a partial restart still being three months away is bearish in

that overall feedgas to LNG facilities demand could remain subdued for a while.

(dan.molinski@wsj.com)

(END) Dow Jones Newswires

Thanks much Larry! I was guessing it might be related to the same thing that hit a week ago based on how similar the reaction was. Last week, the market took a bit longer to react but I think that traders were super tuned into any news on this particular item, after that event last week and reacted with mind boggling swiftness.

Natural gas futures rebounded early Wednesday as traders continued to mull the impact of an extended outage at the Freeport liquefied natural gas (LNG) export terminal in the context of storage deficits and a potentially hot summer ahead. After plummeting $1.420 in Tuesday’s session following news that the Freeport LNG facility won’t see a return…

metmike: One can guess that we have this dialed in but trading this market without a stop would be insane. If somebody was long 5 contracts of July NG yesterday with no stop, they could have lost $75,000 in 20 minutes yesterday when the news hit.......or made that much being short.

Based on me testing some orders, it looks like the margins haven't changed.

Latest Release Jun 16, 2022 Actual92B Previous97B

https://www.investing.com/economic-calendar/natural-gas-storage-386

https://ir.eia.gov/ngs/ngs.html

for week ending June 10, 2022 | Released: June 16, 2022 at 10:30 a.m. | Next Release: June 23, 2022

+92 BCF Nuetral?

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (06/10/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 06/10/22 | 06/03/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 407 | 376 | R | 31 | 31 | 459 | -11.3 | 474 | -14.1 | ||||||||||||||||

| Midwest | 482 | 454 | R | 28 | 28 | 567 | -15.0 | 550 | -12.4 | ||||||||||||||||

| Mountain | 122 | 118 | 4 | 4 | 164 | -25.6 | 147 | -17.0 | |||||||||||||||||

| Pacific | 221 | 211 | R | 10 | 10 | 242 | -8.7 | 255 | -13.3 | ||||||||||||||||

| South Central | 863 | 843 | 20 | 20 | 993 | -13.1 | 992 | -13.0 | |||||||||||||||||

| Salt | 251 | 251 | 0 | 0 | 299 | -16.1 | 304 | -17.4 | |||||||||||||||||

| Nonsalt | 612 | 593 | 19 | 19 | 694 | -11.8 | 688 | -11.0 | |||||||||||||||||

| Total | 2,095 | 2,003 | R | 92 | 92 | 2,425 | -13.6 | 2,418 | -13.4 | ||||||||||||||||

| R=Revised. Working gas stocks were revised to reflect resubmissions of data during the three-week period from May 20, 2022, to June 3, 2022. The reported revisions caused the stocks for June 03, 2022, to change from 1,999 Bcf to 2,003 Bcf, and working gas stocks for the week ending May 27, 2022, changed from 1,902 to 1,901 Bcf. As a result, the implied net change between the weeks ending May 27 and June 03 changed from 97 Bcf to 102 Bcf. The reported revisions for the week ending May 20, 2022, changed working natural gas stocks from 1,819 Bcf to 1,812 Bcf. Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,095 Bcf as of Friday, June 10, 2022, according to EIA estimates. This represents a net increase of 92 Bcf from the previous week. Stocks were 330 Bcf less than last year at this time and 323 Bcf below the five-year average of 2,418 Bcf. At 2,095 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Note: The shaded area indicates the range between the historical minimum and maximum values for the weekly series from 2017 through 2021. The dashed vertical lines indicate current and year-ago weekly periods.

metmike: We spiked to $8 after the release and are off 4,000 from the highs but still up almost 2,000 for the day with extreme heat dominating the 2 week forecast.

1pm update: We're 6,000 off the highs and around unchanged for the day.

NG had a fairly decent sized gap lower on the open. -2,000 compared to the last trade Friday.

We continued down another 1,000 after that, so the gap is wide open.

Could serve as a bearish downside break away gap.

A trade above 6.881 would fill the gap and negate that technical formation above and potentially be a gap and crap, selling exhaustion signature.

Weather model updates will play a role in determining which one of those technical formations is likely to stay in place.

Seasonals strongly favor an early Summer top at this time of year. The massive spike higher in recent weeks would certainly suggest the top is in.

+++++++++++++++++++++++++++

https://www.marketwatch.com/investing/future/ngn22/charts?mod=mw_quote_advanced

I had said 11 days ago:

"Mike, excellent guess of the EIA. With it being +97, it is the largest injection of the season to date. It remains to be seen whether or not it ends up the largest of the entire year. Going back 20 years, Memorial Day week's average injection is higher by a good margin than any other week of the year though that doesn't mean any one year's Memorial Day week's injection will necessarily be the largest of that year."

-------------------------------------------------------------------

Update: I just realized that this changed due to revisions released in last week's report:

"the implied net change between the weeks ending May 27 and June 03 changed from 97 Bcf to 102 Bcf."

This obviously somewhat increases the chance that Memorial Day week in 2022 will be the largest of the year.

Also, note that the subsequent week had a +92 or a 10 lower injection. This was despite having 4 fewer CDDs and 2 fewer HDDs than Memorial Day week. This likely was largely due to not having the holiday slowdown of Memorial Day week. It is the holiday slowdown of Memorial Day week within a very low demand time of year that is the major reason why that week averages the highest injection of the season.

Now I'll update my table to add 2022:

Memorial Day week EIA vs CDDs 2003-2021:

CDD EIA Year

60 +92 2018

57 +77 2006

55 +62 2012

55 +80 2011

52 +65 2016

51 +99 2010

45 +119 2019

44 +102 2022

42 +102 2020

38 +110 2007

37 +119 2014

36 +102 2004

32 +132 2015

31 +111 2013

30 +106 2017

30 +124 2009

30 +105 2008

26 +105 2005

26 +98 2021

25 +114 2003

Avg CDD 2003-2022 = 40

Avg EIA 2003-2022 = +101

Thanks much Larry!

we missed your ng posts like this from the past and are thrilled to see them.

so I went from being 2 bcf too high to 3 bcf too low.

Tuesday after the close:

https://www.marketforum.com/forum/topic/83844/

------------------------------------

Mike,

As you know, this is one of the major reasons I've lost interest in trading it.

Thanks Larry!

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jun 23, 2022 Actual74B Forecast65B Previous92 BBEARISH!!!

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 23, 2022 | 10:30 | 74B | 65B | 92B | |

| Jun 16, 2022 | 10:30 | 92B | 97B | ||

| Jun 09, 2022 | 10:30 | 97B | 96B | 90B | |

| Jun 02, 2022 | 10:30 | 90B | 86B | 80B | |

| May 26, 2022 | 10:30 | 80B | 89B | 89B | |

| May 19, 2022 | 10:30 | 89B | 87B | 76B |

https://ir.eia.gov/ngs/ngs.html

Weekly Natural Gas Storage Report

for week ending June 17, 2022 | Released: June 23, 2022 at 10:30 a.m. | Next Release: June 30, 2022

BEARISH!!!!!!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (06/17/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 06/17/22 | 06/10/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 430 | 407 | 23 | 23 | 484 | -11.2 | 501 | -14.2 | |||||||||||||||||

| Midwest | 506 | 482 | 24 | 24 | 591 | -14.4 | 577 | -12.3 | |||||||||||||||||

| Mountain | 128 | 122 | 6 | 6 | 168 | -23.8 | 153 | -16.3 | |||||||||||||||||

| Pacific | 231 | 221 | 10 | 10 | 239 | -3.3 | 260 | -11.2 | |||||||||||||||||

| South Central | 875 | 863 | 12 | 12 | 992 | -11.8 | 1,009 | -13.3 | |||||||||||||||||

| Salt | 248 | 251 | -3 | -3 | 296 | -16.2 | 305 | -18.7 | |||||||||||||||||

| Nonsalt | 628 | 612 | 16 | 16 | 697 | -9.9 | 704 | -10.8 | |||||||||||||||||

| Total | 2,169 | 2,095 | 74 | 74 | 2,474 | -12.3 | 2,500 | -13.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,169 Bcf as of Friday, June 17, 2022, according to EIA estimates. This represents a net increase of 74 Bcf from the previous week. Stocks were 305 Bcf less than last year at this time and 331 Bcf below the five-year average of 2,500 Bcf. At 2,169 Bcf, total working gas is within the five-year historical range.

This was the 7 day period for that EIA........HOT!

High demand for AC and burning of NG to generate electricity!!

metmike: Seasonals crash lower here but storage is near the bottom of the 5 year average and there's too much heat in the July forecast to do much catching up. However, the rig count is finally responding to the higher prices.

metmike: Mixed signals here. Bearish items are noted above. Also, July NG expires tomorrow which often features a spike......more often higher than lower. Weather is still bullish/hot in many places but NOT AS hot as previous and Summer forecasts and the heat backs off in the high population Northeast.

metmike: Nothing new in the forecast. July NG expires today.

Temps last week for this week's EIA report:

Hot in the Plains!! Mild/Pleasant Northeast to Mid Atlantic. Also Rockies

Nymex natural gas futures, led now by the August contract, failed to hold onto early price gains amid weakening demand ahead of the holiday weekend. The August Nymex futures contract settled at $6.498/MMBtu, down 7.2 cents on the day. September futures slipped 6.4 cents to $6.493. At A Glance: Models still point to hot July…

metmike: Lower CDD's on all the models this morning/early pm.

https://www.marketforum.com/forum/topic/85343/#86436

Most of the Freeport LNG shipments this year were going to Europe:

The sudden ~2 Bcf/d glut in domestic supply caused US natural gas prices to retreat and European LNG prices to skyrocket again.

The Freeport facility accounts for roughly 20% of U.S. LNG processing capacity, drawing 2 billion cubic feet per day (bcfd) of natural gas from U.S. shale producers.

A full restart of the facility will not happen until late this year, the company said this week. The outage sent U.S. gas futures down 18% from the price a day before the fire, while European gas prices have surged more than 60%, with an additional boost from less gas on Russian pipelines. r

https://ir.eia.gov/ngs/ngs.html

for week ending June 24, 2022 | Released: June 30, 2022 at 10:30 a.m. | Next Release: July 7, 2022

+82 BCF Bearish!

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (06/24/21) | 5-year average (2017-21) | |||||||||||||||||||||||

| Region | 06/24/22 | 06/17/22 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 461 | 430 | 31 | 31 | 509 | -9.4 | 526 | -12.4 | |||||||||||||||||

| Midwest | 535 | 506 | 29 | 29 | 619 | -13.6 | 603 | -11.3 | |||||||||||||||||

| Mountain | 134 | 128 | 6 | 6 | 172 | -22.1 | 158 | -15.2 | |||||||||||||||||

| Pacific | 235 | 231 | 4 | 4 | 243 | -3.3 | 266 | -11.7 | |||||||||||||||||

| South Central | 886 | 875 | 11 | 11 | 1,003 | -11.7 | 1,020 | -13.1 | |||||||||||||||||

| Salt | 242 | 248 | -6 | -6 | 296 | -18.2 | 303 | -20.1 | |||||||||||||||||

| Nonsalt | 644 | 628 | 16 | 16 | 707 | -8.9 | 716 | -10.1 | |||||||||||||||||

| Total | 2,251 | 2,169 | 82 | 82 | 2,547 | -11.6 | 2,573 | -12.5 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,251 Bcf as of Friday, June 24, 2022, according to EIA estimates. This represents a net increase of 82 Bcf from the previous week. Stocks were 296 Bcf less than last year at this time and 322 Bcf below the five-year average of 2,573 Bcf. At 2,251 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

| Release Date | Time | Actual | Forecast | Previous | |

|---|---|---|---|---|---|

| Jun 30, 2022 | 10:30 | 82B | 74B | 74B | |

| Jun 23, 2022 | 10:30 | 74B | 65B | 92B | |

| Jun 16, 2022 | 10:30 | 92B | 97B | ||

| Jun 09, 2022 | 10:30 | 97B | 96B | 90B | |

| Jun 02, 2022 | 10:30 | 90B | 86B | 80B | |

| May 26, 2022 | 10:30 | 80B | 89B | 89B |

Mike, Do you happen to know:

1. How the CDDs were this morning (0Z/6Z) vs yesterday afternoon/evening?

2. How today's 12Z CDDs were vs today's 0Z/6Z?

In other words, can any of today's huge price drop be attributed to modeled DD losses?

TIA

Larry,

The 12z GFS was -11 CDD's vs the previous run and ensemble was -9 CDD's vs the previous run but much of the drop already happened by the time that was out.

Mike, thanks.

Do you know how the CDDs were this morning (0Z/6Z) vs yesterday's 12Z?

The 0z was the same but the 6z was +4 CDD's...then the cooler 12z run for the GFS.

The EE was actually the same for the 12z vs the 0z. Why do you ask?

Hey Mike,

I ask because I'm curious if any portion of one of the biggest % morning price drops on record can possibly be attributed to cooler models/forecasts. All I read was that it due to the bearish EIA as well as more bearish news regarding LNG exports. I saw nothing about cooler wx.

All the models were much hotter overnight.

EE +6 CDD's , GFS En +5 CDDs.

New NG thread starting with closing news for 7/1/22: