KEY EVENTS TO WATCH FOR:

Monday, July 18, 2022

10:00 AM ET. July NAHB Housing Market Index

Housing Mkt Idx (previous 67)

4:00 PM ET. May Treasury International Capital Data

Tuesday, July 19, 2022

8:30 PM ET. June New Residential Construction - Housing Starts and Building Permits

Total Starts (previous 1.549M)

Housing Starts, M/M% (previous -14.4%)

Building Permits (previous 1.695M)

Building Permits, M/M% (previous -7.0%)

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, M/M%

Ret Sales Mo-to-Date, Y/Y%

Latest Wk, Y/Y%

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls)

Gasoline Stocks, Net Chg (Bbls)

Distillate Stocks, Net Chg (Bbls)

Wednesday, July 20, 2022

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 300)

Composite Idx, W/W% (previous -1.7%)

Purchase Idx-SA (previous 224.3)

Purchase Idx-SA, W/W% (previous -3.6%)

Refinance Idx (previous 685.3)

Refinance Idx, W/W% (previous +2.2%)

10:00 AM ET. June Existing Home Sales

Existing Sales (previous 5.41M)

Existing Sales, M/M% (previous -3.4%)

Unsold Homes Month's Supply (previous 2.6)

Median Price (USD) (previous 407600)

Median Home Price, Y/Y% (previous +14.8%)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 427.054M)

Crude Oil Stocks, Net Chg (Bbl) (previous +3.254M)

Gasoline Stocks (Bbl) (previous 224.937M)

Gasoline Stocks, Net Chg (Bbl) (previous +5.825M)

Distillate Stocks (Bbl) (previous 113.803M)

Distillate Stocks, Net Chg (Bbl) (previous +2.668M)

Refinery Usage (previous 94.9%)

Total Prod Supplied (Bbl/day) (previous 18.72M)

Total Prod Supplied, Net Chg (Bbl/day) (previous -1.744M)

Thursday, July 21, 2022

8:30 AM ET. July Philadelphia Fed Business Outlook Survey

Business Activity (previous -3.3)

Prices Paid (previous 64.5)

Employment (previous 28.1)

New Orders (previous -12.4)

Prices Received (previous 49.2)

Delivery Times (previous 9.9)

Inventories (previous -2.2)

Shipments (previous 10.8)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 244K)

Jobless Claims, Net Chg (previous +9K)

Continuing Claims (previous 1331000)

Continuing Claims, Net Chg (previous -41K)

8:30 AM ET. U.S. Weekly Export Sales

Corn (Metric Tons) (previous 407.2K)

Soybeans (Metric Tons) (previous -248.9K)

Wheat (Metric Tons) (previous 1047.2K)

10:00 AM ET. June Leading Indicators

Leading Index, M/M% (previous -0.4%)

Leading Index

Coincident Index, M/M% (previous +0.2%)

Lagging Index, M/M% (previous +0.8%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2369B)

Working Gas In Storage, Net Chg (Cbf) (previous +58B)

4:30 PM ET. Federal Discount Window Borrowings

4:30 PM ET. Foreign Central Bank Holdings

Friday, July 22, 2022

9:45 AM ET. July US Flash Manufacturing PMI

PMI, Mfg (previous 52.4)

9:45 AM ET. July US Flash Services PMI

PMI, Services (previous 51.6)

10:00 AM ET. June State Employment and Unemployment

Thanks for letting us know what's coming up next week.

The Monday, 4pm ET USDA crop condition rating is always a huge one for the grains:

This was the latest one released this past Monday:

https://www.marketforum.com/forum/topic/86945/

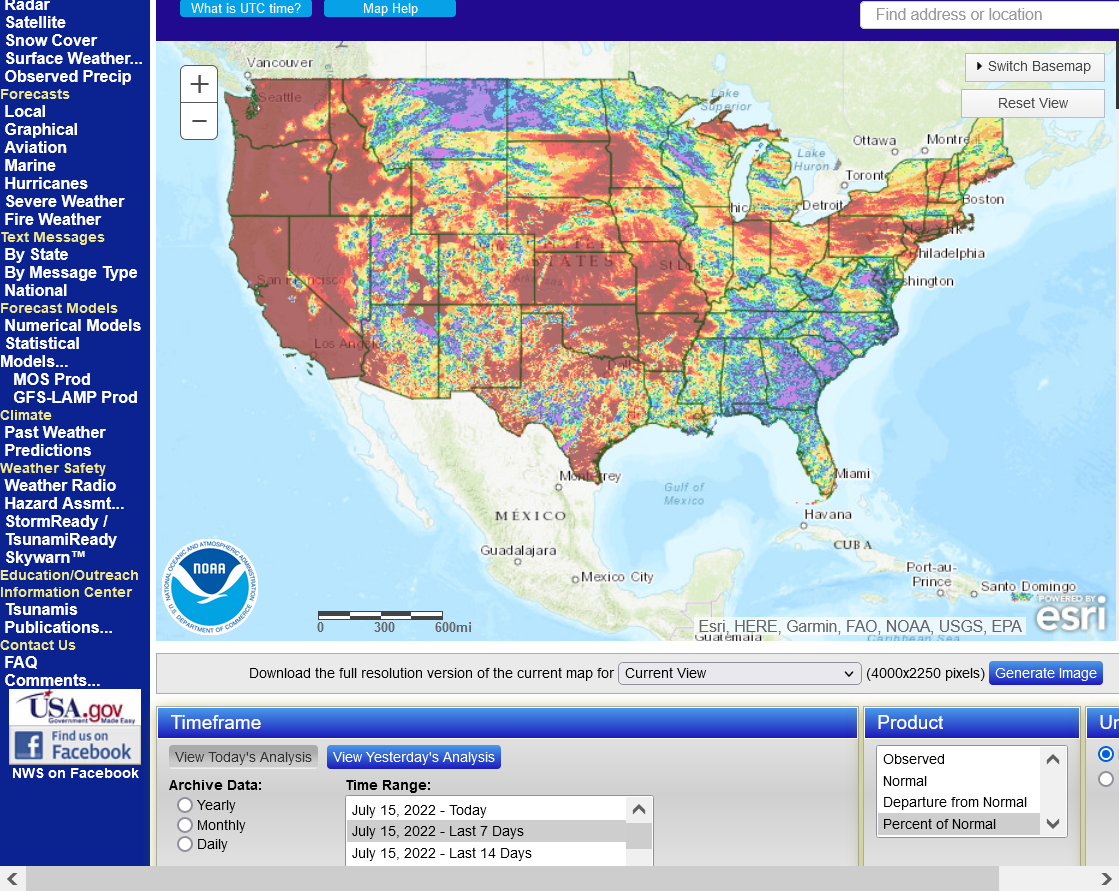

I'll take a wild first guess and say crop ratings drops a bit based on the lack of rain the past 7 days:

https://water.weather.gov/precip/

Temps were hot in the Plains but pleasant in the ECB!

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php