KEY EVENTS TO WATCH FOR:

Thursday, July 21, 2022

8:30 AM ET. July Philadelphia Fed Business Outlook Survey

Business Activity (previous -3.3)

Prices Paid (previous 64.5)

Employment (previous 28.1)

New Orders (previous -12.4)

Prices Received (previous 49.2)

Delivery Times (previous 9.9)

Inventories (previous -2.2)

Shipments (previous 10.8)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 244K)

Jobless Claims, Net Chg (previous +9K)

Continuing Claims (previous 1331000)

Continuing Claims, Net Chg (previous -41K)

8:30 AM ET. U.S. Weekly Export Sales

Corn (Metric Tons) (previous 407.2K)

Soybeans (Metric Tons) (previous -248.9K)

Wheat (Metric Tons) (previous 1047.2K)

10:00 AM ET. June Leading Indicators

Leading Index, M/M% (previous -0.4%)

Leading Index

Coincident Index, M/M% (previous +0.2%)

Lagging Index, M/M% (previous +0.8%)

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 2369B)

Working Gas In Storage, Net Chg (Cbf) (previous +58B)

4:30 PM ET. Federal Discount Window Borrowings

4:30 PM ET. Foreign Central Bank Holdings

Friday, July 22, 2022

9:45 AM ET. July US Flash Manufacturing PMI

PMI, Mfg (previous 52.4)

9:45 AM ET. July US Flash Services PMI

PMI, Services (previous 51.6)

10:00 AM ET. June State Employment and Unemployment

The STOCK INDEXES? http://quotes.ino.com/ex?changes/?c=indexes

The STOCK INDEXES: The September NASDAQ 100 was steady to higher overnight as it extends the rally off June's low.The high-range overnight trade sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are overbought but neutral to bullish signaling that sideways to higher prices are possible near-term. If September extends the aforementioned rally, June's high crossing at 12,973.75 is the next upside target. Closes below the 20-day moving average crossing at 11,938.61 would signal that a short-term top has been posted. First resistance is the overnight high crossing at 12,499.00. Second resistance is June's high crossing at 12,973.75. First support is last-Wednesday's low crossing at 11,479.25. Second support is the June 30th low crossing at 11,351.00. Third support is June's low crossing at 11,068.50.

The September S&P 500 was steady to lower overnight and sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the June 28th high crossing at 3950.00 would mark an upside breakout of the June-July trading range while opening the door for additional gains near-term. Closes below the 20-day crossing at 3860.38 would signal that a short-term top has been posted while opening the door for a possible test of last-Thursday's low crossing at 3723.75. First resistance is Wednesday's high crossing at 3977.25. Second resistance is the May 31st high crossing at 4204.75. First support is last-Thursday's low crossing at 3723.75. Second support is June's low crossing at 3642.00.

INTEREST RATES http://quotes.ino.com/ex changes/?c=interest"

INTEREST RATES: September T-bonds were steady to lower overnight as it extends the trading range of the past two-week's. The mid-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below last-Monday's low crossing at 136-24 would signal that a short-term top has been posted. If September renews the rally off June's low, the 38% retracement level of the 2021-2022 decline crossing at 143-25 is the next upside target. First resistance is the July 6th high crossing at 142-06. Second resistance is the 38% retracement level of the 2021-2022 decline crossing at 143-25. First support is last-Monday's low crossing at 136-24. Second support is June's low crossing at 131-01.

September T-notes was steady to lower overnight as it extends the trading range of the past two weeks, Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the July 8th low crossing at 117.180 would open the door for additional weakness near-term. If September renews the rally off June's low, the 50% retracement level of the 2021-2022 decline crossing at 122.204 is the next upside target. First resistance is May's high crossing at 120.195. Second resistance is the 50% retracement level of the 2021-2022 decline crossing at 122.204 is the next downside target. First support is the July 8th low crossing at 117.180. Second support is the June 28th low crossing at 116.110.

ENERGY MARKETS? http://quotes.ino.com/ex?changes/?c=energy ""

ENERGIES:September crude oil was lower overnight as it consolidates some of the rally off last-Thursday's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If September renews the decline off June's high, the 38% retracement level of the 2020-2022 rally crossing at $86.43 is the next downside target. If September renews the rally off last-Thursday's low, the 50-day moving average crossing at $104.80 is the next upside target. First resistance is the 20-day moving average crossing at $100.01. Second resistance is the 50-day moving average crossing at $104.80. First support is last-Thursday's low crossing at $88.23. Second support is the 38% retracement level of the 2020-2022 rally crossing at $86.43.

September heating oil was lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If September renews the decline off June's high, the 38% retracement level of the 2020-2022 rally crossing at $3.1874 is the next downside target. Closes above the 50-day moving average crossing at $3.7954 would signal that a short-term low has been posted. First resistance is the 50-day moving average crossing at $3.7954. Second resistance is the July 1st high crossing at $3.9461. First support is the July 6th low crossing at $3.2946. Second support is the 38% retracement level of the 2020-2022 rally crossing at 3.1874.

September unleaded gas was lower overnight as it extends the decline off June's high and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off June's high, the 38% retracement level of the 2020-2022 rally crossing at 2.8073 is the next downside target. Closes above the 20-day moving average crossing at 3.2829 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 3.2829. Second resistance is the 50-day moving average crossing at $3.4514. First support is the 38% retracement level of the 2020-2022 rally crossing at 2.8073. Second support is the 50% retracement level of the 2020-2022 rally crossing at 2.4586.

September Henry natural gas was lower overnight as it consolidates some of Wednesday's rally. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. If ;September extends the rally off July's low, the 75% retracement level of the June-July decline crossing at 8.550 is the next upside target. Closes below the 20-day moving average crossing at 6.440 would signal that a short-term top has been posted. First resistance is the 62% retracement level of the June-July decline crossing at 7.978. Second resistance is the 75% retracement level of the June-July decline crossing at 8.550. First support is the 20-day moving average crossing at 6.440. Second support is the July 12th low crossing at 5.895.

CURRENCIEShttp://quotes.ino.com/ex changes/?c=currencies"

CURRENCIES:The September Dollar was steady to slightly higher overnight as it consolidates some of the decline off last-Thursday's high. Overnight trading sets the stage for a steady to higher opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. Closes below the 20-day moving average crossing at $106.278 would signal that a short-term top has been posted. If September renews this year's rally, the 87% retracement level of the 2001-2008 decline on the monthly continuation chart crossing at $114.782 is the next upside target.First resistance is last-Thursday's high crossing at $109.140. Second resistance is the 87% retracement level of the 2001-2008 decline on the monthly continuation chart crossing at $114.782. First support is the 20-day moving average crossing at $106.278. Second support is the 50-day moving average crossing at $104.351.

The September Euro was steady to slightly higher overnight. The low-range overnight trade sets the stage for a steady to slightly higher opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $1.03191 would signal that a short-term low has been posted. If September renews the decline off May's high, the December 2002 low on the monthly continuation chart crossing at $0.98540 is the next downside target. First resistance is the 20-day moving average crossing at $1.03191. Second resistance is the 50-day moving average crossing at $1.05197. First support is last-Thursday's low crossing at $1.00000. Second support is the December 2002 low on the monthly continuation chart crossing at $0.98540.

The September British Pound was steady to slightly lower overnight and sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 1.2044 would signal that a short-term low has been posted. If September renews this year's decline, the March-2020 low on the monthly continuation chart crossing at 1.1438 is the next downside target. First resistance is the 20-day moving average crossing at 1.2044. Second resistance is the 50-day moving average crossing at 1.2265. First support is last-Thursday's low crossing at 1.1778. Second support is the March-2020 low on the monthly continuation chart crossing at 1.1438.

The September Swiss Franc was lower overnight as it consolidates some of the rally off last-Thursday's low. The mid-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 1.03701 would signal that a short-term low has been posted. If September renews the decline off June's high, the 87% retracement level of June's rally crossing at 1.00974 is the next downside target. First resistance is the 20-day moving average crossing at 1.03701. Second resistance is June's high crossing at 1.05910. First support is the 75% retracement level of June's rally crossing at 1.01656. Second support is the 87% retracement level of June's rally crossing at 1.00974.

The September Canadian Dollar was lower overnight as it consolidates some of the rally off last-Thursday's low. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are overbought but remain neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 50-day moving average crossing at $77.71 would signal that a short-term low has been posted. If September renews the decline off June's high, the 62% retracement level of the 2020-2021 rally crossing at $75.09 is the next downside target. First resistance is the 50-day moving average crossing at $77.71. Second resistance is the June 28th high crossing at $78.02. First support is the 50% retracement level of the 2020-2021 rally crossing at $75.79. Second support is the 62% retracement level of the 2020-2021 rally crossing at $75.09.

The September Japanese Yen was steady to lower overnight and sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are oversold and remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off May's high, the August-1998 low on the monthly continuation chart crossing at 0.068730 is the next downside target. Closes above the 20-day moving average crossing at 0.073493 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 0.073493. Second resistance is the 50-day moving average crossing at 0.075537. First support is last-Thursday's low crossing at 0.072085. Second support is the September-1990 low on the monthly continuation chart crossing at 0.072160.

PRECIOUS METALS http://quotes.ino.com/ex changes/?c=metals"

PRECIOUS METALS: Augustgold was lower overnight and posted a new contract low as it extends the decline off March's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If August extends the decline off June's high, the March-2021 low on the monthly continuation chart crossing at $1673.30 is the next downside target. Closes above the 20-day moving average $1755.90 would signal that a short-term low has been posted. First resistance is the 10-day moving average $1714.60. Second is the 20-day moving average crossing at $1755.90. First support is the overnight low crossing at $1678.70. Second support is the March-2021 low on the monthly continuation chart crossing at $1673.30.

September silver was lower overnight. The low-range trade sets the stage for a steady to lower opening when the day session begins trading later this morning. Stochastics and the RSI are oversold but remain neutral to bearish signaling that sideways to lower prices are possible near-term. If September extends the decline off March's high, the June-2020 low on the weekly continuation chart crossing at $17.015 is the next downside target. Closes above the 20-day moving average crossing at $19.515 would signal that a short-term low has been posted. First resistance is the 20-day moving average crossing at 19.515. Second resistance is the 50-day moving average crossing at 20.884. First support is last-Thursday's low crossing at $18.010. Second support is the June-2020 low on the weekly continuation chart crossing at $17.015.

September copper was lower overnight. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at 3.4885 would signal that a short-term low has been posted. If September extends the decline off June's high, the 75% retracement level of the 2020-2022 rally crossing at 2.8770 is the next downside target. First resistance is the 20-day moving average crossing at 3.4885. Second resistance is the June 28th high crossing at 3.8500. First support is last-Friday's low crossing at 3.1315. Second support is the 75% retracement level of the 2020-2022 rally crossing at 2.8770.

GRAINS http://quotes.ino.com/ex changes/?c=grains

December corn was lower overnight as it extends the decline off Monday's high. Overnight trading sets the stage for a lower opening when the day sessions begins trading. Stochastics and the RSI have turned bearish signaling that sideways to lower prices are possible near-term. If December renews the decline off June's high, the 62% retracement level of the 2020-2022 rally crossing at $5.20 3/4 is the next downside target. Closes above Monday's high crossing at $6.23 3/4 would signal that a short-term low has been posted while opening the door for additional gains near-term. First resistance is Monday's high crossing at $6.23 3/4. Second resistance is the July 11th high crossing at $6.58 1/2. First support is the 50% retracement level of the 2020-2022 rally crossing at $5.74 3/4. Second support is the January low crossing at $5.42 1/2.

September wheat was lower overnight as it consolidates some of the rally off last-Friday's low. Overnight trading sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI have turned neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the 20-day moving average crossing at $8.52 1/2 would signal that a short-term low has been posted. If September extends the decline off May's high, the 75% retracement level of the January-May high crossing at $7.23 is the next downside target. First resistance is the 20-day moving average crossing at $8.52 1/2. Second resistance is the July 11th high crossing at $9.40 1/4. First support is the last-Friday's low crossing at $7.65 3/4. Second support is the 75% retracement level of the January-May high crossing at $7.23.

September Kansas City wheat was lower overnight and sets the stage for a steady to lower opening when the day session begins trading later this morning. Stochastics and the RSI are turning neutral to bullish signaling that sideways to higher prices are possible near-term. Closes above the July 11th high crossing at $9.98 1/4 would signal that a short-term low has been posted. If September extends the decline off May's high, February's low crossing at $7.64 1/2 the next downside target. First resistance is the 20-day moving average crossing at $9.09 3/4. Second resistance is the July 11th high crossing at $9.98 1/4. First support is the 62% retracement level of the January-May rally crossing at $8.32 3/4. Second support is the February's low crossing at $7.64 1/2.

September Minneapolis wheat was lower overnight as it consolidates some of the rally off last-Friday's low. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If September renews the decline of May's high, the 75% retracement level of the January-May rally crossing at $8.12 3/4 is the next downside target. Closes above the July 11th high crossing at $10.44 1/2 would confirm that a short-term low has been posted. First resistance is the 20-day moving average crossing at $9.61 1/4. Second resistance is the July 11th high crossing at $10.44 1/2. First support is the July 6th low crossing at $8.70 1/2. Second support is the 75% retracement level of the January-May high crossing at $8.12 3/4.

SOYBEAN COMPLEX? http://quotes.ino.com/ex?changes/?c=grains "

November soybeans was lower overnight as it extends the decline off Monday's high. Overnight trading sets the stage for a lower opening when the day session begins trading. Stochastics and the RSI are oversold and have turned bearish signaling that sideways to lower prices are possible near-term. If November resumes the decline off June's high, the 38% retracement level of the crossing at $12.99 1/4 is the next downside target. Closes above Monday's high crossing at $13.93 would signal that a short-term low has been posted. First resistance is Monday's high crossing at $13.93. Second resistance is the July 11th high crossing at $14.38 1/2. First support is the 38% retracement level of the 2020-2022 rally crossing at $12.99 1/4. Second support is January's low crossing at $12.74.

December soybean meal was lower overnight. The low-range trade overnight sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI are neutral to bearish signaling that sideways to lower prices are possible near-term. If December renews the decline off June's high, July's low crossing at $375.30 is the next downside target. If December renews the rally off July's low, June's high crossing at $418.00 is the next upside target. First resistance is June's high crossing at $418.00. Second resistance is April's high crossing at $419.10. First support is July's low crossing at $375.30. Second support is the 50% retracement level of the 2020-2022 rally crossing at $365.40.

December soybean oil was lower overnight. The low-range overnight trade sets the stage for a steady to lower opening when the day session begins trading. Stochastics and the RSI have turned neutral to bearish signaling that sideways to lower prices are possible near-term. If December renews the decline off June's high, the 50% retracement level of the 2020-2022 rally crossing at 53.93 is the next downside target. Closes above Monday's high crossing at 61.70 would signal that a short-term low has been posted while opening the door for additional short-term gains. First resistance is the July 11th high crossing at 62.65. Second resistance is the June 29th high crossing at 67.76. First support is last-Thursday's low crossing at 54.42. Second support is the 50% retracement level of the 2020-2022 rally crossing at 53.93.

Thanks tallpine!

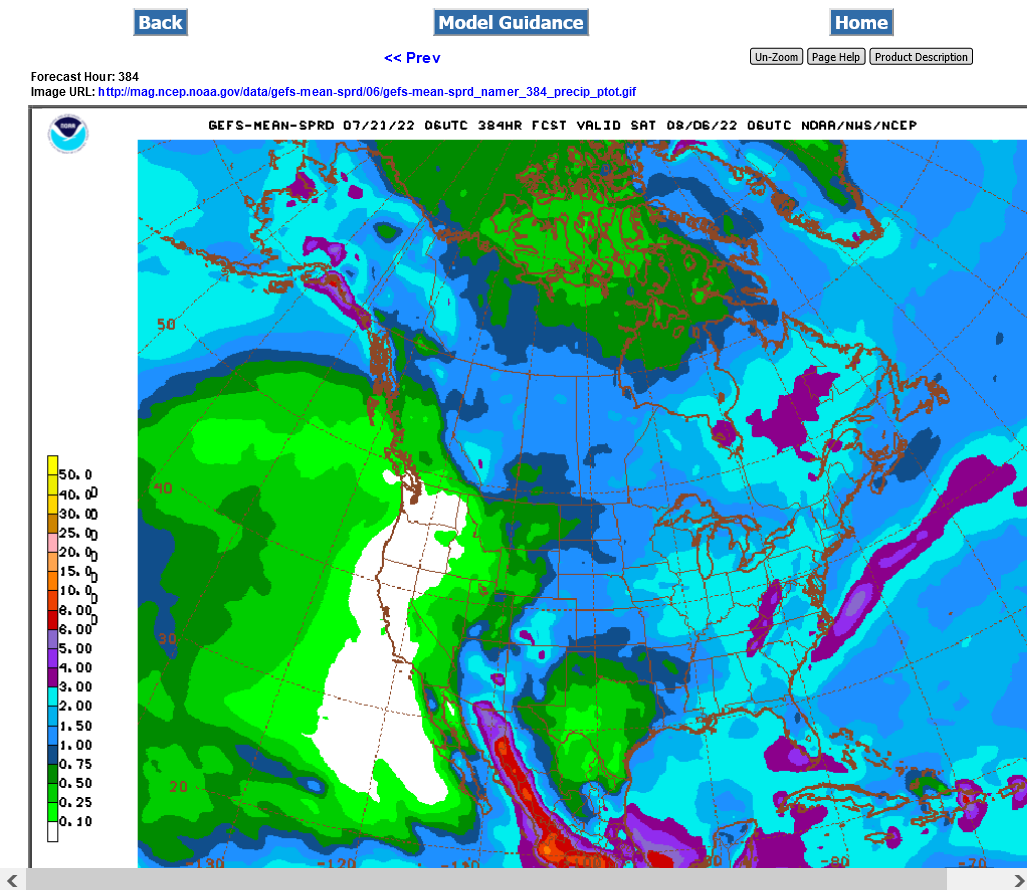

Bearish weather for the grains:

Bullish EIA number for ng:

Crude is getting clobbered this morning.

This adds to the weather pressure on C and S.