Last November, the market felt secure with above average monthly rainfall (circled on chart) following the driest October since 2009. It caused weakness in oilseed markets. Rain in the following months was disappointing, so Argy's 2022 crop didn't turn out great.

+++++++++++++++++++

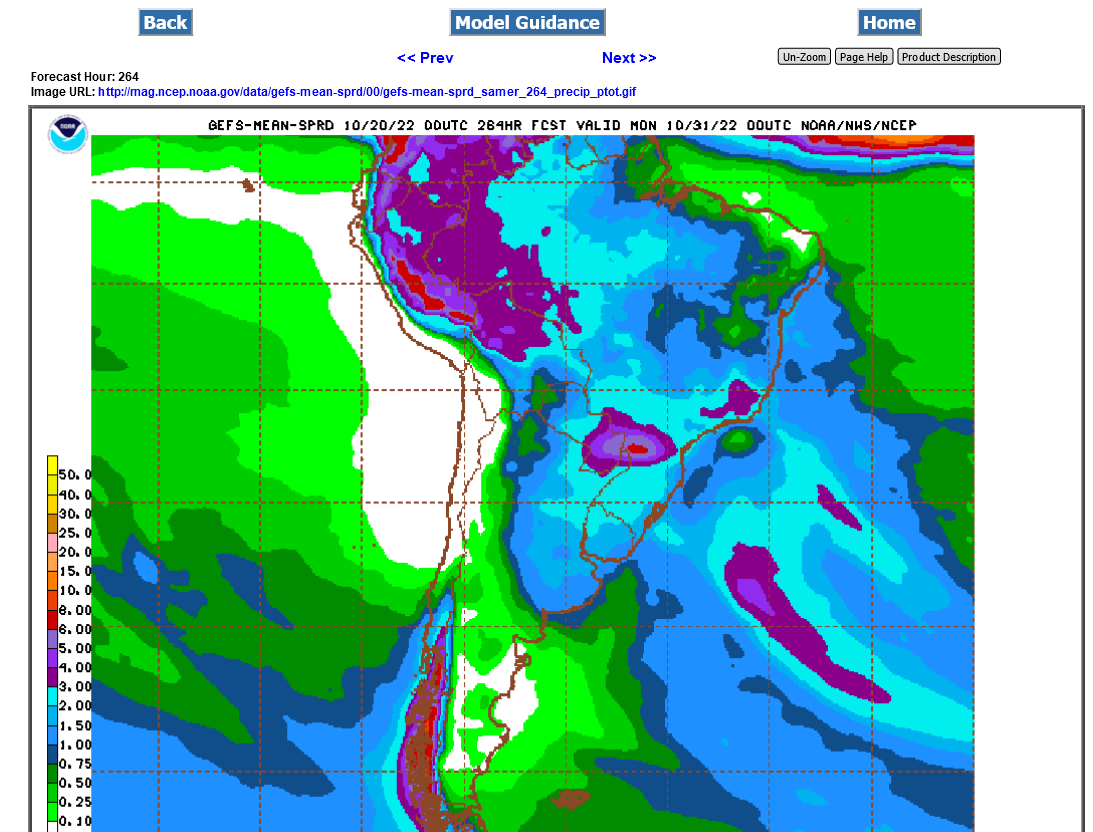

A much needed soaking was forecast for #Argentina's grain belt in Tuesday's midday GFS model run, but Wednesday's run took more than half the rain out. This is what Oct. precip might look like splitting the two forecasts. About 40% below normal and slightly wetter than Oct. 2021.

++++++++++++++++++

The Wed run suggests Oct rainfall 58% below normal and the month's worst in 35+ years. The Tue run would have monthly rainfall 23% below normal, not ideal following the driest September in 16 years. Need the forecasts to trend back wetter for more comfort ahead of soy sowing.

Global precip. % of normal for different periods from 7 days to 180 days(6 months). Note the droughts in the US and Argentina.

https://www.cpc.ncep.noaa.gov/products/Global_Monsoons/gl_obs.shtml

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.7day.figb.gif

Mato Grosso #corn sales are well behind averages, too. The 21/22 crop was 78% sold this month versus 90% normal and 89% last year. The 22/23 crop is 17% sold versus 33% last year/avg.

++++++++++++++++++++++++++++++

Mato Grosso farmers have sold only 29% of their 22/23 #soybeans as of this month, down from last year's 40% and an average of 38%.

Selling pace has slowed way down over the last several months.

#Brazil's farmers planted 6M hectares (14.8M acres) of #soybeans last week to bring planting progress to 24%, up from 10% last week and 22% last year.

+++++++++++++++++++++++++++++

This is despite a surge in fertilizer imports, causing the re-exports of some. Port storage is full, and much of the supply has not moved internally. Fertilizer deliveries could still be lower this year than last as farmers delayed/skipped purchasing.

+++++++++++++++++++++++++

USDA's #Brazil attache estimates the cost to produce #soybeans in top state Mato Grosso will be 47% greater than last year, driven by a huge increase in fertilizer costs. Fertilizers are expected to account for 32% of total soy expenses versus 22% in the previous two years.

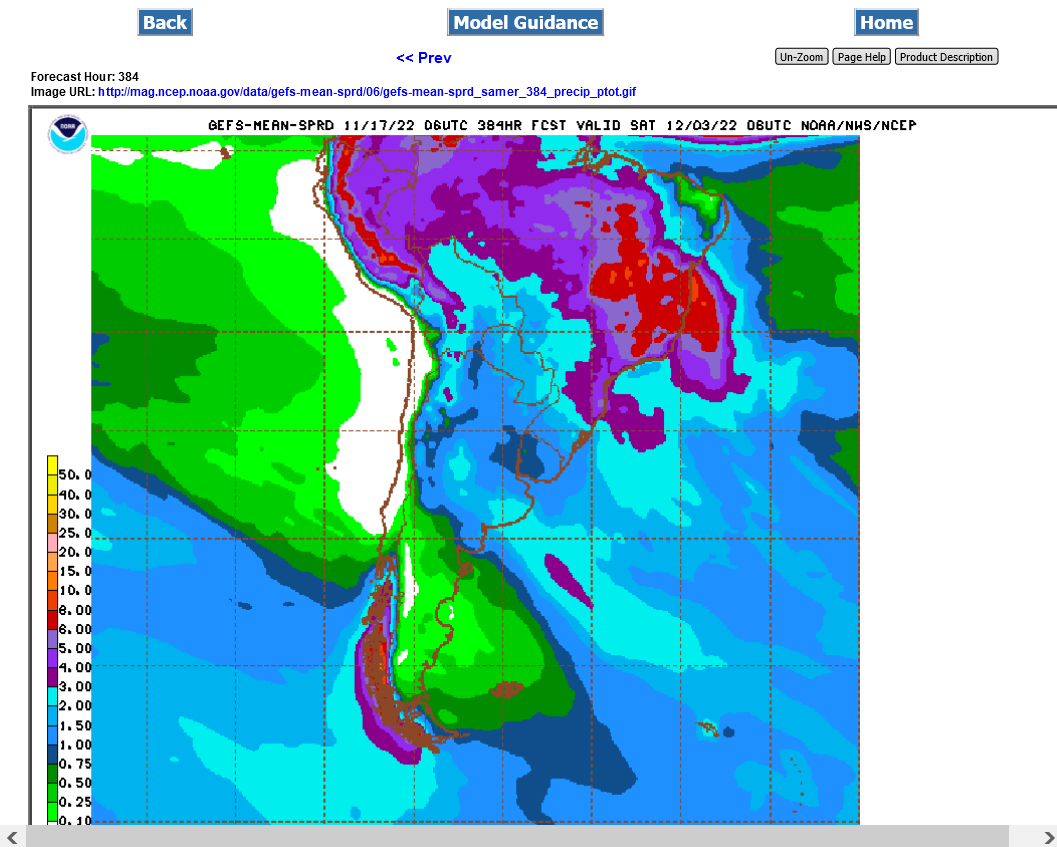

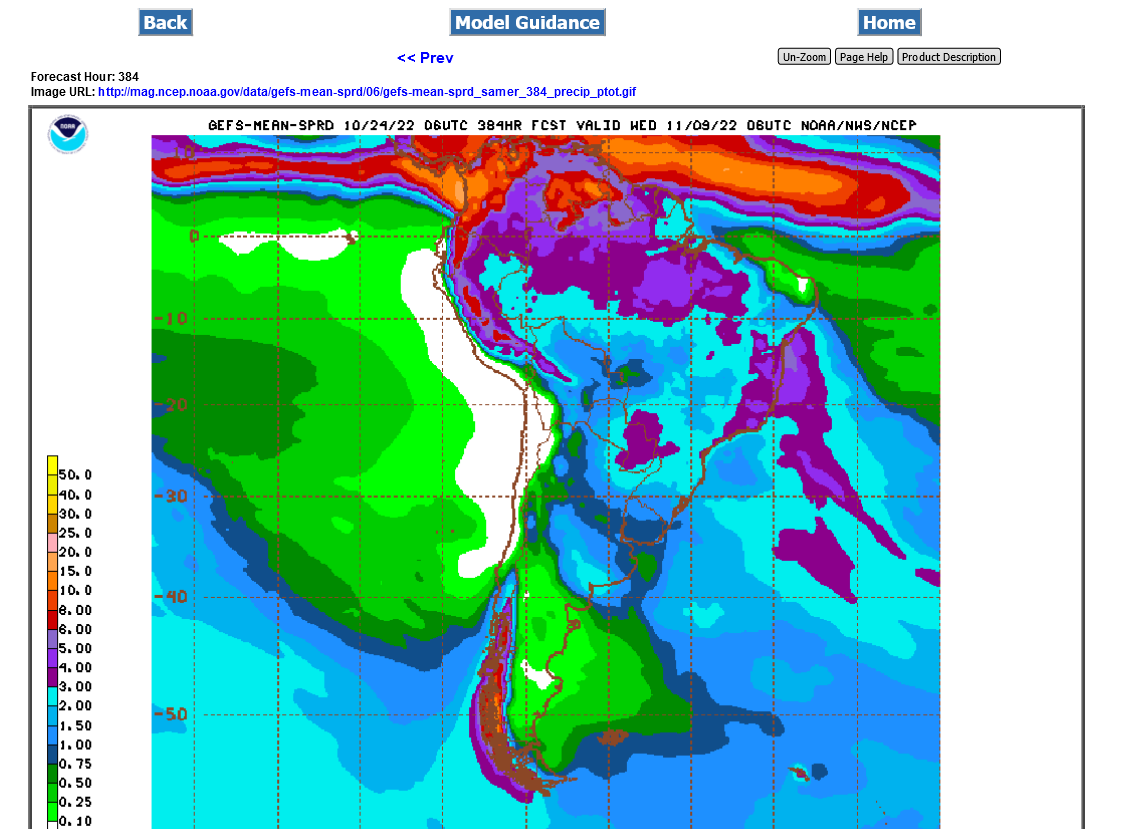

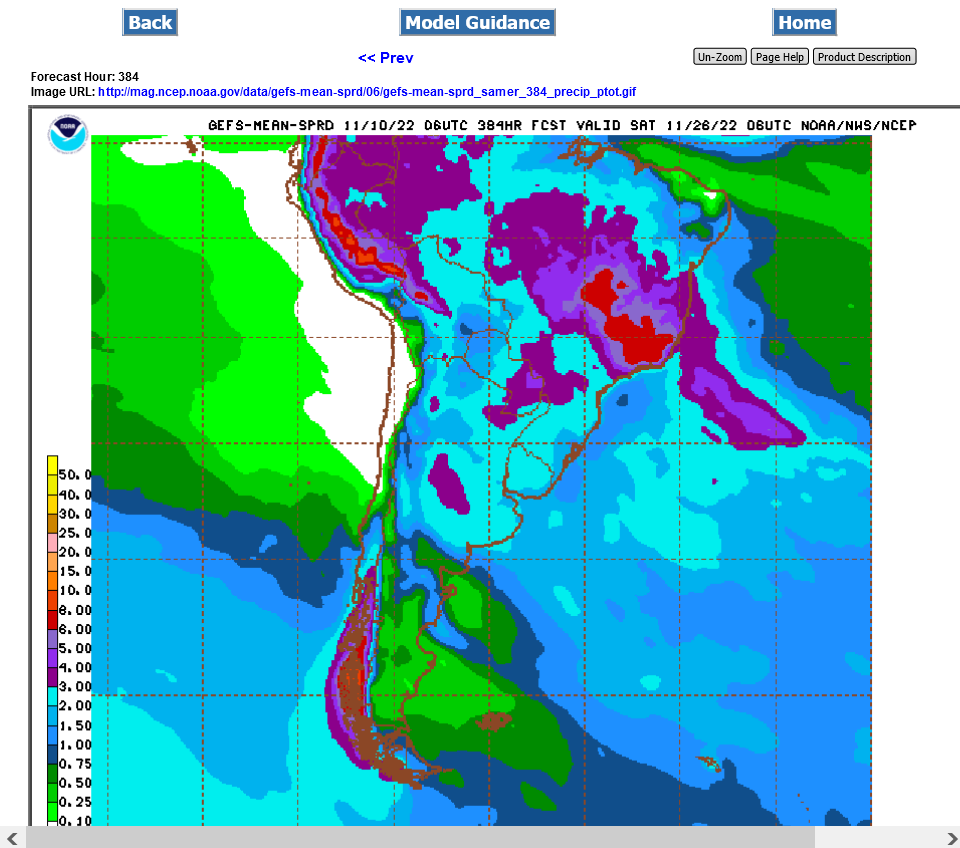

Rain forecast for South America from the 0z GFS ensemble mean just out.

Compare to drought below it. Northern drought areas getting decent rains.

Argentina drought areas to get some rains. Much of this looks like late week 1 and early week 2 and they could change a great deal before then.

Rain amounts a bit lower early this morning.

Likely because some of it fell already. Not a great deal but still very welcome.

We had some decent rains to help the drought in N.Argentina.

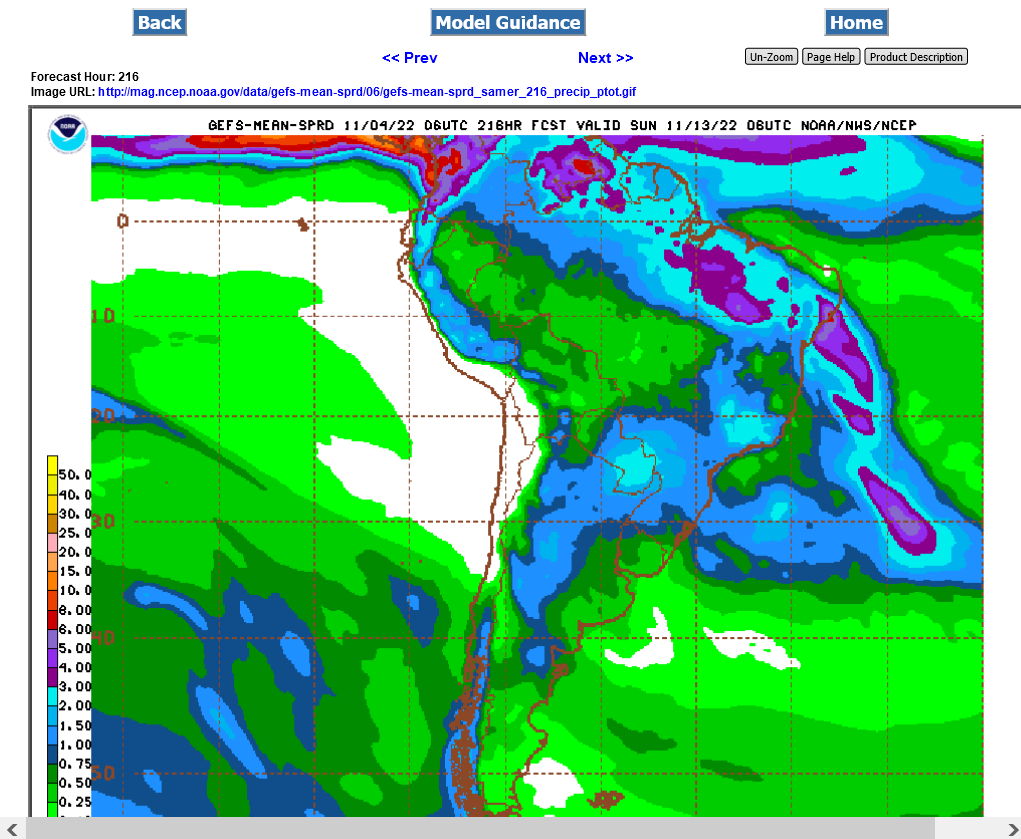

Here's the last GFS ensemble forecast. Rains farther south in the dries areas but nothing close to busting the drought.

https://mag.ncep.noaa.gov/Image.php

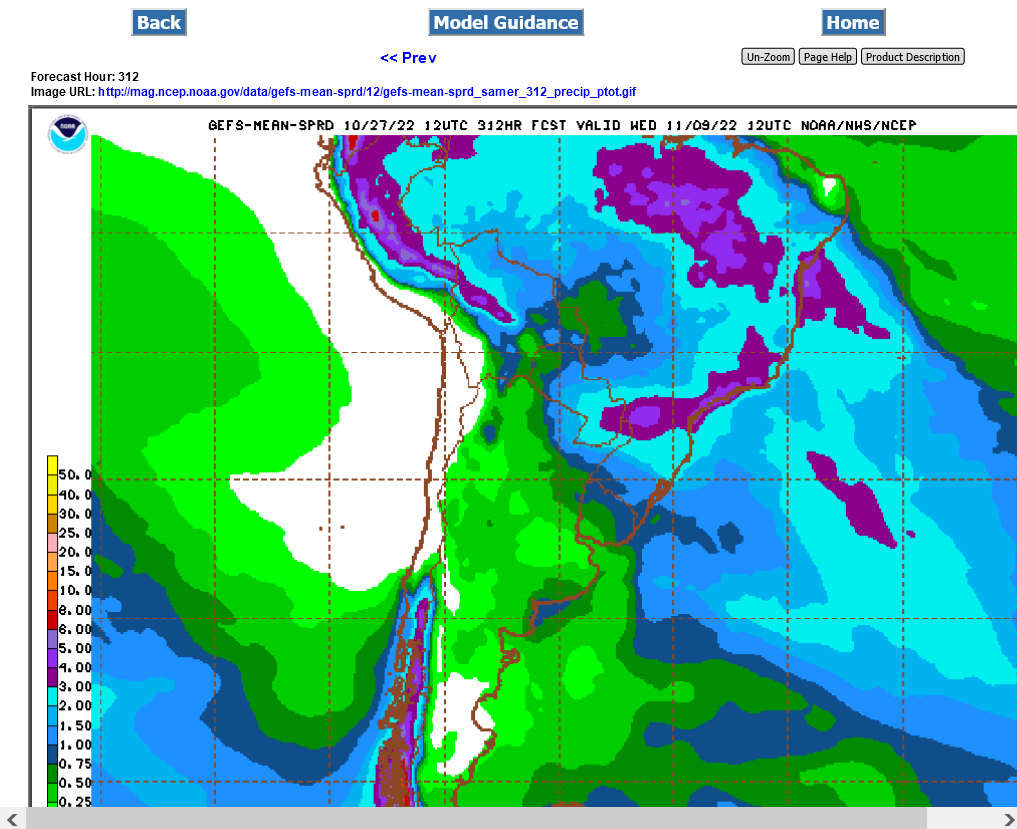

Rains thru 12 days on the updating 12z GFS ensemble mean. Pretty dry in Argentina which has a drought right now. Models show a bit of an increase in rain chances after that but its too far out to count on. I guess its too early in the S.Hemisphere's growing season to get exited about this. In the NH, this would be late April.

Still

https://mag.ncep.noaa.gov/Image.php

++++++++++++++++

++++++++++++++++

https://www.cpc.ncep.noaa.gov/products/Precip_Monitoring/Figures/global/n.7day.figb.gif

Planting pace of #soybeans in #Brazil's southern state of Parana has fallen to an 8-year low for the date and about 12 points below average due to recent rainy weather. Soil moisture is above average after last season's drought, so more rain isn't needed for now.

Not the case in Mato Grosso. #Soybeans were 67% planted as of Friday, nearly even with last year's fast pace. Quick planting in Mato Grosso often precedes good crops, even last year when states to the south suffered from drought and the national crop was very poor.

Pretty dry in Argentina drought areas the next 10 days as shown with the just out 12z GFS ensemble.

However, rains pick up AFTER that with uncertainty because of how far out that is.

Mostly dry in Argentina the next 7-9 days but after that and after this map below from the 6z GFS ensemble mean, rains pick up late in week 2.

Thanks for all the info Mike!

You're extremely welcome Jim! Great to hear/read from ya!

I'm always here Mike, just below the surface.

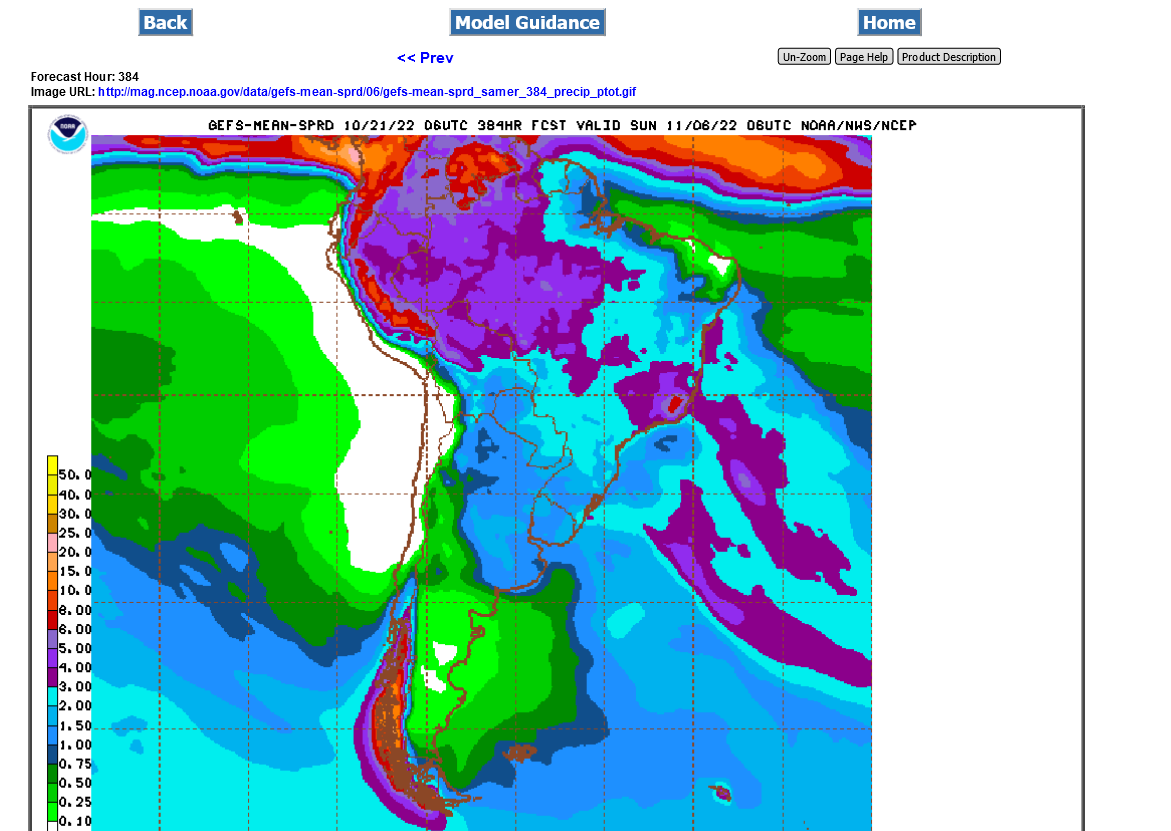

Big boost in rains for Argentina:

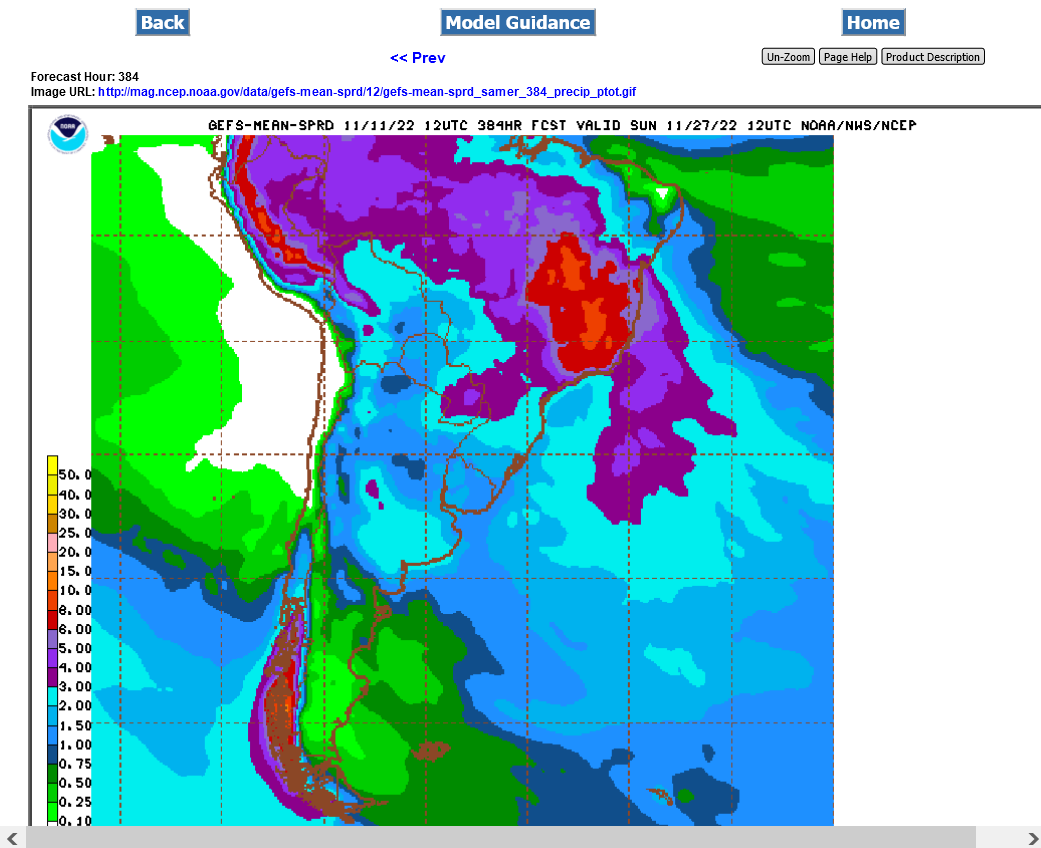

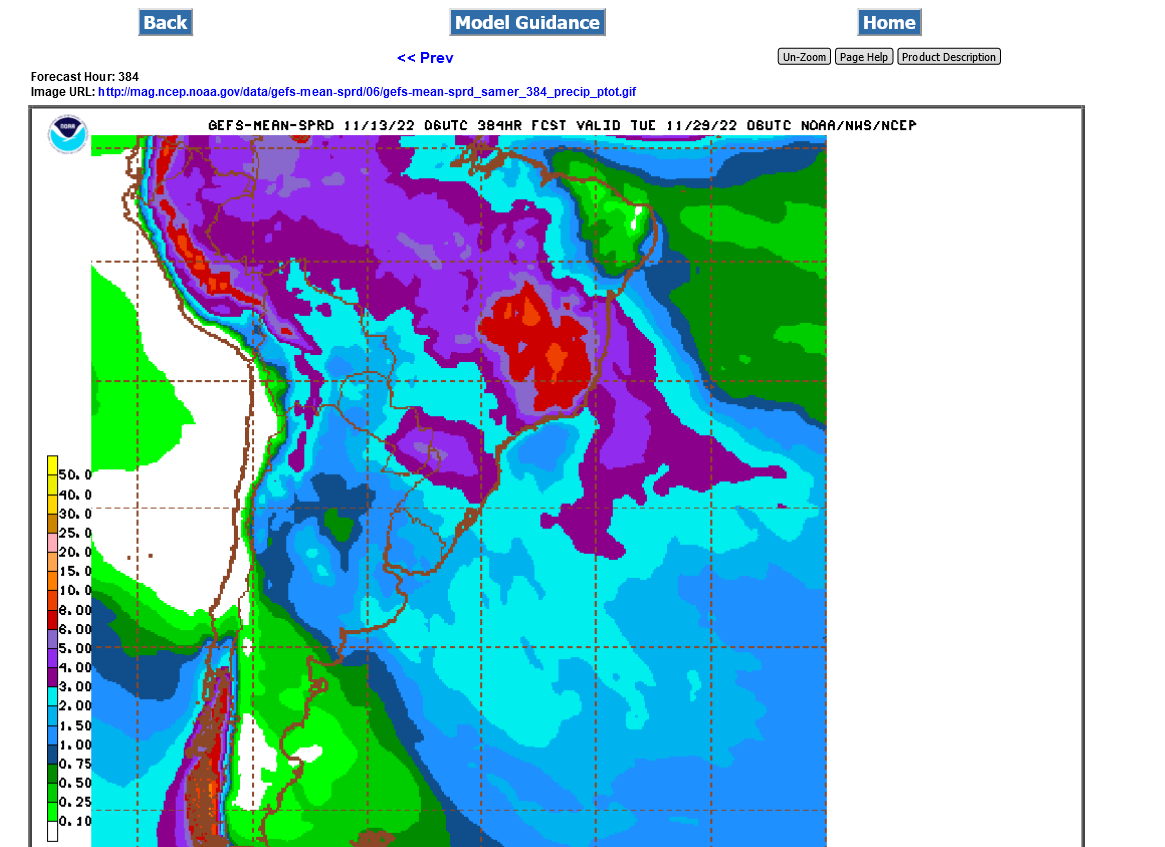

That boost in rains is going to be wimpy for the high soybean producing N.Argentina drought areas. Just out 12z GFS ensemble to 384 hours. +++++++++++++++++++++++

+++++++++++++++++++++++

https://ipad.fas.usda.gov/rssiws/al/ssa_cropprod.aspx

MetMike

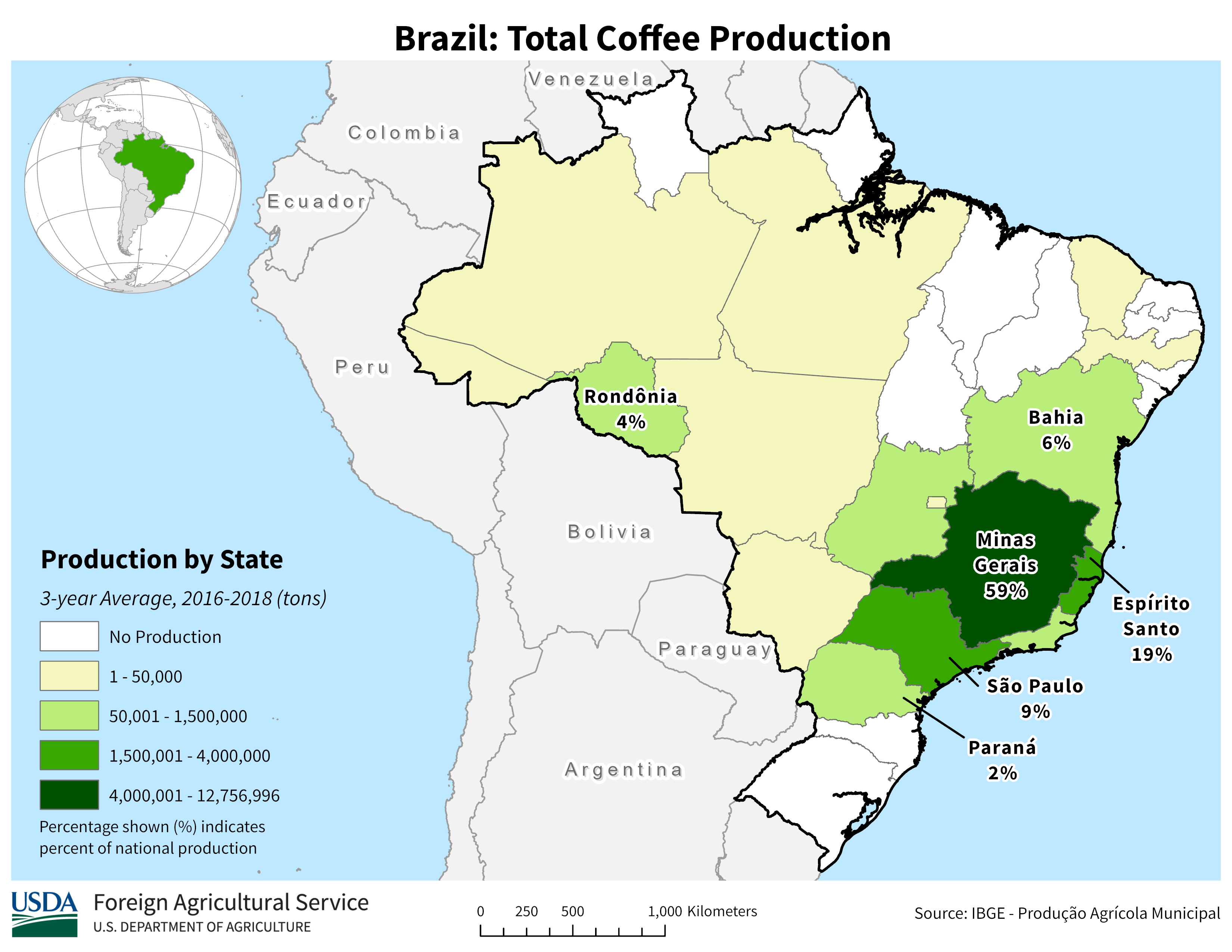

Any thoughts on coffee weather?

Great to read you tjc and great question! Coffee country will be getting massive rains for flowering. No drought this year. There's a chance it could be TOO MUCH rain!

https://ipad.fas.usda.gov/rssiws/al/br_cropprod.aspx

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/Brazil/Municipality/Brazil_Total_Coffee.png

+++++++++++++++++++++++++++++++++++++++

https://perfectdailygrind.com/2016/04/a-concise-guide-to-brazils-major-coffee-producing-regions/

++++++++++++++++++++++++++++++++

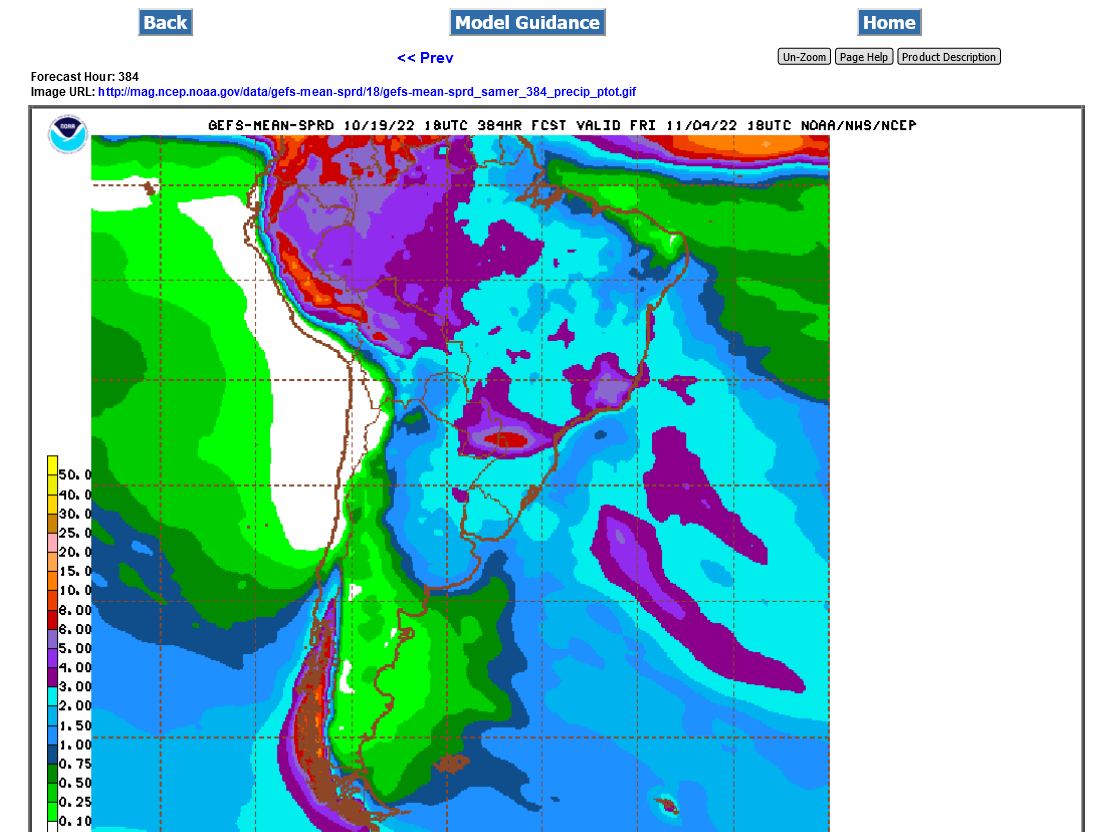

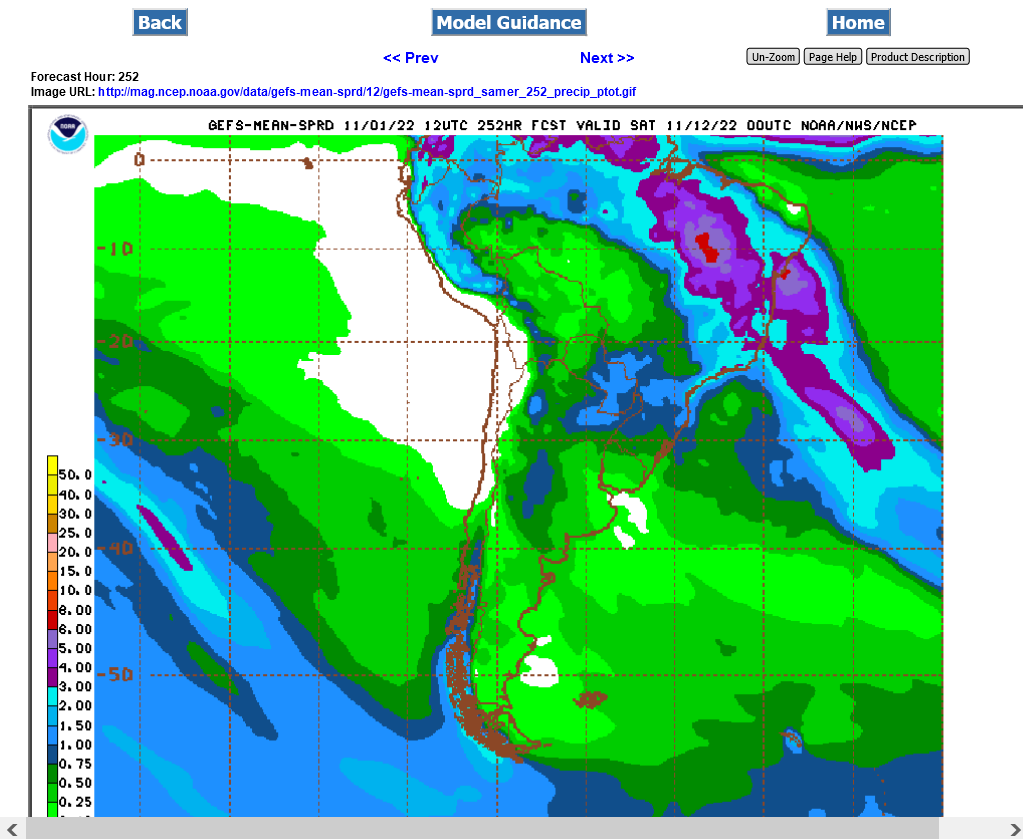

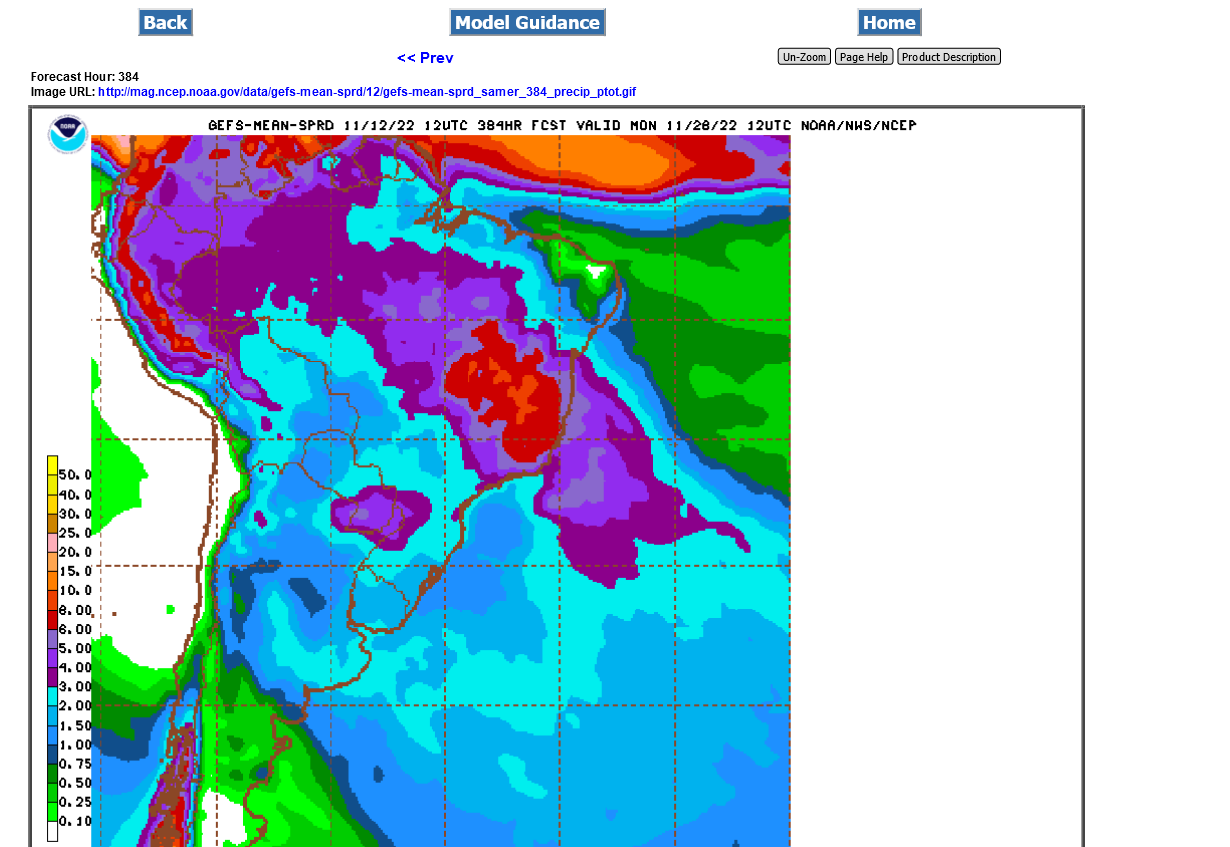

This is the just out 12z GFS ensemble on 11-12-22. Dark red is 6 inches. Bright red is 8 inches for rain totals the next 2 weeks in coffee-land. We should note the continued dry pocket in drought areas of N. Argentina with high soybean production.

https://mag.ncep.noaa.gov/Image.php

++++++++++++++

This data comes from the GFS/US model.

It's constantly updated every day.

http://wxmaps.org/outlooks.php

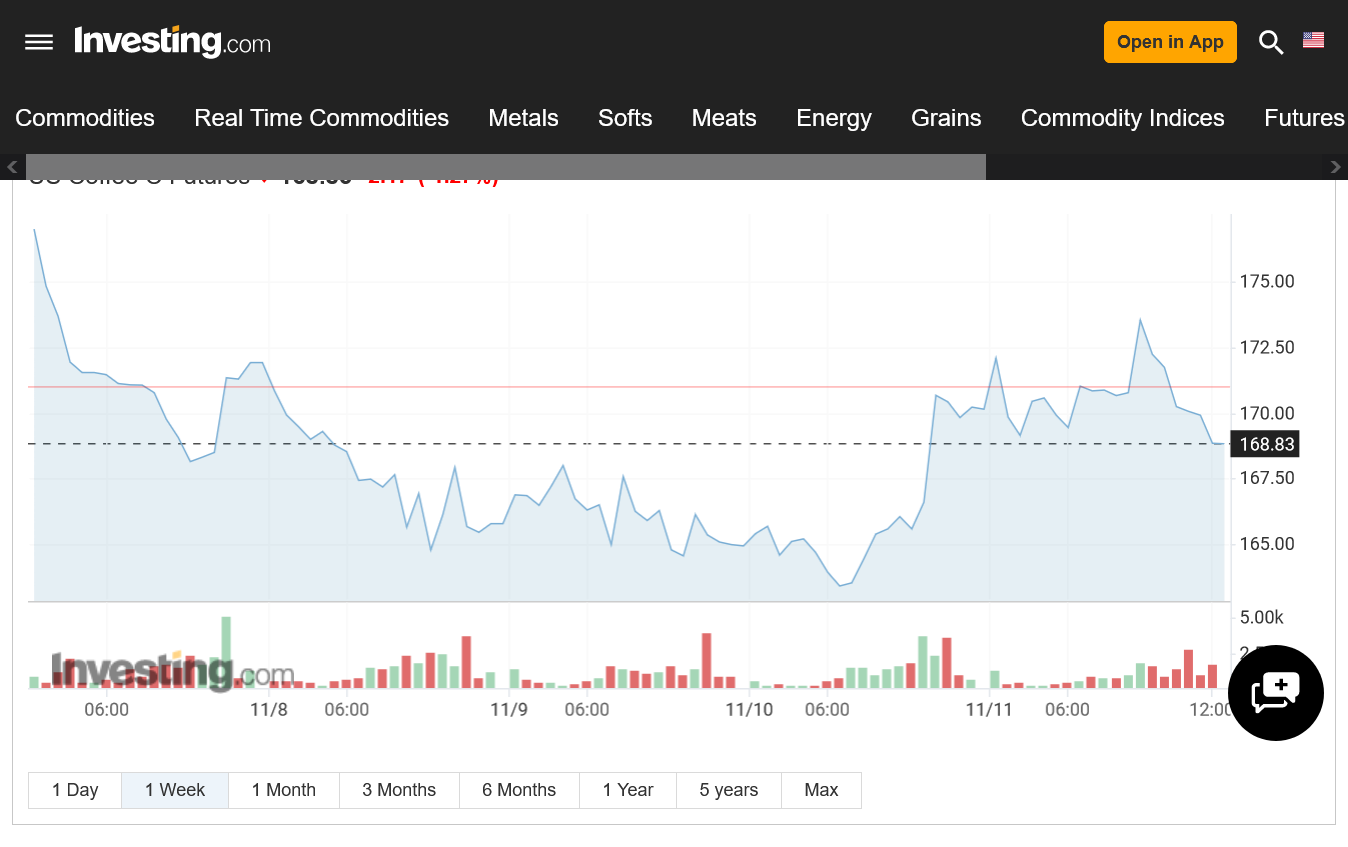

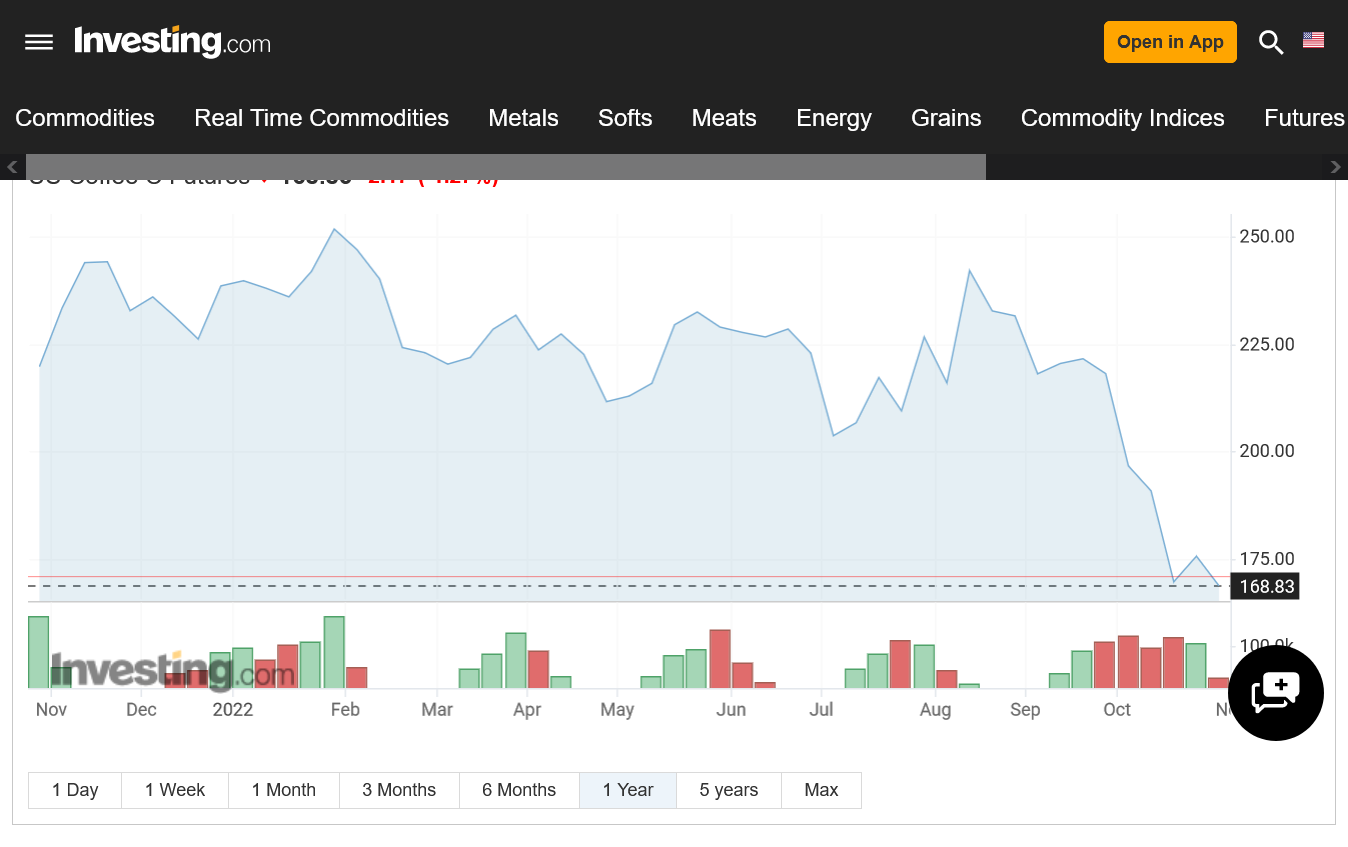

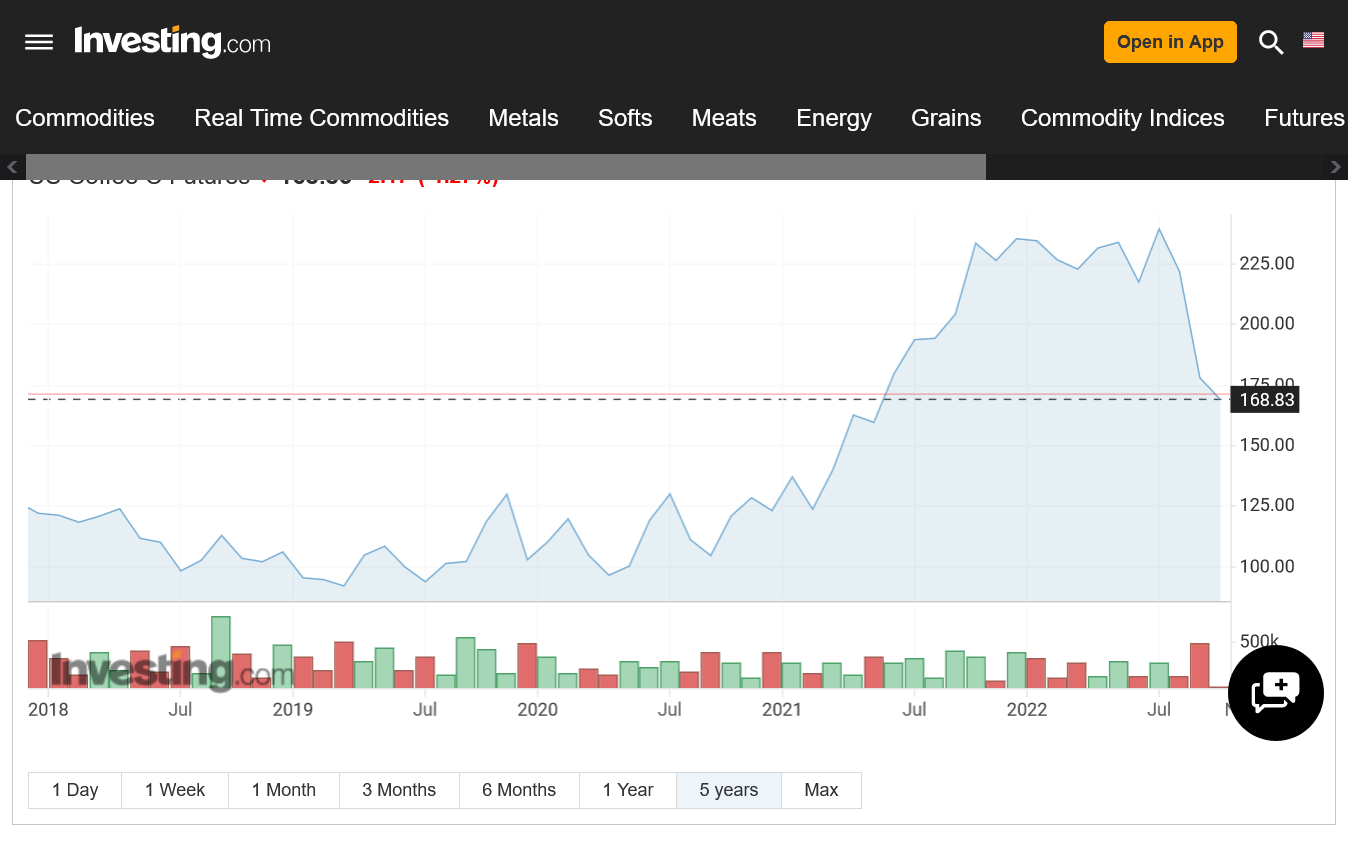

Coffee charts.

1. 1 week

2. 1 month

3. 1 year

4. 5 years

5. Max-42 years

https://www.investing.com/commodities/us-coffee-c

+++++++++++++++

++++++++++++++++++++++++++++

+++++++++++++++++++++++++++

+++++++++++++++++++++++++++

++++++++++++++++++++++++++

https://coffeeaffection.com/brazil-coffee-production-statistics/

+++++++

Take this next seasonal with a grain of salt.

https://charts.equityclock.com/coffee-futures-kc-seasonal-chart

+++++++++++++++++

I'm showing this article below for a couple of reasons.

1. It has some basic information for, especially beginners.

2. It has a seasonal chart that I want to use to point out a couple of things. That coffee is often under pressure during the June/July harvest, then has some strength while the new crop is developing. This holds most of the time..........when there is NO FREEZE/FROST. Obviously when there is a freeze/frost, the price will spike MUCH higher during that same period..........which was what happened in 2021 year. The other point is that after harvest is over, coffee often sees some strength, sometimes amplified by the market trading dry weather and dialing in risk premium when the crop needs a bloom triggering rain (with sharp drops when the rain forecast increases closer to the rain event).

Aug-Dec is a seasonally strong time for prices. Individual years will follow their own price pattern.

https://atas.net/volume-analysis/market-theory/coffee-futures-7-things-you-should-know/

Fri Nov 11, 2:04PM CST

NY coffee prices were undercut by the rebound in arabica ICE coffee inventories over the past week to a 6-week high Friday. However, coffee prices found support from Friday's sharp -1.7% sell-off in the dollar index to a 2-3/4 month low, which added to Thursday's -1.7% sell-off.

In a bearish factor, Rabobank Wednesday projected Brazil's 2023/24 coffee crop would climb +8% y/y to 68.25 mln bags as recent rain is seen favoring the development of crops. Rabobank also said a global coffee surplus could be seen in 2023/24 as consumption is expected to slow down from an economic recession and energy crisis.

Arabica coffee has underlying support from Somar Meteorologia's Monday report that Brazil's Minas Gerais region had 28.4 mm of rain last week, or only 63% of the historical average. Minas Gerais accounts for about 30% of Brazil's arabica crop. However, generally favorable weather in recent weeks has boosted Brazil's longer-term coffee crop outlook. World Weather recently said frequent rain and abundant sunshine had created a "pretty good environment" for Brazil's 2023/24 coffee crop.

A large short position in robusta coffee by funds could fuel some short-covering. Friday's weekly Commitment of Traders (COT) report showed that funds boosted their net-short robusta coffee positions by 3,484 to a 2-year high of 23,516 short positions in the week ended Nov 8.

Tight arabica coffee bean inventories are supportive for prices after ICE arabica coffee inventories on Oct 28 fell to a 23-year low of 384,795 bags. However, ICE arabica coffee inventories rebounded modestly to a 6-week high Friday.

Abundant U.S. coffee inventories are bearish for coffee prices. The Green Coffee Association on Oct 17 reported that U.S. Sep green coffee inventories rose +5.2% y/y to 6,378,478 mln bags.

Robust coffee exports from Vietnam are bearish for robusta prices. Vietnam's General Department of Customs reported on Oct 7 that Vietnam exported 1.73 MMT of coffee in the 2021/22 season that ended Sep 30, a 4-year high. Vietnam is the world's biggest producer of robusta coffee beans.

Smaller global coffee exports support coffee prices after the International Coffee Organization (ICO) reported last Monday that global coffee exports during Oct-Sep fell -0.4% y/y to 129 million bags. Also, the Colombia Coffee Growers Federation reported last Friday that Colombia's Oct coffee exports fell -5% y/y to 942,000 bags. Colombia is the world's second-largest producer of arabica beans. Also, Cecafe reported Thursday that Brazil's Oct green coffee exports fell -2.9% y/y to 3.18 mln bags.

In a bullish factor, Brazil's crop agency Conab Sep 20 cut its 2022 Brazil coffee production estimate to 50.4 mln bags from a May estimate of 53.4 mln bags as adverse weather curbed coffee yields. This year was supposed to be the higher-yielding year of Brazil's biennial coffee crop, but coffee output this year was slashed by drought.

In a bearish factor, the USDA, in its bi-annual report released on Jun 23, projected that 2022/23 global coffee production would climb +4.7% y/y to 174.95 mln bags, primarily due to Brazil's arabica crop entering the on-year of the biennial production cycle. The USDA projects that 2022/23 global coffee ending stocks will climb +6.3% y/y to 34.704 mln bags.

+++++++++++++

I'm very surprised that they don't mention the heavy rains on the way.

Thank you, MetMike! You really went into an extensive, long, detailed answer to a short question! Many will appreciate the 'historical' content---(SAVE EVERYBODY).

Coffee has been on a very protracted decline, loosing over 65 dollars (times $375) in the last 2 months. Thursday it had a very nice reversal, without giving it back on Friday. Looks like Monday will decide whether I have picked the bottom---only wish I had identified the late August top!

YW, tjc!

Better informed traders usually display a higher skill at predicting future prices for that market. Just trying to get everybody informed.

Thanks for sharing your insight as a seasoned veteran.

Since I use weather and am like you here -strongly favor this as a buying set up and trying to pick the bottom if trading it- there is way too much rain in the forecast for a drought scare rally, which would be the main weather trading affect in November for coffee.

However, there have been a few occasions when TOO MUCH rain fell, which caused a problem with flowers setting.

Coffee country is extremely well drained because of the hilly/mountainous terrain and higher altitudes, so flooding is rarely a concern.

Here's an article on a recent excessive rain situation for too much rain in this area from last years crop(January 2022) when flowering was over green cherries replaced them.

However, coffee loves alot of rain so we may need even more than whats on the map now, which is 8 inches the next 2 weeks in some spots below(bright red). I'll try to see what the record monthly rainfall is for these places. If we are approaching that level, then the rains can be bullish.

This was from the extreme even this past January. These rains will only be half of that and not anywhere close to the January monthly record which is almost 40 inches of rain.

So I would call the 6 inches of rain the next 2 weeks much more beneficial, even the 8 inches shouldn't hurt too much but it's flowering season, so that might be different.

By DÉBORA ÁLVARES January 11, 2022

https://apnews.com/article/science-brazil-belo-horizonte-82312070addea36a248fe73e00cf9b04

Parts of Minas Gerais have accumulated more than 400 millimeters (16 inches) of rain in the first 10 days of the year, according to Brazil’s Meteorology Institute. That’s still short of the 950 millimeters of rain recorded in the full January 2020 -- the most ever recorded for the month.

Still the pocket of less than ideal rain in key production, N.Argentina drought areas but at least SOME rain. 2 weeks below for the last GFS ensemble.

Great rains for coffee.

https://mag.ncep.noaa.gov/Image.php