Monday, October 24, 2022

0830/1230 September CFNAI Chicago Fed National Activity Index

NAI (previous 0.00)

NAI, 3-mo Moving Avg (previous 0.01)

0945/1345 October US Flash Manufacturing PMI

PMI, Mfg (previous 51.8)

0945/1345 October US Flash Services PMI

PMI, Services (previous 49.2)

Tuesday, October 25, 2022

8:55 AM ET. Johnson Redbook Retail Sales Index

Ret Sales Mo-to-Date, M/M%

Ret Sales Mo-to-Date, Y/Y%

Latest Wk, Y/Y%

9:00 AM ET. August U.S. Monthly House Price Index

9:00 AM ET. August S&P CoreLogic Case-Shiller Indices

10-City Idx, M/M% (previous -0.8%)

10-City Idx, Y/Y% (previous +14.9%)

20-City Idx, M/M% (previous -0.8%)

20-City Idx, Y/Y% (previous +16.1%)

National Idx, M/M% (previous -0.3%)

National Idx, Y/Y% (previous +15.8%)

10:00 AM ET. October Richmond Fed Business Activity Survey

Mfg Idx (previous 0)

Shipments Idx (previous 14)

10:00 AM ET. October Consumer Confidence Index

Cons Conf Idx (previous 108)

Expectation Idx

Present Situation Idx (previous 149.6)

1:00 PM ET. September Money Stock Measures

4:30 PM ET. API Weekly Statistical Bulletin

Crude Stocks, Net Chg (Bbls)

Gasoline Stocks, Net Chg (Bbls)

Distillate Stocks, Net Chg (Bbls)

Wednesday, October 26, 2022

7:00 AM ET. MBA Weekly Mortgage Applications Survey

Composite Idx (previous 204.6)

Composite Idx, W/W% (previous -4.5%)

Purchase Idx-SA (previous 164.2)

Purchase Idx-SA, W/W% (previous -3.7%)

Refinance Idx (previous 394.6)

Refinance Idx, W/W% (previous -6.8%)

8:30 AM ET. September Advance Economic Indicators Report

10:00 AM ET. September New Residential Sales

New Home Sales (previous 685K)

New Home Sales, M/M% (previous +28.8%)

New Home Sales Months Supply (previous 8.1)

10:30 AM ET. EIA Weekly Petroleum Status Report

Crude Oil Stocks (Bbl) (previous 437.357M)

Crude Oil Stocks, Net Chg (Bbl) (previous -1.725M)

Gasoline Stocks (Bbl) (previous 209.368M)

Gasoline Stocks, Net Chg (Bbl) (previous -0.114M)

Distillate Stocks (Bbl) (previous 106.187M)

Distillate Stocks, Net Chg (Bbl) (previous +0.124M)

Refinery Usage (previous 89.5%)

Total Prod Supplied (Bbl/day) (previous 20.761M)

Total Prod Supplied, Net Chg (Bbl/day) (previous +1.49M)

Thursday, October 27, 2022

8:30 AM ET. 3rd Quarter Advance estimate GDP

Annual Rate, Q/Q% (previous -0.6%)

Chain-Weighted Price Idx, Q/Q% (previous +9.0%)

PCE Price Idx, Q/Q% (previous +7.3%)

Purchase Price Idx, Q/Q% (previous +8.5%)

Real Final Sales 1st Est, Q/Q% (previous +1.3%)

Core PCE Price Idx, Q/Q% (previous +4.7%)

Personal Consumption, Q/Q% (previous +2.0%)

8:30 AM ET. September Advance Report on Durable Goods

Durable Goods-SA, M/M% (previous -0.2%)

Dur Goods, Ex-Defense, M/M% (previous -0.9%)

Dur Goods, Ex-Transport, M/M% (previous +0.2%)

Orders: Cap Gds, Non-Def, Ex-Air, M/M%(previous +1.3%)

Shipmnts: Cap Gds, Non-Def, Ex-Air, M/M% (previous +0.3%)

8:30 AM ET. Unemployment Insurance Weekly Claims Report - Initial Claims

Jobless Claims (previous 214K)

Jobless Claims, Net Chg (previous -12K)

Continuing Claims (previous 1385000)

Continuing Claims, Net Chg (previous +21K)

8:30 AM ET. U.S. Weekly Export Sales

10:30 AM ET. EIA Weekly Natural Gas Storage Report

Working Gas In Storage (Cbf) (previous 3342B)

Working Gas In Storage, Net Chg (Cbf) (previous +111B)

11:00 AM ET. October Federal Reserve Bank of Kansas City Survey of Tenth District Manufacturing

Mfg Activity Idx (previous 2)

6-Mo Exp Prod Idx (previous 16)

Mfg Composite Idx (previous 1)

6-Mo Exp Composite Idx (previous 9)

4:30 PM ET. Foreign Central Bank Holdings

4:30 PM ET. Federal Discount Window Borrowings

Friday, October 28, 2022

8:30 AM ET. September Personal Income & Outlays

Personal Income, M/M% (previous +0.3%)

Consumer Spending, M/M% (previous +0.4%)

PCE Price Idx, M/M% (previous +0.3%)

PCE Price Idx, Y/Y% (previous +6.2%)

PCE Core Price Idx, M/M% (previous +0.6%)

PCE Core Price Idx, Y/Y% (previous +4.9%)

8:30 AM ET. 3rd Quarter Employment Cost Index

ECI, Q/Q% (previous +1.3%)

ECI, Y/Y% (previous +5.1%)

10:00 AM ET. September Pending Home Sales Index

Pending Home Sales (previous 88.4)

Pending Home Sales Idx, M/M% (previous -2.0%)

Pending Home Sales Idx , Y/Y% (previous -24.2%)

10:00 AM ET. October University of Michigan Survey of Consumers - final

End-Mo Sentiment Idx (previous 58.6)

End-Mo Expectations Idx (previous 58.0)

12-Month Inflation Forecast (previous 4.7%)

5-Year Inflation Forecast (previous 2.7%)

End-Mo Current Idx (previous 59.7)

Thanks tallpine!

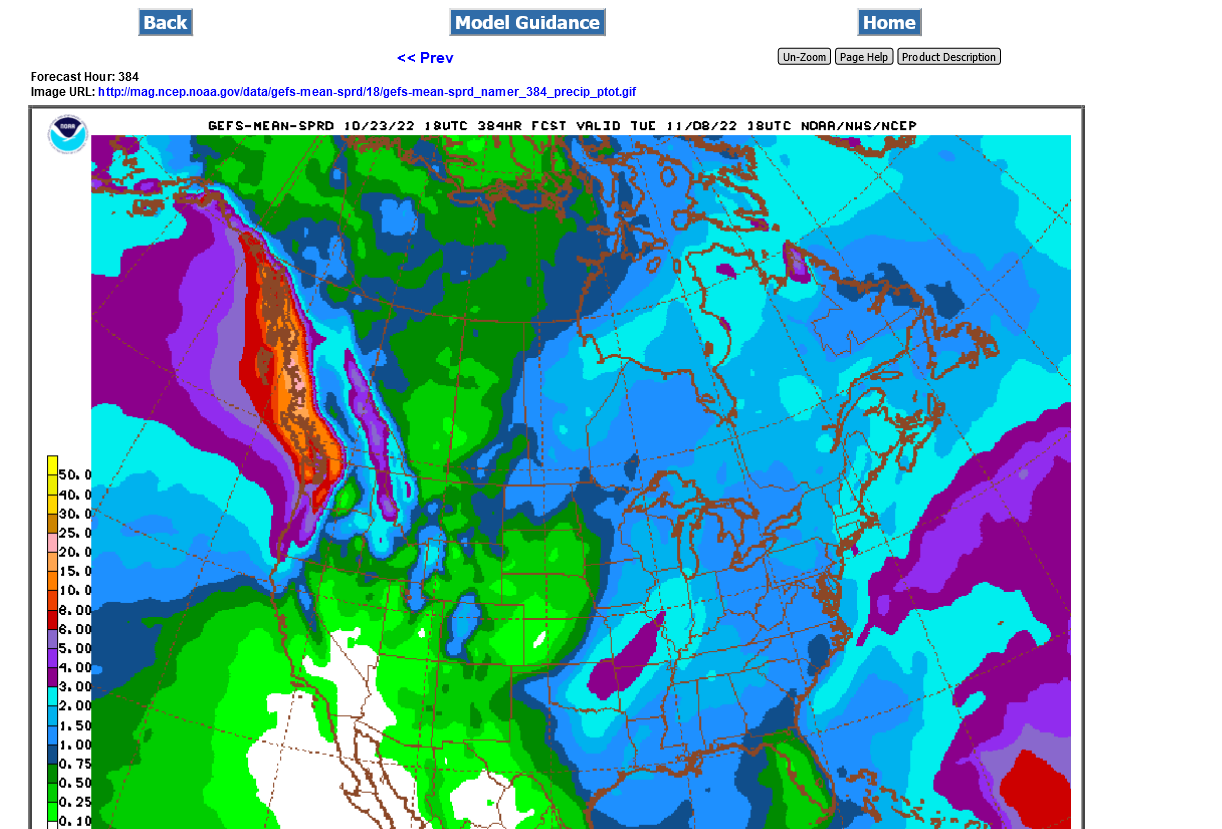

Rain in SOME places that need it in southeast Plains and mid/lower Miss River Valley. Missing in others.

Very mild and bearish natural gas in the high population centers of the Midwest and East. Massive injections as record supplies gush in to help refill storage before the end of the year.

All the weather here:

https://www.marketforum.com/forum/topic/83844/

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

Extended weather.

https://www.cpc.ncep.noaa.gov/products/predictions/610day/ | |||||||||

| 6 to 10 day outlooks | |||||||||

| Click below for information about how to read 6-10 day outlook maps Temperature Precipitation | |||||||||

| Click below for archives of past outlooks (data & graphics), historical analogs to todays forecast, and other formats of the 6-10 day outlooks ArchivesAnalogsLines-Only FormatGIS Data | |||||||||

Temperature Probability | |||||||||

Precipitation Probability | |||||||||

| |||||||||

Just out 18z GFS ensemble precip the next 15 days. Most of it is this week:

This should help the lower Miss River levels and barge traffic.