11-12-22

Nov. 15th Tues. NOPA Crush

18th Friday Cattle On Feed

19th Russian grain deal expires (talks are in the process to extend the agreement)??

Railroad strike pushed back to Dec. 4th

Mexico to cancel any imports from US (GMO Corn) 2024

MX is our largest buyer 25% of our exports and then add 40% US ethanol usage

Both as of now is (demand) is slipping.

Nov. Low the week of (looking for harvest lows)

Week of 11-12-21 11-06-20 11-22-19

Could we have seen the low??

Dec. Corn 200 day ma. 665.25 and the 100 day ma 650.50

IF we can't hold the 100 day imho possible support 646-644 and 633.50-630.50

Mch. Corn 200 day ma. 669.75 and the 100 day ma.656.75

IF we can't hold 100 day ma. then possible 651-646 and 639

The last time the US Dollar was at this level 106.16

Aug. 16th 2022

Dec. corn was 620-615 March Corn 618-616

Nov Beans 1381-1376 Jan Beans 1388-1383

Dec. Wheat 802.75-798.50 March Wheat 816.75-812.75

Dec. Corn 23 vs. Nov. bean 23 ratio is 2.275

That is the High since I been writing it down since 9-16 -22

Soon Corn should gain on Beans

thanks for the great grain post bcb. We are so tired from harvest we tend to lose sight and quit thinking markets for a bit. The way things are you remind us dirt farmers to keep our eyes open. thanks

The reason I like to work with farmers/ clients. My job is to try and show the what if's and the bottom line is they need to make the decisions.

For got to say in all my yrs. trading and being a Broker never do I remember the grain markets jumping up and down on Geo Political news / statements. I like to sleep at night and suggest don't put on new trades during night session for spec. Use night session to take off risk then trade the BIG Boys hrs. 8:30am -1:15pm Just mho

https://www.cmegroup.com/articles/2022/the-soybean-corn-ratio-in-2022.html

Figure 1 shows the front-month Soybean futures daily settlement price compared to the front-month Corn futures settlement price for the last decade. Corn futures and Soybean futures prices saw a steep upward trajectory in the pandemic recovery of 2021, and after a rebound later in that year, climbed again after the Russian invasion of Ukraine on February 24, 2022.

Figure 2 shows the correlation between daily settlement prices of front-month Corn futures and Soybean futures between 2012 and 2022. This year’s prices fall predominantly below the trendline, signaling that the soybean-corn ratio in 2022 has been low compared to the historical average. Figure 3 shows the soybean-corn ratio, calculated by front-month Soybean futures divided by front-month Corn futures daily settlement prices, averaged by week between 2012 and 2022. The average weekly spread (2012-2022) hovers just above 2.5 for the first half of the calendar year, then sees a slight increase in the summer months, and returns to 2.5 later in the year. This dynamic reflects the seasonality of the respective crops, which are both harvested late in the year and see seasonal highs in the summer. Front-month soybean seasonal highs tend to be more pronounced than those of corn.

The bean-corn ratio in the current year has averaged less than 2.5, with recent weeks marking the lowest ratio seen in the past decade, after high soybean prices sent the ratio rising in August. Figure 4 gives a detailed view of 2022’s pricing dynamics.

Classical microeconomics presents students with the question of how many widgets to produce and at what price. Working economists criticize this question as secondary to the needs of real-life producers, whose primary quandary is whether to make widgets at all, or rather something else entirely. Every spring, U.S. farmers face the question of what to plant, not just how much to plant. With corn and soybeans continually vying for dominance and the soil-nutrient needs of farmers demanding rotation, the question is not a light one and necessarily incurs risk. CME Group offers a range of Corn futures and option and Soybean futures and option products with which to manage that risk. Learn more at www.cmegroup.com/agriculture.

Soon Corn should gain on Beans

I don't follow your logic on this prediction, bcb. Can you explain more please?

This has been one of the biggest/fastest drops in the US Dollar in a very long time. This bodes well for grain exports and better value experienced by our customers.

https://www.tradingview.com/symbols/TVC-DXY/

https://www.cnbc.com/quotes/.DXY

%20in%20real%20time.png)

%20in%20real%20time.png)

%20in%20real%20time.png)

%20in%20real%20time.png)

%20in%20real%20time.png)

%20in%20real%20time.png)

The ratio is for new crop. The higher the ratio the farmer plants more acres of beans. Lower they plant more acres of corn. This is for new crop 2023 not 2022 that I mentioned. Feels like we need corn acres in 2023 especially if Brazil has a record Beans crop

Thanks bcb!

Gotcha completely on that elaboration. I thought that you meant price gains with the current ratio of the front months.

With the drought in Argentina potentially firing up the bean market on weather concerns more than corn, front month/SA new crop pricing is more likely to favor the bean/corn spread gaining ground.

But I hear you on planted US acres next year since the pricing rewards corn producers more than beans.

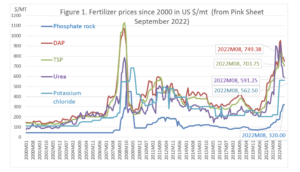

One important element is the very high price of fertilizer right now. That input cost is much greater for corn.

++++++++++++++++++++++

The good news is that natural gas supplies are gushing in at record levels. So the price of natural gas, which is used to manufacture fertilizer and is tied strongly to pricing is very likely to come down.

https://www.marketforum.com/forum/topic/89973/#90264

If anhydrous comes back down to earth, farmers can lock in some decent prices for that and new crop corn.