New NG thread is here!

Long once again future and BOIL etf

Thanks for starting the overdue new ng thread. Been swamped with chess, local wx and other stuff.

Previous NG thread:

https://www.marketforum.com/forum/topic/91972/

Extremely mild temps last week mean another extremely bearish EIA:

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

for week ending January 20, 2023 | Released: January 26, 2023 at 10:30 a.m. | Next Release: February 2, 2023

-91 BCF analysis on next page.

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (01/20/22) | 5-year average (2018-22) | |||||||||||||||||||||||

| Region | 01/20/23 | 01/13/23 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 622 | 662 | -40 | -40 | 618 | 0.6 | 609 | 2.1 | |||||||||||||||||

| Midwest | 749 | 785 | -36 | -36 | 711 | 5.3 | 716 | 4.6 | |||||||||||||||||

| Mountain | 140 | 147 | -7 | -7 | 144 | -2.8 | 145 | -3.4 | |||||||||||||||||

| Pacific | 150 | 157 | -7 | -7 | 201 | -25.4 | 221 | -32.1 | |||||||||||||||||

| South Central | 1,067 | 1,069 | -2 | -2 | 950 | 12.3 | 909 | 17.4 | |||||||||||||||||

| Salt | 310 | 307 | 3 | 3 | 283 | 9.5 | 266 | 16.5 | |||||||||||||||||

| Nonsalt | 757 | 762 | -5 | -5 | 666 | 13.7 | 642 | 17.9 | |||||||||||||||||

| Total | 2,729 | 2,820 | -91 | -91 | 2,622 | 4.1 | 2,601 | 4.9 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding. | |||||||||||||||||||||||||

Working gas in storage was 2,729 Bcf as of Friday, January 20, 2023, according to EIA estimates. This represents a net decrease of 91 Bcf from the previous week. Stocks were 107 Bcf higher than last year at this time and 128 Bcf above the five-year average of 2,601 Bcf. At 2,729 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

https://www.investing.com/economic-calendar/natural-gas-storage-386

Latest Release Jan 26, 2023 Actual-91B Forecast-82B Previous-82B

++++++++++++++++++++

Note the BLUE LINE on the graph below, with accompanying data above:

We are now 100+ BCF ABOVE the 5 year average and ABOVE last years storage......the first surplus of that magnitude in a while but that pales compared to the massive surplus that will grow if the supply spickets don't get turned lower.

Supplies have continued to gush in since the end of last Summer at a huge historic record. That has been the driving force for fundamentals that have swamped everything else. Technical indicators indicating a bottom haven't meant diddly squat in this incredibly bearish environment. They've been suggesting a bottom since prices were almost $30,000/contract higher, then $20,000, then +$10,000/contract higher than this........and now look where we are.

Every time it's seen as THE bottom.

Forecasted cold waves have caused very brief, dead cat bounces that are just blips on the price chart as we crashed lower since trading to almost $10 last Summer.

cutworm nominated this as "post of the week/month" last weekend, so here it is again, describing the situation and you can see what's happened to NG prices since then too, which actually makes it worthy of that wonderful compliment from cutworm.

https://www.marketforum.com/forum/topic/91972/#92358

+++++++++++++++++++++++++++++++++++++++

Weather outlook NOT favorable for this big cold shot coming up to last much more than a week.

As soon as the models showed it letting up, early this week, NG crashed to new lows"

+NAO and +AO below are not favorable for cold air delivery into the Eastern US in week 2.....just the opposite, increasing chances for ABOVE temps there.

Arctic Oscillation Index, North Atlantic Oscillation Index, Pacific North American Index.

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/daily_ao_index/ao.shtml

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/pna/nao.shtml

https://www.cpc.ncep.noaa.gov/products/precip/CWlink/pna/pna.shtml

++++++++++++++++++++++++++++++++++++++++++++

GFS ensemble mean anomalies at 2 weeks.

https://www.psl.noaa.gov/map/images/ens/z500anom_nh_alltimes.html

2 week 850 temp for ensemble mean anomaly

https://www.psl.noaa.gov/map/images/ens/t850anom_nh_alltimes.html

More from earlier this week/yesterday with momentum that has carried over to this morning, so far:

Re: Re: Re: Re: Re: Re: Re: Re: Re: Re: Re: Natural Gas 1-7-23

The 7-9 day cold snap in the forecast gave us a brief dead cat bounce and now its back to supplies gushing in for the focus.

Last 18z GEFS was -18 HDDs!

Noon central time a 'new' weather report must have come out Sudden buying!

I forgot that the front month, Feb is getting ready to expire. increased Volatility often defines time frames like this.

seasonally, we are actually in the window for an early seasonal bottom.

never be short ng from late feb thru April without an extremely good reason.

Yes, tjc, the GEFS was +6HDDs.

MetMike/Wx

What is the likelihood of two/three bullish weather reports in a row?

Now that midAmerica and East is white and 'cold', can this feed upon itself?

EE was -1 HDDs.

bigger news was freeport approved to come back on line

That would be big bullish news, coffee. The market didn't act very bullish.

traders trying to pick the bottom for the last month+ by going long and then bailing every time in order to avoid massive losses, should realize that selling and staying short for that same period would have netted +$30,000 for just 1 contract.

https://tradingeconomics.com/commodity/natural-gas

Sarcasm!

And you, THE weather/NG sage, are short how many contracts?

I made 4000 short and have given back 5000 TRYING to pick bottom.

Perhaps I have done so TODAY, Thursday, with biggest bet.

i lightened up last night and expected to retest today into monday..we opened higher 4 straight sunday nights perhaps this time we go lower and then revrese

Thanks coffee and tic,

Gefs was +3 hdds

EE was -9 HDDs.

nothing about the upcoming pattern suggests a change to sustained cold that lasts in the population dense, natural gas consuming East that would make wx a major bullish factor compared to what the market expected at the start of the week when it had its latest dead cat bounce.

Tjc,

ill try to reword the post so that you don’t take it personal.

the intent here is for all traders, including me to look at markets objectively and not get married to positions or get married to seeing only one side of a trade …….the one that favors what we want to see.

the best traders are always humble and can recognize both sides and can step back and see the big picture, especially when powerful elements in it are constantly sabotaging our personal indicators and expectations.

instead of defending what’s not working, we look for the reasons why not and adjust our mentality accordingly.

i greatly appreciate you sharing here and am here to ASSIST you, not pacify you or state things you want to read or have A trading contest with you or cause confrontations.

just objective market analysis based on humbly viewing markets with an open mind That also contemplates and Dials in why I might be wrong.

Mike

Great points! And as indicated, SARCASM.

You are objective, have a keen ability to be decisive, and always prepared. Your weather knowledge and career gives you a leg up on most aspects of a trade or lack of a viable trade. ALWAYS appreciate your posts and insight.

I think all of us can learn from this multiple weeks NG trade. I suspect there is literally no one who has held a net short position for the entirety of this 9 week, constant decline. VERY DIFFICULT to hold a trade. Best I have ever done was two Oat short Sept contracts from late July to a week prior to expiration. Perhaps BECAUSE I was not adding to the position (not pressing) allowed me to just hold on, for a profitable trade.

Very hard to identify a trade that will take 1-3 months to complete its move. Moreover, the 'fear' of not taking a profit usually prevents the ultimate climax of the complete trade.

LET US ALL continue to contribute. Fresh opinions and suggestions always should be welcomed.

tjc,

Your wonderful, open minded response shows what a professional that you are and we already knew that you have the well developed analytical skills for using and identifying markets that are overdone.

My favored trading sets ups often suffer from the same thing that I mentioned, so I was referring to my own mentality at times, related to looking for markets way overdone in one direction, trying to pick the bottom/top and reversal going the other way from the influence in the weather.

You 100% understand this and trade the same thing, which is why our thoughts connect strongly so often here.

Weather report 1 pm ? Bounce in NG

Expiring Feb NG spike!

Last 12z GEFS was -6 HDDs.....bearish vs the 6z run, 6 hours earlier.

-3 HDDs vs the run 12 hours earlier.

MetMike

Thank you for prompt reply.

NG has been whirling around all day. Obviously, I want NGH to close positive!

EE was +0. No change in HDDs.

The GEFS has a pattern very likely to stay mild in week 3 for the East.

However, the EE, Canadian and CMC models COULD turn bullish and are trying to build a ridge/west, trough/east pattern at the end of 2 weeks......which would turn bullish next week IF that happened.

This, I believe is the biggest nemesis to NG being able to put in an early seasonal bottom right now.

This last week, we went to a 100+ surplus in storage to last year and the 5 year average.

The temps below are for weeks 2, 3 and 4 which takes us thru much of February. Combine the mild weather in much of the high population areas (lower than average heating demand) and the amount of supplies gushing in and its the recipe for some seasonally small draw downs.

But even worse is what the comparison will be to last year, 2022 as seen below the weather maps.

The first 3 months of 2022 featured some HUGE drawdowns so by the time we get to Spring 2023, the small drawdowns this year with the current weather forecast means that the surplus compared to 2022 and the 5 year average will have grown significantly.

The only way that won't be the case is if the weather forecast for February changes and turns MUCH colder.

https://www.cpc.ncep.noaa.gov/products/predictions/814day/index.php

https://www.cpc.ncep.noaa.gov/products/predictions/WK34/

| Release Date | Time | Actual | Forecast | Previous |

|---|

| Apr 28, 2022 | 09:30 | 40B | 38B | 53B | |

| Apr 21, 2022 | 09:30 | 53B | 37B | 15B | |

| Apr 14, 2022 | 09:30 | 15B | 15B | -33B | |

| Apr 07, 2022 | 09:30 | -33B | -26B | 26B | |

| Mar 31, 2022 | 09:30 | 26B | 21B | -51B | |

| Mar 24, 2022 | 09:30 | -51B | -56B | -79B | |

| Mar 17, 2022 | 09:30 | -79B | -73B | -124B | |

| Mar 10, 2022 | 10:30 | -124B | -117B | -139B | |

| Mar 03, 2022 | 10:30 | -139B | -138B | -129B | |

| Feb 24, 2022 | 10:30 | -129B | -134B | -190B | |

| Feb 17, 2022 | 10:30 | -190B | -193B | -222B | |

| Feb 10, 2022 | 10:30 | -222B | -222B | -268B | |

| Feb 03, 2022 | 10:30 | -268B | -216B | -219B | |

| Jan 27, 2022 | 10:30 | -219B | -216B | -206B | |

| Jan 20, 2022 | 10:30 | -206B | -194B | -179B | |

| Jan 13, 2022 | 10:30 | -179B | -173B | -31B | |

| Jan 06, 2022 | 10:30 | -31B | -54B | -136B |

++++++++++++++++++++++++++++++++

What are the chances for the weather pattern to shift to much colder in February?

Not very good with a solidly ++AO and +NAO. That makes it extremely difficult for cold from high latitudes to move south, then penetrate deeply into the Eastern US. The PNA is near 0.

However, the market knows this and has dialed alot of it in recently.

I will copy this post below but add that we are getting close to the time frame when seasonal weakness is waning and approaching the time when seasonal bottoms usually happen.

Keep in mind the previous page which is THE REAL market moving fundamantal information which is the focus of the market right now, when trying to pick a bottom here.

https://www.marketforum.com/forum/topic/91972/#92325

By metmike - Jan. 19, 2023, 9:53 p.m.

Also, seasonals at this time of year are still pretty negative, especially for the front month.

During the Winter months, the only times you want to be long NG for the best opportunity are when 1 or more of these factors exist:

1. Ahead of extreme cold

2. When ng in storage is critically low

3. When the storage is eroding vs the 5 year average

http://charts.equityclock.com/seasonal_charts/futures/FUTURE_NG1.PNG

Again, very compelling reasons to be SHORT. (Certainly not long)

My non-meteorological assessment: Market knows 'weather', short and longer term. "IT HAS BEEN a 'good' ride." I am covering my shorts! RING THE BELL!

ALL day, it was short covering, persistent "I won't let you off the bottom selling, yet it was not an ugly, victorious win for shorts.

IF, IF, nothing else, just have March rally to February expiration close!

The obvious--market extremely over sold

NO ONE ON THIS SITE should enter a trade based upon my trading, now gunslinger, approach! Bottom picking at its worse (hopefully best).

I'll try to keep you posted on the weather.

Dang, Larry just started this thread early on the 26th and here late on the 27th, it's already a mile long.

That's a good thing though because we're having a productive conversation!

Overnight runs seem to have shed some Hdds? CNBC was discussing the fact that there was a significant trade of call buying in UNG for March

cc,

It's going to take a complete flip flop of the pattern at the end of 2 weeks to turn it cold for the East. Almost everything points to warm.

That warning tend appears to have solidified since the close yesterday. Correct me if in am mistaken

Not much change.

GEFS slightly colder, EE was -5 HDDs.

I have one statement for all short NG traders, "I hope your legs grow together!"

Pretty big gap lower on the open just shows that the market is still trading this:

https://www.marketforum.com/forum/topic/92520/#92588

And this:

https://www.marketforum.com/forum/topic/91972/#92358

Nothing has changed since Friday......except that a couple more days of very mild weather at the end of the forecast are being dialed in and the ones before that are higher confidence.

Can this change?

Of course but the market will usually trade based on what it knows with high confidence(that's most important to fundamentals) , which will always trump wishful thinking at extremes from top and bottom pickers.

This is an awesome place to buy.......but that seemed to be the case numerous times this Winter, just looking at the prices charts/technical indicators but ignoring the extremely bearish fundamentals.

If the weather models turn sharply colder this week....then I'm in on the long side but we have some very bearish EIA reports coming up that will add 100's of BCF to the supply surplus during February/March.

This is what matters to ng right now.

i think what happened this opening was simple..the market attempted to find a bottom with the thursday bounce and friday 2 way trade.... 3 weeks in a row the sunday night open was huge gaps to the upside..this likely helped the short covering end last week and also emboldened a few longs...when weather didnt really materialize and they saw some moderation of the cold air coming over next 2 weeks they slammed it...but that said we should be reaching a low here monday into tues

Tjc

that was an hilarious comment about the shorts last night!

This was the last oz European ensemble below. Another -5 HDDs and huge warming trend in week 2.

++++++++++++++++

EE -7 HDDs but ng WON'T GO LOWER!

Have we FINALLY run out of sellers down here?

Was the gap lower Sunday Night an exhaustion gap?

Is the seasonal low in?

Will the global market and exports support us?

is it bottom? or just end month position squaring,,,guess we shall see

Natural gas futures stabilized on Tuesday, supported by a cold front, eased production and strength in cash markets Coming off a 17.2-cent drop in its debut as the front month a day earlier, the March Nymex gas futures contract on Tuesday settled at $2.684/MMBtu, up seven-tenths of a cent day/day. April rose 1.0 cent to

+++++++++++++++++++

Could just be that the current cold hitting the East is causing a big enough spike higher in key, high demand cash price markets and so much higher than FUTURES that shorts can't keep pressing futures lower while cash keeps going higher.

Might just be a pause/another bear flag but unless the economy and demand is collapsing, we are getting extremely close to the low.

Temps thru last Thursday for this weeks' EIA number. Another low-ish drawdown with an increase in the growing surplus vs 2022 and the 5 year average.

Next week's EIA number will be more robust from this weeks cold!

https://www.cpc.ncep.noaa.gov/products/tanal/temp_analyses.php

Funny line, but from a frustrated long.

Exited yesterday. Looks smart now.

Will try again near 2.4

curious why did you exit yesterday ?

So it WAS just another bear flag? and here we go lower again. The weather continues bearish.

MetMike

When is next weather report?

Thinking one more new low!

Weather is still unchanged and bearish tjc!

Note the blue line below is getting WELL ABOVE the 5 year average +163 BCF and last year's storage +222 BCF and the surplus will continue to grow in February. Extremely bearish but the market has been trading this for weeks.

++++++++++++++

The U.S. Energy Information Administration (EIA) said 151 Bcf was withdrawn from natural gas inventories for the week ending Jan. 27, coming in on the high side of estimates ahead of the weekly report. Notably, however, the latest government data included a revision from the previous week’s report, which reflected slightly higher levels of storage.…

+++++++++++++++++++

for week ending January 27, 2023 | Released: February 2, 2023 at 10:30 a.m. | Next Release: February 9, 2023

Working gas in underground storage, Lower 48 states Summary text

CSV

JSN Historical ComparisonsStocks

billion cubic feet (Bcf) Year ago

(01/27/22)5-year average

(2018-22) Region01/27/2301/20/23net changeimplied flow Bcf% change Bcf% changeEast578 622 -44 -44 551 4.9 560 3.2 Midwest708 754 R -46 -46 628 12.7 656 7.9 Mountain132 140 -8 -8 134 -1.5 137 -3.6 Pacific140 150 -10 -10 197 -28.9 213 -34.3 South Central1,025 1,067 -42 -42 851 20.4 854 20.0 Salt297 310 -13 -13 238 24.8 250 18.8 Nonsalt728 757 -29 -29 613 18.8 604 20.5 Total2,583 2,734 R -151 -151 2,361 9.4 2,420 6.7 R=Revised.

The reported revision caused the stocks for January 20, 2023 to change from 2,729 Bcf to 2,734 Bcf. As a result, the implied net change between the weeks ending January 13 and January 20 changed from -91 Bcf to -86 Bcf.

Totals may not equal sum of components because of independent rounding.

Working gas in storage was 2,583 Bcf as of Friday, January 27, 2023, according to EIA estimates. This represents a net decrease of 151 Bcf from the previous week. Stocks were 222 Bcf higher than last year at this time and 163 Bcf above the five-year average of 2,420 Bcf. At 2,583 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

Natural gas futures slipped further into the red on Thursday despite the potential for cold weather to return to the Lower 48 within the next couple of weeks. With mixed messages in the latest storage data, and Freeport LNG not yet back online, the March Nymex gas futures contract settled at $2.456/MMBtu, down 1.2

+++++++++++++++++++++

-100 Deg. F??? ........Fake weather news!!!

-60 Deg. F yes but not -100 deg. F.

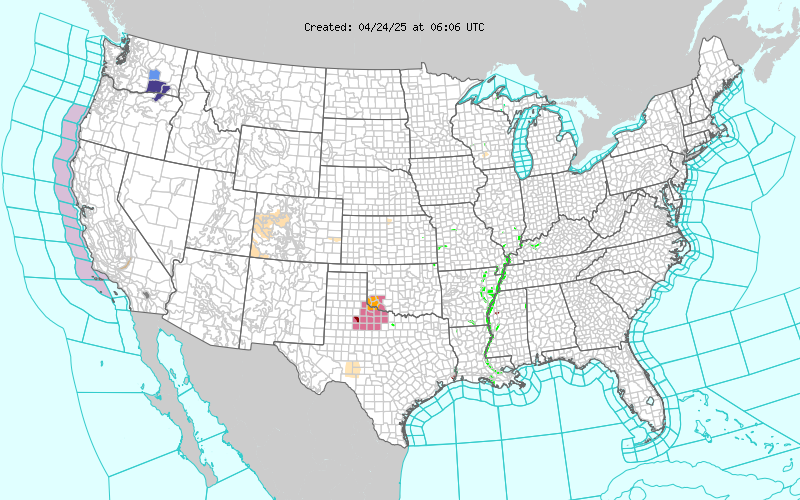

Current Hazards at the link below.

Go to the link below, hit hazards box in the top right hand corner(it will also define all the color codes), if its not already in the hazards mode when you load the link.

Then you can hit any spot on the map, including where you live and it will go to that NWS with all the comprehensive local weather information for that/your county.

over the weekend?

I bought Thursday and remained long. Added Friday but then bailed on those flat.. Weather forecast runs any indication since the close Mike?

I fear one more low Monday into Tuesday

A few more HDDs from individual days being colder but no pattern change to colder.

7 day temps for next Thursday's EIA storage report. Mild east more than offset by cold along and west of the Miss. River. MUCH below temps in the Plains to Upper Midwest.

Morning Mike.. Someone posted on the Ng forum that many HDD were lost past 24 hours and indicated a large gap lower

Thanks CC,

HDD's went up yesterday, then down since then but as mentioned previously, these are just day to day changes in the exact same bearish weather pattern......which has NOT changed.

https://www.marketforum.com/forum/topic/83844/#83856

Is this the NG forum that you mentioned?

There seems to be some excellent comments mixed in with the no nothings.

https://www.investing.com/commodities/natural-gas-commentary

Yes Mike That's it.. Some trolls yes.. But some valuable posters.. The one that posts about the HDD ab mu and gaspar has been accurate every week.. They claim that there were a lot of HDD lost over the last 2 days but that the back end of the forecast has some blue that's interesting

So far this Sunday night NG is up.

MetMike has probably (once again) said it correctly---Market has run out of sellers.

Time will tell. If no more sellers, gradual rise, then everyone may want out at same time for significant BOUNCE.

18z GEFS was a whopping +12 HDDs, entirely from colder days 12-13-14-15.

Gave us a bounce for almost an hour when it was just coming out to just after.

It continues the trend from the previous 12z run of slightly flattening the upper level ridge in the Northeast.

Considering the NAO/AO/PNA are all unfavorable for cold air delivery during that period, we have to consider that just a variation in the model runs vs a coming pattern change.

But it could be an early sign.

0z GEFS -6 HDDs and the EE was -5HDDs

I am breathing!

May have (finally) set a daily and cycle low!

Congrats so far, tjc,

Your bottom picking may have finally hit one.

Models to me are suggesting a potential pattern change to colder late in week 2 for the middle of the country that could progress eastward in week 3.

The just out 12z GEFS was -8 HDDs bearish. We sold off but then roared back to new highs. The market isn't trading individual model solution HDDs. More likely, the bullish elements are :

1. This Thursdays EIA will be more bullish than recent ones.

2, This is the time frame for a seasonal low

3. We have run out of sellers. All the bearish news has been traded for weeks

4. The cure for low prices.......is low prices and this is extremely low.

5. The export facility has been repaired and exports will be ramping up quickly.

The bearish news includes

1. Weather overall the next 2 weeks

2. The Storage, which is now a surplus will be gaining on last year and the 5 year average between now and early April. We've had record supplies gushing in since the end of last Summer.

3. The big traders could be taking a breather and this is just another bear flag/bounce.The risk to reward is insanely bad down here to be doing that, however.

4. Other stuff that I don't know about

Natural gas futures faltered midweek, erasing the prior two days’ gains as traders looked ahead to growing storage surpluses later this month amid ongoing warmth across most of the country. The March Nymex gas futures contract settled Wednesday at $2.396/MMBtu, down 18.0 cents on the day. April futures slid 18.7 cents to $2.477. At ++++++++++++++++++

Back down close to the lows again. Temps for tomorrows EIA:

EE should come in around -10 HDDs less than the previous 12z run!

i dozed off before hitting send 4 hours ago with the message above. This caused the spike lower but we can’t stay there. EIA coming up could be a big deal with the cold last week.

Bullish but I'm thinking some of us expected that.

for week ending February 3, 2023 | Released: February 9, 2023 at 10:30 a.m. | Next Release: February 16, 2023

-217 BCF

| Working gas in underground storage, Lower 48 states Summary text CSV JSN | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Historical Comparisons | |||||||||||||||||||||||||

| Stocks billion cubic feet (Bcf) | Year ago (02/03/22) | 5-year average (2018-22) | |||||||||||||||||||||||

| Region | 02/03/23 | 01/27/23 | net change | implied flow | Bcf | % change | Bcf | % change | |||||||||||||||||

| East | 529 | 578 | -49 | -49 | 493 | 7.3 | 513 | 3.1 | |||||||||||||||||

| Midwest | 641 | 708 | -67 | -67 | 561 | 14.3 | 600 | 6.8 | |||||||||||||||||

| Mountain | 120 | 132 | -12 | -12 | 123 | -2.4 | 128 | -6.3 | |||||||||||||||||

| Pacific | 124 | 140 | -16 | -16 | 183 | -32.2 | 206 | -39.8 | |||||||||||||||||

| South Central | 951 | 1,025 | -74 | -74 | 774 | 22.9 | 803 | 18.4 | |||||||||||||||||

| Salt | 271 | 297 | -26 | -26 | 210 | 29.0 | 236 | 14.8 | |||||||||||||||||

| Nonsalt | 680 | 728 | -48 | -48 | 563 | 20.8 | 567 | 19.9 | |||||||||||||||||

| Total | 2,366 | 2,583 | -217 | -217 | 2,133 | 10.9 | 2,249 | 5.2 | |||||||||||||||||

Totals may not equal sum of components because of independent rounding | |||||||||||||||||||||||||

Working gas in storage was 2,366 Bcf as of Friday, February 3, 2023, according to EIA estimates. This represents a net decrease of 217 Bcf from the previous week. Stocks were 233 Bcf higher than last year at this time and 117 Bcf above the five-year average of 2,249 Bcf. At 2,366 Bcf, total working gas is within the five-year historical range.

For information on sampling error in this report, see Estimated Measures of Sampling Variability table below.

My speculation of a possible inside week is working out

++++++++++++++

Not surprised the number came in that big.

Still long and STUPID nnnooooo stop

I bought 'well' . Even this 'horrible' break, I was never more than 50 under.

Today was "3" day rule! 3 days after low/high a market will test its high/low---what a test!! Should be good for 2-3 week rally.

I seem to be VERY good at putting on trades, somebody needs to say 'when' better than "I"

im with you .though on sideline now..inside week perhaps one last spike then outside week next week? or do the bears get to raid 2.0

The AO and NAO that have been extremely unfavorable for cold in the east the next 2 weeks are crashing lower at the end of 2 weeks, towards but still above 0.

This increases the chance of cold during the last week of February in the Midwest to possibly the Northeast.

Still a huge upper level ridge in the Southeast that needs to break down for cold to really penetrate deeply in the East.

Mike said,

"The AO and NAO that have been extremely unfavorable for cold in the east the next 2 weeks are crashing lower at the end of 2 weeks, towards but still above 0."

--------------

Hey Mike,

I just replied to you about the potential impending AO/NAO plunge in the new NG thread: