Get Out Now as Labor Market Report Flashes Huge Warning Suggesting Stock Prices Will Soon Crash

https://www.youtube.com/watch?v=TkfzeuT5DVo

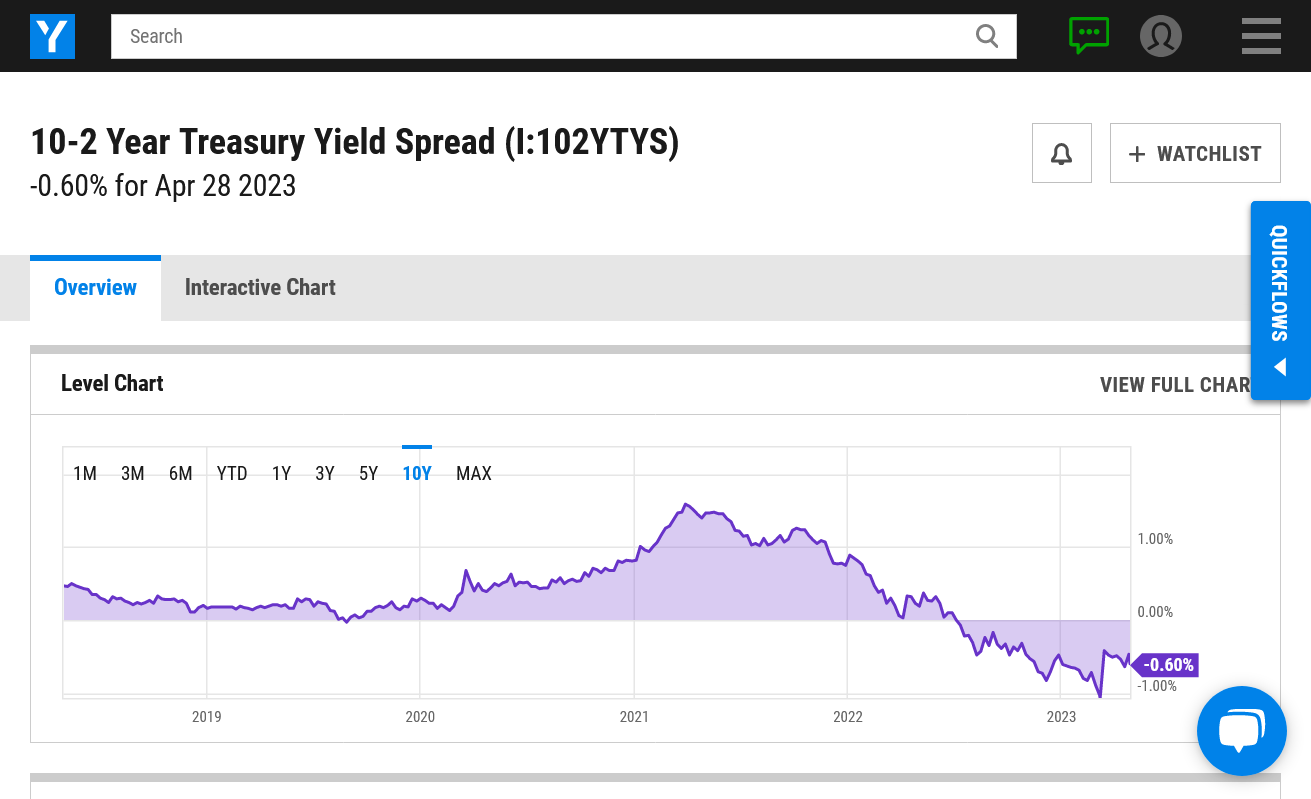

-0.60% for Apr 28 2023

https://ycharts.com/indicators/10_2_year_treasury_yield_spread

| 10-2 Year Treasury Yield Spread is at -0.60%, compared to -0.54% the previous market day and 0.22% last year. This is lower than the long term average of 0.90%. |

| The 10-2 Treasury Yield Spread is the difference between the 10 year treasury rate and the 2 year treasury rate. A 10-2 treasury spread that approaches 0 signifies a "flattening" yield curve. A negative 10-2 yield spread has historically been viewed as a precursor to a recessionary period. A negative 10-2 spread has predicted every recession from 1955 to 2018, but has occurred 6-24 months before the recession occurring, and is thus seen as a far-leading indicator. The 10-2 spread reached a high of 2.91% in 2011, and went as low as -2.41% in 1980. |

https://fred.stlouisfed.org/graph/?graph_id=137388

Velocity of M2 Money Stock (M2V)

Source: Federal Reserve Bank of St. Louis

Release: Money Velocity

Units: Ratio, Seasonally Adjusted

Frequency: Quarterly

Calculated as the ratio of quarterly nominal GDP to the quarterly average of M2 money stock.

The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy.

The frequency of currency exchange can be used to determine the velocity of a given component of the money supply, providing some insight into whether consumers and businesses are saving or spending their money. There are several components of the money supply,: M1, M2, and MZM (M3 is no longer tracked by the Federal Reserve); these components are arranged on a spectrum of narrowest to broadest. Consider M1, the narrowest component. M1 is the money supply of currency in circulation (notes and coins, traveler's checks [non-bank issuers], demand deposits, and checkable deposits). A decreasing velocity of M1 might indicate fewer short- term consumption transactions are taking place. We can think of shorter- term transactions as consumption we might make on an everyday basis.

Biden and others claim there's no banking crisis.

The chart below doesn't lie.........they do.

https://fred.stlouisfed.org/series/DPSACBQ158SBOG

YEPPER! I LIKE THE GUY & WHEN HE MIS-SPEAKS, OR IS WRONG IN HIS TIMING, HE ADMITS IT!

I've not followed this guy for very long but he provides some extremely solid reasoning and knowledge with his data.

With that being the case, I am just providing you with his reports and not embracing them or disagreeing with them, since I don't know nearly as much as him about the economy.

https://www.youtube.com/watch?v=x35Tif_3-1Q

https://www.youtube.com/watch?v=xJ2XjQvMAgk

It's possible this guy is focused on selling newsletters?

I wouldn't even know who this guy is without you, Jean.

If nothing bad happens..............then he's not going to be at the top of my viewing list.

If something really bad happens, I'll watch him on a regular basis!

LOL AIN'T THAT THE WAY THE BALL ALWAYS BOUNCES?

YOU CAN READ HIS PAST PROJECTIONS, IF'N YER SO INCLINED

great, perfect to check on him if I have some extra time.

THIS IS KNDA "SPECIAL" ~ YIKES!

Secret Closed Door Meeting Shows Policymakers Know the Financial System is on the Brink of Failure

Thanks, Jean!

A Financial Crisis is Imminent as a Severe Contraction in the Money Supply Shows More Bank Will Fail

HE EVEN TALKS SOYBEANS, IN THIS'N.

Wow!

FLAT FEDERAL INCOME TAX? CONSUMER TAX? NO STATE INCOME TAX? ???????????????? PRETTY INTERESTING, IMO LOL

‘SCARY’: Michigan is getting ‘nothing’ but Chinese corporations:

KEEP SUPPORTING THE CCP!!!!!!!!

One thing I noticed when working in the union, when someone would be ask to work a lot of overtime with a big expected pay increase and they would receive only a small increase they would not want to work overtime again. This was, I believe, because of the standard deduction being met at standard pay. All increase was taxed. BUT it did lead to less production. JMHO

I RECALL THE LATE 60'S, WHEN INDIANA HAD NO SALES TAX. LOL

INSTEAD OF CRUIZIN' AROUND TOWN ALL NIGHT, AT 30 CENTS A GALLON FOR GAS ~ WE'D HIT THE ROAD & GO SHOPPIN' IN INDIANA. HAHHHAHHAHAAA

THOSE WERE THE DAYS! WEEEEEEEEEEEEEEEEEEEEE