Again, EXTREMELY bullish for wheat!

U.S. #wheat production comes in significantly lower than expected - hard red winter and white winter were greatly overestimated by the trade. Total wheat crop is seen barely beating last year despite a large rise in acres.

++++++++++++++

This is the ENTIRE reason why:

https://www.marketforum.com/forum/topic/83844/#83853

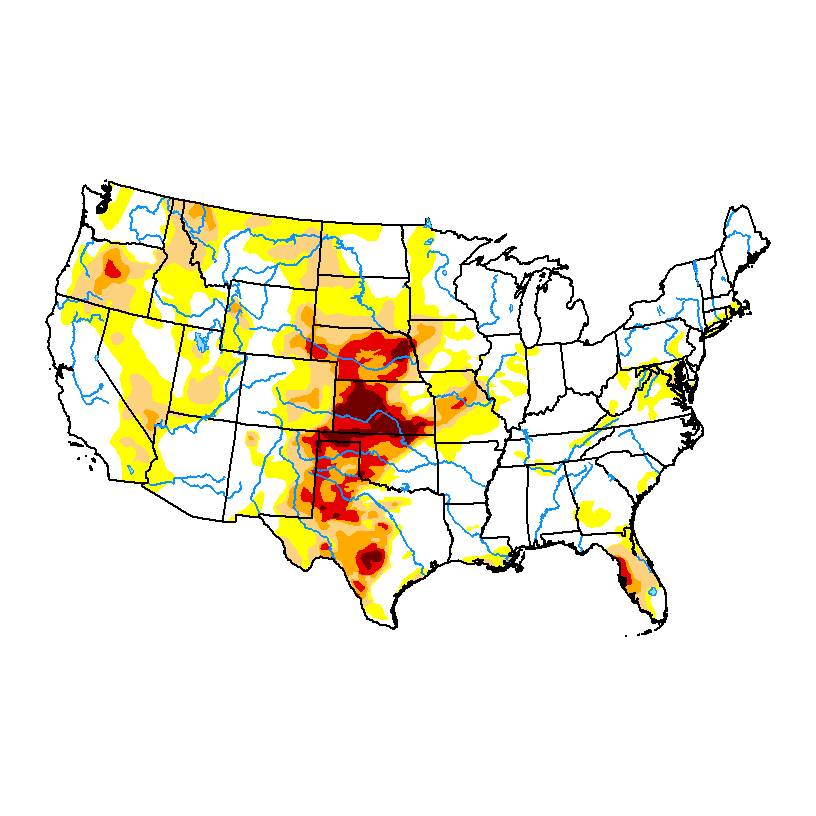

Soilmoisture anomaly:

These maps sometimes take a day to catch up to incorporate the latest data(the bottom map is only updated once a week).

https://www.cpc.ncep.noaa.gov/products/Soilmst_Monitoring/US/Soilmst/Soilmst.shtml#

++++++++++++++++++++++++++++

https://droughtmonitor.unl.edu/

Drought Monitor:

May 9, 2023

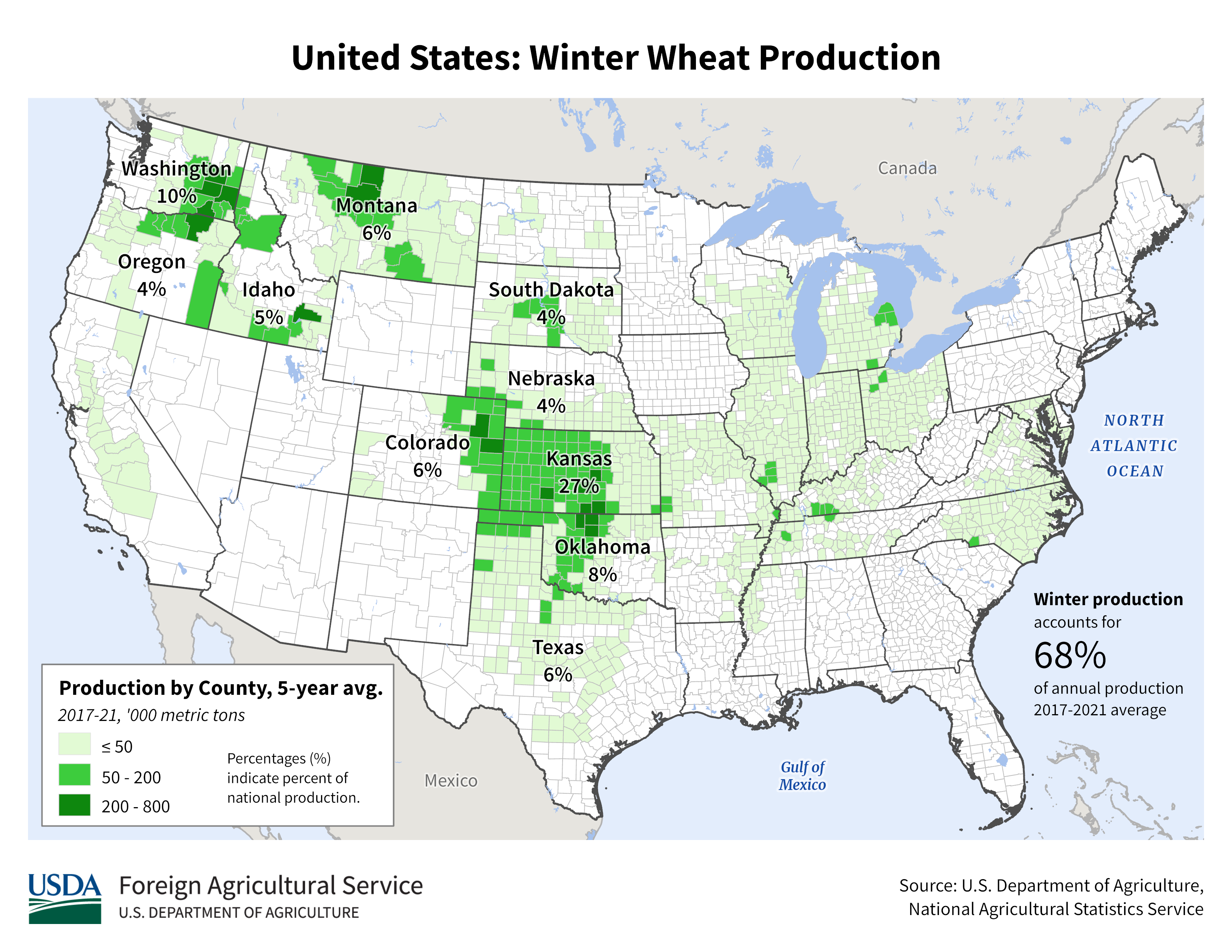

https://ipad.fas.usda.gov/rssiws/al/crop_production_maps/US/USA_Winter_Wheat.png

This is entirely a hard red winter wheat crop issue. HRW , grown in the Plains is up almost 40c right now but the SRW, grown farther east is up only 11c!

This is entirely a hard red winter wheat crop issue. HRW , grown in the Plains is up almost 40c right now but the SRW, grown farther east is up only 11c!

Surprisingly no changes to #Argentina's #corn or #soybeans from last month.Huge bump in #Brazil's corn crop, soybeans rise as expected.

The state of the U.S. #soybean market (projected) heading into 2023/24: Record crop, four-year high in ending stocks and stocks-to-use, but exports at a four-year low. Record crush, though.

U.S. #corn supply relative to use in 2023/24 is seen just about as high as it's been since the mid-2000s. Demand assumptions are comparably modest versus supplies. Record crop expectations rely on a 181.5 bu/acre yield, up 4.8 from the prior high.