Look for planting to be progressing very fast In this afternoons report.

As mentioned yesterday, the dry weather that has allowed for this timely planting, along with heat in the forecast for week 2 has now become bullish for C, S and W.

I wondered if we were going to see a bounce sooner than later. All the fatalists out there predict this summer will be so hot it will mark the end of times!

Toss that in with a drier Midwest and the predicted heat, could we be seeing the bottom already?

Thanks, Jim.

Exports have been very dismal and bearish for prices this year.

https://www.marketforum.com/forum/topic/95200/

The USDA crop report was crazy bullish for HRW crop production:

https://www.marketforum.com/forum/topic/95157/

Now, the potential for very warm and dry weather. However, it's early in the growing season(which is when droughts often start) and El Nino's typically feature wonderful growing seasons.

This El Nino has an extremely strange temp configuation, however.

I'll try to start a thread on that later.

USDA crop conditions:

https://release.nass.usda.gov/reports/prog2023.txt

Slight improvement to U.S. winter #wheat conditions from the poor/very poor category, though top grower Kansas is just 10% good/excellent.#Corn and #soybeans are ahead of normal on planting and emergence, though progress in North Dakota is extremely slow so far.

Indeed! I have saw some cancellations. Twitter has all sorts of doomsday posts about the temp. I'll have to drop some in here when I come across them.

Jim,

The heat in ND(and WI/MI/OH/CO) is the best thing that could happen to them to catch up planting corn!

U.S. #corn planting at 65% complete is 6 points ahead of the recent average despite a slower pace in Colorado, Michigan, Ohio, Wisconsin. North Dakota is the problem area as only 5% of corn is planted, the 2nd slowest to last year for May 14.

#Corn acres are starting to shrink in North Dakota for a second straight year as only 5% of the crop was planted by Sunday, well below the recent average of 26% and barely above last year's 4%. The 5yr avg reflects the sins of 2019, 2020 & 2022. In 2019, the May 14 avg was 49%.

#Soybeans are well ahead of normal pace at 49% complete as of Sunday, the 4th fastest for the date since 1980. Many major states have a huge lead on their averages, but North Dakota is the concern for now.

Wheat saw 3% less in the P/VP conditions from last weeks rains, so slight improvement.

Same % for G/EX and close to the worst HRW rated crop in the last 3 decades. Funds are short corn and wheat though, which will help with short covering on any bullish news.

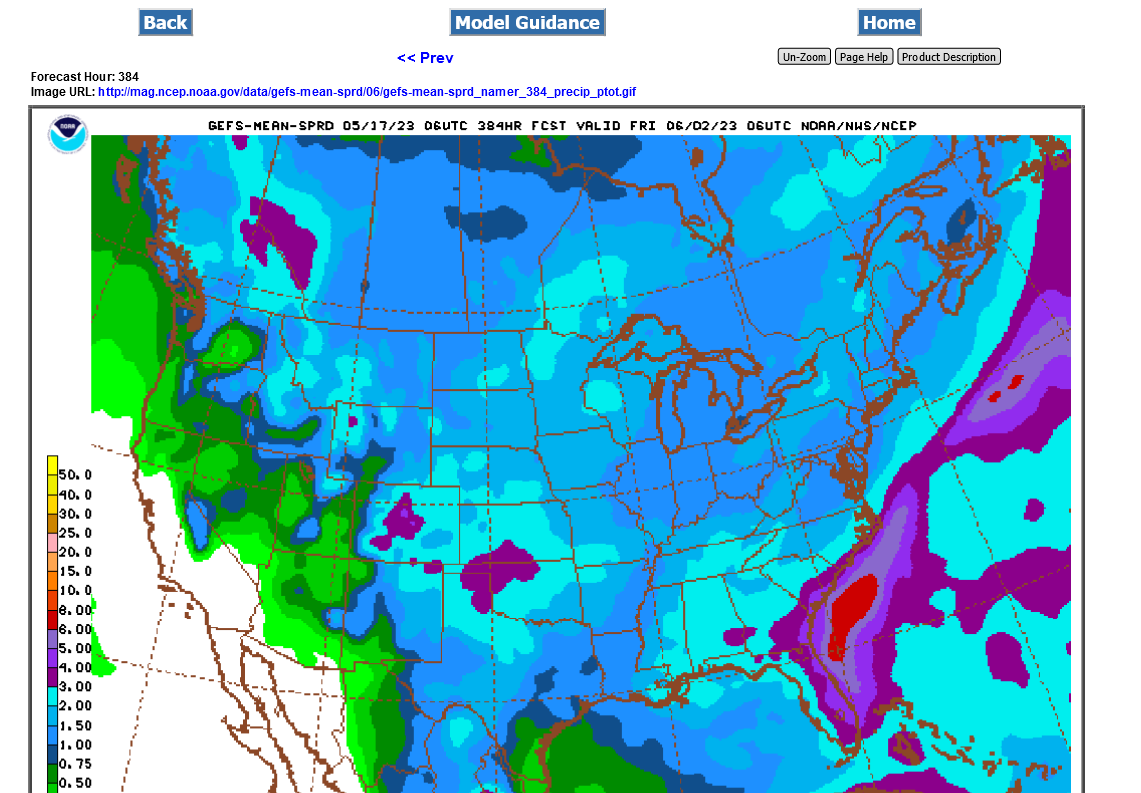

The weather models have increased rains for week 2 the past 2 days:

https://www.marketforum.com/forum/topic/95243/#95245

Grains getting crushed because of this:

2 week rain totals from the last 6z GEFS

Week 2 guidance for this afternoons 8-14 day outlook.

May 17: CBOT December #corn falls below $5/bu for the first time since Sept. 10, 2021. But the mid-session low (so far) of $4.94 is the lowest for Dec corn during year of expiry since April 12, 2021.The recent move's all-time high of $7.66-1/4 came a year ago (May 16, 2022).

May 17: CBOT November #soybeans drop below $12/bushel for the first time since late 2021. The late session price of around $11.93 is 22% lower than on the same day a year ago and 15% lower than two years ago.

WOW! This includes the Dust Bowl Days of the 1930's(when they would have tried to harvest anything)

I'm not first to point this out, but in case you missed it, only 67% of planted U.S. winter #wheat acres are seen being harvested for grain - the lowest since 1917. Data goes to 1909 and 1917 is the lowest harvest % at 66% followed by 2023, 1933 then 2022 (70.5%).

Again, this is entirely a HRW issue:

Front-month contracts are in delivery, but the huge premium of Kansas City to Chicago #wheat futures is unprecedented, delivery or not.Shown here is 2023 against the last 40 years. Using ratio instead of spread to account for inflation. KC is ~1.44x Chi on Wed.

USDA May 12, 2023

6 responses |

Started by metmike - May 12, 2023, 12:11 p.m.

Extremely bullish for (HRW) wheat!

Huge rains coming to some of the driest areas of the S.Plains is obliterating HRW prices.

https://www.marketforum.com/forum/topic/95268/#95272

Here's all the weather

https://www.marketforum.com/forum/topic/83844/

7 Day Total precipitation below:

http://www.wpc.ncep.noaa.govcdx /qpf/p168i.gif?1530796126

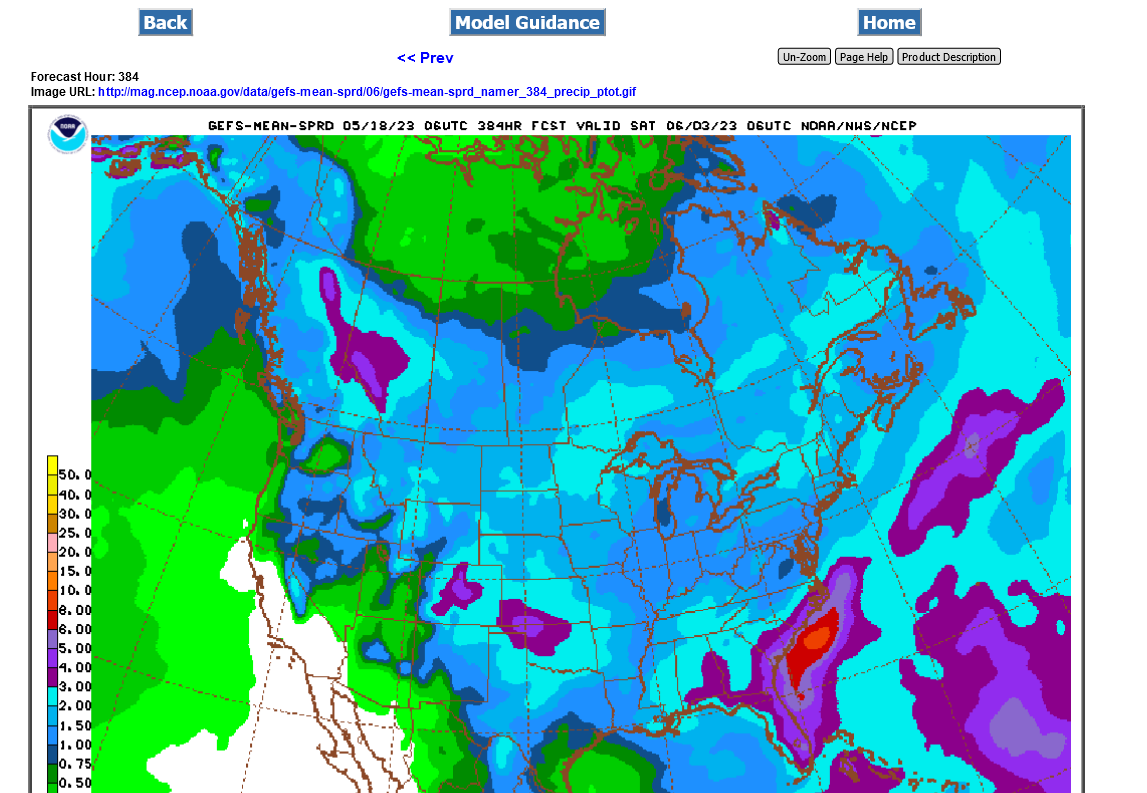

The week 2 models are telling us it will be wetter in the Plains/WCB that need rain the most and dry in the east.

This could shift and become bullish if it shifts farther west and more bearish if it shifts east.

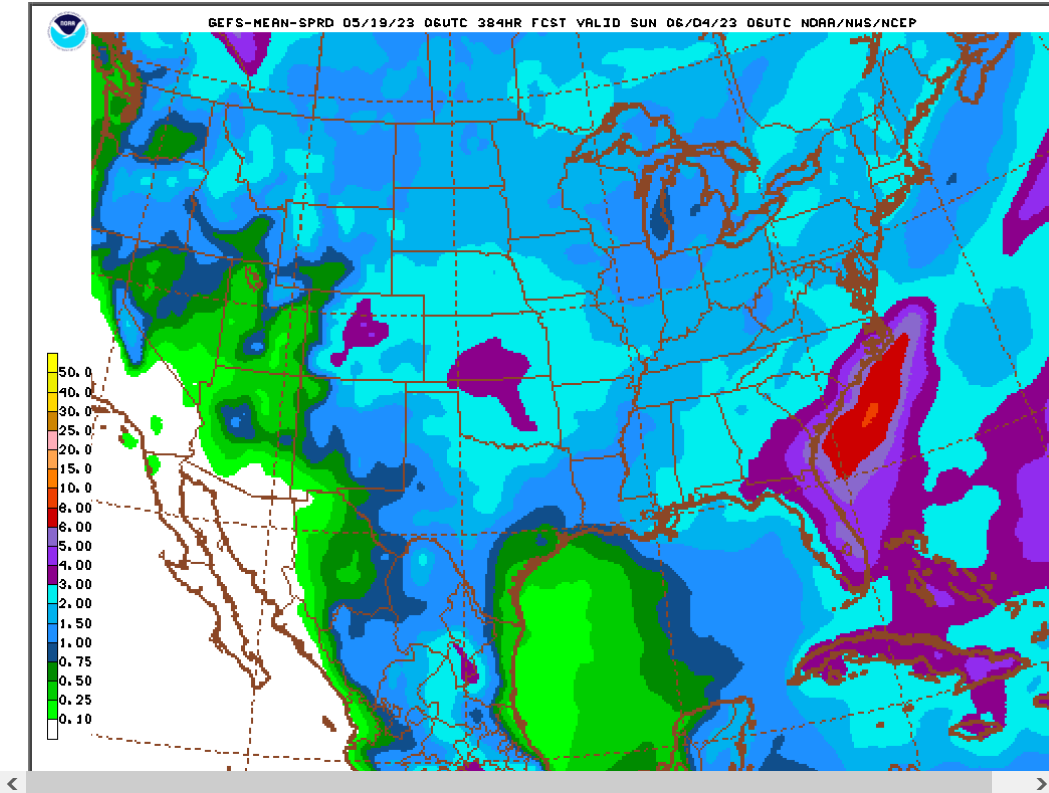

5-19 this has actually shifted and become much drier!!! The map below is constantly updated.

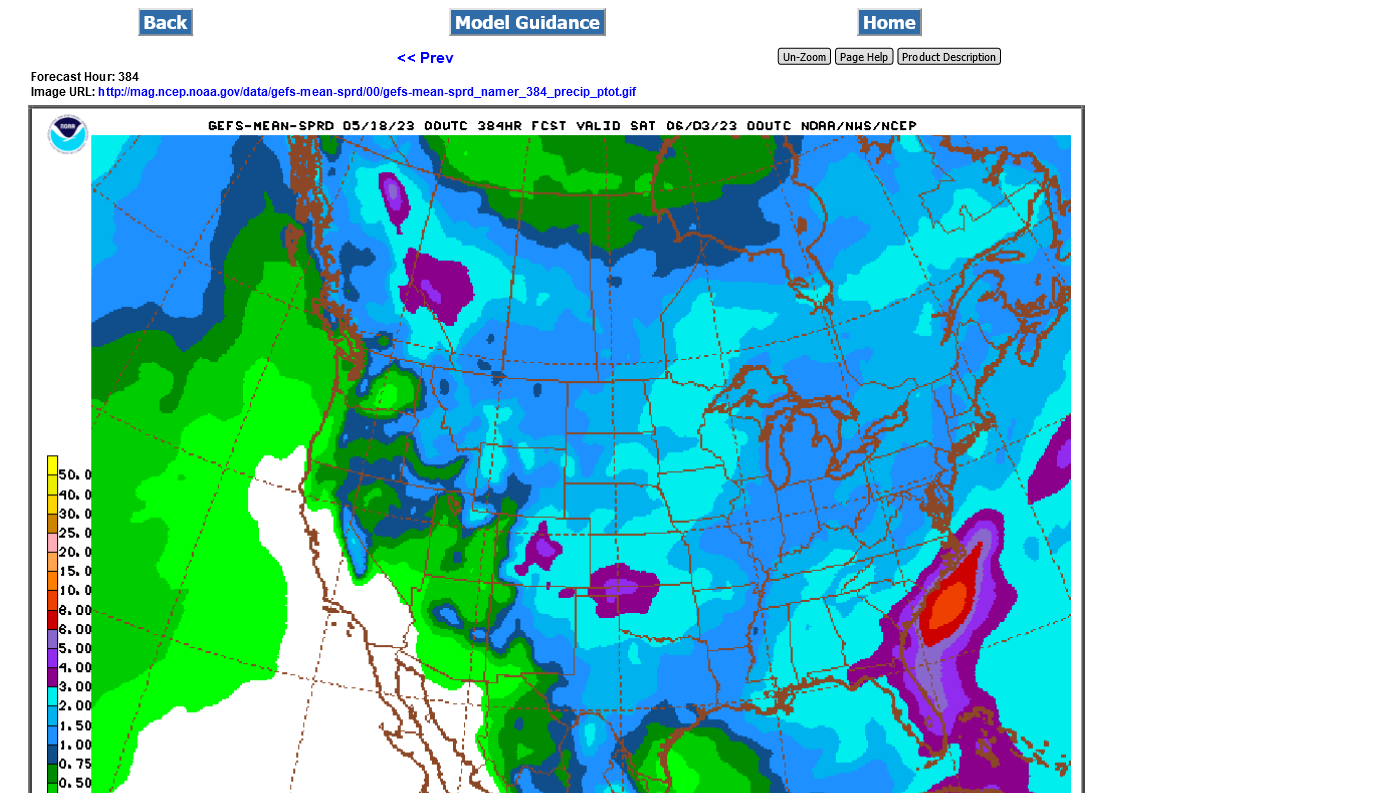

The last 6z GEFS run was DRIER for the central Cornbelt!! Possibly why we've recovered from very steep losses.

1. Last 6z GEFS

2. Previous 0z GEFS

https://www.marketforum.com/forum/topic/95260/#95266

Last 0z GEFS 2 week rains:

Light blue is 2+ inches!

Epi-center in S.Plains is 4+ inches!

https://www.marketforum.com/forum/topic/95296/#95302

Thanks tallpine!

HRW continues lower from rains hitting dry places.

Not sure why C is up and beans down a bit. It's not an obvious weather reason.

https://www.marketforum.com/forum/topic/95216/#95301

There is a strong correlation between El Nino growing seasons and favorable weather. It's likely CAUSATION related with La Nina's, like the last couple of growing seasons often featuring bad/dry weather.

For sure the market knows this and is already dialing that into prices and is LESS threatened with current drought areas expanding. Week 2 weather maps were increasing rains this week(especially for the driest areas), which confirmed less need for drought scare weather premium and prices crashed.

This was the last 6z GEFS rain total map for 2+ weeks.

Light blue is 2+ inches and good rains for the some of the driest areas. 3+ inches will make a dent in the drought and just what the doctor ordered for the worst rated HRW in the S.Plains since accurate records started on this metric.

This will help some P/VP wheat to make Fair but not give up much G/Ex wheat in KS, though there will be a single digit amount of that.

Planting being well ahead of average means there will be no planting delay concerns for most of the crop this year (other than ND).

ND/MN are not as wet but they need warm/dry to plant so its actually bearish for them too.

Re: Re: INO Morning Market Commentary

By metmike - May 19, 2023, 12:30 p.m.

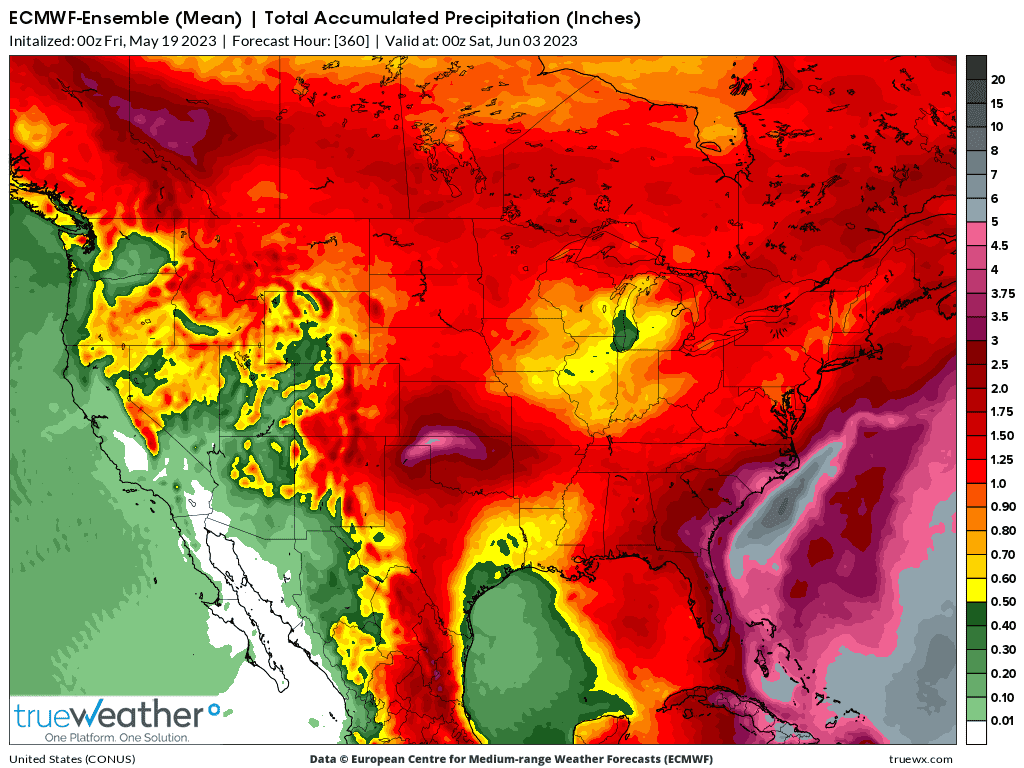

Upon a more extensive analysis, I'm adjusting my forecast DRIER for much of the Midwest.

The Plains will still get great rains but I think much of the Cornbelt will be getting drier the next 2 weeks, the farther east, the less rain.

In fact, I think IA/IL,IN and OH will not have a decent rain the next 2 weeks.

This may in fact be why corn is strong today.

Beans might still be looking at this as a planting time and it having a bearish spin but corn is farther along and this very dry weather, with increasing heat could be viewed as GROWING conditions.

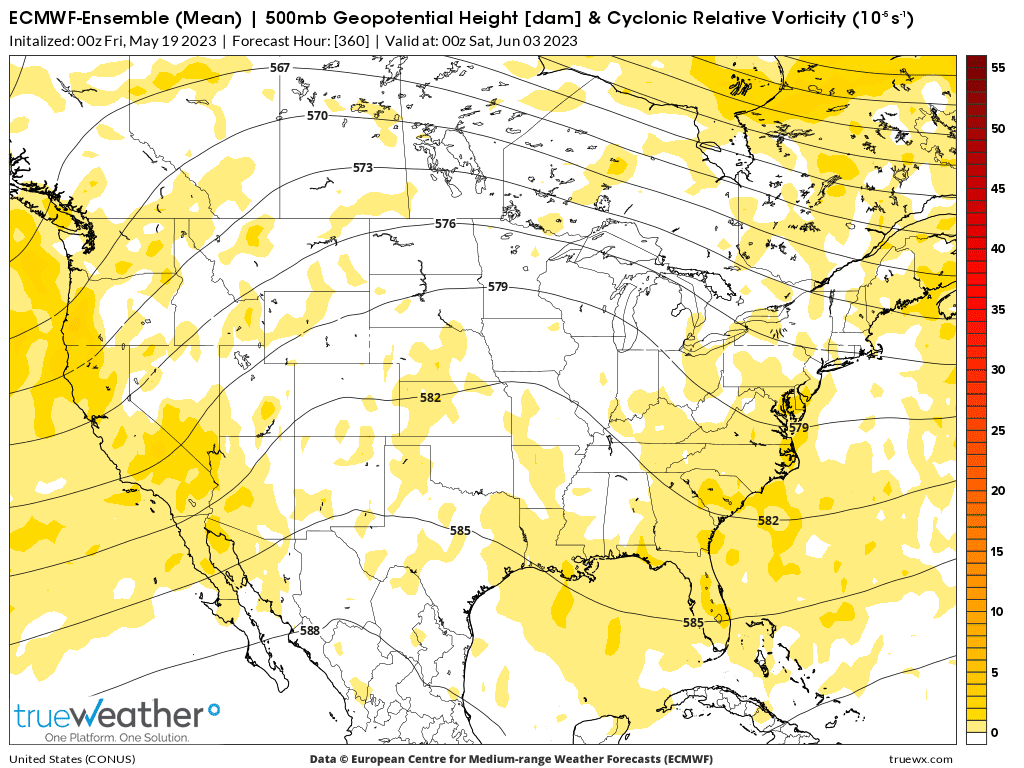

The European model is especially dry in those locations and actually lines up with the upper level ridge in place at that time:

2 week rains

Upper levels in 2 weeks. Rain suppressing ridge across the middle part of the country.

The GEFS is WETTER than this, so it's a low confidence forecast!

IF THIS KEEPS UP... CORN IS GONNA SURPASS WHEAT, ON THE MONEY SCALE. LOL

Thanks, Jean!

I'm starting a new thread on this.