I'm not in any positions at the moment,too busy installing sump pumps!

Thanks tjc!

Any reasons you want to share?

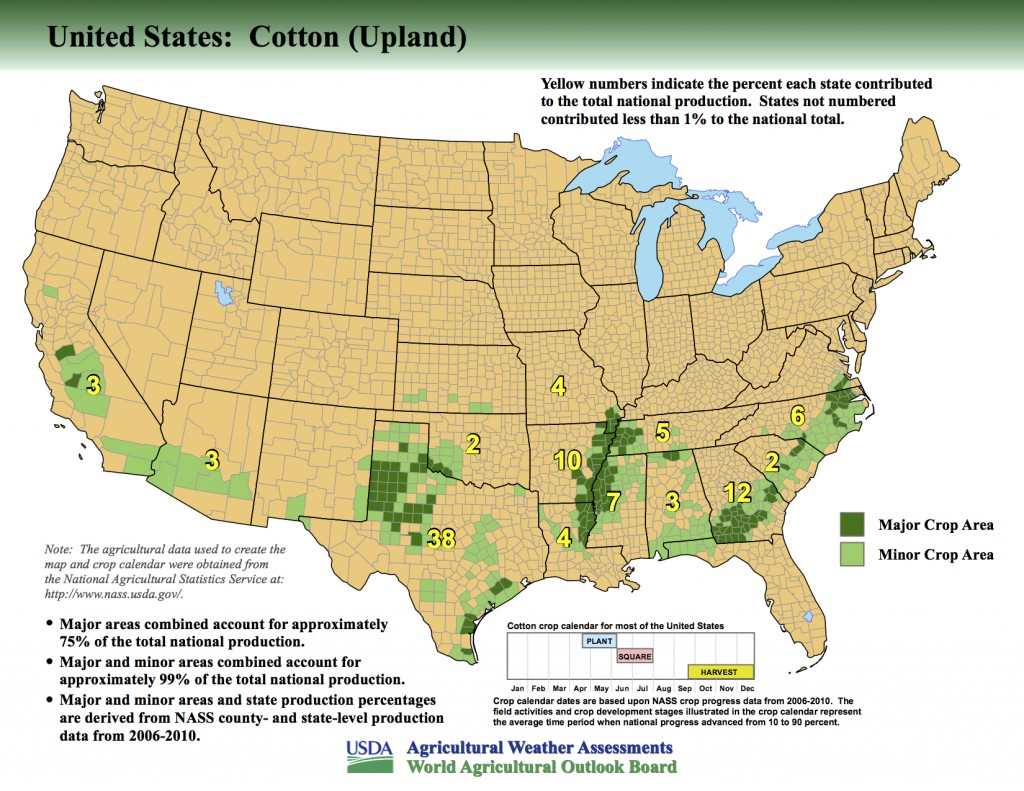

Cotton weather is interesting because this heat ridge in TX was so intense in June.

If it becomes a feature of our Summer, TX, the #1 cotton producing state by far might get hurt.

I'm not especially tuned into the cotton weather right now but may have more.

https://blog.fillyourplate.org/usda-releases-new-maps-identifying-major-crop-producing-areas-cotton/

Old crop corn, CN getting crushed again today, while old crop beans, SN are +15c.

Volume on both of them is 1/6th the volume of CZ and SX

Cotton is very oversold. It has had multiple %R buy signals in a daily cycle that was extended (cycle due to end) with RSI 14 in the the low 30s. July contract is no longer relevant (4 vol, 8 OI) and Dec (even though there is an October) takes over as the vol/OI lead contract at a discount to July. Until last 3 weeks, July (old crop) was at a significant premium to Dec. During these 3 weeks, premium vanished. Long 78ish

Coffee likewise is oversold. It is late in its daily cycle with %R buys and low daily RSI. Weather in Brazil has been "pleasant" for harvest, but growing season weather was not ideal. Coffee appears to be at its half primary weekly cycle trough, significantly above the previous weekly low near 142. Long 160ish

Bonds are 'late' in its weekly cycle and today marked a huge plunge, worthy enough to BUY. Bonds half primary low was established a few weeks ago, and today's drop did not make a new low. (Upward progression of cycle) Long 126-10

Probably wont bother with grains until Fall lows. Covered sugar shorts this morning (to buy ct and kc). Holding ng, but not in love with it. Will look next week to position in nqu

Thanks, tjc!

Wonder how much the USDA report out tomorrow is/will impact those markets.