Not new information, but I looked back on this yesterday and it's still hard to grasp just how hard the 2023 growing season was for #soybeans in #Argentina. Yields nearly 50% below trend due to extreme drought. That's either unprecedented or hasn't happened in many decades.

Here's #corn - not as big a dive below trend but the same idea - worst relative crop in decades. I computed these trends myself so the exact deviation may vary among analysts, but that's fine. As long as we capture the relative picture.

#Argentina's #wheat yields in 2023 were also the worst in many decades. USDA forecasts already imply about 10% below trend for 2024, likely because it is still dry. #ElNino doesn't always produce strong Argy wheat harvests. 2016 crop was very "meh" despite huge El Nino.

CBOT Dec #corn hasn't moved much lately, but there has been a slight downtrend over the last month. Action doesn't look too different from 2013, one of the possible 2023 analogs identified earlier this year. The 2012 analog was disqualified by the end of June.

Here's 2023 versus 2022 & 2021. #Corn futures are significantly lower than a year ago and a bit lower than two years ago. Just not a lot of notable movement yet this month.

From Last Thursday:

Last week's sales of U.S. #soymeal were the largest since May and above average for the date. Philippines accounted for about 2/3 of the meal sales. #Corn sales were on the low end of expectations and #soybeans were below. #China had one corn cargo switched from unknown.

·

Strong grain crops in the Black Sea are offsetting losses in rival exporters. IGC sees 23/24 Ukraine #corn and #wheat as well as Russian wheat output higher than previously expected while wheat harvests in Canada, Australia and Argentina shrink.

Also from last Thursday. Beans made a low this morning just before 9am at 1284.5 and are up 20c since then!

Up 6c this evening at 1304ish. Crop rating -2% might be a small factor.

Corn is 483ish + 2c Corn rating was -2%

·

As of mid-session Thursday, November #soybeans are looking at their first settle below all moving averages since early June. A close at $12.96 per bushel (rough price around 11 am CT) would be the lowest since June 29.

On a most-active basis, November #soybeans are already well below all averages. September losses so far are around 5.4%.

Sept. 28: U.S. crude #oil futures (WTI) topped $95/barrel, the highest front-month price since August 2022. CBOT #soyoil notched its lowest close in three months (58.53 cents/lb in the Oct). Scales are different, but note how these two often move in tandem (and sometimes not).

++++++++++++

Here's a view of this relationship 2005-2019. The separation in 2018 is interesting (there's also one in mid-2000s). The 2018 deviation may be linked with extreme weakness in the CBOT soy complex following the US-China trade war.

+++++++++

Sept. 28: U.S. crude #oil futures (WTI) topped $95/barrel, the highest front-month price since August 2022. CBOT #soyoil notched its lowest close in three months (58.53 cents/lb in the Oct). Scales are different, but note how these two often move in tandem (and sometimes not).

Through August, #Ukraine's 2023/24 grain exports were up about 10% on the year (season began July 1). But as of Monday, 23/24 grain shipments were down 26% on the year. The Sept 2023 volume was 51% lower than in Sept 2022.

USDA confirms the sale of 196,607 tonnes of U.S. #corn for delivery to Mexico. 109,226 is for 2023/2024 and 87,381 is for 2024/2025

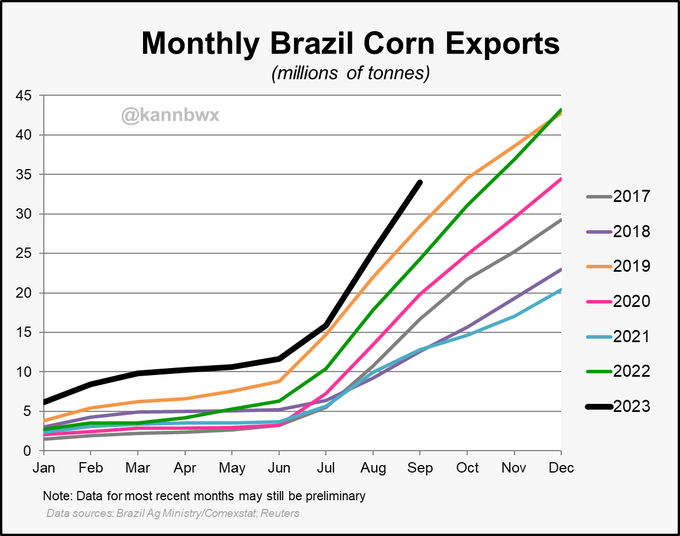

Sep breakdown by country is not yet available, which is why I showed the Jan-Aug portion to China instead. The prior combined Jan-Sep max was 2020, but you can see by the charts that corn's prior max was in 2019. Either way, 2023 is so far record for both.

#Brazil's exports of #corn & #soybeans have reached a new realm in 2023 Preliminary data suggests combined Jan-Sep shipments rose 22.6 million tonnes (866 million bushels) above the period's prior record set in 2020 58% of Jan-Aug corn+soy exports went to #China

Money managers still held a net long in CBOT #soybeans as of last Tuesday, albeit very small. However, speculators as a whole (when adding other reportable traders) turned net short beans as of Oct. 3, specs' first bearish bean stance since March 2020.

Analysts' read of last week's export inspections for U.S. #soybeans was completely off - volume was double the highest estimate. More than 1.4 mmt to #China, about 1.2 mmt of that off the PNW. #Corn insp. weren't great, #wheat was meh. 1 corn cargo to China out of the Gulf.

+++++++++

In context, last week's number for #soybeans was pretty decent. But I think we need to see stronger export sales in the coming weeks in order to flip the narrative on US soy exports (which is kinda bearish right now). Sales have been unusually low.

***this is NOT an updated chart and I am unable to update it right now, but wanted to share it anyway for context. 1.2 mmt of #soybeans out of the PNW last week is about equal to the 2022 peak (which occurred in the week ended Oct. 20).

USDA confirms the following sales of U.S. #soybeans for export in 2023/24:121,000 tonnes to China213,000 tonnes to unknown

Oct. 11: CBOT Nov #soybeans slide to their lowest since June 15 ($12.51 per bushel). Relative Strength Index at 30 suggests the contract has approached oversold territory. Monthly forecasts from the USDA coming on Thursday could influence the direction of trade.

metmike: Some pretty bullish news for beans the last week!

Export inspections for U.S. #soybeans last week were well above trade estimates (again) and incl. 616kt beans to #China via Gulf and 666kt via PNW. After last week's miscount, kinda waiting on verification of these numbers, but look at the adjustments to last week (highlighted)

#China imported 7.15 million tonnes of #soybeans in September, below average for the month and a bit below what traders were expecting. Poor crush margins, slim profits for pig producers and a bearish soy price outlook may have contributed to the lower volume.

2 mmt of #soybeans inspected last week would fit into historical norms for the week, if the number is correct. Note that the adjusted number for the prior week (ended 10/5) is actually closer to the originally reported (erroneous) number than the corrected one...

Big U.S. #corn sales last week incl. 762kt to Mexico. China bought 1.17 mmt of #soybeans, incl. 776kt switched from unknown. Soy sales were a marketing year high last week. Philippines was top buyer of #soymeal last week.

USDA confirms the sale of 110,000 tonnes of U.S. #soybeans for delivery to #China in 2023/24.

@kannbwx·

#Ukraine has suspended use of its new Black Sea grain corridor due to a possible threat from Russian mines and warplanes. The suspension went into effect for Thursday but it could be extended.https://uk.investing.com/news/stock-mar

But #Ukraine is now denying this is true. So this is very much an unfolding story. Point still stands though: the new corridor has a long way to go to restore export volumes to the ones under the Black Sea grain deal with Russia.

+++++++++

Significantly less grain had been moving through the new corridor versus the old one that was part of the deal with Russia, but Ukraine was hoping exports could increase to near the old corridor volumes in the coming months.

#Ukraine could export up to 2.5 mmt of food per month via the new humanitarian corridor, close to the prior 3 mmt when Russia was still in the grain deal. But it has only exported 700kt of grain via the new corridor since it was launched in August.https://reuters.com/article/ukrain

U.S. #ethanol production has averaged 1.02M bpd over the last 4 weeks, stronger than normal, especially in the latest 2 weeks as profit margins remain favorable and U.S. #corn harvest progresses. Ethanol stock levels are moderate for the time of year.

++++++++++

metmike: Electric cars don't use ethanol!

@kannbwx

However, implied U.S. motor gasoline demand is not great, down around 8% from "normal" levels. The 4-week bottom at the end of September was actually the week's lowest since 1997. I'm not close enough to this market to explain why, but let me know if you have any thoughts.

Any time a number stands out like this it always warrants more investigation (doesn't necessarily mean it's wrong, though). Two different chart views included, plus the table showing last week's upward revision.

#India has extended the halt in futures trading on farm commodities through December 2024 in an attempt to curb food inflation. The extension was somewhat expected, though the ban has been in place since 2021 and commodity prices remain elevated.